A Roth IRA rollover allows you to transfer money between your retirement accounts. Specifically, you move money from another retirement plan into your Roth IRA to take advantage of the wealth-building benefits this type of account offers -- most importantly, that your money grows tax-free.

That means you avoid taxes on all dividends, capital gains, and withdrawals, provided you've had your account open for at least five years. The five-year requirement is one of the rules for using a Roth IRA.

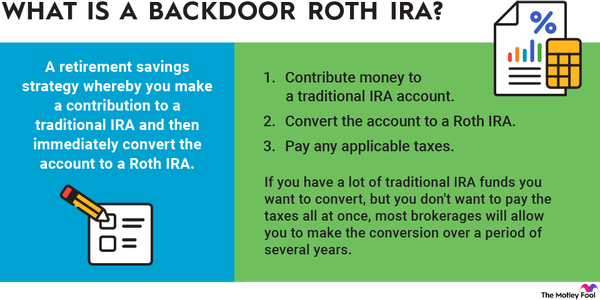

It's important to draw a distinction between a rollover, a conversion, and a contribution. A rollover refers to the transfer of money from any retirement account to another. A conversion is a rollover that involves transferring money from one type of retirement account to another, such as from a traditional IRA to a Roth IRA. A contribution is the placement of new money into an account. While there are very specific Roth IRA annual contribution limits, there is no limit to the number of rollovers you can complete or the amount of money you can roll over.

Avoiding consequences

Roth rollovers with no tax consequences

First, there are some Roth IRA rollovers that don't have any tax consequences if done correctly. The simplest is moving money from one Roth IRA to another. There is only a risk of tax consequences if the rollover isn't completed in a timely manner.

In addition, if you have access to a Roth 401(k) account at work, then rolling over that money into a Roth IRA also avoids any tax consequences. The tax-free nature of the Roth assets is preserved, and you have the full range of investment alternatives your Roth IRA offers. You still may receive a tax reporting form (a 1099-R), but the movement of assets from one Roth to another should result in zero additional tax.

Conversions

Roth conversions from traditional IRAs

If you have money in a traditional IRA, there's no income restriction on your ability to convert it to a Roth IRA. However, there are tax consequences. To the extent your IRA has money that came from deductible contributions or earnings, you'll have to include the amount you convert in taxable income.

This happens because you are converting money from a pre-tax to a post-tax status. In addition to increasing your taxable income, a traditional to Roth conversion can push you into a higher tax bracket. For this reason, it's important for you to estimate all of your income for the year before completing a Roth conversion. This will help you determine the tax cost of such a conversion.

One thing to keep in mind, though, is if you made nondeductible contributions to your traditional IRA, you'll be entitled to claim a pro-rata share of those contributions to reduce the amount of taxable income you report. For instance, if you made a nondeductible contribution of $1,000 and you convert half of your total IRA assets of $10,000 to a Roth IRA, then you'll have taxable income of $4,500. That's half of the $10,000, or $5,000, minus half of the nondeductible $1,000 contribution amount, or $500.

Rollovers

Rollovers from traditional 401(k) and other retirement plans to Roth IRAs

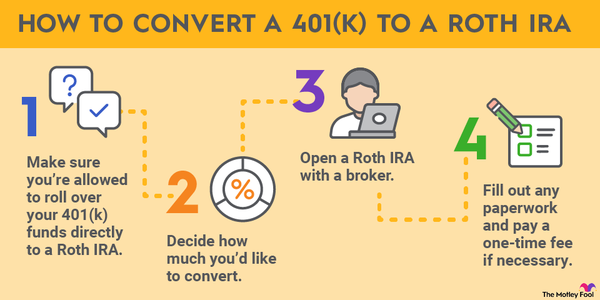

For a long time, rollovers from 401(k) plans or other employer-sponsored retirement accounts such as a 403(b) or 457(b) directly to a Roth IRA weren't allowed. You first had to roll over employer retirement money to a regular IRA and then convert the regular IRA to a Roth IRA.

Now, the government has recognized that the extra step shouldn't be necessary and has allowed direct rollovers from traditional 401(k)s to Roth IRAs.

The tax consequences for such a move are the same as a conversion from a traditional IRA to a Roth IRA. You'll have to treat pre-tax contributions as taxable income in the year in which you convert to the Roth IRA, but any after-tax contributions aren't required to be included in taxable income.

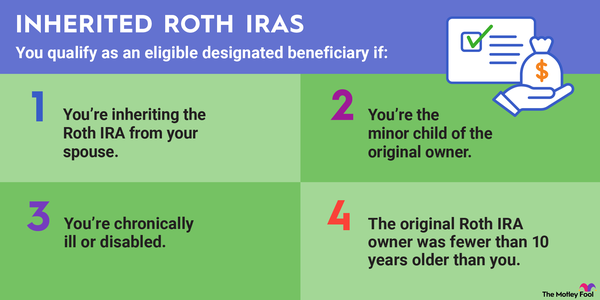

What you can't roll over to a Roth IRA

Finally, there's one category of retirement account that's not eligible for rollover to your personal Roth IRA: an inherited IRA. If you inherit a traditional IRA from a non-spouse, you're stuck with the traditional nature of that retirement account under current law. If you inherit a Roth IRA from a non-spouse, you'll need to open an Inherited Roth IRA and plan to take required minimum distributions (RMDs) over a 10-year period (assuming you inherited the account after Jan. 1, 2020; if it was before then, you are able to take RMDs over your lifetime).

The only exception is if you're the spouse of the deceased IRA holder, in which case you have the right to move inherited IRA assets into your own IRA. From there, you can then convert your own IRA to a Roth. However, as mentioned above, non-spouse beneficiaries don't have that option.

Chart of Roth IRA rollovers

| Account Type | Roll Over to Roth IRA? | Affects Taxable Income? | Limits? |

|---|---|---|---|

| Roth IRA | Yes | No | No |

| Roth 401(k) | Yes | No | No |

| Traditional IRA | Yes | Yes, if contributions were deductible | No |

| 401(k) | Yes | Yes | No |

| 403(b) | Yes | Yes | No |

| 457(b) | Yes | Yes | No |

| Inherited IRA from spouse | Yes | Yes | No |

| Inherited IRA from non-spouse | No | N/A | N/A |

| Other pre-tax account | Yes | Yes | No |

How to tackle a Roth IRA rollover

Practically speaking, a Roth IRA rollover is very simple. Simply contact the administrator for your current retirement account and request a rollover to a Roth account (either at the same or another institution). But before you do so, however, figure out if the rollover will trigger a tax liability so you can plan accordingly.

Once the rollover is complete -- assuming you're eligible to complete one -- you'll be well positioned to generate tax-free growth and unhindered income for decades to come.

Related investing topics

FAQ

Roth IRA rollovers FAQ

Can you roll over a Roth IRA without penalty?

Yes, you can roll over a Roth IRA without penalty, but only to another Roth IRA. If you want to roll over funds from another retirement account to your Roth IRA, the rules depend on the type of retirement account you have. Roth rollovers, including from Roth 401(k)s and Roth IRAs, generally have no tax consequences. Rollovers from retirement accounts with pre-tax contributions are treated as taxable income.

How does a Roth IRA rollover work?

A Roth IRA rollover transfers money from another retirement account to a Roth IRA. That money can then be withdrawn tax-free in retirement.

What is the five-year rule for a Roth IRA rollover?

There must be at least five years between the first contribution to a Roth IRA and the first withdrawal. If not, the withdrawal is classified as a non-qualified distribution, and you could owe taxes and/or penalties. With rollovers, the clock on the five-year rule starts with the accountholder's first contribution to any Roth IRA. Once the requirement for a Roth IRA has been met, it also applies to any other Roth IRAs the person has.

Can I transfer a Roth IRA to another Roth IRA?

Yes, you can transfer a Roth IRA to another Roth IRA. This is called a rollover, and it allows you to transfer funds from one Roth IRA to another without creating a taxable event.