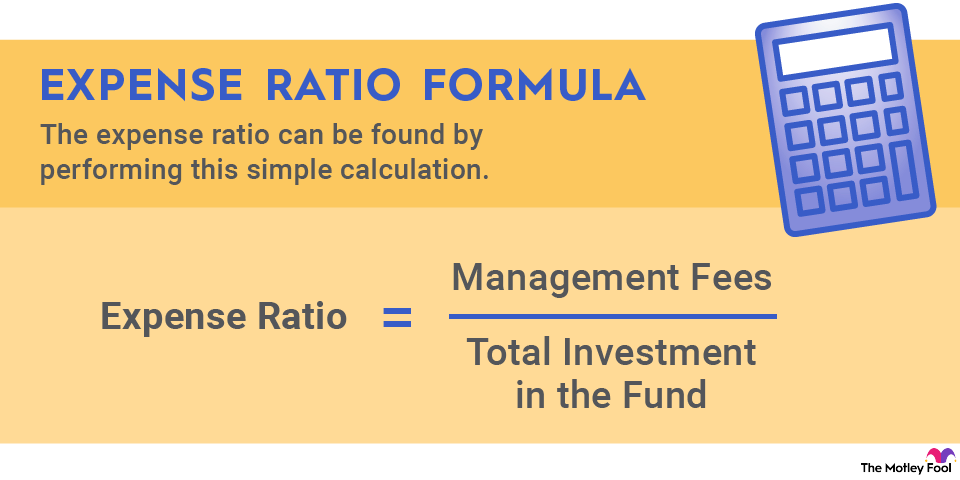

Expense ratio is the percent of your investment that a fund charges each year to manage your invested money. A fund's expense ratio equals the fund's total operating expenses divided by the average value of the fund's net assets.

Expense ratios are charged by mutual funds and exchange-traded funds (ETFs), which are a type of index fund. Many index funds have low expense ratios because they are passively managed by quantitative strategies rather than actively managed by subjective humans.

How to calculate an expense ratio

While expense ratios can be calculated, they are generally given by the funds themselves. The easiest way to learn a fund's expense ratio is to review the general information section of the fund's fact sheet.

What you should calculate, based on a fund's expense ratio, is how much money you will pay to the fund on an annual basis. Simply multiply the fund's expense ratio by the dollar value of your investment to compute your annual total fee. If the value of your investment in a fund is $1,000, and the fund's expense ratio is 1.5%, then you will pay $1.50 each year to the manager of the fund.

Understanding the expense ratio

The expense ratio is important for investors who prioritize buying and holding stock investments because a seemingly small change in expense ratio can, over time, create substantial differences in investment returns.

Consider a mutual fund that returns 8% per year for the next 20 years and a passively managed index fund that tracks a major stock market index and returns 7% per year for the same two decades. The expense ratio for the mutual fund, which is actively managed, is 2%, while the index fund's expense ratio is 0.40%. Investing $100,000 in the mutual fund would return $320,000, while investing the same amount in the index fund would return $360,000.

It's easy to be fooled into thinking that active fund management produces superior investment returns, but, according to a study by fund manager Meb Faber, all of the most popular asset allocation strategies active managers use produce about the same returns. The difference between the best-performing and worst-performing active strategy was about 1%.

In the example above, the high-priced mutual fund outperforms the index fund on an annual basis. But high-priced mutual funds rarely beat the major market indexes, and the largest mutual funds tend to essentially clone the indexes they are attempting to beat.

If you're considering investing in a mutual fund, your first step should be to learn the expense ratio. If it's above 1%, then move on.

Components of an expense ratio

While a fund's expense ratio is generally stable, it can fluctuate due to the variable nature of some of the fund's expenses. The biggest expense for any fund, whether actively or passively managed, is the management fee -- which, as a percentage of assets, is fixed. This is the amount the fund managers themselves receive, and it's higher for active managers.

The variable expenses funds incur include accounting fees, registration fees, reporting fees, and other miscellaneous costs. A fund's marketing expenses must be limited to 1% of the average value of the fund's assets and are reported separately to the U.S. Securities and Exchange Commission (SEC).

Some funds, typically index or other passively managed funds, keep their expense ratios very low by only collecting a small management fee. A fund can lend out its shares to short sellers to earn interest, which it can use to pay the fund's other expenses.

Related investing topics

What is a good expense ratio?

The best expense ratio is 0%. Surprisingly, some passive fund managers are starting to offer index funds with expense ratios of 0%. A good expense ratio for a mutual fund is less than 1%.

An index fund or ETF with no expense ratio is not automatically a good investment, and a mutual fund with a somewhat high expense ratio is not automatically a bad investment. Although high expense ratios should generally be avoided, a mutual fund that trades at a discount to the fund's net asset value can be a worthwhile investment even if the fund has an unfavorably high expense ratio.