Two investing truths have proven timeless:

- Investing in the biggest, strongest companies -- known as blue chip stocks -- is a great way to earn solid returns with a lower risk of loss.

- Dividend-paying stocks that steadily increase their payouts have the best track record of delivering market-beating total investment returns.

Investors seeking a balance of lower risk and steady returns should look at blue chip stocks that pay dividends. Let's take a closer look at these stocks that offer the best of both worlds. They're stalwart companies that meet the blue chip standard and pay a strong dividend to deliver the best returns.

Blue chip + dividends

Combining blue chip stock quality with dividends

A broad definition of a blue chip stock is a well-known, high-quality company that's considered a leader in its industry. The "blue chip" descriptor comes from the game of poker, in which blue chips have the highest dollar value.

Not every blue chip stock pays a dividend. Younger companies, such as Amazon (AMZN 1.81%), still have plenty of valuable opportunities to invest profits back into their business to accelerate growth. Others, such as Berkshire Hathaway (BRK.A 0.38%)(BRK.B 0.46%), have proven track records of earning high returns by reinvesting their company's profits and with share repurchase programs.

But many of the best blue chip companies are also those that pay dividends. Some are Dividend Aristocrats® (The term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services). These companies have increased their dividends consistently for at least 25 consecutive years and are part of the S&P 500 index. Other blue chip companies are Dividend Kings, which have increased their dividends for 50 years or more.

Regardless of whether a blue chip stock has a rapidly growing dividend, the combination of blue chip status and steadily rising dividend payments can be rewarding for investors.

The best blue chip dividend stocks

Best blue chip dividend stocks of 2025

Let's take a close look at some of the top blue chip dividend stocks:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Apple (NASDAQ:AAPL) | $3.0 trillion | 0.51% | Technology Hardware, Storage and Peripherals |

| Mastercard (NYSE:MA) | $516 billion | 0.50% | Diversified Financial Services |

| NextEra Energy (NYSE:NEE) | $152 billion | 2.93% | Electric Utilities |

| Broadcom (NASDAQ:AVGO) | $1.2 trillion | 0.89% | Semiconductors and Semiconductor Equipment |

| Realty Income (NYSE:O) | $52 billion | 5.54% | Retail REITs |

Stocks 1 - 2

1. Apple

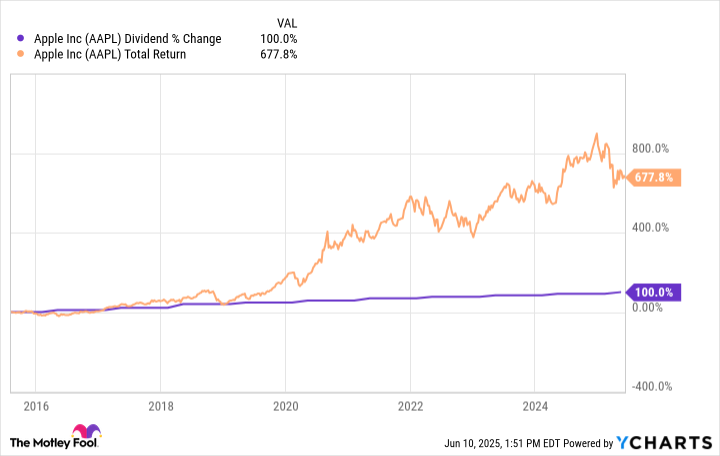

Apple (AAPL 0.81%) investors have enjoyed immense returns during the past two decades as the company has risen to become one of the biggest and most profitable in the world. Apple's powerful brand makes it the most lucrative consumer electronics provider and one of the most reliable companies to own for the long term.

The foundation of Apple's success is the iPhone, which has enormous user loyalty and generates more than half of Apple's sales. Much of the company's growth in services is derived from its massive iPhone user base. Customers use their smartphones to stream music and movies, play video games, store data, and access media content from thousands of third-party publishers in the App Store.

Apple is also in an enviable position going forward. The deployment of 5G mobile networks in many markets is likely to boost sales of the iPhone. Meanwhile, the company continues to launch innovative new products, like its artificial intelligence (AI) platform Apple Intelligence.

Apple's gradual growth, paired with its increasing dividend payout, is an attractive combination. The stock's dividend yield may be somewhat low, but the company's dividend payout comprises a little less than 15% of Apple's cash flow, meaning that continued dividend growth is likely. Apple has raised its dividend every year since it instituted the payout in 2013. When looking for blue chip stocks that dole out regular and rising income, Apple is a top choice.

2. Mastercard

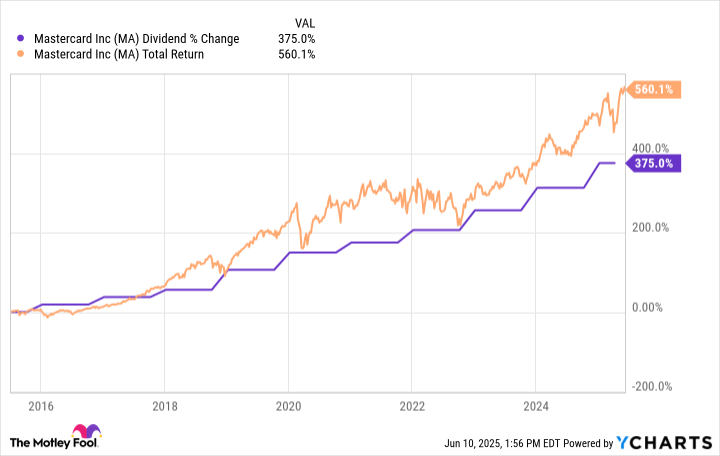

Payment processing giant Mastercard (MA 1.18%) is a blue chip company in the digital payments space. As one of the most recognizable global names in electronic payments, Mastercard has competitive advantages that enable it to maintain its dominant marketplace position. It partners with banks and other lenders that want to issue cards to their customers and simply collects a small fee every time a transaction is processed using its network.

With another billion people set to join the global consumer class over the next decade, Mastercard still has plenty of opportunities to expand its payment processing network. Along the way, it's increased the cash it returns to shareholders by a dramatic amount.

Mastercard is ignored by many dividend investors for the simple reason that the dividend yield is low -- only around 0.5% as of mid-2025. However, the company boasts a remarkable record of expanding its dividend payout, raising it by more than 8,300% since paying its first dividend.

Semiconductor

Stocks 3 - 5

3. Broadcom

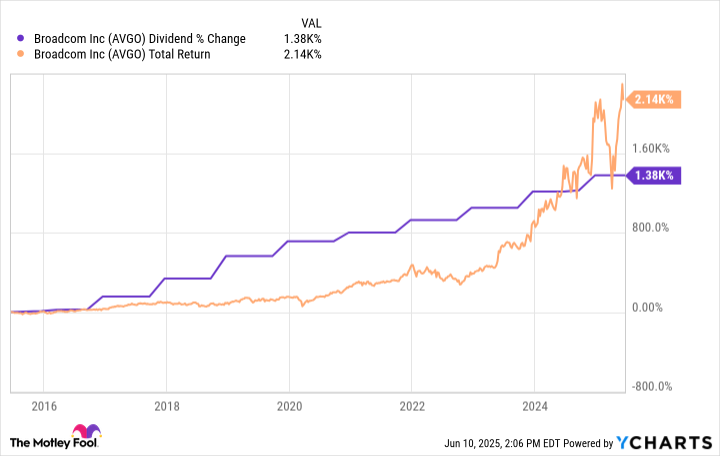

Broadcom (AVGO 1.12%) isn't exactly a household name among semiconductor companies. The company designs parts for a wide range of items, from smartphones to mobile network equipment to data center hardware. In a world where technology is growing in importance, Broadcom's chips are an absolute staple.

Broadcom dedicates billions of dollars to research and development every year, so the importance of its products isn't likely to fade anytime soon. Those investments have helped it become an early leader in the AI semiconductor market. That's driving robust growth for the semiconductor and software company.

Management's target is to return half of the previous year's free cash flow to shareholders via its dividend. That has led to fantastic income increases for owners of this tech stock.

Broadcom has increased its dividend for 14 straight years since initiating the payout in its 2011 fiscal year.

4. Realty Income

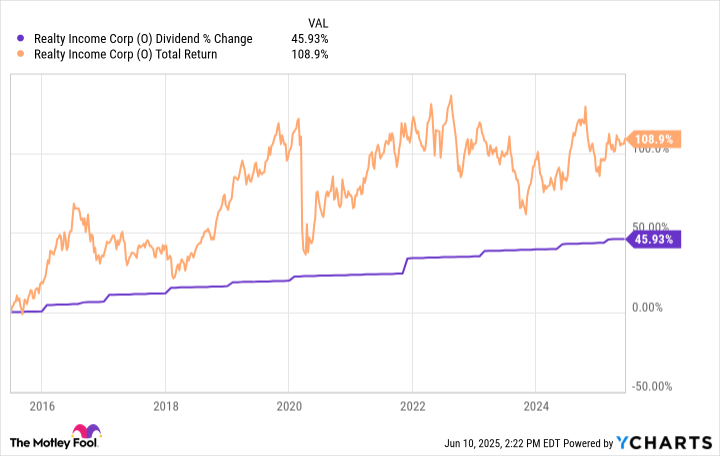

Realty Income (O -0.43%) is one of the largest real estate investment trusts (REITs). The company owns a diversified portfolio of retail, industrial, gaming, and other properties net leased to many of the world's leading companies. That lease structure provides the REIT with stable and growing rental income.

Realty Income combines a high-quality real estate portfolio with a top-tier balance sheet. It has one of the ten best balance sheets in the sector. That strong financial profile gives the REIT the financial flexibility to continue expanding its portfolio and dividend.

The landlord has an incredible track record of paying dividends. As of mid-2025, Realty Income has raised its dividend payment 130 times since its public market listing in 1994. At the time, it has increased its payment for 110 quarters in a row and for 30 straight years. Realty Income has grown its dividend at a 4.3% compound annual rate since coming public. The company's rising dividend has helped support a robust 13.6% compound annual total return since its listing.

5. NextEra Energy

NextEra Energy (NEE -1.32%) isn't your typical utility stock. The company is a growing producer of energy -- much of it generated by renewable sources -- that it sells and transfers to utility companies in other markets. The steady demand for electricity that underpins its business, combined with growth in demand for renewable energy, gives NextEra blue chip status.

NextEra is one of the largest utility companies in the U.S. and among the largest producers of renewable energy in the world. The company benefits partly from being headquartered in Florida, one of the fastest-growing states in terms of both population and solar energy.

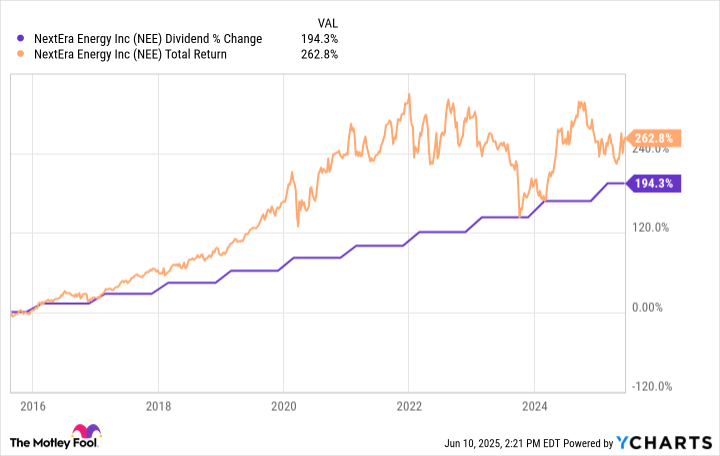

Over the past 20 years, NextEra has grown its dividend at roughly a 10% compound annual rate. That has helped power a more than 15% compound annual return.

While NextEra's dividend yield is comparatively low for its peer group, it more than makes up for it in its growth. NextEra plans to increase its payout by roughly 10% annually through at least 2026.

Related investing topics

Should I invest?

Should you buy blue chip dividend stocks?

Investing in blue chip companies that pay dividends can significantly increase your wealth over time. Although the stock market constantly gains and loses value, these stocks often exhibit below-average volatility while delivering market-beating returns over long time horizons. Blue chip dividend-paying stocks are strong additions to portfolios of all kinds, especially for investors seeking stability and income.