Exchange-traded funds, or ETFs, are an easy way to begin investing. They are fairly simple to understand and can generate impressive returns without much expense or effort. Here's what you should know about ETFs, how they work, and how to buy them.

Definition

What is an ETF?

An ETF allows investors to buy many stocks or bonds at once. People buy shares of ETFs, and the money is invested according to a certain objective. For example, if you buy an S&P 500 ETF, your money will be invested proportionately in the 500 companies in that index, and your investment's performance should roughly match that of the index over time.

ETFs versus mutual funds

ETFs versus mutual funds

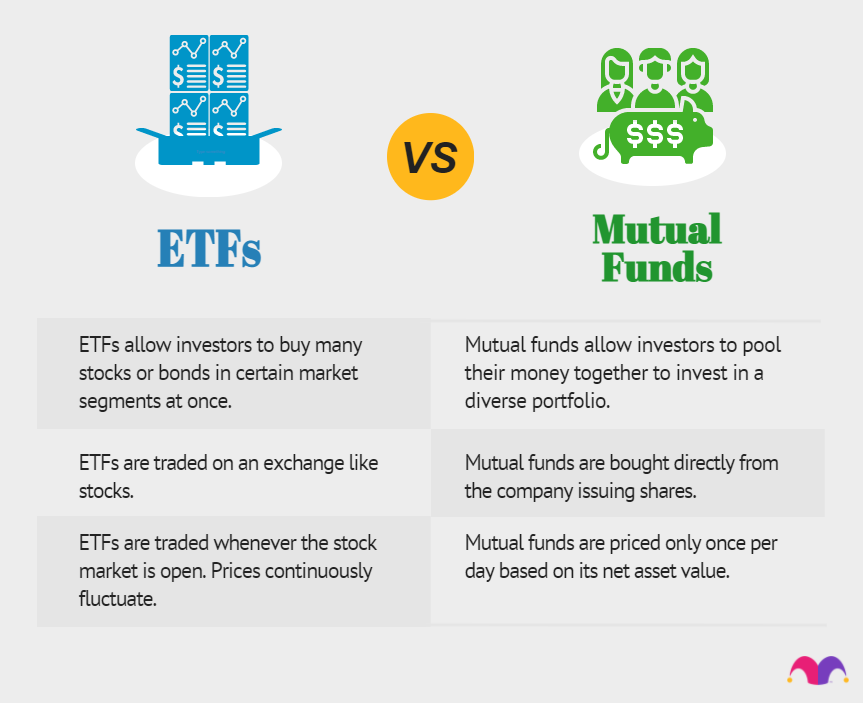

One common question is how ETFs differ from mutual funds, since the basic principle is the same. The key difference between these two types of investment vehicles is how you buy and sell them. Mutual funds are priced once per day, and you typically invest a set dollar amount. For example, you might place an order to buy $1,000 of a certain mutual fund.

Mutual funds can be purchased through a brokerage or directly from the issuer. The key point is that the transaction is not instantaneous.

ETFs, on the other hand, trade just like stocks on major exchanges such as the New York Stock Exchange (NYSE) or the Nasdaq Stock Market. Instead of investing a specific dollar amount, you simply buy shares of the ETF like you would any stock.

Because they trade like stocks, ETF share prices continuously fluctuate throughout the trading day, and you can buy shares of ETFs whenever the stock market is open. With many brokers, you might even be able to buy ETFs when the market is closed.

The basics

Understanding ETF basics

Before we get any further, there are a few concepts that are important to know before you buy your first ETFs.

- Passive versus active ETFs: There are two basic types of ETFs. Passive ETFs (also known as index funds) simply track a stock index, such as the S&P 500, while active ETFs hire portfolio managers to invest their money. The key takeaway: Passive ETFs aim to match an index's performance, while active ETFs want to beat it.

- Expense ratios: ETFs charge fees, known as the expense ratio. You'll see the expense ratio listed as a percentage. For instance, a 1% expense ratio means you'll pay $10 in fees for every $1,000 you invest. For funds with the same objective (like two S&P 500 index funds), a lower expense ratio will save you money. To be clear, this isn't a fee you have to pay -- it is simply reflected in the ETF's performance over time.

- Dividends and DRIPs: Many ETFs pay dividends. For example, an S&P 500 ETF receives dividends from many of the 500 stocks it owns and passes those along to investors. You can choose to have your dividends paid to you as cash or automatically reinvested in additional shares of the same ETF through a dividend reinvestment plan, or DRIP.

Taxes

Understanding ETF taxes

If you buy ETFs in a standard brokerage account (i.e., not a retirement account), you should know that they could result in taxable income. Any gains you make from selling an ETF will be taxed according to capital gains tax rules, and any dividends you receive will likely be taxable as well.

Of course, if you invest in ETFs through an individual retirement account (IRA), you won't have to worry about capital gains or dividend taxes. In a traditional IRA, money in the account is considered taxable income only after it is withdrawn, while Roth IRA investments aren't taxable at all in most cases.

Cost

How much money do you need to be able to invest in ETFs?

ETFs don't have minimum investment requirements -- at least not in the same sense that mutual funds do. However, ETFs trade on a per-share basis. Unless your broker offers the ability to buy fractional shares of stock, which is becoming more common, you'll need at least the current price of one share to get started.

Pros and cons

Pros and cons of ETFs

Let's look at some pros and cons of investing in ETFs.

Advantages:

- ETFs provide exposure to a variety of stocks, bonds, and other assets, typically at a low expense.

- ETFs take the guesswork out of stock investing. Many ETFs are index funds, which allow investors to match the performance of a certain benchmark index over time.

- ETFs are more liquid (i.e., easy to buy and sell) than mutual funds. Online brokers make it easy to buy or sell ETFs with a simple click of the mouse.

- It can be extremely complicated to invest in individual bonds on your own, but a bond ETF can make the fixed-income portion of your portfolio very easy.

Potential drawbacks:

- Since ETFs own a diverse assortment of stocks, they don't have quite as much return potential as individual stocks.

- ETFs are often low-cost, but they aren't free. If you buy a portfolio of individual stocks on your own, you won't have to pay any management fees.

How to start

How to start investing in ETFs

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Best beginners

10 of the best ETFs for beginners

- Vanguard S&P 500 ETF (VOO 0.84%): Large U.S. companies. (The S&P 500 is often regarded as the best benchmark for the overall U.S. stock market.)

- Schwab U.S. Mid-Cap ETF (SCHM 0.56%): Midsize U.S. companies between those included in the S&P 500 and Russell 2000.

- Vanguard Russell 2000 ETF (VTWO 0.95%): Smaller U.S. companies. (The Russell 2000 is the most widely followed small-cap index.)

- Schwab International Equity ETF (SCHF 0.14%): Larger non-U.S. companies.

- Schwab Emerging Markets Equity ETF (SCHE 0.4%): Companies from countries with developing economies, also known as emerging markets.

- Vanguard High-Dividend Yield ETF (VYM 0.59%): Stocks that pay above-average dividends, mostly large-cap stocks.

- Schwab U.S. REIT ETF (SCHH 0.0%): Real estate investment trusts (REITs), which own properties and tend to pay high dividends.

- Schwab U.S. Aggregate Bond ETF (SCHZ -0.3%): Bonds of all different varieties and maturity lengths.

- Vanguard Total World Bond Fund (BNDW -0.07%): Includes international bonds and U.S. bonds of various lengths and maturities.

- Invesco QQQ Trust (QQQ 1.03%): Tracks the Nasdaq-100 index, which is heavy on tech and other growth stocks.

You might notice that this list is heavy on Vanguard and Schwab. There's a good reason: Both are dedicated to offering easy access to the stock market at a minimal expense, so ETFs from both tend to be among the cheapest in the business.

Related investing topics

Let your ETFs do the hard work for you

It's important to keep in mind that ETFs are generally designed to be maintenance-free investments. Newer investors tend to have a bad habit of checking their portfolios far too often and making emotional, knee-jerk reactions to major market moves.

In fact, the average fund investor significantly underperforms the market over time, and overtrading is the main reason. So, once you buy shares of some great ETFs, the best plan is to leave them alone and let them do what they're intended to do: produce excellent investment growth over long periods of time.

Expert Q&A

Expert Q&A on ETFs

Dr. A. Seddik Meziani

The Motley Fool: Are ETFs good for beginner investors?

Dr. A. Seddik Meziani: ETFs are an easy way to invest. They are rightly considered an ideal entry point into the market for fledgling investors thanks to their simplicity, low upfront cost, simple fee structure, and ease of trade. Also, beyond an ETF share price, there is no minimum amount to invest, unlike for mutual funds. Any broker can turn an investor into a new ETF holder via a straightforward brokerage account. Investors can easily access the market or submarket they want to be in. It is easily done through an ETF that tracks it.

The Motley Fool: Is an ETF considered safer than an index fund to mitigate risk? Or vice versa?

Dr. A. Seddik Meziani: To be clear, many ETFs are an “index fund” in that they also track an index, just with different terms and conditions. That being said, most ETFs can be used to mitigate risk since they are generally inherently diversified via their underlying baskets of securities which offer a widening range of asset classes. Like index funds, they cannot, however, fully eliminate risk such as market risk or counterparty and credit risk inherent in an ETF structure.

The Motley Fool: Are ETFs considered safer than stocks? Why or why not?

Dr. A. Seddik Meziani: ETFs are generally considered safer to own than individual stocks because of their wide array of underlying holdings which provide the benefits of diversification. Generally, it’s safer to hold a group of stocks rather than just one stock. In other words, ETFs eliminate exposure to individual securities risk.

The Motley Fool: How do ETFs help with diversification? Is it possible to over-diversify your ETF portfolio?

Dr. A. Seddik Meziani: Diversification is a widely accepted framework for managing investments. ETFs help with diversification especially if the underlying portfolios include multiple asset classes. But like everything else, diversification also has its limits. It should be practiced in moderation. The role of diversification is to reduce investment risk. Taking it too far, however, could lead to portfolio bloat and overdiversification. It happens when the additional benefit of reducing risk via diversification begins to be outweighed by the marginal loss of the expected return. Holding more stocks simply for the sake of having more holdings and not thinking about how the risk of each additional stock balances against the risk of the existing stocks is not a good investment strategy.

FAQ

Beginner investing in ETFs: FAQ

What is an ETF?

An exchange-traded fund, or ETF, allows investors to buy many stocks or bonds at once. People buy shares of ETFs, and the money is invested according to a certain objective.

ETFs trade just like stocks on major exchanges such as the New York Stock Exchange and the Nasdaq Stock Exchange. Because they trade like stocks, ETF prices continuously fluctuate throughout the trading day, and you can buy shares of ETFs whenever the stock market is open.

How do I invest in ETFs?

Steps to investing in ETFs:

- Open your brokerage app.

- Search for the ETF you want to buy.

- Decide how many shares to buy.

- Select the order type.

- Submit your order.

- Review your purchase.

What is an ETF's expense ratio?

An ETF's expense ratio indicates how much of your investment in a fund will be deducted annually as fees. A fund's expense ratio equals the fund's operating expenses divided by the average assets of the fund. To be clear, this isn't a fee you'll have to pay -- it will be reflected in the ETF's performance over time.

What is the 3:5-10 rule for ETF?

The 3:5-10 rule (also known as the 3-5-10 limits) is a regulatory guideline for ETFs and other investment funds that restricts the amount they can own in another fund's voting shares. The breakdown is:

- 3% limit: A fund can't acquire more than 3% of the outstanding voting shares of another registered investment company.

- 5% limit: It can't invest more than 5% of its total assets into another single registered investment company.

- 10% limit: A fund can't invest more than 10% of its total assets in all other registered investment companies.

How long should you hold your ETF?

You should aim to hold most ETFs indefinitely. These funds are long-term investment vehicles that typically hold a diversified group of stocks, bonds, or other assets. A good rule of thumb is to only sell an ETF if you want to invest the money into a higher-performing or lower-risk fund or if you need the money for something else (e.g., down payment on a house or retirement).

Do ETFs provide diversification?

Many ETFs provide some form of diversification. Some ETFs hold a wide selection of stocks (e.g., all companies in a market index), while others provide diversification across different stock types (i.e., dividend, value, or growth stocks).

However, not all ETFs provide diversification. Some thematic funds only hold stocks in a certain sector (e.g., energy or tech) while some only invest in one asset (a specific stock or other asset class like gold).

How is an ETF different from an index fund?

The main difference between an index fund and ETFs lies in how they trade. ETFs trade like stocks on an exchange throughout the trading day. Index funds typically only price once a day, usually at market close. Other differences are liquidity (it's easier to buy and sell ETFs than index funds), fees (some ETFs have higher fees), and investment minimum (some index funds require you to invest a specific minimum amount, like $1,000).