15 Stocks Millionaires Are Buying Now

15 Stocks Millionaires Are Buying Now

Here's what major investors have been buying

A good place to look for investment ideas for your portfolio is among the recent purchases of major investors, such as those who run big mutual funds or hedge funds. Here's a look at 15 stocks that 15 major investors have been grabbing shares of, according to the 13F forms they most recently filed with the Securities and Exchange Commission (SEC).

See which ones seem intriguing enough to you to warrant a closer look and possibly a berth in your portfolio. Don't buy any automatically, though, for several reasons: Even the best investors make mistakes and regrettable stock purchases. And the information on the forms can be out of date by the time you read it. The stock in question may have been sold. So gather ideas, but do your own research, thinking, and deciding.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Bank of America

Let's start with Berkshire Hathaway, the company helmed by Warren Buffett for the past 50-plus years. It's a huge conglomerate with all kinds of businesses under its roof, such as in the energy and insurance realms. It also owns a lot of stock in a bunch of public companies.

One of the company's biggest holdings is Bank of America (NYSE: BAC), and in the third quarter, it added 85 million more shares, bringing its total owned shares to more than a billion, worth more than $28 billion. Bank stocks are worth considering for your portfolio in part because they're built to last, and people (and businesses) will have banking needs no matter what the economy is doing. Bank of America, recently sporting a dividend yield of 2.5%, is a big, strong, and well-run bank.

ALSO READ: 6 Reasons Warren Buffett Is Such a Successful Investor

Previous

Next

2. Walmart

With recent total discretionary assets under management (AUM) of $235 billion, Bridgewater Associates is the biggest hedge fund around. Billionaire Ray Dalio heads the company, and he includes diversification and meditation among the factors responsible for his success.

Bridgewater's seventh-largest holding at quarter's end was Walmart (NYSE: WMT), and it added to that position during the quarter. Retail stocks are worth considering, in part because they're easier than average for us ordinary investors to understand. We can even research them more easily, as we can count cars in the parking lot and see how much shoppers seem to be spending. Walmart has been beefing up its e-commerce operations during the pandemic, and has been investing in international growth, among other things.

Previous

Next

3. Microsoft

Renaissance Technologies, run by James Simons, was recently the second-largest hedge fund, with discretionary assets under management of $166 billion. The fund's top holding is one of the darlings of pandemic investors -- Zoom Video Communications -- and it's estimated that the fund roughly doubled its money on that investment.

What has the fund bought lately? Well, a new holding for the company is Microsoft (NASDAQ: MSFT). It's easy to imagine what was appealing about Microsoft, as it boasts a dominant operating system (Windows), dominant productivity software (Office), and a major commercial cloud business that brought in $13 billion last quarter. It even sports a major gaming business, with its Xbox.

Previous

Next

4. Amazon.com

Millennium Management, run by Israel (Izzy) Englander, is a large hedge fund, with recent discretionary assets under management of $277 billion. Amazon.com (NASDAQ: AMZN) is one of its largest holdings, and it added to the position in the last quarter, boosting it by 55%.

Amazon.com has usually appeared overvalued. Those who have bought in anyway and have held for years have been well rewarded, and that's likely to happen to long-term investors buying today as well. The company is a compelling investment proposition, as it's not only dominant in online retail but also has a major cloud computing business in its Amazon Web Services. Some disagree, though, seeing it facing headwinds and approaching saturation in the U.S.

Previous

Next

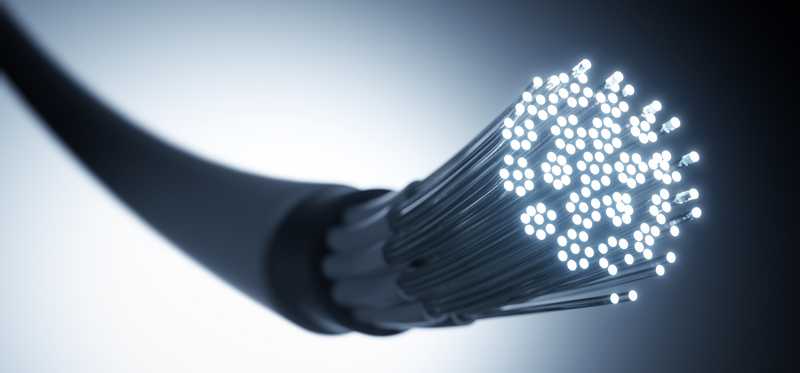

5. Uniti Group

Elliott Management is another large hedge fund, with recent discretionary assets under management of $73.5 billion. One of its biggest new purchases in the quarter was Uniti Group (NASDAQ: UNIT), a communications infrastructure real estate investment trust (REIT) that was the hardware operations of telecom company Windstream Holdings (which ended up in bankruptcy proceedings). Windstream had been Uniti's main customer, but Uniti has been shrinking the portion of its business that comes from Windstream. Uniti boasts 6.5 million miles of high-speed fiber-optic networks and is positioned to benefit from the rollout of 5G technology nationwide.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Visa

BlackRock is a publicly traded investment manager, serving a wide range of clients, including pension funds, third-party mutual funds, charities, endowments, governments, and individual investors. BlackRock's seventh-largest holding is Visa (NYSE: V), and it recently owned 7.5% of the entire Visa company. In the last quarter, BlackRock exhibited continuing confidence in Visa, snapping up even more shares. Visa is a "fintech" stock, deeply financial and tech-heavy at the same time. It has a lot going for it, starting with its major position in electronic payments -- with more than 3 billion Visa-branded credit cards in force and a system capable of processing 65,000 transaction messages per second, globally. In its most recent fiscal year, Visa processed more than 140 billion transactions on its network, totaling about $8.8 trillion in value.

Previous

Next

7. Boston Properties

The Bill & Melinda Gates Foundation is a major investing entity, with more than $22 billion in managed securities, per its last 13F filing. Much of that is shares of Warren Buffett's company, Berkshire Hathaway -- because Buffett is in the process of donating almost all of his wealth to the foundation, in chunks every year. In the last quarter, the foundation started a position in Boston Properties, a REIT focused on office real estate -- owning Class A property in Boston, as well as New York City, San Francisco, Los Angeles, and Washington, D.C. Unsurprisingly, the pandemic has made office-related investments less appealing, as so many people are working from home, with many suspecting that the trend will not completely reverse post-pandemic. Believers in Boston Properties see it continuing to grow over time, and increasing its dividend payments, which recently yielded 3.9% annually.

ALSO READ: Want to Retire a Millionaire? Learn These 3 Investment Rules

Previous

Next

8. Vertex Pharmaceuticals

Citadel Advisors, run by Kenneth Griffin, is a large hedge fund, with recent discretionary assets under management of $234.7 billion. One of its largest new positions in the third quarter, recently worth more than $200 million, is Vertex Pharmaceuticals (NASDAQ: VRTX). It's a global biotechnology company known mostly for its treatments for cystic fibrosis (CF), and it has treatments in its pipeline tackling diseases such as sickle cell disease, beta thalassemia, Duchenne muscular dystrophy, and type 1 diabetes mellitus. Some worry about patent protection running out for Vertex's big sellers, but bulls expect new big sellers to come from the pipeline. In the meantime, the company is growing briskly, aided in part by its recently approved CF treatment Trikafta.

Previous

Next

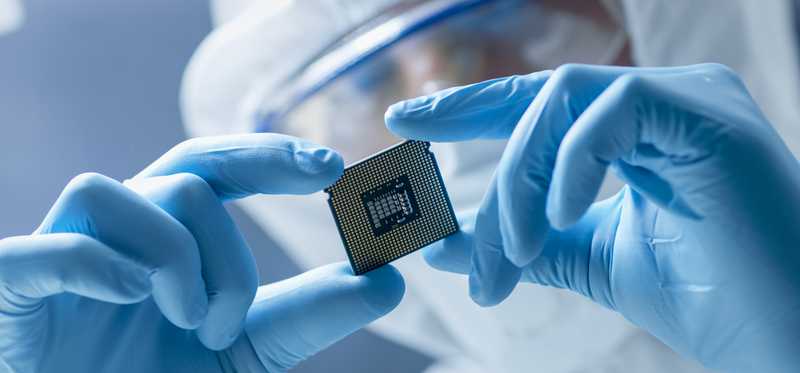

9. Advanced Micro Devices

D. E. Shaw & Company, founded by David Shaw, is a large hedge fund, with recent discretionary assets under management of $82 billion. One of its largest holdings is Advanced Micro Devices (NASDAQ: AMD), and that position grew in the last quarter, by a whopping 47% -- so that D. E. Shaw now holds more than $1.2 billion worth of it. Semiconductor chipmaker Advanced Micro Devices has been on a tear in recent years, stealing market share from Intel and selling lots of graphics cards to cryptocurrency miners and game players, among others.

Previous

Next

10. Pershing Square Tontine Holdings

The Baupost Group, run by respected investor Seth Klarman (who has written a classic on margin of safety), is a large hedge fund, with more than $9 billion in managed securities, per its latest 13F. Its largest new position is in Pershing Square Tontine Holdings (NYSE: PSTH), an interesting security established by Bill Ackman, another noted investor. Pershing Square Tontine is a SPAC -- a special purpose acquisition company that aims to raise money from investors and use it to buy other companies.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

11. Match Group

Markel, run by Tom Gayner, is publicly traded company that's often referred to as a "baby Berkshire," referring to Warren Buffett's Berkshire Hathaway. It sported close to $6 billion in managed securities on its last 13F filing. That filing listed only one new addition to its portfolio: Match Group (NASDAQ: MTCH). With a market value recently near $40 billion, Match's mission is to help people make meaningful connections. Think: dating apps and services, with familiar names such as Tinder, Match, Meetic, OkCupid, Hinge, Pairs, PlentyOfFish, and OurTime -- among others. Tinder has grown to become its biggest property, expected to generate around $1.4 billion for Match this year.

Previous

Next

12. The Trade Desk

Akre Capital Management is a large hedge fund, with recent discretionary assets under management of $13.7 billion. It's not afraid to concentrate its money on stocks in which it has strong confidence, and its recent top three holdings -- Mastercard, American Tower, and Moody's -- made up about 38% of the overall portfolio's value. Akre's only new holding in the quarter was The Trade Desk (NASDAQ: TTD), operator of a popular data-driven digital advertising platform. The Trade Desk's stock has surged more than 1,700% over the past three years, and many expected continued growth in the near term.

Previous

Next

13. DocuSign

Lone Pine Capital, run by Stephen Mandel, is a hedge fund with about $23 billion in managed securities on its last 13F filing. Its largest new holding is DocuSign (NASDAQ: DOCU), a cloud-based specialist in e-signatures. As you might imagine, this pandemic year has been good for DocuSign's business, as fewer documents were signed in person when online alternatives were available. DocuSign's stock has been on a tear, and the company recently boasted more than 820,000 customers and hundreds of millions of users in more than 180 countries.

Previous

Next

14. Taiwan Semiconductor Manufacturing

Viking Global Investors, run by O. Andreas Halvorsen, is a large hedge fund, with about $27.7 billion in managed securities on its last 13F filing. Its largest holding is Microsoft, making up more than 6% of its overall portfolio, and its largest new holding is Taiwan Semiconductor Manufacturing (NYSE: TSM). Taiwan Semiconductor is a major player in the chip arena, though it's not as well known as peers such as Intel and Advanced Micro Devices. The company does a lot of manufacturing of chips designed by other companies -- a difficult business, but one it's good at. The stock has run up a lot lately, so while some see more growth in the near future, others are waiting and watching.

Previous

Next

15. Alphabet

Farallon Capital Management is a large hedge fund, with recent discretionary assets under management of $32.4 billion. It's run by a name that might sound familiar -- Tom Steyer. (He recently ran for U.S. president.) Farallon's second-largest holding is the parent company of Google, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Farallon likes Alphabet so much that it increased its stake in the company by 64% over the last quarter, to a position recently worth more than $600 million. It's no mystery why people would invest their dollars in Alphabet, as it has a lot going for it -- such as a dominant search engine (Google), Gmail, YouTube, the rather prevalent Android operating system, and lots of innovative ventures including various initiatives in healthcare. Still, some worry these days about antitrust concerns, though even if Alphabet is broken up, it might not be bad for investors.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Do your own homework

Many of these 15 stocks could serve you well in your portfolio. Read up on the ones of most interest and see how well you understand them and how promising you think they are.

Remember, too, that there are plenty of other terrific stocks out there, and that simply opting to invest most of your dollars in a low-fee, broad-market index fund such as one that tracks the S&P 500 is a very rational thing to do.

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Selena Maranjian owns shares of Alphabet (C shares), Amazon, Berkshire Hathaway (B shares), DocuSign, Markel, Microsoft, The Trade Desk, and Vertex Pharmaceuticals. The Motley Fool owns shares of and recommends Alphabet (C shares), Amazon, American Tower, Berkshire Hathaway (B shares), DocuSign, Markel, Mastercard, Match Group, Microsoft, Moody's, Taiwan Semiconductor Manufacturing, The Trade Desk, Visa, and Zoom Video Communications. The Motley Fool recommends Intel and Vertex Pharmaceuticals and recommends the following options: long January 2021 $200 calls on Berkshire Hathaway (B shares), short January 2021 $200 puts on Berkshire Hathaway (B shares), short January 2022 $1940 calls on Amazon, long January 2022 $1920 calls on Amazon, and short December 2020 $210 calls on Berkshire Hathaway (B shares). The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.