Two investing truths have proven timeless:

- Investing in the biggest, strongest companies -- known as blue chip stocks -- is a great way to earn solid returns with a lower risk of loss.

- Dividend-paying stocks that steadily increase their payouts have the best track record of delivering market-beating total investment returns.

Investors seeking a balance of lower risk and steady returns should look at blue chip stocks that pay dividends. Let's take a closer look at these stocks that offer the best of both worlds. They're stalwart companies that meet the blue chip standard and pay a strong dividend to deliver the best returns.

Blue chip + dividends

Combining blue chip stock quality with dividends

A broad definition of a blue chip stock is a well-known, high-quality company that's considered a leader in its industry. The "blue chip" descriptor comes from the game of poker, in which blue chips have the highest dollar value.

Not every blue chip stock pays a dividend. Younger companies, such as Amazon (AMZN -4.97%), still have plenty of valuable opportunities to invest profits back into their business to accelerate growth. Others, such as Berkshire Hathaway (BRK.A -1.36%)(BRK.B -1.42%), have proven track records of earning high returns by reinvesting their company's profits and with share repurchase programs.

Many of the best blue chip companies pay dividends. Some are Dividend Aristocrats® (The term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services). These companies have increased their dividends consistently for at least 25 consecutive years and are part of the S&P 500 index. Dividend Kings have even more impressive records, having increased their dividends for 50 years or more.

Investing in companies with the combination of blue chip status and steadily rising dividend payments can be rewarding.

The best blue chip dividend stocks

Best blue chip dividend stocks of 2025

Let's take a close look at some of the top blue chip dividend stocks:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Apple (NASDAQ:AAPL) | $3.6 trillion | 0.42% | Technology Hardware, Storage and Peripherals |

| Mastercard (NYSE:MA) | $504 billion | 0.55% | Diversified Financial Services |

| NextEra Energy (NYSE:NEE) | $172 billion | 2.66% | Electric Utilities |

| Coca-Cola (NYSE:KO) | $289 billion | 3.01% | Beverages |

| Realty Income (NYSE:O) | $54 billion | 5.46% | Retail REITs |

Stocks 1 - 2

1. Apple

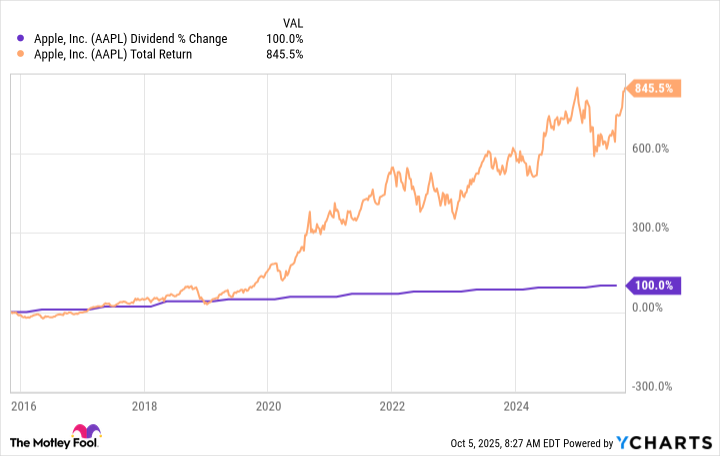

Apple (AAPL -3.4%) investors have enjoyed immense returns during the past two decades as the company has risen to become one of the biggest and most profitable in the world. Apple's powerful brand makes it the most lucrative consumer electronics provider and one of the most reliable companies to own for the long term.

The foundation of Apple's success is the iPhone, which has enormous user loyalty and generates more than half of Apple's sales. Much of the company's growth in services is derived from its massive iPhone user base. Customers use their smartphones to stream music and movies, play video games, store data, and access media content from thousands of third-party publishers in the App Store.

Apple is also in an enviable position going forward. The deployment of 5G mobile networks in many markets is likely to boost sales of the iPhone. Meanwhile, the company continues to launch innovative new products, like its artificial intelligence (AI) platform Apple Intelligence.

Apple's gradual growth, paired with its increasing dividend payout, is an attractive combination. The stock's dividend yield may be somewhat low, but the company's dividend payout ratio comprises a little less than 15% of Apple's cash flow, meaning that continued dividend growth is likely. Apple has raised its dividend every year since it instituted the payout in 2013. When looking for blue chip stocks that dole out regular and rising income, Apple is a top choice.

2. Mastercard

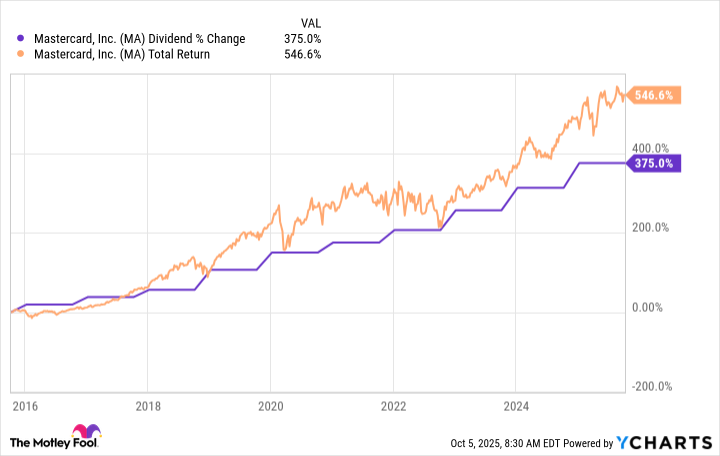

Payment processing giant Mastercard (MA -1.34%) is a blue chip company in the digital payments space. As one of the most recognizable global names in electronic payments, Mastercard has competitive advantages that enable it to maintain its dominant marketplace position. It partners with banks and other lenders that want to issue cards to their customers and simply collects a small fee every time a transaction is processed using its network.

With another billion people set to join the global consumer class over the next decade, Mastercard still has plenty of opportunities to expand its payment processing network. Along the way, it's increased the cash it returns to shareholders by a dramatic amount.

Mastercard is ignored by many dividend investors for the simple reason that the dividend yield is low -- only around 0.5% as of late 2025. However, the company boasts a remarkable record of expanding its dividend payout, raising it by more than 8,300% since paying its first dividend.

Stocks 3 - 5

3. Coca-Cola

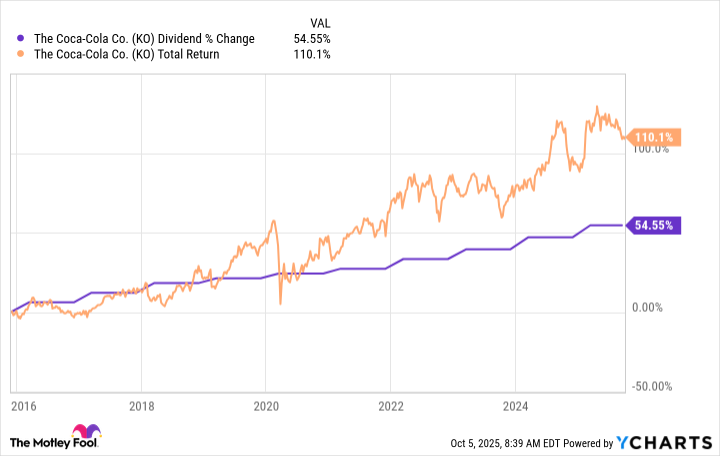

Coca-Cola has been satisfying investors' thirst for dividend income for many decades. The beverage giant has increased its dividend for 63 consecutive years. That puts Coca-Cola in the elite group of dividend stocks known as Dividend Kings.

The iconic beverage company generates a lot of cash, giving it money to pay an attractive and growing dividend. Coca-Cola paid out $8.4 billion in dividends in 2024 and has paid out almost $100 billion in dividends since January 2010.

Coca-Cola's high-yielding -- more than 3% yield in late 2025 -- and steadily rising dividend make it a very attractive option for investors seeking a durable and growing dividend.

4. Realty Income

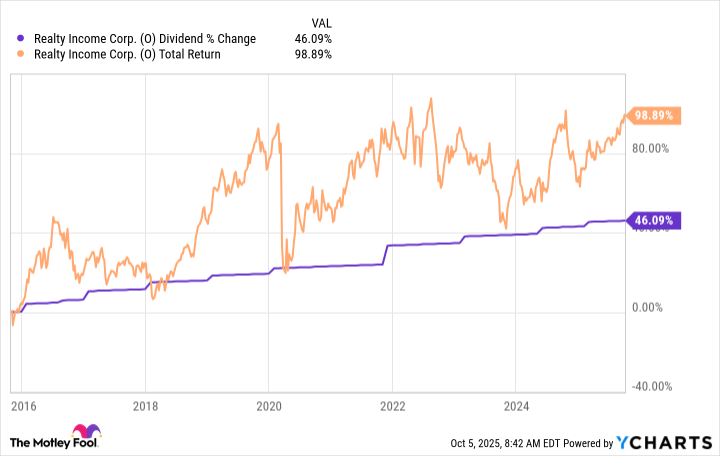

Realty Income (O -0.67%) is one of the largest real estate investment trusts (REITs). The company owns a diversified portfolio of retail, industrial, gaming, and other properties net leased to many of the world's leading companies. That lease structure provides the REIT with stable and growing rental income.

Realty Income combines a high-quality real estate portfolio with a top-tier balance sheet. It has one of the 10 best balance sheets in the sector. That strong financial profile gives the REIT the financial flexibility to continue expanding its portfolio and dividend.

The landlord has an incredible track record of paying dividends. As of October 2025, Realty Income had raised its dividend payment 132 times since its public market listing in 1994. At the time, it has increased its payment for 112 quarters in a row and for 30 straight years. Realty Income has delivered a 4.2% compound annual growth rate in its dividend since going public. The company's rising dividend has helped support a robust 13.5% compound annual total return since its listing.

5. NextEra Energy

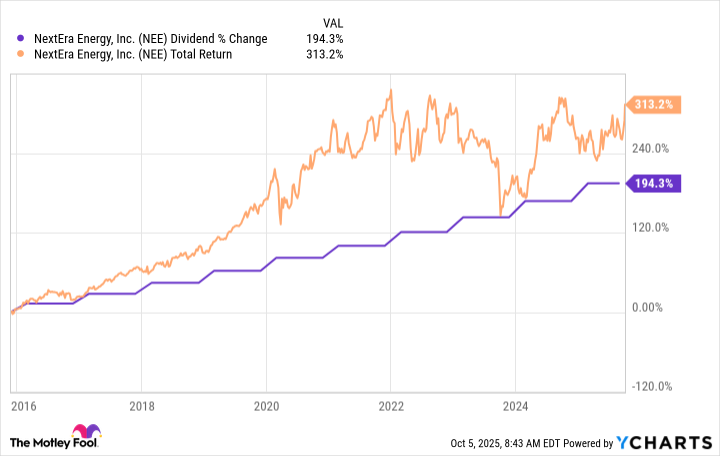

NextEra Energy (NEE -0.5%) isn't your typical utility stock. The company is a growing producer of energy -- much of it generated by renewable sources -- that it sells and transfers to utility companies in other markets. The steady demand for electricity that underpins its business, combined with growth in demand for renewable energy, gives NextEra blue chip status.

NextEra is one of the largest utility companies in the U.S. and among the largest producers of renewable energy in the world. The company benefits partly from being headquartered in Florida, one of the fastest-growing states in terms of both population and solar energy.

Over the past 20 years, NextEra has grown its dividend at roughly a 10% compound annual rate. That has helped power a more than 15% compound annual return.

While NextEra's dividend yield is comparatively low for its peer group, it more than makes up for it in its growth. NextEra plans to increase its payout by roughly 10% annually through at least 2026.

Related investing topics

Should I invest?

Should you buy blue chip dividend stocks?

Investing in blue chip companies that pay dividends can significantly increase your wealth over time. Although the stock market constantly gains and loses value, these stocks often exhibit below-average volatility while delivering market-beating returns over long time horizons. Blue chip dividend-paying stocks are strong additions to any portfolio, especially for investors seeking stability and income.

How to invest in blue chip dividend stocks

Anyone can invest in blue chip dividend stocks. Here's a step-by-step guide on how to add one to your portfolio:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.