Financial leverage can help investors and businesses do more with what they've got, but it's not for everyone, and it's not a perfect idea in all situations. Read on to learn more about financial leverage, when it's useful, and how to determine if a company is over-leveraged.

What is financial leverage?

Financial leverage is when you use borrowed money to attempt to make more money. This is often a successful strategy to increase wealth or the value of a company. Almost every large company uses financial leverage in some way to build its assets.

Some common ways to use financial leverage for investors include investing on margin, buying options, or buying futures contracts. Real estate investors often use leverage to make their cash go a lot further when financing properties. Companies will also often use financial leverage to invest in operations or temporarily improve cash flow instead of issuing more stock.

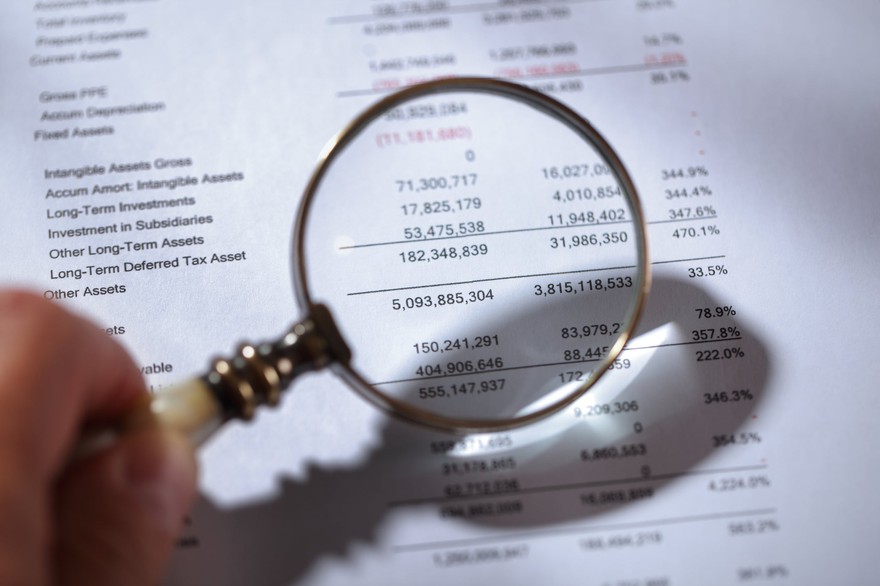

Financial leverage calculations

The right amount of debt is a good thing, but the wrong amount can send your company spiraling out of control and into bankruptcy. There are several different ways to look at the financial leverage of a company, including:

Debt ratio. Determining how much debt a company uses to generate assets can help you determine if it's over-leveraged compared to its peers. A ratio of 1.0 or higher means the company has more debt than assets.

Debt ratio = Total debt/total assets

Debt-to-equity (D/E) ratio. Looking at the debt-to-equity ratio is another way to see how debt is being used. A D/E ratio of 1.0 or greater means the company has more debt than equity, which is not great when you consider how it's planning to repay that debt.

D/E ratio = Total debt/total equity

Equity multiplier. Although not directly considering debt, the equity multiplier considers how assets have been financed. A high multiplier means a lot of assets are likely to be leveraged; a low one means that most assets were paid for with equity.

Equity multiplier = Total assets/total equity

Degree of financial leverage. The degree of financial leverage during a set period helps investors understand the delicacy of a company's earnings per share (EPS). A higher ratio means more leverage and much more volatile earnings to go with it.

Degree of financial leverage = percent change in EPS/percent change in earnings before interest and taxes (EBIT)

Pros and cons of financial leverage

There are a lot of arguments both for and against the use of financial leverage as a company or investor. The most important argument for it tends to be that leveraging can allow you to make more money with less input. When you can invest $10 million by only putting up $1 million, that can multiply pretty fast.

But the downside is potentially severe. You can also lose all of the money you put in, and sometimes more, if you make a bad investment, your plans for repaying the debt don't come to fruition, or the world simply takes an unlucky turn. You'll also spend a lot more when leveraging your investments, but sometimes that's OK if some or all of those interest or fees are deductible.

The best way to manage financial leverage is to strike a balance between these two states. The very best investments are a delicate dance between going in too hard and being too conservative and not leveraging enough to really get the biggest possible return.

Related investing topics

Why financial leverage matters to investors

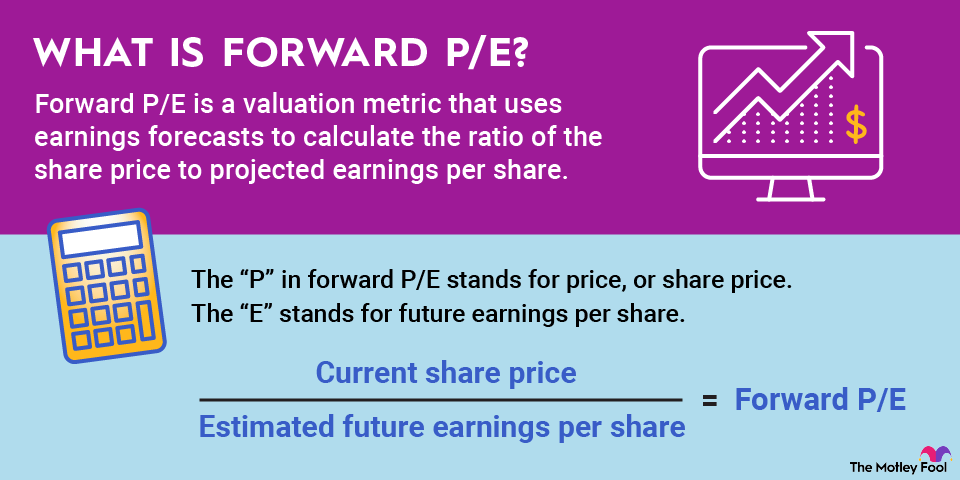

Financial leverage is one of the most important concepts for investors to understand, especially if they're buying stocks or directly investing in companies or real estate. How much the asset is leveraged also represents how much money it can make. That makes sense, right? If you have a rental property that's got a payment almost as high as the rent you can get from it, a lot of things have to go right for a long time before that place is profitable.

The same goes for stock in a company. If that company is heavily leveraged, it will take it a long time to become more profitable, so your investment needs to reflect all the risk that you take along the way to profitability. You might love XYZ, Inc. You might really believe in its mission and its goals. But it's not a charity; it's an investment. You have to look at it with that eye, which includes examining how, when, and why it borrows money and what that means for how much you're willing to pay per share.