The iShares Semiconductor ETF (SOXX -1.50%) is one of the best ways to gain exposure to the chipmakers powering the artificial intelligence (AI) boom. There's no need for niche thematic or sector ETFs.

Semiconductor exchange traded funds (ETFs) like SOXX give you direct access to the companies building the processors, memory, and hardware that make AI development and deployment possible, from training large language models to powering edge computing.

But just because SOXX is popular doesn’t mean it's right for everyone. Its concentrated portfolio and history of volatility make it a fund worth examining more closely. Here's what you need to know.

Exchange-Traded Fund (ETF)

What is the iShares Semiconductor ETF (SOXX)?

SOXX is a passively managed ETF that replicates the holdings of the NYSE Semiconductor Index, a benchmark composed of the 30 largest U.S.-listed semiconductor companies. The index is weighted by a modified market capitalization approach, giving larger companies more influence while still limiting overconcentration.

The fund includes a mix of:

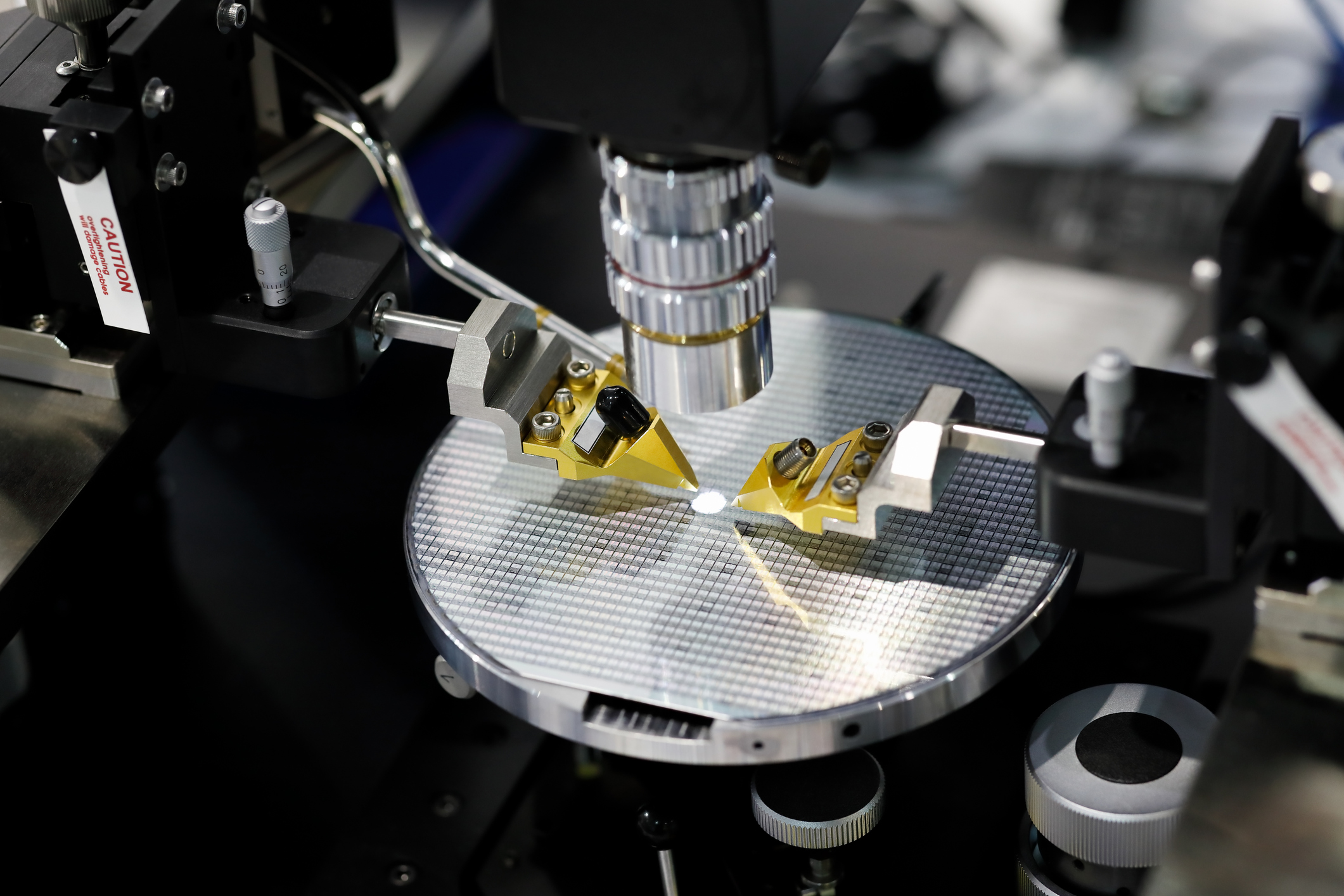

- Semiconductor designers, which develop the architecture and blueprints for chips

- Manufacturers, which fabricate those chips in specialized foundries

- Semiconductor equipment providers, which supply the machines and tools -- such as lithography systems -- that make chip production possible

The ETF is well capitalized, with more around $16.3 billion in assets under management, and it's highly liquid with a low 0.02% 30-day median bid-ask spread. But investors should be prepared for volatility. SOXX has a three-year beta of 1.72 and a standard deviation of 29.06%, meaning its price tends to swing more sharply than the broader market.

How to buy the iShares Semiconductor ETF (SOXX)

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest in the iShares Semiconductor ETF (SOXX)?

You should consider SOXX if you want targeted exposure to semiconductor sector stocks but don't want to pick individual companies. Buying this ETF is a way to express a bullish view of the entire chipmaking industry rather than betting on a single name.

Just remember that this comes with reduced diversification since many of these stocks already appear in major benchmarks like the S&P 500 and Nasdaq-100. It's worth checking how much overlap SOXX has with your existing portfolio before adding it.

Does the iShares Semiconductor ETF (SOXX) pay a dividend?

SOXX pays a modest dividend with a 30-day SEC yield of 0.31%. The yield is supported by a few higher-paying names like Broadcom, while many other holdings prefer to reinvest earnings or return capital through buybacks. Dividends are paid on a quarterly basis.

What is the iShares Semiconductor ETF (SOXX)'s expense ratio?

SOXX has an annual expense ratio of 0.34%, which means you'll pay about $34 per year for every $10,000 you invest. You don't pay this fee directly -- it's automatically deducted from the fun's performance behind the scenes. That means your returns are already net of fees.

Expense Ratio

Historical performance of the iShares Semiconductor ETF (SOXX)

Looking at SOXX's historical annualized returns over various trailing periods provides a sense of how the fund has performed through different market cycles. All performance figures are as of Sept. 30, 2025, and reflect reinvested dividends.

Metric | 1y | 3y | 5y | 10y |

|---|---|---|---|---|

SOXX Total Return | 18.51% | 37.84% | 22.76% | 27.19% |

SOXX Market Price | 18.41% | 37.75% | 22.74% | 27.19% |

Related investing topics

The bottom line on the iShares Semiconductor ETF (SOXX)

SOXX offers straightforward, relatively affordable, and highly liquid exposure to the dominant chipmakers driving modern technology, with a bias toward the largest players in the space. It gives you a simple way to target the entire semiconductor industry with a single ticker instead of buying multiple individual stocks.

Just be aware of its high volatility and keep expectations in check -- the stellar returns of the past decade are unlikely to continue over the long term.