You don't need to be a stock market expert to be a good investor. Index funds are a big reason why. If you want to put money to work in the stock market, you don't necessarily need to buy individual stocks or pay expensive fees to investment managers.

Index funds can put your stock investment strategy on autopilot. And they can do this while still producing excellent appreciation over the long run.

An index fund is an investment that tracks a financial index, such as the S&P 500 or Nasdaq Composite. Index funds can allow you to invest in broad stock market indexes, such as those I just mentioned.

There are also more narrowly focused stock indexes, such as those that invest in specific sectors or certain types of stocks, and others that focus on fixed-income investments such as bonds. There are hundreds of great index funds available.

How do index funds work?

Index funds are a type of mutual fund or exchange-traded fund (ETF). They are designed to replicate the performance of a certain benchmark index, and they do this by investing proportionally in all the components of their target index.

For example, an S&P 500 ETF would invest in all 500 companies in the S&P 500 index and in the same proportions as each one is represented in the index. The idea is that the S&P 500 index fund would return the same performance (minus any investment fees) as the S&P 500 over time.

Four great index funds to get you started in 2025

Are you looking for some index fund ideas to help you invest better? As I mentioned, there are hundreds to choose from.

However, these four are a good place to start. All of these are broad index funds that could help form a solid backbone for your investment portfolio.

- Vanguard S&P 500 ETF (VOO +0.19%): Tracks the benchmark S&P 500 index, which is widely regarded as the best overall representation of the stock market; $3 annual cost for a $10,000 investment (0.03% expense ratio)

- Vanguard Total Stock Market ETF (VTI +0.14%): Tracks an index of U.S. stocks of all sizes; $3 annual cost for a $10,000 investment (0.03% expense ratio)

- Vanguard Total International Stock ETF (VXUS +0.20%): Tracks an index of global stocks, excluding the U.S.; $5 annual cost for a $10,000 investment (0.05% expense ratio)

- Vanguard Total Bond Market ETF (BND -0.12%): Tracks an index of various bonds; $3 annual cost for a $10,000 investment (0.03% expense ratio)

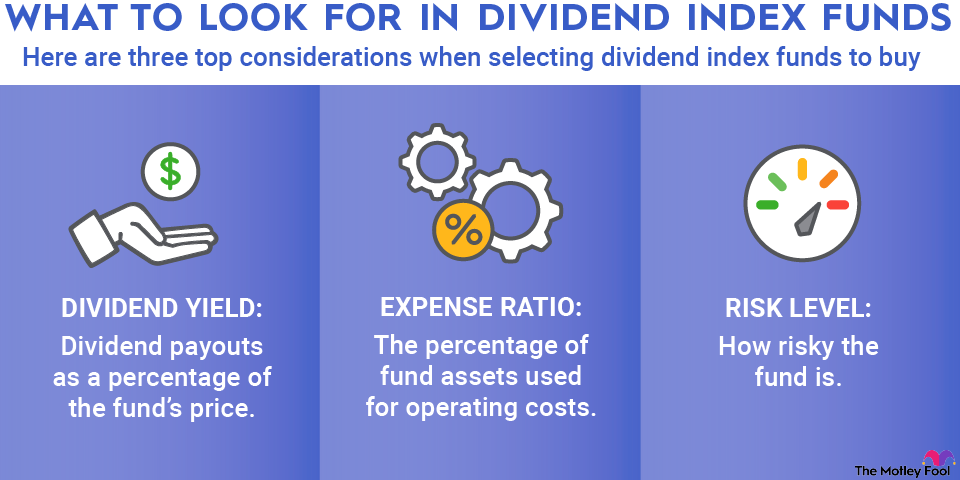

It's worth clarifying the annual costs mentioned here, which are technically known as expense ratios. These aren't actual out-of-pocket costs you pay. They are management fees and are reflected in the share price of the index fund over time.

Also, you might notice that this list includes four Vanguard ETFs, and there's a good reason for it. Vanguard funds have low expenses and are widely regarded as an easy entry point for new index fund investors.

However, it's important to mention that you can find similar funds from other providers as well. Schwab is another example of a provider of excellent low-cost index funds.

Index funds allow you to form a stock and bond asset allocation that is appropriate for your risk tolerance and investment goals. By doing so, they let you create a stock portfolio without the need to research individual stocks or pay an expensive investment advisor.

Once you've used index funds like these to establish a backbone to your portfolio, you can then explore some more focused and specialized index funds to add over time. Beyond the four "backbone" index funds already mentioned, here are some steps to find others that could be great choices for you.

1. Pick an index

There are hundreds of indexes you can track using index funds. The most popular index to invest in is the S&P 500. This includes the stocks of 500 of the largest U.S. companies and is widely considered the best gauge of how the overall U.S. stock market is doing. Here's a short list of some additional top indexes, broken down by the part of the market they cover:

- Large U.S. stocks: S&P 500, Dow Jones Industrial Average, Nasdaq Composite

- Small U.S. stocks: Russell 2000, S&P SmallCap 600

- International stocks: MSCI EAFE, MSCI Emerging Markets

- Bonds: Bloomberg Global Aggregate Bond

In addition to these broad indexes, you can find sector indexes and indexes tied to specific industries. For example, you can buy an index fund that tracks the financial sector. Or you can find one that tracks an index of artificial intelligence (AI) stocks or cybersecurity stocks, just to name a couple of possibilities.

There are several other types of index funds. You can find country indexes that target stocks in specific international markets, style indexes emphasizing fast-growing companies or value-priced stocks, and other indexes that limit their investments based on their own filtering systems.

Passive Indexing

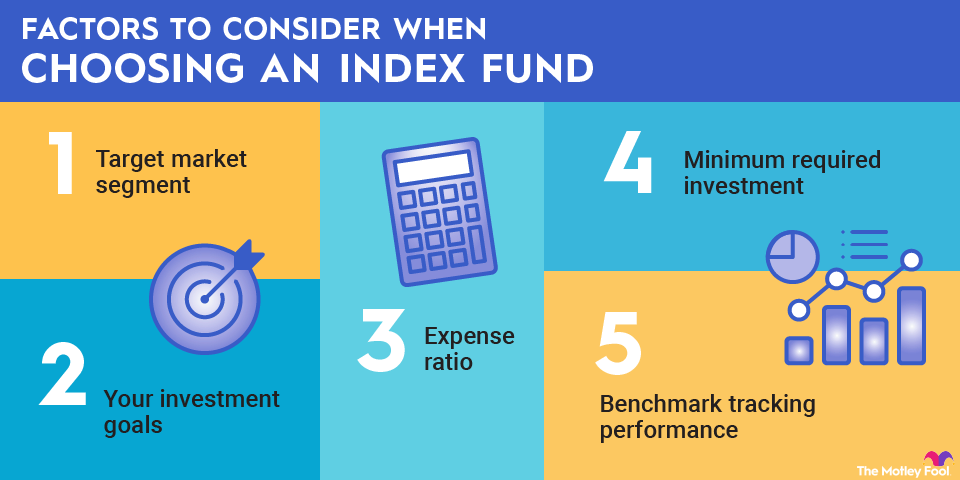

2. Choose the right fund for your index

Once you've chosen an index (or just a specific industry), you can generally find at least one index fund that tracks it. For popular indexes, like the S&P 500, you might have a dozen or more choices. If you have more than one option for your chosen index, you'll want to examine the costs.

Of the top index funds that meet your needs, which has the lowest costs? Even a seemingly small difference can have a big impact over the long term. You can determine which index fund is more cost-effective by comparing the expense ratios of two or more index funds.

3. Buy index fund shares

You can open a brokerage account that allows you to buy and sell shares of the index fund that interests you. Index funds come in both exchange-traded fund (ETF) and mutual fund forms.

You could open an account directly with a fund provider, like Vanguard. However, most people prefer to have all their investments held in a single brokerage account.

Plus, many brokers and investment app providers allow customers to buy fractional shares of index funds in ETF form. This can allow you to start investing and create a diversified portfolio without needing thousands of dollars right away.

Pros and cons

Types of index funds

There are literally thousands of index funds to choose from, and they can be divided into several sub-categories:

- ETF index funds - Index funds that trade on major stock exchanges on a per-share basis.

- Mutual funds - Many index funds are in the form of mutual funds, which only price once a day.

- Major benchmarks - Index funds that track major stock indices like the S&P 500, Nasdaq Composite, or the Russell 2000.

- Types of stocks - There are index funds that allow you to invest in companies of certain sizes (small caps, large caps, etc.) or companies that have certain characteristics (growth stocks or value stocks, for example).

- Sector index funds - If you want to invest in the financial sector, for example, there are index funds that allow you to do that.

- Commodity index funds - Index funds that track certain commodity prices, such as oil and gas.

- Specialized index funds - There are index funds that have narrow specializations, such as artificial intelligence or cybersecurity stocks.

Why invest in index funds?

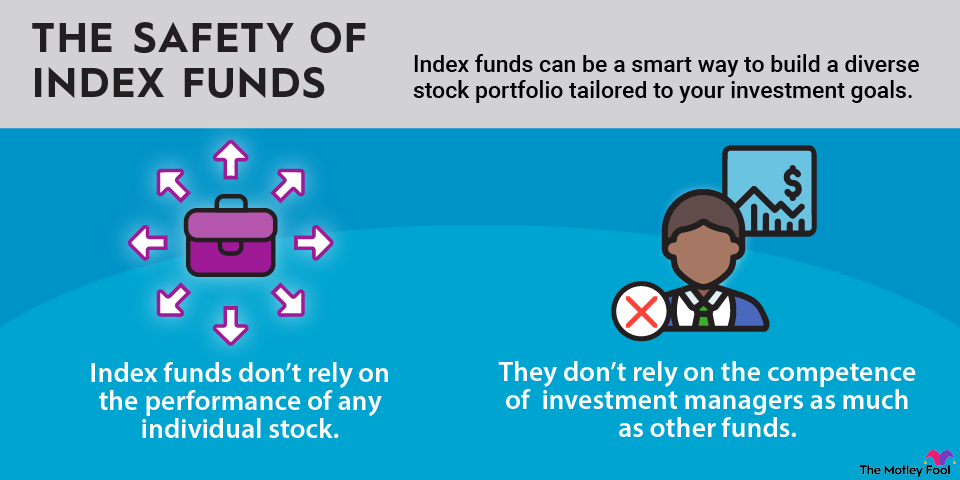

Investing in index funds is one of the easiest and most effective ways for investors to build wealth. By simply matching the impressive performance of the financial markets over time, index funds can turn your investment into a huge nest egg in the long run -- and best of all, you don't have to be a stock market expert to do it.

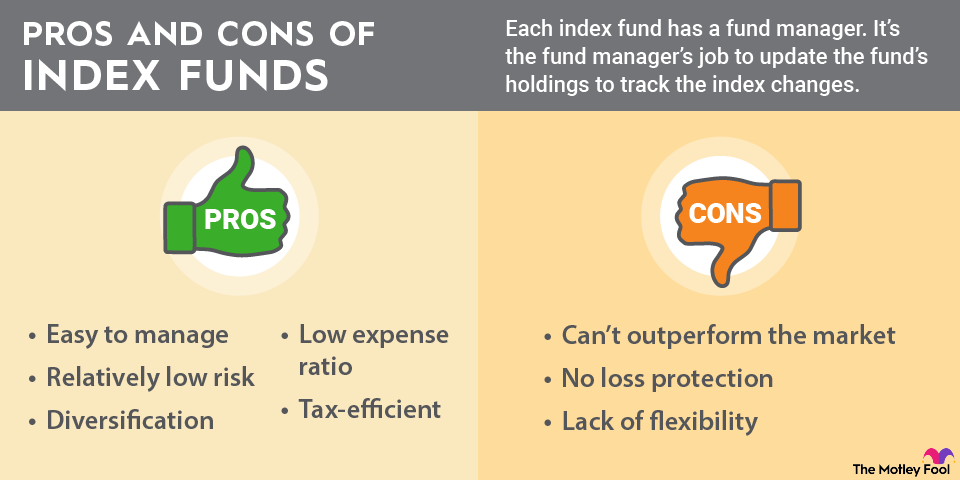

Investors find index funds especially useful for many reasons:

- Minimal investment research: You can rely on the index fund's portfolio manager to simply match the underlying index's performance over time. If you buy an S&P 500 index fund and the S&P 500 rises by 10%, your investment should increase by roughly the same amount.

- Managed investment risk: Diversification leaves you less likely to suffer big losses if something bad happens to one or two companies in the index.

- Lots of choices: You can buy broad index funds, such as those that track the S&P 500, or more focused index funds that invest in specific sectors or trends. For example, if you want to invest in artificial intelligence stocks, you have several great AI index funds to choose from.

- Low fees: Index funds are usually far less costly than alternatives such as actively managed funds. That's because an index fund manager simply has to passively buy the stocks or other investments in an index.

- Tax efficiency: Index funds are quite tax-efficient compared to many other investments. They generally don't do as much buying and selling of their holdings as actively managed funds, so they typically produce lower capital gains that can add to your tax bill.

- Building your portfolio over time: When you use index funds, you are a passive investor. You can invest month after month and ignore short-term ups and downs, confident that you'll share in the market's long-term growth and build your nest egg.

Why not invest in index funds?

As simple as index funds are, they're not for everyone. The downsides of investing in index funds include the following:

- No chance of beating the benchmark: Index funds are designed solely to match the market's performance or the performance of a certain benchmark index. If you want to prove your mettle as a superior investor, index funds won't give you that chance.

- Short-term downside risk: Index funds track their respective markets in good times and bad. They can be volatile places to put your money. Investors may have been reminded of this lesson during a stock market correction in early 2025, fueled by tariff uncertainty, to name a recent example. If your primary objective is capital preservation (not losing money), investments like bonds or high-yield certificates of deposit (CDs) may be better choices for you.

- Many different stocks: The diversification of an index fund works both ways. Depending on the index you choose, you could end up owning some stocks you'd rather not own while missing out on others you'd prefer.

How to invest in index funds

Index funds can be rather easy to invest in, especially if you already have a brokerage account. Simply follow these steps to get started:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the index fund: Enter the ETF or mutual fund's ticker or name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this index fund.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Building a balanced portfolio with index funds

It's entirely possible to build a balanced stock portfolio using nothing but index funds. Or, index funds can be a component of a balanced portfolio that also includes individual stock investments. And here are some principles to keep in mind that can help you do it:

- Rule of 110: The Rule of 110 is used to determine how much of your portfolio should be in stocks (or stock-based index funds), with the rest in fixed-income or bond investments. Simply subtract your age from 110 to find your age-appropriate stock allocation. For example, if you're 45, this rule says that you should have 65% of your portfolio in stocks, with the other 35% in fixed income.

- Look beyond the headline indexes: There are some that will argue that an S&P 500 index fund is a balanced investment portfolio all by itself, but it can be wise to add exposure to other types of stocks. At a minimum, it can be a smart idea to put a small percentage of your portfolio in small-cap and international index funds.

- Use trend-following index funds in moderation: There are index funds that allow you to invest in high-momentum (volatile) trends like artificial intelligence, cryptocurrency, and quantum computing. These can be a good addition to an already well-rounded portfolio, but it's wise to limit your position sizes.

Related investing topics

Are index funds right for you?

If you have the time, knowledge, and desire to create a portfolio of individual stocks, by all means, go for it. But index funds can be a great wealth-building tool all by themselves. Index funds offer investors of all skill levels a simple, time-tested way to invest. They can be a nice backbone to any stock portfolio, even for the most experienced and knowledgeable investors.

If you're interested in growing your money but would rather put some or all of your investments on autopilot, index funds can be a great solution to achieve your financial goals.