The best index funds can help you build wealth by diversifying your portfolio while minimizing your fees. Investing in an index fund is less risky than investing in individual stocks or bonds because index funds often hold hundreds of financial securities. Index funds spread your investment risk across the stocks or bonds of many different individual companies.

How to choose an index fund

Index funds hold baskets of investments that track a market index, such as the S&P 500 (^GSPC +0.62%). They are passively managed, meaning the fund's holdings are entirely determined by the index the fund tracks.

The goal of an index fund is to match the performance of the underlying index. They're a good choice for long-term investors because you can lock in the returns of the overall stock market or a specific segment of it.

The returns generated by an index fund generally never exceed the performance of the index itself, if only because of index fund expense ratios, which are the annual management fees collected by index fund managers. Since index funds are passively managed, they are actually more likely to outperform funds with active managers over the long term.

An index fund can be either a mutual fund or an exchange-traded fund (ETF), both of which are managed by investment advisers who have to register with the U.S. Securities and Exchange Commission (SEC). Investors buy shares of mutual funds directly from asset management companies, while shares in ETFs are purchased and sold through stock exchanges.

Exchange-Traded Fund (ETF)

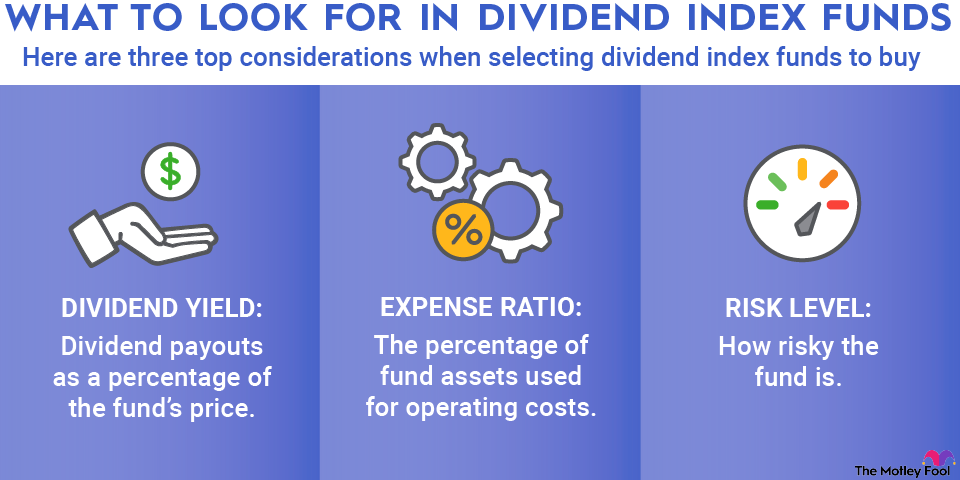

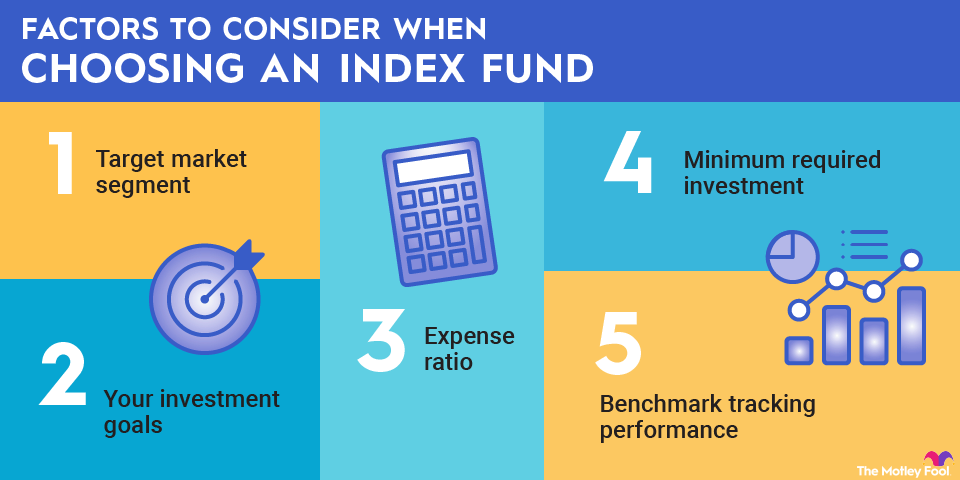

Consider these key factors when picking an index fund to invest in:

- Target market segment: Some index funds confer portfolio exposure to the entire U.S. stock market by tracking indexes such as the S&P 500. Others track narrower indexes focused on specific stock market sectors, industries, countries, or company sizes.

- Your investment goals: Some stock market indexes and, by extension, some index funds track companies with specific characteristics, such as high growth potential, a history of reliable dividend payments, or adherence to environmental, social, and governance (ESG) standards.

- Expense ratio: An index fund's expense ratio -- the percentage of your investment paid annually as a management fee to the fund's manager -- can vary significantly. A good expense ratio for a total stock market index fund is about 0.1% or less; a small number of index funds have 0% expense ratios. More specialized index funds tend to have higher expense ratios.

Expense Ratio

- Minimum required investment: Some mutual funds have minimum investments of $1,000 or more. ETF index funds are accessible for the cost of a single share. Many brokers also offer ETFs as fractional shares, allowing you to invest for as little as $1.

- Benchmark tracking performance: The degree to which an index fund tracks its underlying index can vary. The performances of the best index funds are very closely correlated with their benchmark indexes.

Best index funds to invest in for 2026

Our picks for the eight best index funds for this year can help you accomplish a variety of investment goals. Plus, they have low expense ratios and low minimum investments.

Many of the funds listed below are up significantly year to date as of September 2025 after experiencing substantial volatility in March and April. The rocky performance earlier in the year was largely due to fears of a trade war, due to President Trump's tariffs. But remember: Index investing is about building wealth for the long haul, so try not to focus on short-term ups and downs.

1. Fidelity ZERO Large Cap Index Fund

NASDAQMUTFUND: FNILX

Key Data Points

2. Schwab S&P 500 Index Fund

NASDAQMUTFUND: SWPPX

Key Data Points

3. Vanguard Growth ETF

NYSEMKT: VUG

Key Data Points

If you want to assume more investment risk in the pursuit of higher rewards, the Vanguard Growth ETF (VUG +0.36%) is a solid choice. The fund tracks the CRSP US Large Cap Growth Index, which performs similarly to the S&P 500 Growth Index. The ETF invests in 165 U.S. large-cap growth stocks. The fund is most heavily concentrated in the following sectors:

- Tech stocks (61%)

- Consumer discretionary stocks (18%)

- Industrial stocks (8%)

Consumer staples and utility stocks each make up less than 1% of the fund's value. The ETF has a minuscule 0.04% expense ratio.

As of Aug. 31, 2025, the fund's average annual return over five years (before taxes) was almost 14.5%, similar to the S&P 500's returns for the same period.

4. SPDR S&P Dividend ETF

NYSEMKT: SDY

Key Data Points

The SPDR S&P Dividend ETF (SDY +1.04%) is a top-performing index fund for income-oriented investors. The dividend-weighted fund's benchmark is the S&P High Yield Dividend Aristocrats® Index, which tracks about 150 stocks with the highest dividend yields in the S&P Composite 1500 Index. (Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services LLC.)

Dividend Yield

All the companies owned by the ETF have increased their dividend payments annually for at least 25 consecutive years.

Dividend-paying stocks tend to be less volatile compared to the overall stock market. So it's unsurprising that the SPDR S&P 500 Dividend ETF underperformed compared to the S&P 500 in 2023 and 2024. Though the fund outperformed the S&P 500 in the early months of 2025, when the overall stock market swooned over tariffs, it's delivered year-to-date returns of about 8% as of Aug. 31, 2025 -- significantly lower than the S&P 500's 13% gains in the same period.

The fund's 30-day SEC yield as of mid-September 2025 was 2.54% -- significantly higher than the S&P 500's 1.16%. The expense ratio is also somewhat higher at 0.35%. The fund's top five holdings are:

- Verizon Communications Inc. (VZ +0.17%)

- Realty Income (O -0.71%)

- Chevron Corp. (CVX -4.29%)

- PepsiCo Inc. (PEP -0.69%)

- Abbvie (ABBV +1.70%)

Several real estate investment trusts (REITs) are represented in the fund. REITs typically pay high dividends because they're required to disburse at least 90% of their taxable income. The ETF is underweighted in tech stocks, which don't tend to pay generous dividends.

5. Vanguard Real Estate ETF

NYSEMKT: VNQ

Key Data Points

If you want to invest across the real estate market, the Vanguard Real Estate ETF (VNQ +0.73%) is a solid, low-cost option. With an expense ratio of 0.13%, it's also the largest real estate index fund by far, with total net assets of more than $65 billion.

Its benchmark index is the MSCI US Investable Market Real Estate 25/50 Index, which broadly tracks equity REITs in the U.S. Although the index includes a few real estate management and development companies, it consists mostly of equity REITs, which own and operate income-producing real estate.

Because it invests primarily in REITs, the ETF is also attractive to dividend investors. The fund's 12-month dividend yield as of mid-September 2025 was 3.74%. The Vanguard ETF may also appeal to investors concerned about inflation since real estate is traditionally seen as a hedge against rising prices elsewhere.

6. Vanguard Russell 2000 ETF

NASDAQ: VTWO

Key Data Points

The Vanguard Russell 2000 ETF (VTWO +1.31%), which tracks the Russell 2000, is a good place to start for investors who want to take advantage of the potential upside of investing in small-cap companies. The fund invests in about 2,000 small- and mid-cap companies with a median market capitalization of $3.3 billion.

As of Aug. 31, 2025, the index fund's largest concentrations were in industrials (19%), financials (18%), and healthcare (15%). At 0.1%, its expense ratio is relatively low, especially for a fund offering exposure to the companies with the most growth potential. Like its benchmark index, the Vanguard Russell 2000 ETF was up about 7% during the first eight months of 2025.

7. ROBO Global Robotics and Automation Index ETF

NYSEMKT: ROBO

Key Data Points

Thematic investors wanting to capitalize on a long-term secular trend should check out the ROBO Global Robotics and Automation Index ETF (ROBO +1.60%). The index fund's benchmark is the Robo Global Robotics and Automation Index, which tracks 76 robotics, automation, and artificial intelligence (AI) companies. It has more than $1.1 billion in total net assets and a 0.95% expense ratio, higher than any fund on this list.

Artificial Intelligence

The ETF offers investors a way to capture the growth of several booming trends. Robotics offers huge cost savings to companies; the industry is forecast to have a compound annual growth rate of 14% through 2030. Interest in AI stocks has surged since late 2022, when ChatGPT launched. However, the ETF has still underperformed the stock market since then, posting three-year average annualized returns of less than 11%, compared to about 19% for the S&P 500 over the same period.

8. Schwab Emerging Markets Equity ETF

NYSEMKT: SCHE

Key Data Points

If you want to diversify your portfolio through exposure to high-growth emerging markets but don't want your risk concentrated in a single economy or region, the Schwab Emerging Markets Equity ETF (SCHE +0.53%) may be a good fit. It tracks the FTSE Emerging Index, a collection of large- and mid-cap stocks in more than 20 developing countries.

The fund has more than 2,000 holdings, with the largest concentrations in China, India, Taiwan, Brazil, and Saudi Arabia. Its expense ratio is only 0.11%.

The stocks of companies in emerging markets have historically underperformed compared to U.S. stocks. In the past five years as of September 2025, the Schwab emerging market fund had annualized returns just shy of 6%. Meanwhile, the S&P 500 racked up annualized returns of about 16% during the same five-year period.

The Schwab emerging market fund has been up over 18% year to date as of September 2025, as international stocks have largely outperformed U.S. stocks in 2025.

Considering about 85% of the world's population lives in developing countries, investors who have a long-term focus and are comfortable with volatility may want to consider investing in this fund.

Related investing topics

The bottom line on index funds for long-term investors

There are two ways to make money from index funds: sell the investment for a gain or earn dividends. A growth-focused index fund, like the Vanguard Growth ETF, has the potential for big gains.

However, higher rewards come with greater risk, and dividend payments will likely be minimal. If you want investment income, a dividend fund like the SPDR S&P Dividend ETF is a good choice. There's less potential for big gains, but you can earn reliable dividend income.

Although there's no single best index fund to invest in, a couple of good options are an S&P 500 index fund, which tracks about 80% of the U.S. stock market, or a total stock market fund, which tracks the entire U.S. stock market. These tend to be good choices because they're well diversified and allow you to lock in the historical growth of the domestic stock market.

All investments carry some risk, but S&P 500 index funds have been historically safe investments for the long term since the S&P 500 has always delivered positive returns over long periods. The S&P 500's average annual returns are about 10%.