Investing $10,000 might seem like a daunting task at first. However, learning how to invest that much money can be a great way to build wealth and achieve your financial goals.

But how should you invest your money? Whether you're a beginner at investing or have already started a portfolio, you first need to decide on your investment goals, your timeline for using this money, and your strategy for reacting to volatility.

Here are a few questions to guide your decisions:

- Are you saving for a particular end goal or to build your overall wealth?

- How soon do you need this money, and how much of it will you need? Will the whole account balance be needed all at once or in regular withdrawals (such as on a monthly or quarterly schedule)?

- How will you react to sudden fluctuations in portfolio value along the way, both down and up? Will you invest more, stay the course, or be tempted to change strategies?

Eight ways to invest $10,000

Eight ways to invest $10,000

After determining your answers to these questions, you're ready to start investing your $10,000. Here are eight strategies to get you started.

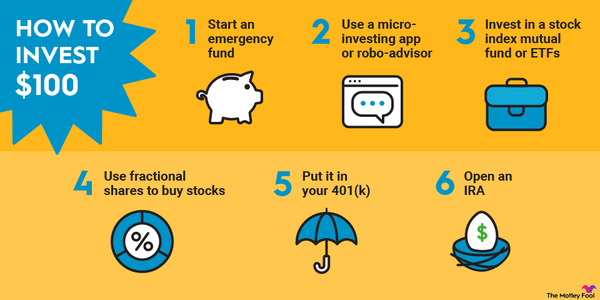

1. Emergency fund

1. Build your emergency savings fund

Simply put, if you don't have an emergency fund yet, that's the first step you need to take in your investing journey. Park at least some of your cash in a savings account or certificates of deposit (CDs) so you'll be ready when life throws you a curveball. Cash on hand in case of emergency -- three to six months' worth of expenses is a good rule of thumb -- is a necessity. Even adding part of your $10,000 to a savings account (and leaving it alone for a rainy day) is a solid start to an investment journey.

This may not feel exciting to you. However, keeping cash available is still a good investment if it means avoiding taking out a loan (in the form of credit card debt, for example) in a time of need. Your return on investment comes from the interest earned on your account and avoiding high-interest-rate payments from debt in the future.

2. Debt repayment

2. Pay off high-interest loans

Paying off debt might not seem like an investment. However, along with building an emergency cash cushion, it's essential to rid yourself of high-interest debt. Liabilities and interest payments can erase the growth of wealth. Money headed to a bank in the form of an interest payment reduces what you are able to save for yourself, so paying off high-interest debt can have a high return.

It's worth noting that not all debt needs to be offloaded as quickly as possible. A mortgage on a home, for example, typically bears a low interest rate. Paying a home off quicker than the term may be a good use of money, especially since it tends to be the single largest cash outflow for households in an average month. But first, prioritize any debt that sits at a higher interest rate. Credit cards, for example, should be a primary target since they usually bear interest rates many times higher than a mortgage (often about 20% annually).

If you have a lump sum, funneling it into paying down debt can be a great long-term investment -- and one that can liberate a budget from interest payments.

3. Retirement account

3. Fund your retirement account

No matter what "retirement" will look like for you, a retirement account can support your long-term financial needs.

There are a few vehicles you can use to save for retirement. Individual retirement accounts (IRAs) can be ideal for a lump sum of money. Traditional IRAs often allow for a tax deduction, barring any income restrictions, and can be invested with taxes deferred until funds are withdrawn. Roth IRAs give no tax deduction, but funds are tax-free when withdrawn after at least five years. Bear in mind that both accounts are designed to be withdrawn from after age 59 1/2 -- although Roth contributions (but not earnings) can be taken out early without penalty. There are also annual contribution limits for IRAs, which are set at $7,000 ($8,000 if you're 50 or older) in 2025.

While a deposit into a 401(k) or similar employer-sponsored retirement plan usually can't be made directly from your savings account, these plans are another good option. If an employer offers a match -- in which the company makes a contribution to your account based on the amount you deposit directly from your paycheck -- taking advantage of that money is a must. If you later leave that job, a company-sponsored retirement plan can be rolled into or combined with a personal IRA as described above.

4. Index fund

4. Invest in an index fund

Retirement accounts aren't the only places you can invest. Unlike an IRA, a brokerage account has no contribution limit. Think of it like a savings account but with the option to invest instead of simply collecting interest. If you have $10,000, starting a brokerage account may be the ticket -- either with all $10,000 or with what's left over after starting an emergency fund, paying off debt, and/or maximizing an annual retirement account contribution.

Now the question becomes where to invest that cash. An index fund can be a great, relatively lower-risk place to start, especially if you're interested in earning money without regular active management. Companies such as Vanguard offer a range of low-cost index funds for investors looking to passively capture the performance of a market or industry. Options range from funds that invest in bonds (typically lower volatility but lower return) to funds that invest in stocks (typically higher volatility but potentially higher returns). For example, the Vanguard 500 Index Fund (VFIAX -0.63%) tracks the S&P 500 index (500 of the largest publicly traded companies in the U.S.). The fund has a low investment minimum of $3,000.

If you will be staying invested for the long term (at least five to 10 years), and you aren't interested in babysitting your money, an index fund in a brokerage account is worth considering.

5. Invest in ETFs

5. Invest in ETFs

Exchange-traded funds (ETFs) can be a great way for beginners to invest $10,000. They offer the diversification of a mutual fund but trade on the stock market, offering increased liquidity.

Many ETFs track an index, making them similar to an index fund. For example, Vanguard S&P 500 ETF (VOO 0.6%) also tracks the S&P 500. However, it has a much lower investment minimum of only $1. It also trades on a major stock exchange, enabling you to buy and sell shares through a brokerage account.

Meanwhile, other ETFs focus on a specific sector (e.g., energy or technology), type of stock (value, growth, or dividends), investment theme (e.g., space companies or restaurants), or asset class (stocks, bonds, or preferred stocks). ETFs enable anyone to build a diversified portfolio with $10,000.

6. Individual stocks

6. Invest in individual stocks

You can use a brokerage account to invest in individual stocks as well as in ETFs. Stocks represent ownership in a business and can be a great means of building wealth for the long term. Since they tend to fluctuate greatly in value, it's wise to diversify your portfolio of stocks by owning several at a time.

Even with $10,000, it's possible to own a well-balanced portfolio of individual stocks. Many brokerage firms, such as Fidelity, Robinhood (HOOD -1.19%), and Block's (NYSE:SQ) Cash App, offer the ability to purchase fractional shares. If a single stock is priced so high it eats up a large percentage of your $10,000 (say a stock priced at more than $500 or $1,000), it's possible to purchase half a share, a quarter, or even less. This can be a great way to invest in multiple businesses, ranging from large and stable companies to small, up-and-coming future leaders. Here are some top individual stocks to consider buying.

The Motley Fool's Investment Philosophy is to build a diversified portfolio of 25 to 30 stocks that you plan to hold for five or more years.

7. Invest in real estate

7. Invest in real estate

Real estate has been a great long-term investment. While you probably need more than $10,000 to invest directly in a rental property, there are other lower-cost ways to invest in real estate. The easiest is to buy shares of a real estate investment trust (REIT). These entities own portfolios of residential rental properties, commercial real estate, and real estate-backed loans. REITs distribute the majority of the rental or interest income they produce to investors via dividends. You can buy a diversified REIT or build a diversified portfolio of REITs. Many REITs focus on a specific property type such as apartments, offices, or industrial properties.

You can also invest in real estate funds such as real estate mutual funds, exchange-traded funds (REIT ETFs), and real estate investment funds. Meanwhile, some online portals allow you to buy partial shares of rental properties.

8. Invest in bonds

8. Invest in bonds

Buying bonds is a low-risk way to invest $10,000. Bonds are fixed-income investments that pay interest (monthly, quarterly, biannually, and annually, depending on the bond). There are many bond investments, including government bonds (Treasuries), corporate bonds (investment-grade and junk bonds), and municipal bonds. In addition to buying bonds directly, you can invest in a bond mutual fund or a bond ETF.

Related investing topics

Tips

Tips for investing $10,000

Here are three practical tips to consider as you plan to invest $10,000:

- Fortify your financial foundation: Make sure you're first building a solid financial foundation by building an emergency fund and paying off high-cost debt. These investments might not generate a return, but they'll help fortify your financial future.

- Take full advantage of your retirement options: Take full advantage of your employer's 401(k) match. That's free money and a 100% return on your investment. Also, consider what account to invest your other retirement money. A traditional IRA can help you save on taxes now, while a Roth can help you save on future taxes.

- Know your risk tolerance: Investing has risk. You need to determine how much risk you can handle. If you can't afford to lose the money you invest, consider lower-risk investments.

Which investment is right for you?

Deciding how to invest $10,000 might seem like a daunting task. There's no one-size-fits-all strategy. You need to determine the best path for you. However, there are three basic approaches you can take:

- The conservative approach: If you're more conservative with your money, you might want to consider building a bigger emergency fund and paying down debt before investing that money. Once you've fortified your personal finances, you might want to consider lower-risk investment strategies such as index funds, bonds, and real estate. This approach should help you preserve and slowly grow the value of your investment portfolio over time.

- The balanced approach: If you want to balance risk with return, consider taking a more balanced approach. Max out your retirement savings and invest some money into lower-risk assets such as bonds and real estate, and riskier investments like ETFs and individual stocks. A balanced approach should enable you to grow your $10,000 investment over time without the risk of losing your entire investment.

- The aggressive approach: If you want to maximize your return on investment and have a high risk tolerance, you'll want to consider investing your entire $10,000 into individual stocks or ETFs. However, be careful not to get too aggressive, as you won't want to lose all your money in one investment. Aim to build a diversified portfolio that you believe can deliver the best returns for the risk over the long term.