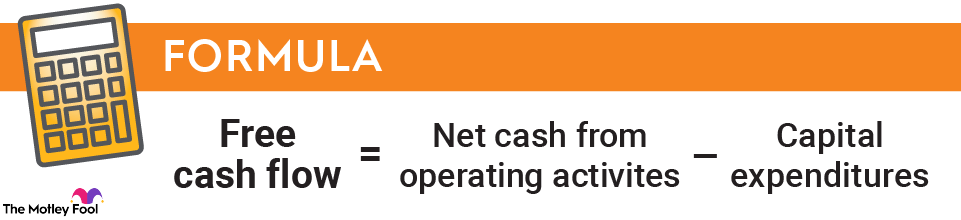

How to calculate FCF

Here are two real-world FCF examples from two different companies, Chevron (NASDAQ:CVX) and Nike(NASDAQ:NKE).

First, from Chevron's statement of cash flows from its 2022 annual report.

(Net cash provided by operating activities of $49.6 billion) - (Capital expenditures of $12 billion) = Free cash flow of $37.6 billion

And from Nike's 2022 annual report filing under the consolidated statement of cash flows:

(Cash provided by operations of $5.2 billion) - (Additions to property, plant, and equipment of $758 million) = Free cash flow of $4.4 billion.

As you can see, FCF is calculated for all types of companies. A company that requires heavy investment in property and equipment like Chevron can produce meaningful free cash flow. So can companies with lots of non-physical assets like branding and e-commerce sites such as Nike.

Whatever the company does for business, FCF is a simple measure of leftover cash at the end of a stated period of time. This remaining cash is available to the company for paying off debt, paying dividends to shareholders, or funding stock repurchase programs. (Such transactions are recorded in the "financing activities" section of the cash flow statement).

The free cash flow figure can also be used in a discounted cash flow model to estimate the future value of a company.