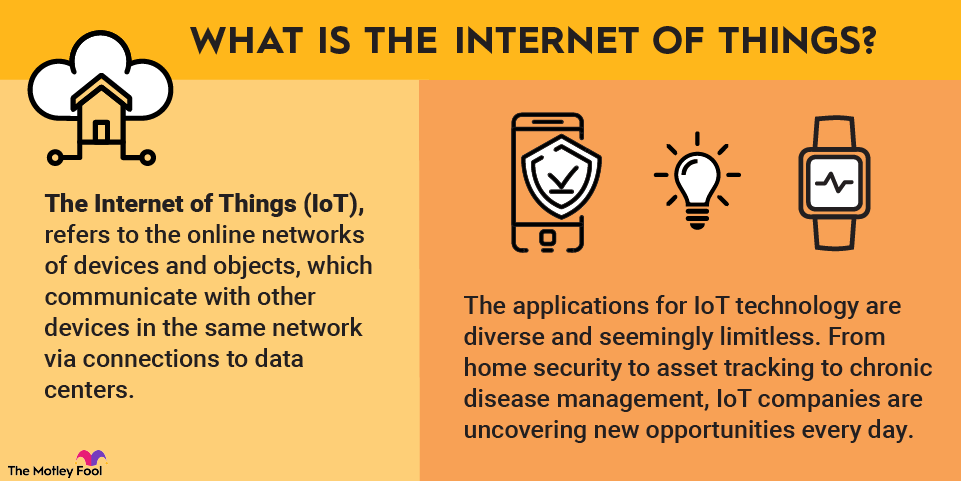

The technology sector is vast, encompassing gadget makers, software developers, semiconductor manufacturers, cloud computing providers, and more. Any company whose products or services rely heavily on technology is generally considered part of the tech sector.

That breadth is both a strength and a challenge for investors. Technology stocks offer some of the strongest growth opportunities in the market, but they can also be volatile and sensitive to shifts in economic conditions and investor sentiment.

What are tech stocks?

Hardware Companies

These design and build devices such as:

- Personal computers.

- Networking servers.

- Semiconductors.

- Smartphones.

- Fitness trackers.

- Smart speakers.

- Enterprise equipment, such as servers and networking gear.

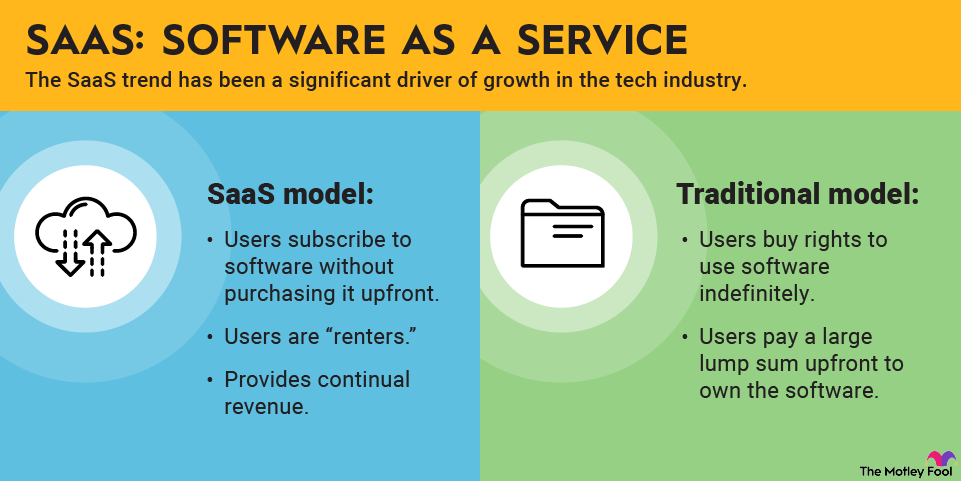

Software Companies

These design the software that runs on hardware, such as:

- Operating systems.

- Databases.

- Cybersecurity software.

- Productivity software.

- Cloud computing providers.

- Artificial intelligence (AI).

Many software companies now operate under a software-as-a-service (SaaS) model, where customers pay recurring subscription fees instead of buying one-time licenses. This approach can provide more predictable revenue over time.

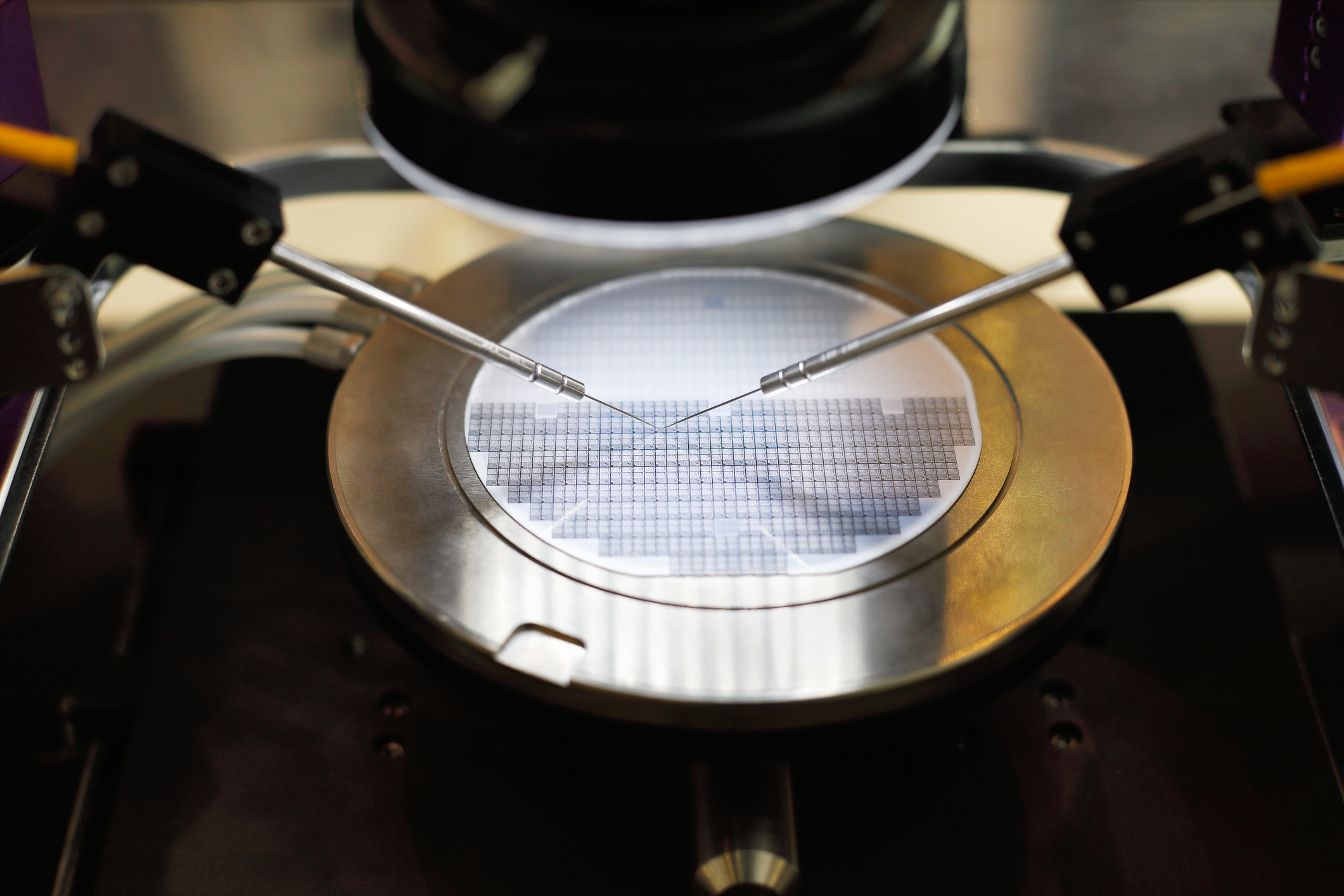

A note on semiconductors

Semiconductors power both hardware and software. Chipmakers design and manufacture CPUs, GPUs, memory chips, and specialized processors that make modern computing possible.

Telecom companies and streaming services often feel like tech stocks, but they are typically classified under the communications or consumer discretionary sectors, even though they rely heavily on technology.

Top tech stocks

Many of the most valuable companies in the world are technology companies. Here are three of the most dominant and largest tech stocks that investors should consider:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Microsoft (NASDAQ:MSFT) | $3.6 trillion | 0.71% | Software |

| Apple (NASDAQ:AAPL) | $3.8 trillion | 0.40% | Technology Hardware, Storage and Peripherals |

| Nvidia (NASDAQ:NVDA) | $4.6 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

1. Microsoft

NASDAQ: MSFT

Key Data Points

Microsoft (MSFT +0.51%) is a dominant software company best known for Windows and Office. Over time, it has expanded far beyond desktop software.

Today, Microsoft is one of the largest cloud infrastructure providers through Azure, and it has positioned itself as a major beneficiary of artificial intelligence through products like Copilot and Azure OpenAI services. The company’s combination of scale, profitability, and enterprise reach makes it a core holding for many tech investors.

2. Apple

NASDAQ: AAPL

Key Data Points

Apple (AAPL -0.56%) designs consumer devices such as the iPhone, iPad, and Mac. Customer loyalty remains one of Apple’s biggest strengths, helping drive consistent upgrade cycles.

In recent years, services, including subscriptions, app store fees, and digital content, have become a growing source of high-margin revenue. While newer products like the Vision Pro headset have had a slower start, investors continue to watch how Apple integrates AI into its ecosystem through Apple Intelligence.

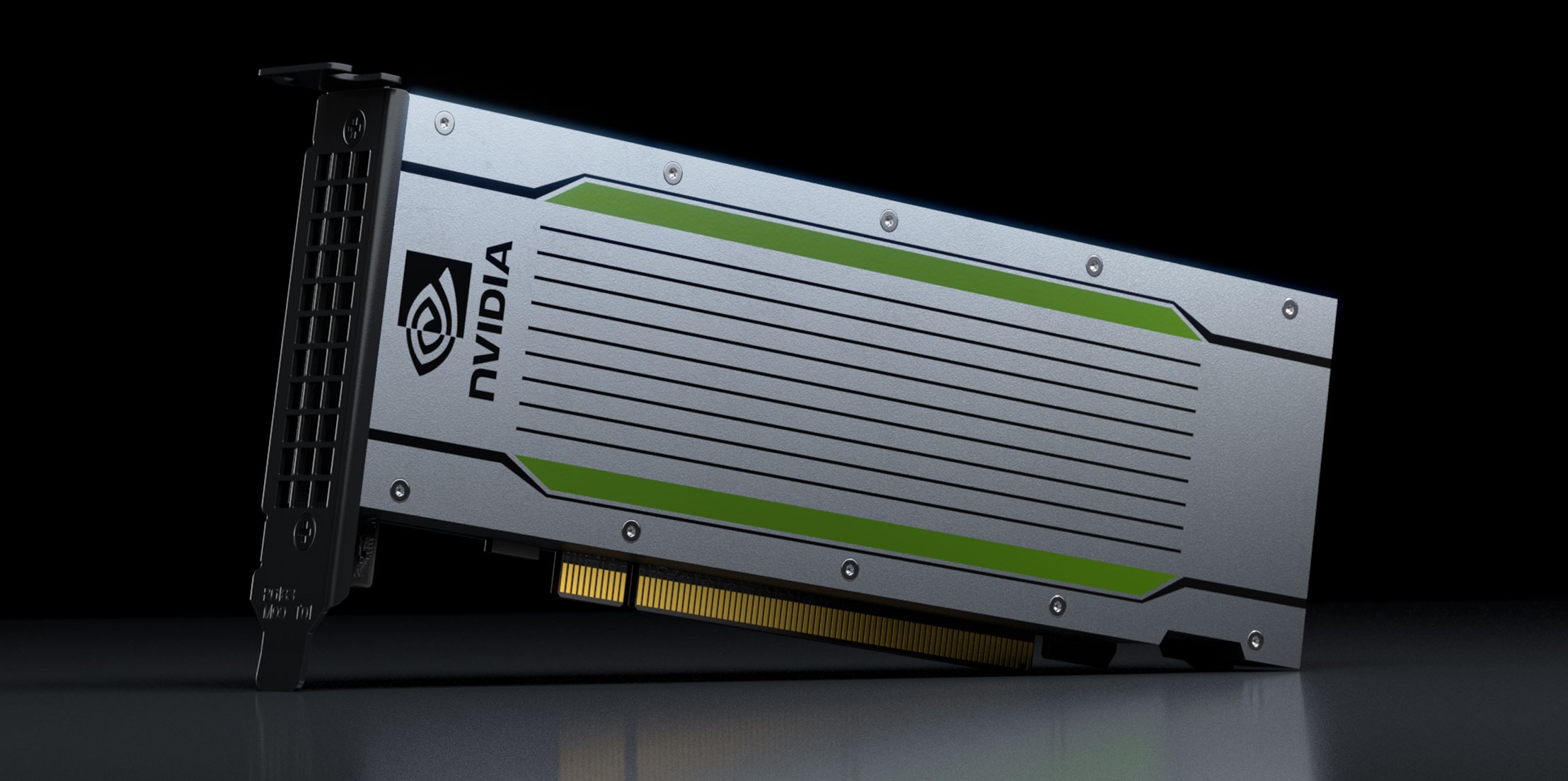

3. Nvidia

NASDAQ: NVDA

Key Data Points

Nvidia (NVDA +1.67%) is the leading manufacturer of advanced GPUs, which are essential for gaming, data centers, and artificial intelligence workloads.

The company has emerged as a central player in the AI boom, supplying the computing power needed to train and run large AI models. Strong demand from cloud providers and enterprises has driven rapid revenue growth, making Nvidia one of the most influential stocks in the tech sector.

Alphabet, Amazon, and Meta Platforms are often grouped with tech stocks, but they’re technically classified in other sectors. Alphabet and Meta fall under communications services, while Amazon is part of consumer discretionary, despite their heavy use of technology.

Pros and cons of investing in tech stocks

While there's no definitive answer as to whether tech stocks are an ideal choice for your portfolio, there are some undeniable advantages and disadvantages to investing in these stocks.

Pros:

- Tech stocks represent a considerable growth opportunity. According to research provider Business Research Insights, the technology market was valued at $5 trillion in 2024, and it's projected to soar to $7 trillion by 2033.

- Investors have unique goals, yet portfolio diversification remains an essential element of any investment strategy, and tech stocks can help achieve this.

- Companies across a wide range of industries rely on the valuable tools that tech companies provide.

Potential cons:

- Because businesses often reduce the degree to which they invest in themselves during market downturns, tech companies could suffer during times of economic uncertainty.

- There is a strong political interest in implementing tariffs as well as potentially limiting sales of semiconductors to China. These factors could place pressure on the financials of tech companies.

- Tech companies often invest heavily in research and development to stay ahead of their competitors. These reinvestments in their business often come at the sacrifice of returning large amounts of capital to shareholders with dividends, so those looking to generate passive income may have limited options with tech stocks.

Tech stocks in the current market

Technology stocks have strongly outperformed the broader market in recent years. The Technology Select Sector SPDR Fund (XLK), which tracks S&P 500 tech stocks, has significantly outpaced the S&P 500.

After a market pullback earlier in 2025, investor interest returned to growth stocks, particularly those tied to artificial intelligence.

Recent highlights include:

- Nvidia: Continued explosive growth in data center revenue driven by AI demand.

- Microsoft: Double-digit growth across revenue and earnings, supported by AI integration and cloud expansion.

- Apple: Major investments in U.S.-based manufacturing and infrastructure to support its AI initiatives.

How to analyze tech stocks

For profitable tech companies, valuation metrics like the price-to-earnings (P/E) ratio can be helpful. A higher P/E often reflects expectations for strong future growth.

For younger or unprofitable companies, revenue growth and improving margins matter more. Investors should look for signs that losses are narrowing as the business scales.

No matter the company, valuation should be considered in the context of growth potential. Paying a premium can make sense if growth materializes, but it increases risk if expectations fall short.

Investors who want broader exposure may consider tech-focused ETFs, such as the iShares Expanded Tech Sector ETF (IGM), which offers diversified access to the sector.

How to invest in tech stocks

Those interested in clicking the buy button on tech stocks only have a few simple steps to take in order to get started.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

The bottom line on investing in tech stocks

Technology stocks remain a powerful force in the market, driven by innovation, scale, and growing reliance on digital tools across industries.

While risks exist, investors who understand valuations, diversify appropriately, and focus on long-term trends may find tech stocks an important component of their portfolios.