Semiconductor stocks are shares of companies that produce the microchips and electronic components used in everything from smartphones to cars.

They are part of the technology sector but are also manufacturing businesses, which means their businesses are cyclical, like any industrial business.

Semiconductor

Picking top-performing semiconductor stocks in the industry can be tricky, and their performance is highly volatile since sales volumes ebb and flow.

But the semiconductor sector is growing rapidly as the world rapidly embraces its critical role in artificial intelligence (AI) development and applications.

Some of the best-performing stocks throughout 2023-25, like Nvidia (NVDA 3.56%), have hailed from the semiconductor industry.

Different types of semiconductor stocks

Different types of semiconductor stocks

The Global Industry Classification Standard (GICS), a system used by investors and index providers to categorize public companies by sector and industry group, places semiconductor stocks under the information technology sector. Within this sector, GICS breaks down semiconductor-related firms into two main categories.

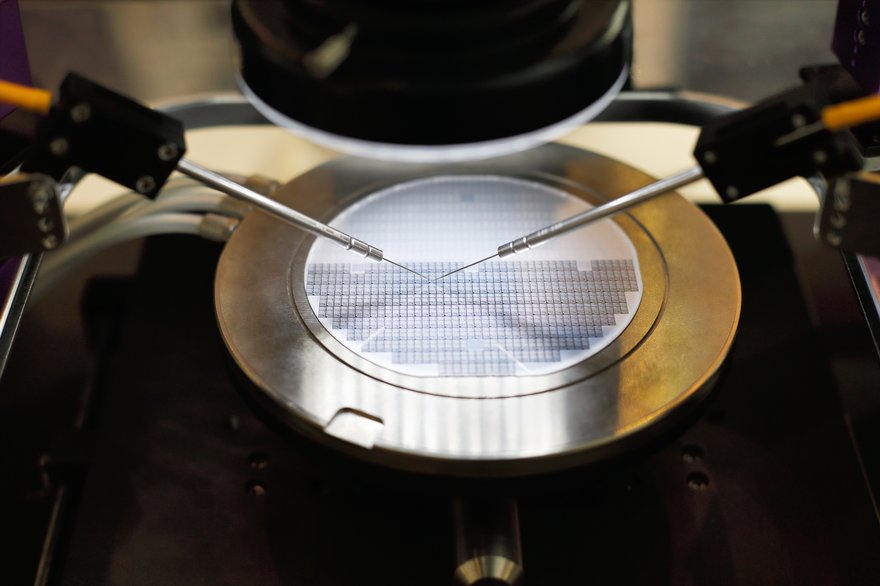

Semiconductor equipment

These companies provide the tools, machines, and services required to manufacture chips. This includes firms that make lithography systems, wafer inspection tools, or etching equipment used by chipmakers. These companies tend to be critical suppliers for the production process, but don’t produce chips themselves.

Semiconductor companies

These are the ones that actually design and manufacture the chips that power computers, smartphones, cars, appliances, and more. These chips can range from basic memory to high-performance processors or specialized sensors.

Other classification methods

Beyond this GICS classification, semiconductor stocks can also be sorted by geography, such as U.S.-based versus international companies, or by business model.

Some are fabless, meaning they design chips but outsource the manufacturing to third-party foundries. Others operate fabs, or fabrication plants, and handle the manufacturing process in-house.

Each of these distinctions can affect how the company earns revenue, manages costs, and scales operations.

Trends

What trends drive semiconductor stocks?

Computer chips have many uses, but up-and-coming semiconductor companies will likely focus on two areas of growth in the decade ahead:

1. The Internet of Things (IoT)

The Internet of Things (IoT) refers to the network of interconnected devices that communicate and exchange data with each other.

This technology is set to revolutionize various industries by enabling smarter homes, cities, and consumer goods.

Semiconductors are crucial in IoT devices since they provide the processing power and connectivity needed for these devices to function.

As IoT applications expand, the demand for advanced, energy-efficient chips that can handle the diverse and high-volume data processing requirements will surge.

Emerging semiconductor companies focusing on IoT will need to innovate to create smaller, more efficient, and more powerful chips to meet the evolving needs of this market.

2. Generative AI

Generative AI, which includes technologies like machine learning and neural networks, is another significant growth driver for semiconductor companies.

These AI systems require immense computational power to process complex algorithms and vast amounts of data.

As generative AI becomes more integrated into applications such as search engines, autonomous vehicles, and advanced robotics, the demand for high-performance chips will increase.

Semiconductor companies that develop graphics processing units (GPUs) and other specialized AI hardware are poised to benefit immensely from this trend. Innovations in chip architecture to improve speed, efficiency, and processing capabilities will be essential to support the growing AI industry.

Another important long-term catalyst to watch in the U.S. is the CHIPS and Science Act, signed into law in August 2022. The legislation was designed to significantly bolster domestic semiconductor manufacturing and research via billions in funding and significant tax credits.

Semiconductor stocks

Best semiconductor stocks to buy in 2025

Here are two top picks for semiconductor industry secular growth trends:

1. Qualcomm

Qualcomm (QCOM -0.52%) is the longtime leader in mobile chip design. Historically, Qualcomm has been a key Apple (AAPL 0.45%) supplier, having profited from the smartphone boom and Apple's ecosystem over the past decade.

Recently launched flagship Android devices powered by Qualcomm's Snapdragon 8 Gen 3 are seeing strong demand globally, especially in China.

In premium and high-tier smartphones, Qualcomm's Snapdragon Mobile platforms are also enabling generative AI capabilities.

Today, Qualcomm has also pivoted to a strong automotive focus via its Snapdragon X platforms. These platforms aim to transform vehicles with advanced connectivity and autonomous driving features.

In the PC market, Qualcomm has expanded its computer portfolio with the Snapdragon X Plus Platform, tailored towards upcoming launches of next-generation AI PCs.

2. Nvidia

Nvidia (NVDA 3.56%) has positioned itself as the platform for all types of AI, largely thanks to its portfolio and the powerful H100 Tensor Core GPU, putting it in a leading position to pursue new markets and expand revenue.

In 2024, Nvidia clocked new revenue records, driven largely by growth in their data center segment, which CEO Jensen Huang terms "AI factories."

Huang believes AI is increasingly becoming a commodity, and these AI factories are pivotal in accelerating demand for generative AI training and inference. They are essential for consumer internet companies, automotive industries, healthcare sectors, and many other fields that require complex infrastructure to run their models on.

Beyond their GPUs and data centers, Nvidia also offers a variety of platforms to cater to the evolving AI landscape. Blackwell, for instance, is designed for trillion-parameter-scale generative AI. Spectrum-X is a new market offering aimed at scaling AI to Ethernet-only data centers.

Additionally, Nvidia's NIM (Nvidia Infrastructure Management) is a software solution that delivers enterprise-grade, optimized generative AI capable of running on CUDA (Compute Unified Device Architecture) everywhere.

CUDA is Nvidia's parallel computing platform and application programming interface (API) model, which allows developers to utilize Nvidia GPUs for general-purpose processing (an approach known as GPGPU, general purpose computing on graphics processing units).

Semiconductor ETFs

Best semiconductor ETFs to buy right now

If you prefer not to pick single stocks, you can also buy a semiconductor exchange-traded fund (ETF) to gain exposure to the overall sector

Two top semiconductor ETFs in terms of overall assets under management (AUM) are:

1. iShares Semiconductor ETF (SOXX)

The iShares Semiconductor ETF (SOXX 1.32%) tracks 30 market cap-weighted U.S. semiconductor stocks via the NYSE Semiconductor index. This ETF sported more than $13 billion in assets under management (AUM) in mid-2025, charging a 0.35% expense ratio.

2. VanEck Semiconductor ETF (SMH)

The VanEck Semiconductor ETF (SMH 2.2%) tracks 25 market cap-weighted, U.S.-listed semiconductor stocks via the MVIS US Listed Semiconductor 25 index. It had more than $26 billion in assets in mid-2025 and charged a 0.35% expense ratio.

Key factors

Key factors to understand before investing in semiconductors

When looking for the best chipmakers and long-term undervalued semiconductor stocks to buy, consider these four key factors before you buy:

1. Sustainable revenue growth

Companies that gradually increase their sales over time are the best investments, but overall revenue growth matters even more for semiconductor stocks.

Revenue

Many companies in this sector struggle to cope with the industry's cyclical nature. Hardware, such as PC and laptop chips, tends to become a commodity as the years progress and more advanced chips come out. If a new market is growing quickly, other chipmakers might pile on with similar products. Supply swells, prices fall, and individual company sales decline.

If a semiconductor chip company isn't constantly innovating and finding new outlets or developing a robust pipeline for its hardware tech, weathering the cycle can be unsustainable.

That being said, some chip designers are able to protect their work with patents that are not easy to replicate by other means. This can create a type of competitive moat for the company's long-term growth, although it doesn't completely prevent up-and-down sales cycles.

2. Above-average profit margins

Sales need to translate to profits. Companies that cannot control their expenses have low profit margins, and companies with high profit margins have a greater ability to reinvest in research and improve their operations. High gross profit, operating profit, and free cash flow generation are also positive indicators that the company is operating efficiently.

Because of the very high amount of expense needed to get into the semiconductor business, established companies tend to be able to ramp up profit margins as revenue increases over time.

3. Attractive returns on invested capital

A company's return on invested capital (ROIC) indicates how well it's able to generate profit from the cash it raises via debt and equity it receives. A high ROIC means the company is likely innovating strategically, improving operations to increase efficiency, and targeting secular growth trends with new chip designs.

4. Strong balance sheet

Semiconductors are arguably the most complex things ever developed by humankind. Manufacturing chips is very expensive, so it's especially important to understand how semiconductor companies obtain the necessary financial resources to expand.

For example, take chip manufacturers such as the world's largest, Taiwan Semiconductor Manufacturing (TSM 1.52%). For a chip business, the company has above-average debt compared to its revenue. However, it also has more cash and investments than it does debt, which signifies a healthy and profitable business that has no problems getting funding.

A company's balance sheet that has more cash than debt and low debt relative to operating profit is a key element to watch. Plenty of cash relative to debt means that a company is well positioned to pay interest and principal payments, even in a pinch. It can also mean the return of excess cash in the form of dividends and stock repurchases.

Related investing topics

FAQ

FAQ: Best semiconductor investments

What stock is the best for semiconductors?

The best stock depends on your investment objectives and risk tolerance, but Nvidia was one of the best-performing and largest semiconductor stocks in 2025.

What is the best chip stock to buy?

The best chip stock depends on your targeted market (e.g., smartphones, PCs, data centers, gaming, etc.). For general exposure, a large company like Nvidia will provide broad coverage.

Are semiconductors a good investment?

Semiconductors can be a good investment, offering strong returns but also experiencing high volatility. This year has shown their potential for significant gains, but it's important to remember that they are highly cyclical. Investing in semiconductors requires a willingness to handle these fluctuations.

Where can I buy semiconductor stocks?

You can buy semiconductor stocks on most major exchanges, including the New York Stock Exchange (NYSE) and Nasdaq. These stocks are available for purchase through most brokerage apps.

Why are semiconductor stocks going up?

Semiconductor stocks are rising due to a mix of sector-specific tailwinds and broader economic trends. On the industry side, strong demand for high-performance computing and increased investment in AI infrastructure have all played a role. At the macro level, easing interest rate concerns and improving global growth expectations have also helped lift investor sentiment toward cyclical tech stocks like semiconductors.

What are the top semiconductor companies?

The three most prominent semiconductor companies are Nvidia, Taiwan Semiconductor Manufacturing, and ASML Holding NV (NASDAQ:ASML). Together, they represent the design, production, and tooling ecosystem. Nvidia designs the most in-demand AI chips on the market. TSMC is the leading third-party chip fabricator. ASML builds the advanced lithography machines required to produce cutting-edge chips.

Which semiconductor stock is undervalued?

Which semiconductor stock is undervalued depends on how you define value, but one notable candidate is Micron Technology Inc. (NASDAQ:MU), a memory chip manufacturer that produces DRAM components used in servers, PCs, and smartphones. As of July 2025, Micron was trading at 10.02x forward earnings, well below the 33.47x forward earnings multiple of the iShares Semiconductor ETF, suggesting the stock may offer relative value within the sector.