Education stocks are companies that provide educational services. For-profit colleges, blended learning programs, and tech companies with educational apps are all examples of the types of businesses you see in this industry.

There's a diverse group of education investment opportunities to choose from. These companies provide a valuable service to students and can also provide long-term value for investors.

Top education stocks

Here are some of the best education stocks to consider adding to your portfolio:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Duolingo (NASDAQ:DUOL) | $16 billion | 0.00% | Diversified Consumer Services |

| Stride (NYSE:LRN) | $7 billion | 0.00% | Diversified Consumer Services |

| Grand Canyon Education (NASDAQ:LOPE) | $6 billion | 0.00% | Diversified Consumer Services |

| Laureate Education (NASDAQ:LAUR) | $4 billion | 0.00% | Diversified Consumer Services |

| Bright Horizons Family Solutions (NYSE:BFAM) | $7 billion | 0.00% | Diversified Consumer Services |

| Lincoln Educational Services (NASDAQ:LINC) | $631 million | 0.00% | Diversified Consumer Services |

| John Wiley & Sons (NYSE:WLY) | $2 billion | 3.54% | Media |

Companies 1 - 3

1. Duolingo

Duolingo is a familiar name for anyone who has studied another language. While there are many language learning apps available, Duolingo is by far the most popular. In July 2024, it was the leading language learning app by downloads with 14.3 million -- the next app on the list had fewer than 2 million.

There are about 250 courses teaching more than 40 languages on Duolingo. What makes it special is its fun, bite-sized modules. It makes learning easy and enjoyable, which keeps users coming back.

Duolingo reported 40.5 million daily active users in 2024, a 51% year-over-year increase. Paid subscribers increased 43% to 9.5 million, and revenue was up 41% to $748 million.

2. Stride

Stride, formerly known as K12 Inc., is an education management organization offering virtual learning. Students can attend Stride's virtual public schools as an alternative to local public schools or homeschooling. Schools can partner with Stride for blended learning, which uses virtual content to supplement what students learn in the classroom. It also has adult learning programs for career training.

Growth in online education has been great for Stride. In its 2025 fiscal year (ending June 30, 2025), Stride posted revenue of $2.4 billion, an 18% increase year over year. Net income numbers were even more impressive, jumping by 41% to $288 million.

3. Grand Canyon Education

Grand Canyon Education is a for-profit educational services provider. It partners with colleges and universities, providing academic counseling, enrollment management, financial services, curriculum development, tech support, and more.

Because Grand Canyon is a service provider, it has an asset-light model with low costs and strong free cash flow ($919.9 million in 2024). Service revenue increased by 8% to $1.0 billion in 2024, largely due to a 5% increase in enrollments. Net income went up 10% to $226.2 million.

Companies 4 - 5

4. Laureate Education

Laureate Education is the largest private education operator in Mexico and Peru. It has over 50 campuses and more than 470,000 enrolled students in undergraduate, graduate, and specialized degree programs. It focuses specifically on business, medicine, and engineering programs, and these high-demand career paths lead to strong student outcomes.

This education company has been delivering steady growth over the years. In 2024, new and total enrollments were both up 5%, and revenue was up 6% to $1.6 billion. It has a robust balance sheet with $91.4 million in cash as of the end of 2024, compared to gross debt of $102.1 million.

5. Bright Horizons Family Solutions

Bright Horizons Family Solutions provides child care and early education for parents and employers. It operates more than 1,000 child care centers worldwide, with most located in the U.S. Its revenue increased 11% to $2.7 billion in 2024, and net income increased a whopping 89% to $140 million.

Bright Horizons is notable because it creates a competitive advantage through its employer-sponsored services. The company partners with employers to provide on-site child care for employees. This service has low costs and high retention rates, and it's a market segment that Bright Horizons is dominating.

Companies 6 - 7

6. Lincoln Educational Services

Lincoln Educational Services provides post-secondary career education and training. It's popular among young adults for its hands-on training in career-specific fields. Lincoln Educational offers several types of training programs, including:

- Automotive technology.

- Skilled trades such as welding and HVAC.

- Health sciences.

- Information technology support.

In 2024, Lincoln Educational reported $440 million in revenue, a 16% increase from 2023. Student starts have also been on the rise, growing by 15.2%. With falling university enrollment numbers, Lincoln could be poised for significant growth if more high school graduates opt for career training.

7. John Wiley & Sons

Founded in 1807, John Wiley & Sons is a publishing company focusing on educational materials and academic publishing. In addition to physical books and journals, it also offers digital content, courses, and exam prep. It's also the company behind the popular For Dummies brand and book series.

Wiley has a strong, established portfolio of brands. Notably for potential investors, it makes 48% of its money through recurring revenue. It's also one of the more reliable dividend stocks. It has a high dividend yield and more than 30 consecutive years of dividend increases.

As you might expect from a company that's more than 200 years old, Wiley generally delivers modest growth. For its 2025 fiscal year (which ended April 30, 2025), revenue numbers were down 10% to $1.7 billion, but it cut costs even more, so its net income grew 142% to $84 million. This is far from a growth stock, but it's one of the safer education companies, and it has an excellent dividend.

Related investing topics

Trends

Trends in the education sector

The education sector was upended by the COVID-19 pandemic as students of all ages transitioned to online learning, to the benefit of companies offering virtual schooling and online educational content.

A longer-term trend in education is the decline in college enrollment rates, which dropped by 8.4% from 2010 to fall 2024. Technology is also shortening attention spans, which is increasing the popularity of companies that enable microlearning -- consuming educational content in short modules of no more than 15 minutes.

Two more companies to consider are Coursera (COUR -0.7%) and Udemy (UDMY 1.04%), online platforms that give learners full control of their curriculum paths.

Benefits and risks

Benefits and risks of investing in education stocks

Here are some of the biggest benefits of investing in education stocks with your portfolio:

- Education is an essential service. There's always demand for it in some form, even if the type of education people look for changes.

- You have a wide range of businesses available, including education technology companies, career training schools, and academic publishers.

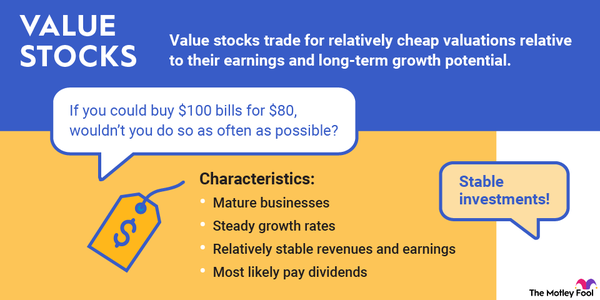

- Many educational stocks have stable or growing revenue as they either maintain or improve enrollment rates each year.

However, the education sector also presents some unique risks:

- It can be difficult to predict the types of education that will be most in demand, as shown by declining university enrollment rates.

- Educational technology companies, while exciting, often trade at high valuations.

- For-profit colleges have a controversial reputation, and some of them have been the subject of regulatory attention and lawsuits.

How to invest

How to invest in education stocks

Once you've found an education stock you like, follow these steps to invest:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.