Let's get this out of the way from the start. There is no such thing as a stock that is completely safe.

Even the best companies can face unexpected trouble. Plus, it's common for even the most stable corporations to experience significant stock price volatility, especially over the short term.

We saw this firsthand when the COVID-19 pandemic created widespread uncertainty in the market. And we saw it in the 2022 bear market as inflation and interest rates surged, causing some of the market's best-performing stocks to plunge.

These are just a few examples from recent history. And they certainly won't be the last periods of stock market volatility we'll experience.

Despite what you might read on social media, stocks that never go down don't exist. If you want a completely safe investment with no chance of losing money, Treasury securities or certificates of deposit (CDs) may be your best bet.

Having said that, there's a broad spectrum of "safety" when it comes to the stock market. In a nutshell, some stocks are significantly safer than others. If a company is in good financial shape, has pricing power over its rivals, and sells products people buy even during recessions, it's likely a relatively safe investment.

Certificate of Deposit (CD)

Best safe stocks to buy in 2026

With all of the above criteria in mind, we can identify some excellent companies with the potential for little volatility and excellent returns. To help start your safe stock search, here are seven (relatively) safe stocks that should deliver strong returns over time:

Dividend Aristocrats® (the term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services LLC), which are companies that have increased dividends for at least 25 consecutive years, are considered safe stocks.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Berkshire Hathaway (NYSE:BRK.B) | $1.1 trillion | 0.00% | Diversified Financial Services |

| Walt Disney (NYSE:DIS) | $201.6 billion | 1.11% | Entertainment |

| Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF (NYSEMKT:VYM) | $0.0 thousand | 0.00% | Capital Markets |

| Procter & Gamble (NYSE:PG) | $322.6 billion | 3.03% | Household Products |

| Vanguard Real Estate ETF (NYSEMKT:VNQ) | $0.0 thousand | 0.00% | Capital Markets |

| Starbucks (NASDAQ:SBUX) | $98.6 billion | 2.83% | Hotels, Restaurants and Leisure |

| Apple (NASDAQ:AAPL) | $3.8 trillion | 0.40% | Technology Hardware, Storage and Peripherals |

1. Berkshire Hathaway

NYSE: BRK.A

Key Data Points

Berkshire Hathaway (BRK.A +0.71%)(BRK.B +0.72%) is a conglomerate that owns a collection of more than 60 subsidiary businesses, including auto insurance giant GEICO, rail transport business BNSF, and battery manufacturer Duracell.

Many (like these three) are noncyclical businesses that generally do well in any economic climate. For example, people still pay their auto insurance bills even in tough times.

Berkshire also owns a massive stock portfolio with large positions in Apple (AAPL -0.50%), Bank of America (BAC +0.97%), Coca-Cola (KO +2.71%), and many more. Owning Berkshire is like owning many different investments in a single stock.

In addition, Berkshire had more than $380 billion in cash on its balance sheet in Fall 2025, giving it unmatched financial flexibility -- a major asset during turbulent economic times.

2. The Walt Disney Company

NYSE: DIS

Key Data Points

Most people know Disney (DIS +1.12%) for its theme parks, movie franchises, and characters. Disney also owns a massive cruise line, the Pixar, Marvel, and Lucasfilm movie studios, the ABC and ESPN television networks, and the Hulu, ESPN+, and Disney+ streaming services.

Its theme parks have tremendous pricing power and do well in most economic climates. Disney's movie franchises are among the most valuable in the world, and its streaming businesses are producing a large (and rapidly growing) stream of recurring revenue.

Disney is not completely immune to recessions. The company's theme parks, cruise line, and movie theaters all depend on the ability and willingness of consumers to spend money. However, the strong demand for Disney's theme parks, even as many consumers are cutting back on spending, shows the strength of its business.

3. Vanguard High-Dividend Yield ETF

NYSEMKT: VYM

Key Data Points

Technically, this isn't a stock but is an exchange-traded fund, or ETF.

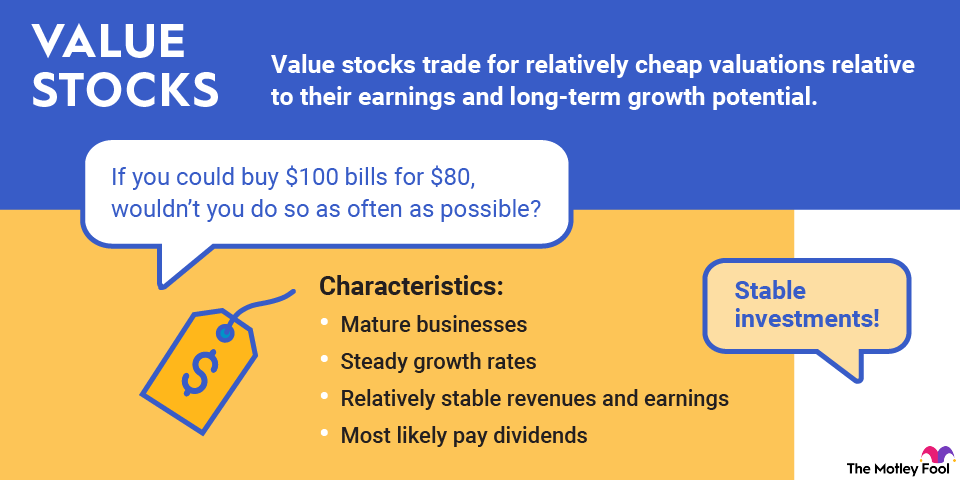

Dividends are a good indicator of a company's stability. And dividend-paying stocks tend to be more stable during tough times than stocks that don't pay dividends.

The Vanguard High Dividend Yield ETF (VYM +0.85%) is a fund that invests in a portfolio of stocks paying above-average dividends. Top holdings include Broadcom (AVGO -3.21%), JPMorgan Chase (JPM +0.86%), and Exxon Mobil (XOM +3.73%), but the fund invests in more than 500 stocks. As of November 2025, the Vanguard High Dividend Yield ETF had a 2.5% annual yield.

4. Procter & Gamble

NYSE: PG

Key Data Points

NYSEMKT: VNQ

Key Data Points

6. Starbucks

NASDAQ: SBUX

Key Data Points

7. Apple

NASDAQ: AAPL

Key Data Points

Apple (AAPL -0.50%) has the durable advantage of having both an extremely loyal customer base and an ecosystem of products designed to work best in conjunction with one another. In other words, iPhone and Mac users tend to remain iPhone and Mac users.

It's no secret that Apple products cost significantly more than comparably equipped phones, computers, and tablets from rivals -- a sign of Apple's tremendous pricing power. Apple's sales can be rather cyclical, meaning they can rise and fall a bit with the strength of the economy, but this is a durable brand.

How to find safe companies to invest in

Although no stock is perfect, you can certainly set yourself up with a portfolio of relatively safe stocks if you incorporate a few guidelines into your stock analysis.

If safety is a priority, consider these five benchmarks:

- Steady, growing revenue: Look for companies that increase their revenue steadily year after year. Erratic revenue tends to correlate with erratic stock prices.

- Free cash flow: This is the money left over after a company pays its operating costs. If you're looking for a green light that a business is durable, positive, and growing free cash flow is a good one.

- Low cyclicality: Cyclicality describes companies' sensitivity to economic cycles. Utilities are an example of non-cyclical businesses because people always need electricity and water.

- Dividend growth: If a company has rarely (or never) cut its dividend and has a strong history of increasing its payout, even in tough economies, that's a great sign.

- Durable competitive advantages: This could be the most important thing to consider. Competitive advantages come in several forms, such as a well-known brand name, a cost-advantaged manufacturing process, or high barriers to entry in an industry.

Benefits of investing in safe stocks

Safe stocks, like those discussed here, have several key benefits, especially for investors who prefer to sleep soundly at night rather than pursue returns that dramatically outperform the market over time.

Just to name a few potential benefits:

- Safe stocks can make excellent income investments, as many have fantastic track records of growing their dividends over time.

- Safe stocks can be a smart way to build wealth over time without too much volatility.

- Safe stocks tend to hold up better than others during recessions, market corrections, and crashes.

Red flags that a stock is unsafe

There are also some telltale factors that indicate a stock is a less safe investment:

- Penny stocks: There's no set-in-stone definition of a penny stock, but the term generally refers to stocks that trade for less than $5 per share. Although not all the stocks that meet this description are bad investments, almost all are cheap for a reason.

- Dividend cuts: If a stock has a frequent history of slashing or suspending its dividend during tough times, it may not be a stable business in all economic climates.

- Declining or unstable revenue: If a company's revenue is frequently up one year and down the next, it's tough to make the case that it's a stable business.

- High payout ratio: If a company's dividend represents a high percentage of the earnings (say, more than 70%), that could be a sign that the dividend is unsustainable.

Related investing topics

The recipe for investing in safe stocks

If you're looking to invest in safe stocks, the list above will get you started. But before you begin, remember two caveats:

First, diversifying is one of the best ways to make your portfolio safer. As previously noted, no stock is completely safe from volatility and competition. So, by finding relatively safe stocks and spreading your money across a bunch of them, you'll give yourself much more of a safety net than if you just purchased one or two.

Second, the stocks mentioned here (and any others that seem safe) aren't necessarily "safe" over short periods. Even the best-run companies experience short-term price swings.

Don't worry about stock prices over days or weeks; keep your focus on companies that are most likely to do well over the long haul. And when it comes to safe, long-term stocks like these, short-term share price weakness can make for excellent buying opportunities.

Essentially, the recipe for safe stock investing is to find stable companies, buy a bunch of their stocks, and hold on for the long haul.

How to invest in safe stocks

Once you've identified safe stocks you want to invest in, the process is fairly straightforward:

1. Open your brokerage app: Log in to your brokerage account where you handle your investments.

2. Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

3. Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

4. Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

5. Submit your order: Confirm the details and submit your buy order.

6. Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.