International stocks are the stocks of companies based outside the U.S. and can help strengthen your portfolio through diversification and creating new avenues to explosive growth. Many investors should consider allocating a percentage of their portfolios to stocks in international markets.

Top 5 international stocks in 2026

1. ASML Holding

NASDAQ: ASML

Key Data Points

Headquartered in the Netherlands, ASML Holding (ASML -4.07%) is one of the world's leading providers of semiconductor manufacturing equipment. Semiconductors extend beyond powering computers and mobile devices and providing the hardware foundations for big leaps forward in artificial intelligence.

Semiconductors are now essential components for automobiles, appliances, and a wide range of everyday products and services. And access to chip supplies is a major national security issue for countries around the world.

As a result, there's a big push for localized chip production in the U.S., Europe, and other major markets. ASML's extreme ultraviolet lithography (EUV) machines are unmatched when it comes to manufacturing state-of-the-art chips. The company is set to play a big role in expanding global manufacturing capacity.

2. CD Projekt

OTC: OTGL.Y

Key Data Points

Based in Poland, CD Projekt (OTGL.Y +1.08%) has established itself as a strong player in the video game industry. The company is best known for games such as The Witcher and Cyberpunk 2077, but it also operates an online marketplace and sharing platform for digitally distributing games.

Demand for interactive entertainment is still poised for huge growth over the long term. CD Projekt has compelling opportunities as it releases content expansions for existing titles, launches new properties, and taps into emerging trends, including augmented reality and the metaverse.

Metaverse

3. MercadoLibre

NASDAQ: MELI

Key Data Points

MercadoLibre (MELI -2.24%) is a leading provider of e-commerce and fintech services in Latin America. The company was founded in Argentina and is still growing quickly there, but it actually does most of its business in Brazil and generates a major portion of its revenue in Mexico.

MercadoLibre has continued to increase sales rapidly despite macroeconomic headwinds, and it's actually making a big hiring push at a time when many other businesses are reducing their employee counts. MercadoLibre's forefront positions in online retail and fintech point to huge expansion potential as these services become more popular in Latin America.

4. Shoprite Holdings

OTC: SRGH.Y

Key Data Points

The United Nations predicts Africa will account for more than half of global population growth through 2050, and Shoprite Holdings' (SRGH.Y -0.33%) status as that continent's largest grocery chain positions it to benefit from economic and demographic tailwinds. The company is headquartered in South Africa and operates about 3,500 locations across 14 countries.

5. HDFC Bank

NYSE: HDB

Key Data Points

India's largest private sector lender, HDFC Bank (HDB +1.12%), is in a favorable position to benefit as the country's economy continues to develop. The company has more than 7,800 bank branches across more than 3,800 cities and towns. HDFC is also a player in the digital payments space.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| ASML (NASDAQ:ASML) | $541.0 billion | 0.53% | Semiconductors and Semiconductor Equipment |

| CD Projekt (OTC:OTGL.Y) | $7.0 billion | 0.40% | Entertainment |

| MercadoLibre (NASDAQ:MELI) | $106.5 billion | 0.00% | Multiline Retail |

| Shoprite (OTC:SRGH.Y) | $9.0 billion | 2.65% | Food and Staples Retailing |

| HDFC Bank (NYSE:HDB) | $172.2 billion | 1.12% | Banks |

Types of international stocks

American Depositary Receipts (ADRs) are functional equity equivalents that allow investors to buy stakes in foreign stocks. The underlying equities are typically held by banks that offer ADRs on public markets that investors can purchase directly. ADRs do not typically come with the voting rights associated with normal shares.

Foreign ordinaries are equities that trade on foreign exchanges that U.S. investors can purchase directly. Local-foreign-market stocks may be traded on foreign exchanges if an investor has the necessary foreign account. Foreign ordinaries can also be traded through U.S. brokerages through the over-the-counter (OTC) exchange. If traded OTC, foreign ordinary shares will typically be denominated in U.S. dollars.

Global exchange-traded funds (ETFs) and global mutual funds are investment vehicles that bundle together multiple international stocks into an investable security. Some of these funds may also include bonds, money-market instruments, and other investable assets. Investing in global ETFs and mutual funds can give investors broad-based exposure to companies in international markets, but these instruments also typically come with expense fees.

Pros and cons of investing in international stocks

Pros

- Foreign markets present opportunities you miss if your holdings are strictly limited to U.S.-based stocks.

- International stocks allow investors to diversify and gain exposure to growth in other countries.

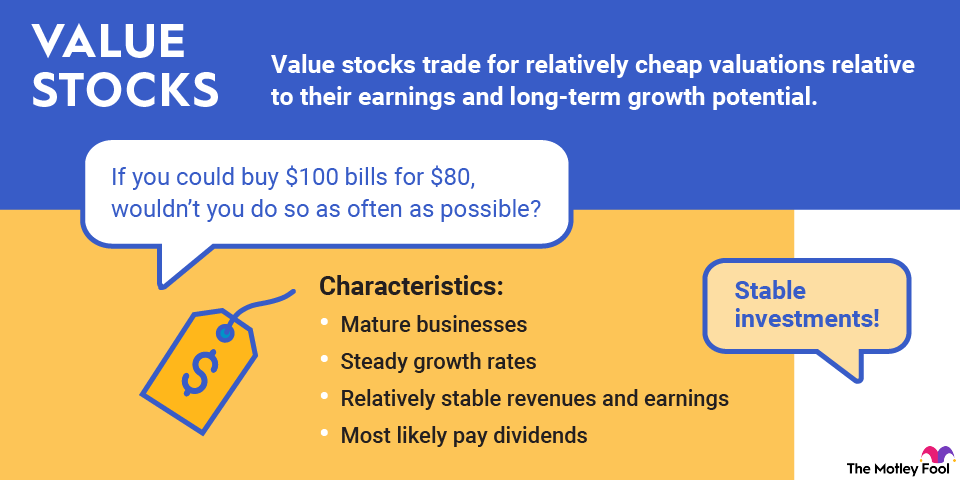

- While foreign companies sometimes come with added risks, international companies tend to have lower price-to-sales (P/S) and price-to-earnings (P/E) multiples relative to comparable businesses in the U.S.

- Many investors prefer to pay more for domestic stocks, and that can result in potentially explosive international stocks trading at discounted valuations.

Cons

- Business growth in international markets is generally considered less reliable than growth for U.S.-based businesses.

- International stocks tend to receive less coverage from U.S. analysts and media outlets, which can result in weaker valuation performance even when business results are strong.

- International companies can face outsized macroeconomic and geopolitical risks.

- In some cases, investing in international stocks means that investors have to embrace high levels of risk related to lower levels of financial visibility and the trustworthiness of reported results.

Political instability is a risk to weigh when investing internationally.

Gain direct international access through a broker

The other main way to invest in foreign stocks is to use a brokerage to obtain direct access to the exchange where the company is listed. A global account with a participating U.S. brokerage is suitable, or you can establish one in the country where you intend to trade.

Opening a global or foreign brokerage account may cause you to incur fees and taxes and face more regulations than you'd expect from a U.S. equity market. Also, your investment is not protected by domestic securities laws, and you could face difficulty achieving restitution through a foreign court.

What risks come with investing in international markets?

Although the rewards of investing in international stocks can be high, there are some risks to consider.

- International markets often see outsized impacts when economic conditions worsen.

- Political instability and other developments in the country can devalue an investment, and the values of currencies fluctuate.

- Geopolitical dynamics can result in the withdrawal of support from institutional investors and lead to poor stock performance.

- Investors can face higher levels of risk related to visibility on business operations and the reliability of reported financial results.

Key differences between international and U.S. stocks

International and U.S. stocks each represent equity ownership differences in underlying companies, but there are some important distinctions that investors should be aware of.

International companies with stocks that primarily trade on foreign exchanges may have different financial auditing, reporting, and visibility requirements compared to U.S. stocks that are subject to requirements put in place by the Securities and Exchange Commission (SEC). Because of these differences, international stocks can come with added risks that investors need to consider.

International stocks may also not trade directly on major U.S. exchanges. Instead, these stocks may be available to U.S. investors through American Depositary Receipts or traded over the counter.

Related investing topics

For instance, many countries in Latin America have seen inflation levels even higher than in the U.S. and relatively weak economic recoveries on the heels of the coronavirus pandemic. While foreign stocks often trade at low price-to-earnings (P/E) and price-to-sales (P/S) multiples relative to comparable domestic companies, they also tend to be even more sensitive to macroeconomic shifts, and the current backdrop suggests plenty of potential for volatility.

Foreign companies are also more likely to fail to meet most U.S. investors' communications and reliability expectations. Even foreign companies approved by the SEC to list ADRs on U.S. exchanges sometimes fail to meet reporting expectations. It's vital to understand how well and by what means an international company communicates with investors.

Before investing in international stocks, consider how much risk you're comfortable with. While emerging markets grow faster, they also tend to be more volatile, so you may prefer to focus on developed economies. By establishing a clear strategy for your non-domestic portfolio, you are better positioned to endure market turbulence and pursue long-term gains.