Competition in the car industry

Generally speaking, the automaker with the newest products tends to command the highest prices and achieve the greatest profits. Automakers must continually invest to be sure they have a steady flow of new products in the pipeline.

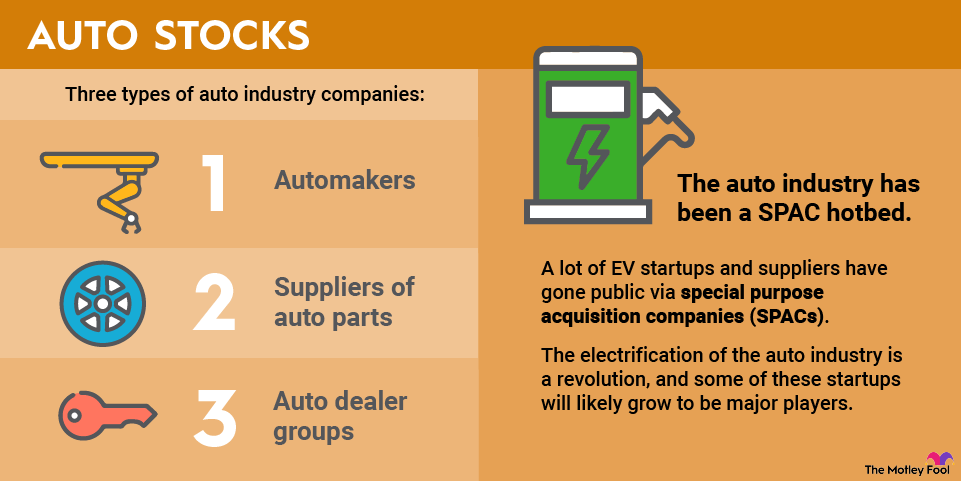

Virtually all automakers and many parts suppliers are also making significant investments in future technologies such as EVs, extra safety features, and autonomous driving systems.

Electric vehicles

Some exciting opportunities in the next few years will involve manufacturers of electric and hybrid electric vehicles. These are new and different, and most analysts expect them to eventually displace internal-combustion cars.

EV companies might see high growth, which is also exciting for investors. However, it's essential to note that the processes involved in developing and manufacturing EVs aren't significantly different from those employed by traditional internal-combustion vehicle manufacturers. That means EV manufacturers face the same high costs as conventional automakers.

It's also important to remember that all the major traditional automakers are introducing their own electric vehicles. However, Ford and Stellantis have both had to take huge charges as they restructure failing EV strategies.

The future of the auto industry

One vision of the future of the industry lies in EV and autonomous vehicles, with an increasing part of the value in the car coming from its software component. In addition, many believe the industry is headed more towards ride sharing, notably via robotaxis.

It's a vision held by Tesla, but other automakers have pared their EV investments in response to weak sales, and ICE and hybrid vehicles are set to be major parts of the industry for the foreseeable future.

That said, Tesla's robotaxi rollout and its aim of having unsupervised full self-driving (FSD) available (so Tesla drivers can transform their vehicles into robotaxis and Tesla can launch its dedicated robotaxi, the Cybercab) are not risk-free. If Tesla can get it right, the stock's upside potential is significant.

Benefits and risks of investing in automotive stocks

It's an industry in the throes of transformation. If Tesla's vision of a future of transportation dominated by autonomous vehicles and robotaxis comes to pass, then traditional automakers could face significant challenges. At the same time, there's no guarantee that Tesla will prevail.

It's a fundamental schism that could take time to resolve, and is far from clear which way it will go. The benefits of winning are significant to Tesla, as robotaxis will generate a mammoth amount of recurring income. Alternatively, if Tesla's vision fails, then traditional automakers will have an opportunity to grow.