Verizon (VZ -0.80%) is one of the largest telecommunications companies in the country. The company provides consumers and businesses with voice, data, and video services and solutions. It's one of the largest wireless service providers, with a coast-to-coast network.

NYSE: VZ

Key Data Points

Verizon has invested heavily in recent years to upgrade its wireless network to faster 5G (fifth-generation) technology. Those investments should enable the telecom company to grow its revenue by providing consumers and businesses with faster mobile data services.

You might be one of the millions of customers who rely on Verizon. That could have piqued your interest in learning how to invest in its stock. Here's a step-by-step guide to investing in the communications stock and some factors to consider before adding it to your portfolio.

Stock

How to buy Verizon stock

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest in Verizon?

It's important to spend time researching a stock before adding it to your portfolio. Here are some reasons you might want to invest in Verizon:

- You're a Verizon customer and want to buy shares in a company you rely on.

- You want to invest in companies that generate stable and growing cash flow.

- You're looking for higher-yielding dividend stocks that steadily increase their dividends.

- You think Verizon's investments in 5G will cause its growth rate to increase in the coming years.

- You believe Verizon will turn things around and become a market-beating stock over the next three to five years.

- You're seeking to invest in value stocks.

- Buying Verizon would help diversify your portfolio.

On the other hand, here are some reasons you might not want to buy Verizon stock:

- You're not a fan of Verizon or you use a rival's service.

- You're not interested in stocks that produce dividend income.

- You're looking for companies growing faster than Verizon.

- You think Verizon will continue to underperform the market.

- You already own shares of another communications company.

Is Verizon profitable?

Verizon is a very profitable company. The telecom giant reported $134.79 billion in revenue and $17.95 billion of net income in 2024.

Meanwhile, it's a cash flow machine. Verizon produced $36.91 billion of cash flow from operations in 2024, easily covering its capital expenses ($17.09 billion) and dividend payments ($11.2 billion). That enabled it to produce excess free cash to strengthen its balance sheet.

Verizon has been making heavy capital investments in recent years to build out infrastructure to support its faster 5G network. The company expects its investments in 5G will grow its revenue, earnings, and operating cash flow in the future. These initiatives position Verizon to increase its profits in the coming years.

Does Verizon pay a dividend?

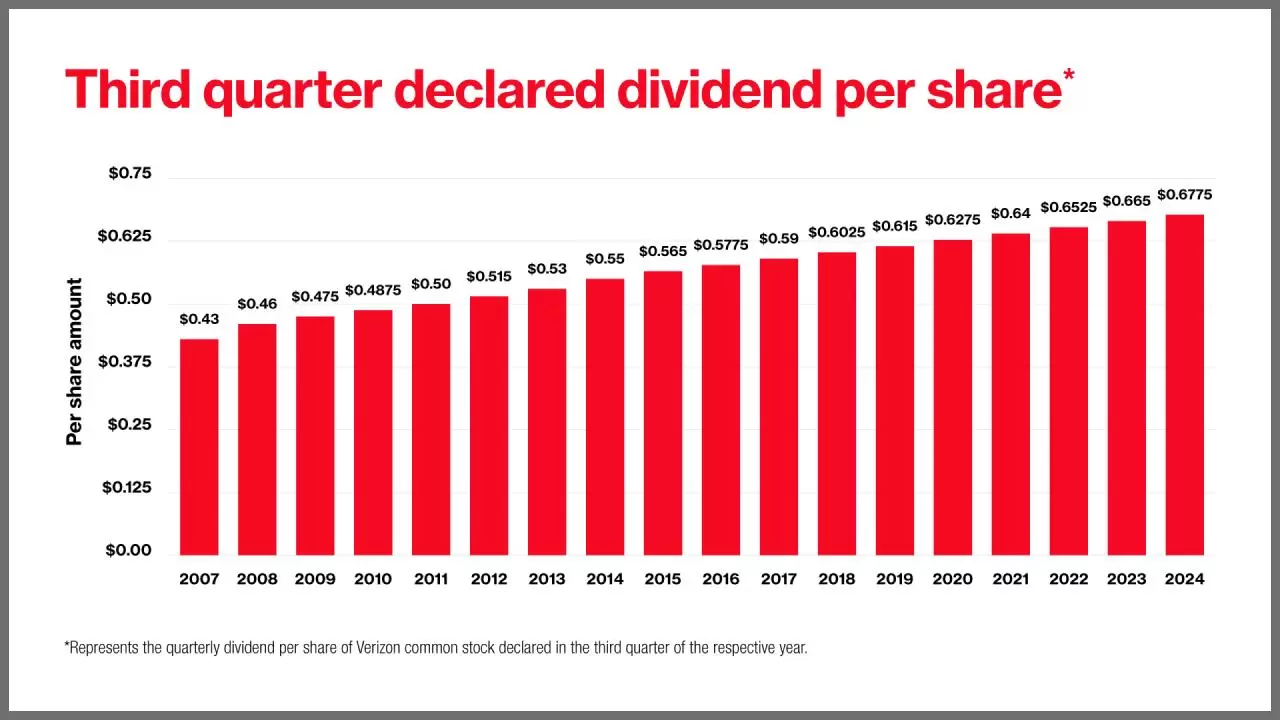

Verizon makes quarterly dividend payments to its investors. The telecom giant has a long history of increasing its dividend:

2024 was Verizon's 18th straight year of increasing its dividend.

Verizon stands out for its high dividend yield. It was more than 6% in mid-2025. That's almost double the average telecommunications company's dividend yield of 3.2% and four times that of the S&P 500 index (which had a 1.25% dividend yield).

ETFs with exposure to Verizon

Not all investors want to actively invest in stocks they need to manage. Many would rather be passive investors. An easy way to be a passive investor is to own exchange-traded funds (ETFs).

Exchange-Traded Fund (ETF)

The bottom line on Verizon

Verizon is one of the largest telecommunications companies in the country. It generates billions of dollars in free cash flow each year, giving it the cash to pay a very attractive and steadily rising dividend, making Verizon a great stock for people seeking stable income.