The annual Roth IRA contribution limit in 2024 is $7,000 for adults younger than 50 and $8,000 for adults 50 and older. These limits will remain the same in 2025. But other factors could limit how much you can contribute to your Roth IRA.

Here's a closer look at the factors that influence your annual Roth IRA contribution limit and how to figure out what yours is for 2024 and 2025.

Factors affecting your contribution limit

Factors affecting your Roth IRA contribution limit

The following factors play a role in determining how much you can contribute to your Roth IRA:

The IRS sets annual limits every year dictating the maximum a person may contribute to a Roth IRA.

Adults 50 and older are eligible to make catch-up contributions annually. The IRS also sets limits on how much extra these individuals may contribute in a year.

Your MAGI is your adjusted gross income (AGI) -- your gross income minus certain tax deductions -- with some of those tax deductions added back in. Those with MAGIs above certain thresholds may not be able to contribute up to the annual limit or contribute directly to a Roth IRA at all.

The government evaluates your MAGI based on your tax filing status. See the table below for details.

The IRS limit applies to all of your IRA contributions during the year, so if you've already put some money into a traditional IRA, you must subtract this contribution from the annual limit to determine how much you can still contribute to your Roth IRA.

Contribution limits

Roth IRA contribution limits in 2024 and 2025 by MAGI and tax filing status

The following table shows how much you can contribute to your Roth IRA in 2024 and 2025 based on your tax filing status and your MAGI:

| Tax Filing Status | Contribute up to the IRS limit if your MAGI is less than: | Contribute a reduced amount if your MAGI is: | Contribute nothing if your MAGI is more than: |

|---|---|---|---|

| Single, head of household, or married filing separately if you didn't live with your spouse at all during the year | $146,000 (2024) or $150,000 (2025) | $146,000-$161,000 (2024) or $150,000-$165,000 (2025) | $161,000 (2024) or $165,000 (2025) |

| Married filing jointly or qualifying widow(er) | $230,000 (2024) or $236,000 (2025) | $230,000-$240,000 (2024) or $236,000-$246,000 (2025) | $240,000 (2024) or $246,000 (2025) |

| Married filing separately if you lived with your spouse at any point during the year | N/A | $0-$10,000 | $10,000 |

Single adults with MAGIs of less than $146,000 may contribute up to the annual contribution limit for 2024 -- $7,000, or $8,000 if they're 50 or older. Married couples with MAGIs below $230,000 may each contribute up to the annual limit.

In 2025, single adults with MAGIs below $150,000 will be able to contribute the full amount: $7,000, or $8,000 for those who are 50 and older. Married couples with a MAGI of less than $236,000 can make the full contribution.

Single adults with MAGIs above $161,000 and married couples filing jointly with MAGIs of more than $240,000 are ineligible to make a direct Roth IRA contribution in 2024. These limits rise to $165,000 for single filers and $246,000 for married couples in 2025.

Modified Adjusted Gross Income

Married couples filing separately who lived together and have a MAGI above $10,000 may not contribute any money directly to a Roth IRA in 2024 or 2025.

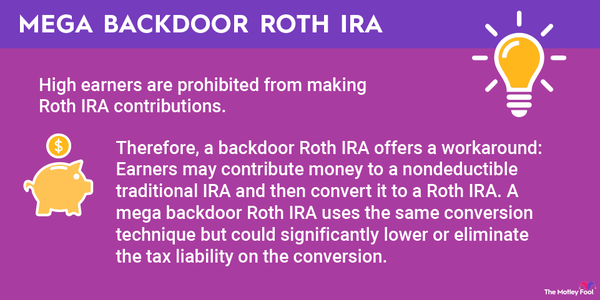

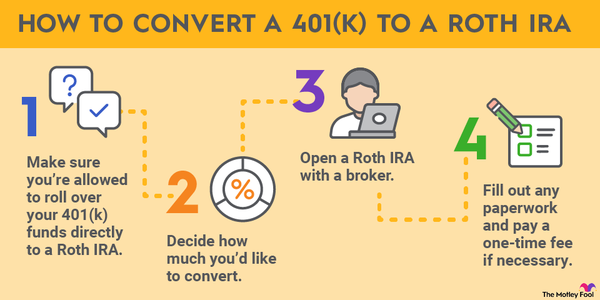

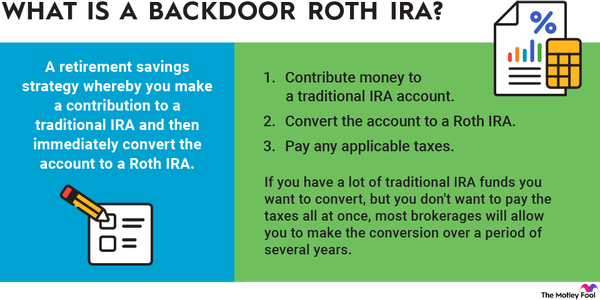

However, if your income is above these limits, you can use a backdoor Roth IRA. This is where you contribute money to a traditional IRA and then do a Roth IRA conversion in the same year. It's a few more hoops to jump through, but it will get you to the same place in the end.

If your MAGI falls between the two thresholds for your tax filing status, follow the steps below to figure out how much you're allowed to legally contribute to a Roth IRA this year.

Calculating your reduced contribution limit

How to calculate your reduced Roth IRA contribution limit

The first step in calculating how much you can contribute is to nail down your MAGI. Start with your gross income -- all the money you earned during the year -- and subtract any money spent on certain tax deductions, including:

- Half of your self-employment taxes, if applicable

- Student loan interest

- Tuition and fees

- Unreimbursed medical expenses exceeding 7.5% of your AGI

- Health savings account (HSA) contributions

- Tax-deferred retirement account contributions

- Health insurance premiums, if self-employed

- Qualified educator expenses

- Penalties for early withdrawal of retirement savings

The result is your AGI. You can also find this number for previous years on your tax return, which might give you a close estimate of your AGI for this year if your income and spending habits haven't significantly changed.

To calculate your MAGI, take your AGI and add back some of these deductions, including:

- Student loan interest

- Tuition and fees

- IRA contributions

- Half of your self-employment taxes

- Rental losses

- Passive losses or passive income

- Employer-paid adoption expenses

- Foreign earned income or housing exclusions

- Losses from publicly traded partnerships

- Taxable Social Security payments (excluding SSI)

It's possible your MAGI could end up being the same as your AGI, although this isn't always true. Once you have this number, you can calculate your reduced Roth IRA contribution limit for the year using the following formula:

- Find your MAGI using the steps above.

- Choose the appropriate next step based on your tax filing status:

- Single, head of household, or married filing separately if you didn't live with your spouse all year: Subtract $146,000 from your MAGI for 2024 or $150,000 for 2025.

- Married filing jointly or qualifying widow(er): Subtract $230,000 for 2024 or $236,000 for 2025.

- Married filing separately if you lived with your spouse at any point during the year: Proceed with your MAGI to the next step.

3. Divide your result from step 2 by:

- $15,000 if you filed single, head of household, or married filing separately if you didn't live with your spouse all year

- $10,000 if you filed married filing jointly, qualifying widow(er), or married filing separately if you lived with your spouse at any point during the year

4. Multiply your result from step 3 by the applicable annual contribution limit: $7,000, or $8,000 if you're 50 or older.

5. Subtract your result from step 4 from the annual contribution limit.

To see how this works in practice, consider a single adult younger than 50 who has a MAGI of $150,000 in 2024. They would subtract $146,000 from their MAGI, getting $4,000. Then they would divide that $4,000 by $15,000, leaving 0.267. They would then multiply the 0.267 by the $7,000 annual Roth IRA contribution limit for adults younger than 50 and get $1,867. Finally, they'd subtract that $1,867 from the $7,000 limit for a maximum reduced contribution limit of $5,133.

It sounds pretty complex, but it's not too difficult to figure out once you've got your MAGI. Keep in mind that the government changes the rules from year to year about who can contribute to a Roth IRA and how much they can contribute. Therefore, you should always check to see if anything's changed before making contributions in future years.