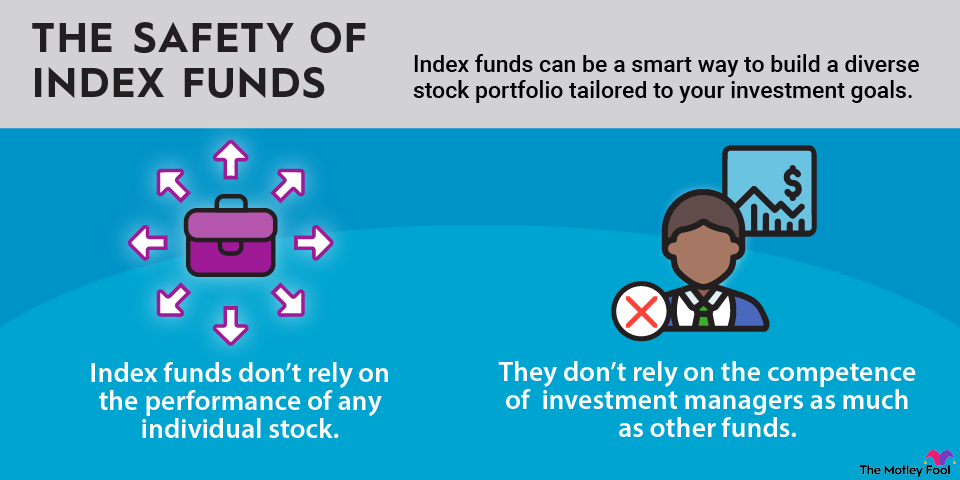

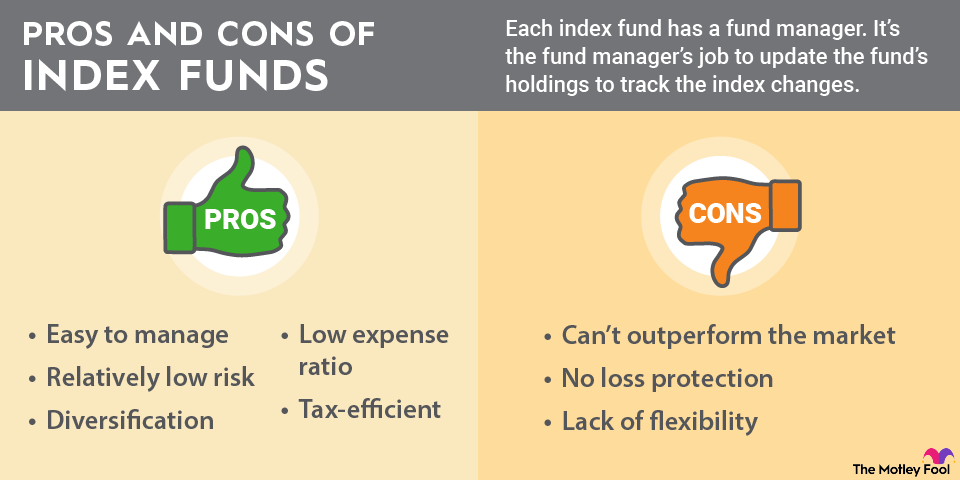

Index funds allow you to form a stock and bond asset allocation that is appropriate for your risk tolerance and investment goals. By doing so, they let you create a stock portfolio without the need to research individual stocks or pay an expensive investment advisor.

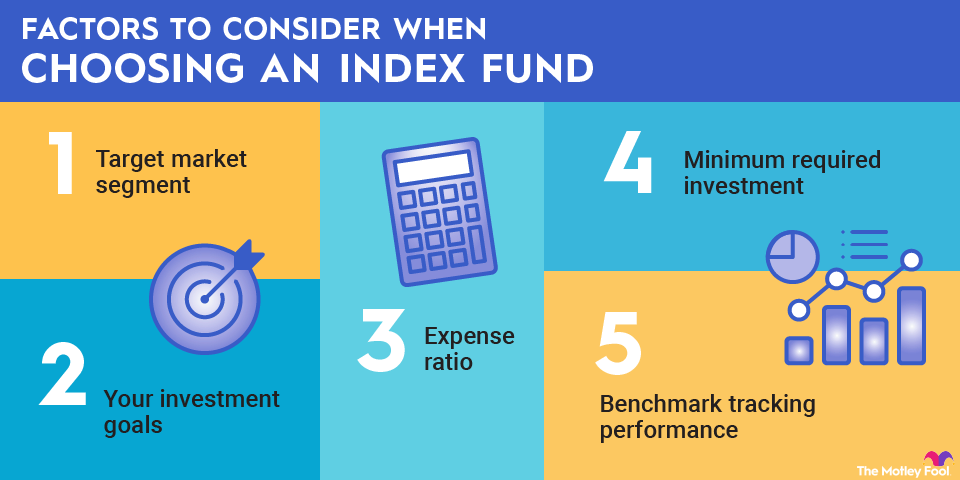

Once you've used index funds like these to establish a backbone to your portfolio, you can then explore some more focused and specialized index funds to add over time. Beyond the four "backbone" index funds already mentioned, here are some steps to find others that could be great choices for you.

1. Pick an index

There are hundreds of indexes you can track using index funds. The most popular index to invest in is the S&P 500. This includes the stocks of 500 of the largest U.S. companies and is widely considered the best gauge of how the overall U.S. stock market is doing. Here's a short list of some additional top indexes, broken down by the part of the market they cover:

In addition to these broad indexes, you can find sector indexes and indexes tied to specific industries. For example, you can buy an index fund that tracks the financial sector. Or you can find one that tracks an index of artificial intelligence (AI) stocks or cybersecurity stocks, just to name a couple of possibilities.

There are several other types of index funds. You can find country indexes that target stocks in specific international markets, style indexes emphasizing fast-growing companies or value-priced stocks, and other indexes that limit their investments based on their own filtering systems.