Global marijuana markets are growing like a weed. The value of the worldwide legal cannabis market is projected to increase by a compound annual growth rate of 34% and to reach $444 billion by 2030, according to Forbes Business Insights.

With this impressive expected growth, it's no wonder many investors are interested in owning cannabis stocks. What's the best approach to marijuana stock investing? These seven key steps will tell you what you need to know to become a cannabis investor.

1. The products

1. Understand the various types of marijuana products

There are two broad categories of cannabis products:

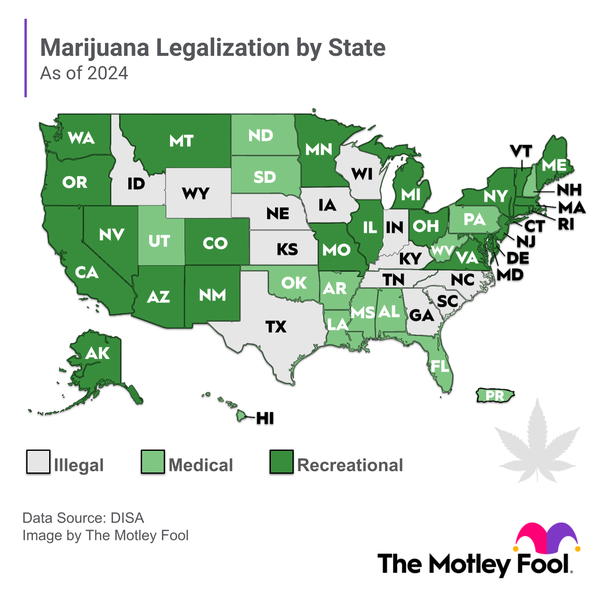

- Medical marijuana: This is cannabis used for medicinal purposes, and it is legal in 39 U.S. states, the District of Columbia, three U.S. territories, and more than 40 countries. A prescription from an authorized healthcare provider is typically required for patients to obtain medical marijuana. It is frequently prescribed to adults for anxiety, depression, pain, and stress.

- Recreational marijuana: Twenty-four U.S. states, plus Washington, D.C., have legalized recreational marijuana for adult use. It is also legal in Canada, Georgia, Germany, Luxembourg, Malta, Mexico, South Africa, Thailand, and Uruguay.

2. The companies

2. Know the different types of marijuana companies

The three primary types of companies in the marijuana industry are:

- Cannabis growers and retailers: These companies cultivate cannabis (often in indoor facilities and greenhouses), harvest the crops, and distribute the end products to customers. Some also operate retail stores that sell medical and/or recreational cannabis.

- Cannabis-focused biotechnology companies: Some biotech companies participate in the cannabis industry by extracting cannabinoids from marijuana to develop new pharmaceuticals.

- Ancillary product and service providers: These companies don't touch the plants but support the marijuana industry by providing products and services, such as hydroponic products, lighting systems, packaging materials, and management services.

3. The risks

3. Understand the risks of investing in the marijuana industry

Investing in any type of asset comes with some degree of risk. Investing in marijuana stocks is associated with additional specific risks you should clearly understand:

- Legal and political risks: In the U.S., selling marijuana remains illegal at the federal level. U.S. federal law places severe restrictions on banks that deal with marijuana-related businesses. As a result, it's difficult for U.S. cannabis businesses to access critical financial services. Political support for federally legalizing marijuana has increased, but there's no guarantee it will occur.

- Supply and demand imbalances: As a burgeoning industry in the agriculture sector, marijuana is particularly prone to irregularities in supply and demand. Canadian marijuana growers initially undertook major expansion initiatives to increase production capacity so they could meet recreational marijuana demand. Some companies later cut back on production because the cannabis supply in Canada outstripped demand, causing prices to fall and revenue to suffer.

- Over-the-counter (OTC) stock risks: Many cannabis companies trade on over-the-counter (OTC) markets. That means they are not required to regularly file financial statements, which are important for investors wanting to assess a stock's risk. Companies trading OTC also don't have to maintain minimum market capitalizations, which can result in low levels of liquidity and difficulty trading the cannabis stock.

- Financial constraints: Many cannabis industry participants are unprofitable growing companies that face the prospect of running out of cash. They often raise capital by issuing new shares, which dilutes the value of the existing shares. Even with this dilution, financially constrained marijuana companies can struggle to obtain enough capital to operate successfully.

4. The research

4. Know what to look for in a top marijuana stock

When considering any marijuana stock, you should:

- Research the management team.

- Understand the company's growth strategy and competitive position.

- Scrutinize the company's financial statements.

- Examine the number of warrants and convertible securities the company has issued. A high number on a percentage basis could indicate that the stock will be meaningfully diluted in the future, potentially causing the share price to drop substantially.

For marijuana growing companies, specific metrics to research include:

- All-in cost of sales per gram: A company's total per-gram cost of producing cannabis

- Cash cost per gram: A company's total per-gram cost of producing cannabis, excluding the costs associated with amortization, packaging, and inventory adjustments

You can look for and prioritize marijuana growers with lower cost structures since they tend to be the most competitive.

5. Investments

5. Evaluate the top cannabis stocks and ETFs

Now for the fun part: digging into the top marijuana companies. You may also want to check out marijuana-focused exchange-traded funds (ETFs).

Below is a list of top marijuana stocks to consider thoroughly. Note that this collection isn't comprehensive and includes only marijuana stocks with a market cap of at least $200 million.

| Company name | Company ticker | Market cap | Sector |

|---|---|---|---|

| Green Thumb Industries | OTC:GTBIF | $1 billion | Health Care |

| Trulieve Cannabis | OTC:TCNNF | $738 million | Health Care |

| Cronos Group | NASDAQ:CRON | $786 million | Health Care |

| Curaleaf | OTC:CURLF | $633 million | Health Care |

| Tilray Brands | NASDAQ:TLRY | $559 million | Health Care |

| SNDL | NASDAQ:SNDL | $327 million | Health Care |

| Canopy Growth | NASDAQ:CGC | $232 million | Health Care |

| Aurora Cannabis | NASDAQ:ACB | $255 million | Health Care |

| Jazz Pharmaceuticals Plc | NASDAQ:JAZZ | $7 billion | Health Care |

| Scotts Miracle-Gro | NYSE:SMG | $4 billion | Materials |

| Innovative Industrial Properties | NYSE:IIPR | $2 billion | Real Estate |

Here are a couple of marijuana ETFs to also consider adding to your portfolio:

| Marijuana ETF | Assets Under Management |

|---|---|

| Amplify Alternative Harvest ETF (NYSEMKT:MJ) | $104 million |

| Global X Marijuana Life Sciences Index ETF (OTC:HMLSF) | $45 million |

6. Pick favorites

6. Invest in your favorite cannabis companies

Investing in marijuana companies is not suitable for everyone. For some, particularly conservative investors, the best approach is to avoid these stocks entirely. Only investors who understand and can tolerate high levels of risk should add cannabis companies to their investment portfolios.

Even for aggressive investors, it's unwise to put too much of your portfolio into any one marijuana stock or ETF. Consider starting with a small position in a marijuana stock and adding to your holdings as the cannabis market grows and the company increases its revenue and earnings.

The investment becomes less risky as your investment thesis is confirmed. However, if the company performs poorly, you should reevaluate your investment assumptions.

When choosing which cannabis stocks to buy, remember that some are arguably safer than others. For example, Scotts Miracle-Gro, which historically sells lawn and garden products, generates much of its revenue outside the cannabis industry. So, the company doesn't face many of the risks normally associated with cannabis products and could be a better choice for more conservative investors.

Related investing topics

7. Monitoring

7. Monitor changing marijuana industry dynamics

While investors are generally advised to take a long-term view when buying stocks, the dynamics of the marijuana industry are rapidly changing. The criteria you should use today to make a stock-buying decision could be dramatically different in just a few months.

Marijuana industry investors should closely monitor any marijuana stocks or ETFs in their portfolios, along with the overall industry itself. Some changes -- such as the U.S. federal government relaxing its marijuana laws -- would be beneficial, while others could be devastating.

The global marijuana industry is likely to experience tremendous growth, but it may not occur evenly or predictably. Following these seven steps for investing in marijuana stocks can help investors navigate this exciting and challenging industry.