Two investing truths have proven timeless:

- Investing in the biggest, strongest companies -- known as blue chip stocks -- is a great way to earn solid returns with a lower risk of loss.

- Dividend-paying stocks that steadily increase their payouts have the best track record of delivering market-beating total investment returns.

Investors seeking a balance of lower risk and steady returns should check out blue chip stocks that pay dividends. Let's take a closer look at these stocks that offer the best of both worlds. They're stalwart companies that meet the blue chip standard and pay a strong dividend to deliver the best returns.

Combining blue chip stock quality with dividends

A broad definition of a blue chip stock is a well-known, high-quality company that's considered a leader in its industry. The "blue chip" descriptor comes from poker, where blue chips have the highest value.

Not every blue chip stock pays a dividend. Younger companies, such as Amazon (AMZN -1.73%), still have plenty of valuable opportunities to invest profits back into their business to accelerate growth. Others, such as Berkshire Hathaway (BRK.A +1.47%)(BRK.B +1.27%), have proven track records of earning high returns through share repurchase programs and reinvesting the company's profits.

Many of the best blue chip companies pay dividends. Some are Dividend Aristocrats® (The term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services) or Dividend Kings.

Dividend Aristocrats® are companies that have increased their dividends consistently for at least 25 consecutive years and are part of the S&P 500 index. Dividend Kings have even more impressive records, having increased their dividends for 50 years or more.

Investing in companies with a combination of blue chip status and steadily rising dividends can be rewarding.

Best blue chip dividend stocks of 2026

Let's examine some of the top blue chip dividend stocks:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Johnson & Johnson (NYSE:JNJ) | $561.6 billion | 2.21% | Pharmaceuticals |

| Mastercard (NYSE:MA) | $494.7 billion | 0.57% | Diversified Financial Services |

| NextEra Energy (NYSE:NEE) | $185.0 billion | 2.55% | Electric Utilities |

| Coca-Cola (NYSE:KO) | $330.8 billion | 2.65% | Beverages |

| Realty Income (NYSE:O) | $56.5 billion | 5.68% | Retail REITs |

1. Johnson & Johnson

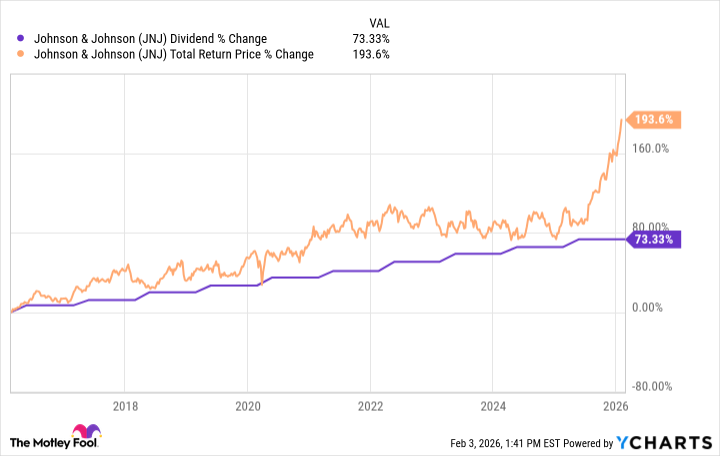

Johnson & Johnson (JNJ +1.03%) is one of the bluest of the blue chip dividend stocks. The global healthcare giant has increased its dividend for 63 straight years, including by 4.8% in early 2025. That kept it in the elite group of Dividend Kings. The company pays one of the safest dividends in the world.

NYSE: JNJ

Key Data Points

Johnson & Johnson is one of only two companies with a pristine AAA bond rating. It also generates robust free cash flow. It generated $20 billion in free cash flow in 2025, easily covering the $12.4 billion in dividends it paid out. The company generated strong free cash flow even though it's one of the world's leading investors in research and development (R&D), spending more than $14.7 billion in 2025.

Johnson & Johnson's investments in R&D enable it to discover and test innovative medicines and medical technologies. Meanwhile, its financial flexibility allows it to make acquisitions to enhance its drug pipeline and accelerate the growth of its MedTech platform.

The company closed its landmark acquisition of Intra-Cellular Therapies in early 2025 and agreed to buy Halda Therapeutics in November 2025. These investments position Johnson & Johnson to continue growing its cash flow and dividend payment.

2. Mastercard

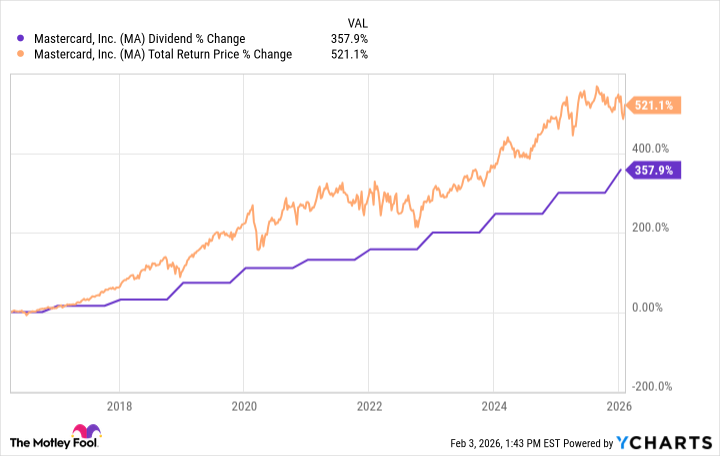

Payment processing giant Mastercard (MA -0.85%) is a blue chip company in the digital payments space. As one of the most recognizable global names in electronic payments, Mastercard has competitive advantages that enable it to maintain its dominant marketplace position.

NYSE: MA

Key Data Points

The company partners with banks and other lenders that want to issue cards to their customers. Then, it simply collects a small fee every time a transaction is processed through its network.

With another billion people set to join the global consumer class over the next decade, Mastercard still has plenty of opportunities to expand its payment processing network. Along the way, it has increased the cash it returns to shareholders by a dramatic amount.

Mastercard is ignored by many dividend investors simply because its dividend yield is low -- only around 0.6% as of early 2026. However, the company boasts a remarkable record of dividend growth, raising it by more than 9,500% since its first dividend payment, including a 14% increase in December 2025.

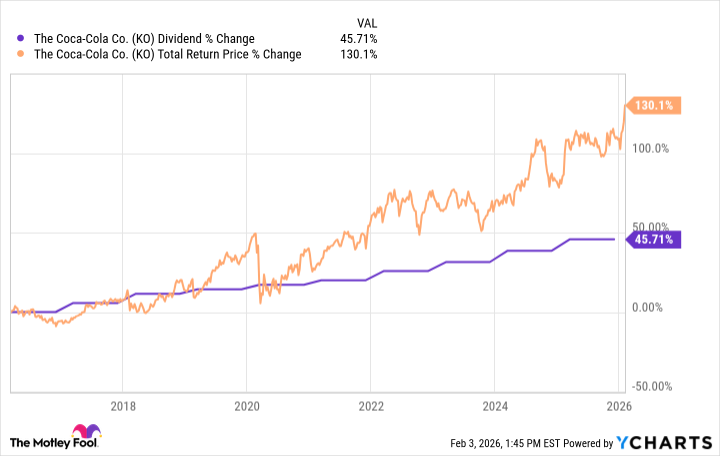

NYSE: KO

Key Data Points

The iconic beverage company generates substantial cash, enabling it to pay an attractive, growing dividend. Coca-Cola paid out $8.4 billion in dividends in 2024 and has paid out almost $100 billion in dividends since January 2010. Coca-Cola's steadily rising dividend -- an over 2.5% yield in early 2026 -- makes it a very attractive option for investors seeking a durable and growing dividend.

4. Realty Income

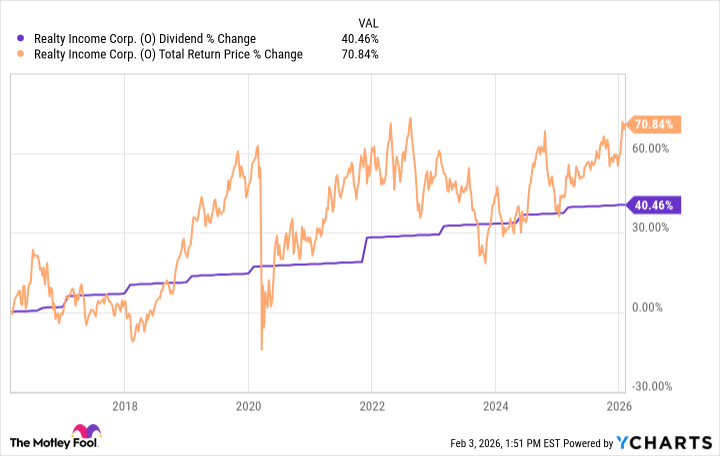

Realty Income (O +1.47%) is one of the largest real estate investment trusts (REITs). The company owns a diversified portfolio of retail, industrial, gaming, and other properties net leased to many of the world's leading companies. That lease structure provides the REIT with stable and growing rental income.

NYSE: O

Key Data Points

Realty Income combines a high-quality real estate portfolio with a top-tier balance sheet. It has one of the 10 best balance sheets in the sector. That strong financial profile gives the REIT the flexibility to continue expanding its portfolio and dividend.

The landlord also has an incredible track record of paying dividends. As of February 2026, Realty Income had raised its dividend payment 133 times since its public market listing in 1994. At that time, it had increased its payment for 113 quarters in a row and for over 30 straight years.

Realty Income has delivered a 4.2% compound annual growth rate in its dividend since going public. The company's rising dividend has helped support a robust 13.7% compound annual total return since its listing.

5. NextEra Energy

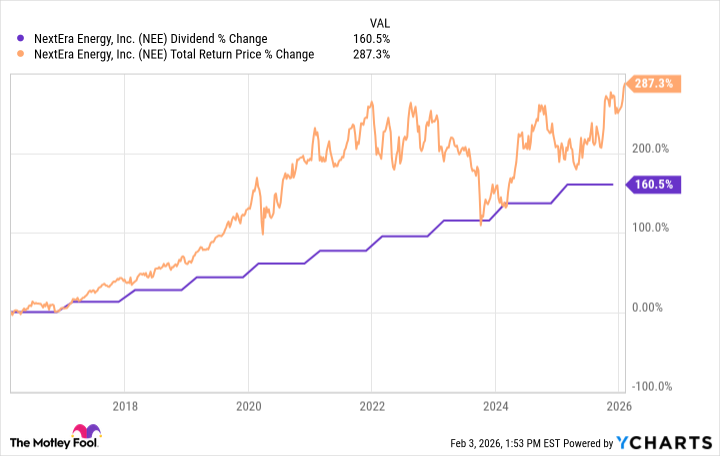

NextEra Energy (NEE +2.92%) isn't your typical utility stock. The company is a growing producer of energy -- much of it generated by renewable sources -- that it sells and transfers to utility companies in other markets. The steady demand for electricity that underpins its business, combined with growth in demand for renewable energy, gives NextEra blue chip status.

NYSE: NEE

Key Data Points

NextEra is one of the largest utility companies in the U.S. and is among the largest producers of renewable energy in the world. The company benefits from being headquartered in Florida, one of the fastest-growing states in both population and solar energy.

Over the past 20 years, NextEra has grown its dividend at roughly a 10% compound annual rate. That has helped power a more than 15% compound annual return. While NextEra's dividend yield is comparatively low for its peer group, it more than makes up for it in its growth. NextEra plans to increase its payout by roughly 10% in 2026 and at a 6% compound annual rate through 2028 off that level.

Should you buy blue chip dividend stocks?

Investing in blue chip companies that pay dividends can significantly increase your wealth over time. Although the stock market constantly gains and loses value, these stocks often exhibit below-average volatility while delivering market-beating returns over long time horizons. Blue chip dividend-paying stocks are strong additions to any portfolio, especially for investors seeking stability and income.

How to Find Blue Chip Dividend Stocks

Some of the best places to find blue chip dividend stocks are:

- The Dow Jones Industrial Average

- The Dividend Aristocrats® list.

- The list of Dividend Kings.

How to invest in blue chip dividend stocks

Here's a step-by-step guide on how invest in blue chip dividend stocks:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Related investing topics

How to build a blue chip dividend stock portfolio

To build a blue chip dividend stock portfolio, you should aim to buy shares of at least 10 blue chip companies across several different sectors. This diversification will reduce risk. Look for companies with excellent records of dividend growth and strong financial metrics backing their payouts. You should also focus on companies operating in noncyclical, growing industries.

You should avoid stocks that have the appearance of being a blue chip (well-known name and long dividend growth track record) but have poor financials or growth prospects. Also, give higher priority to a company's ability to grow its dividend in the future than to its current yield.

FAQ

Blue chip dividend stocks FAQ

About the Author

Matt DiLallo has positions in Amazon, Apple, Berkshire Hathaway, Coca-Cola, Mastercard, NextEra Energy, and Realty Income and has the following options: short January 2026 $265 calls on Apple. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Mastercard, NextEra Energy, and Realty Income. The Motley Fool has a disclosure policy.