Tax considerations

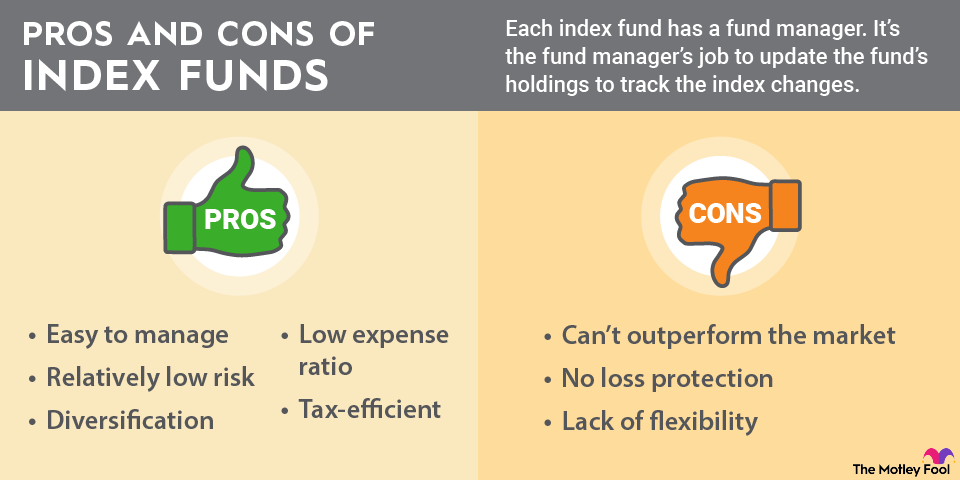

Investing in index funds can be a hands-off approach to investing, but it's essential for investors to understand that this strategy can have significant tax implications.

Whether you need to worry about taxes depends on whether you invest in index funds in a standard (taxable) brokerage account, or if you buy them in a retirement account like an IRA or 401(k). In the latter case, you won't need to worry about taxes -- at least until you withdraw money from the account.

On the other hand, if you own index funds in a standard brokerage account, there are two potential tax situations you need to be aware of:

- Capital gains - If you sell your index funds for more than you paid, the profit can be considered a capital gain. If you hold the index fund for a year or less, it will be taxed the same as ordinary income. If you hold for longer than a year, it will be considered a long-term capital gain, which is treated a bit more favorably by the IRS.

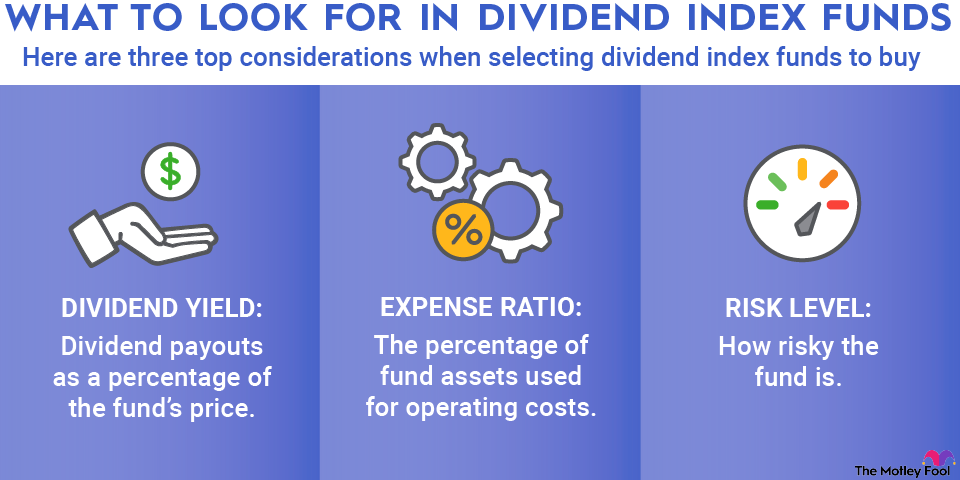

- Dividends - Index funds receive dividends from their portfolio companies and distribute them regularly to investors in the form of dividends. These payments can be a great way to get a steady income from your portfolio, but they are also considered to be a form of taxable income.

If you're concerned that owning index funds could have serious tax implications for you, the best course of action could be to seek the advice of a Certified Financial Planner or other professional who can evaluate your specific situation.

Building a balanced portfolio with index funds

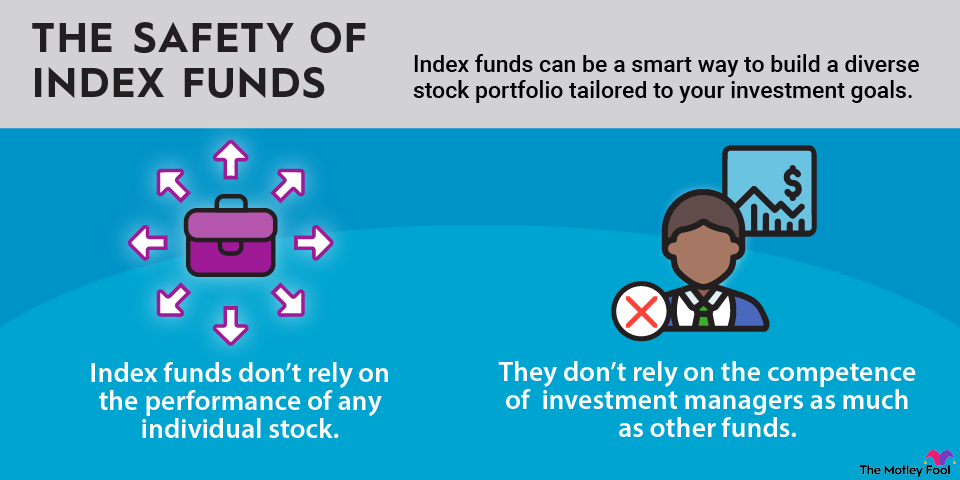

It's entirely possible to build a balanced stock portfolio using nothing but index funds. Or, index funds can be a component of a balanced portfolio that also includes individual stock investments. And here are some principles to keep in mind that can help you do it:

- Rule of 110: The Rule of 110 is used to determine how much of your portfolio should be in stocks (or stock-based index funds), with the rest in fixed-income or bond investments. Simply subtract your age from 110 to find your age-appropriate stock allocation. For example, if you're 45, this rule suggests that you should allocate 65% of your portfolio to stocks, with the remaining 35% to fixed income.

- Look beyond the headline indexes: Some argue that an S&P 500 index fund is a balanced investment portfolio in itself, but it can be wise to add exposure to other types of stocks. At a minimum, it can be a smart idea to put a small percentage of your portfolio in small-cap and international index funds.

- Use trend-following index funds in moderation: There are index funds that allow you to invest in high-momentum (volatile) trends like artificial intelligence, cryptocurrency, and quantum computing. These can be a good addition to an already well-rounded portfolio, but it's wise to limit your position sizes.