There are thousands of micro-cap stocks on the market. It is the most common type of public stock, size-wise -- but these small businesses are not always the best investments. Let me tell you exactly what a micro-cap stock is and how informed investors should look at this category.

What is a micro-cap stock?

What is a micro-cap stock?

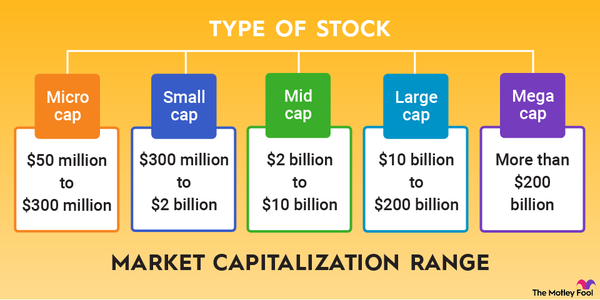

A micro-cap stock is like the small fish in the big pond of the stock market. By definition, these companies have a market capitalization -- total market value, as in the price per share multiplied by the number of shares -- of $300 million or less.

It should be noted that the boundary may vary a bit. Some people set the micro-cap limit at $250 million or even $200 million, and you could subdivide this space even further. For example, a so-called nano-cap stock comes with a market value no larger than $50 million. The whole section also overlaps with small-cap stocks, whose market caps generally stand between $200 million and $2 billion, although some investors lump anything less than $2 billion into this group.

Some people also conflate micro-caps with penny stocks. This makes sense because both classifications point to low values, but they are not strictly the same thing. For example, shares of telecom equipment giant Nokia (NOK -2.01%) have been stuck with single-digit prices since 2011, but its market cap has always been quite large. Sometimes, Nokia meets the definition of penny stocks without coming near the category of micro-caps.

You may run into the opposite situation, too. It's not unusual to see small-cap and micro-cap stocks with stock prices around $100 per share. Remember, companies can manipulate their stock price by performing stock splits or reverse splits, but the market value is based on investors' analysis of the underlying business.

So, a penny stock is not always a micro-cap, and vice versa. They just seem similar at a glance.

Why consider them?

So, what's the big deal?

Micro-cap stocks can provide thrilling highs but also stomach-churning lows. Small-caps and micro-caps are often considered riskier than their larger counterparts, primarily because they tend to be newer, less established companies. Just getting started on their long-term journey, they might have fewer resources, less access to capital markets, and less-experienced management teams.

You'll also find some former giants here, fading out as their products, services, or business models turn obsolete. Some climb back from that dangerous precipice, but successful turnaround stories are not very common.

On the flip side, these stocks can offer significant growth potential. Because they are small, there's plenty of room for growth, and even a small dollar-based increase in sales or earnings can lead to a hefty percentage gain. It's easier to multiply a small starting figure than a large one, after all. However, it's crucial to tread carefully and do your homework before diving in.

Can micro-caps be good investments?

Can micro-caps be good investments?

If you're thinking of dipping your toes into the micro-cap stock pond, there are a few things to consider. First, due to their size, these stocks may not be as liquid as larger stocks, meaning it might be harder to buy or sell shares without affecting the stock's price.

It's like Heisenberg's famous uncertainty principle in particle physics. You can't measure both the speed and position of a particle with perfect accuracy, and you can't buy or sell illiquid stocks without affecting their stock price in the process.

Additionally, micro-cap stocks may not be as widely covered by analysts and the financial press, which can make it harder to gather reliable information about the company.

For the brave at heart who are willing to put in the time and research, investing in micro-cap stocks can be a rewarding endeavor. Industry titans like Netflix (NFLX 1.28%) and Monster Beverage (MNST 1.43%) were also micro-caps (or even nano-caps) once upon a time before they found the big ideas that took them into billion-dollar territory. If you found them at their lowest point and then held on to that investment through thick and thin, you're probably set for life by now.

And, of course, it's always a good idea to diversify your portfolio. Don't put all your eggs in one basket, as they say. Including a mix of different types of stocks can help spread out the risk and increase the potential for reward. For every long-term winner in the Netflix and Monster mold, you'll see dozens or even hundreds of failed launches going nowhere.

Whatever you invest in these promising but risky stocks could very well go to zero in the end, and you need to accept that potential outcome before you start.

Related investing topics

Finding hidden gems

Finding the hidden gems

How do you find these elusive micro-cap stocks, you ask? There are various stock screeners available that can help you filter stocks based on specific criteria, such as market capitalization, industry, and various financial metrics. Set the market cap to $300 million or less, and off you go.

Of course, then you need to separate the future winners from gadflies headed for a quick and painful exit. This is where financial analysis comes in. Consider the company's revenue growth, profitability, global expansion plans, unique products, and so forth -- these are the qualities that could take the stock price higher and grow the market cap, too. On the other hand, you should also account for head-to-head competitors, regulatory risks, the cost of doing business, and other business challenges. There is no such thing as a risk-free investment, especially in this crowded corner of Wall Street.

Don't put your hard-earned money to work until you can accept the stock's balance of pros and cons. If your analysis turns up a dark result, it's better to move on and find a better idea.