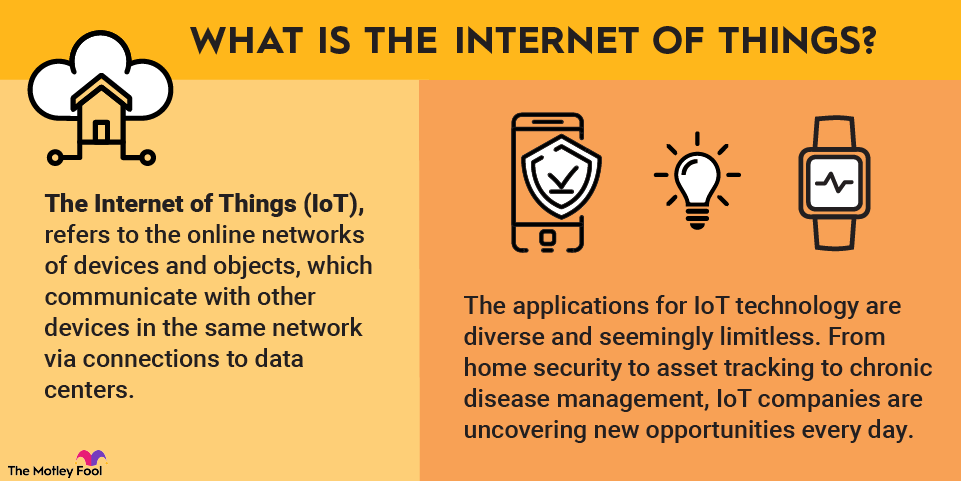

Computers and smartphones aren't the only devices connecting to the internet. Everyday objects such as lights, televisions, major appliances, cars, and even doorbells are being brought online. The Internet of Things (IoT) refers to the networks of devices and objects that communicate with other devices in the same network via connections to data centers.

What is the Internet of Things?

Although there is plenty of overlap among general technology, cloud computing, and the IoT, pure-play IoT companies are relatively rare. Any company that makes consumer electronics devices, sensors, or chips for industrial or commercial purposes has at least some exposure to IoT technology. Software platforms that manage IoT devices and cloud computing companies are also engaged with the IoT sector.

Best IoT stocks in 2025

These six top IoT stocks range from a diversified tech giant to a pure-play IoT company:

1. Cisco Systems

NASDAQ: CSCO

Key Data Points

Cisco Systems (CSCO +0.58%) is the leading provider of enterprise networking hardware. Because its products form the backbone of the internet, the tech giant benefits from the explosion of internet-enabled devices.

Cisco sells networking hardware designed for handling large numbers of connected devices, including rugged, durable products aimed at industrial applications. On the software side, the company provides the Cisco Edge Intelligence platform and other tools for managing IoT data and devices.

Cisco is also one of the largest cybersecurity companies. The company offers hardware, software, and services aimed at securing networks against threats, including those specifically targeting IoT systems.

Cisco is a low-risk way of investing in IoT. The company is supremely profitable, having generated net income of $10.3 billion on revenue of $53.8 billion in fiscal 2025. And it's not only on the income statement that Cisco shines. In fiscal 2025, Cisco generated about $13.3 billion in free cash flow.

The company is sensitive to global economic conditions, given that its customer base includes many large companies, organizations, and governments. However, investing in the stock is a good way to gain exposure to IoT without taking big risks. Cisco remains as dominant as ever, and the company is poised to benefit from the growth of the IoT market.

2. Alarm.com

Revenue

Management recognizes ample growth opportunities, identifying more than 500 million serviceable properties. Since only a small fraction of homes are currently using Alarm.com’s platform, the IoT company has a long growth runway.

With the smart home trend here to stay, Alarm.com -- and its millions of subscribers -- is an early leader.

3. DexCom

NASDAQ: DXCM

Key Data Points

NASDAQ: PI

Key Data Points

Total spending on consumer and industrial IoT technology is expected to pass $1 trillion in 2025.

5. Intel

NASDAQ: INTC

Key Data Points

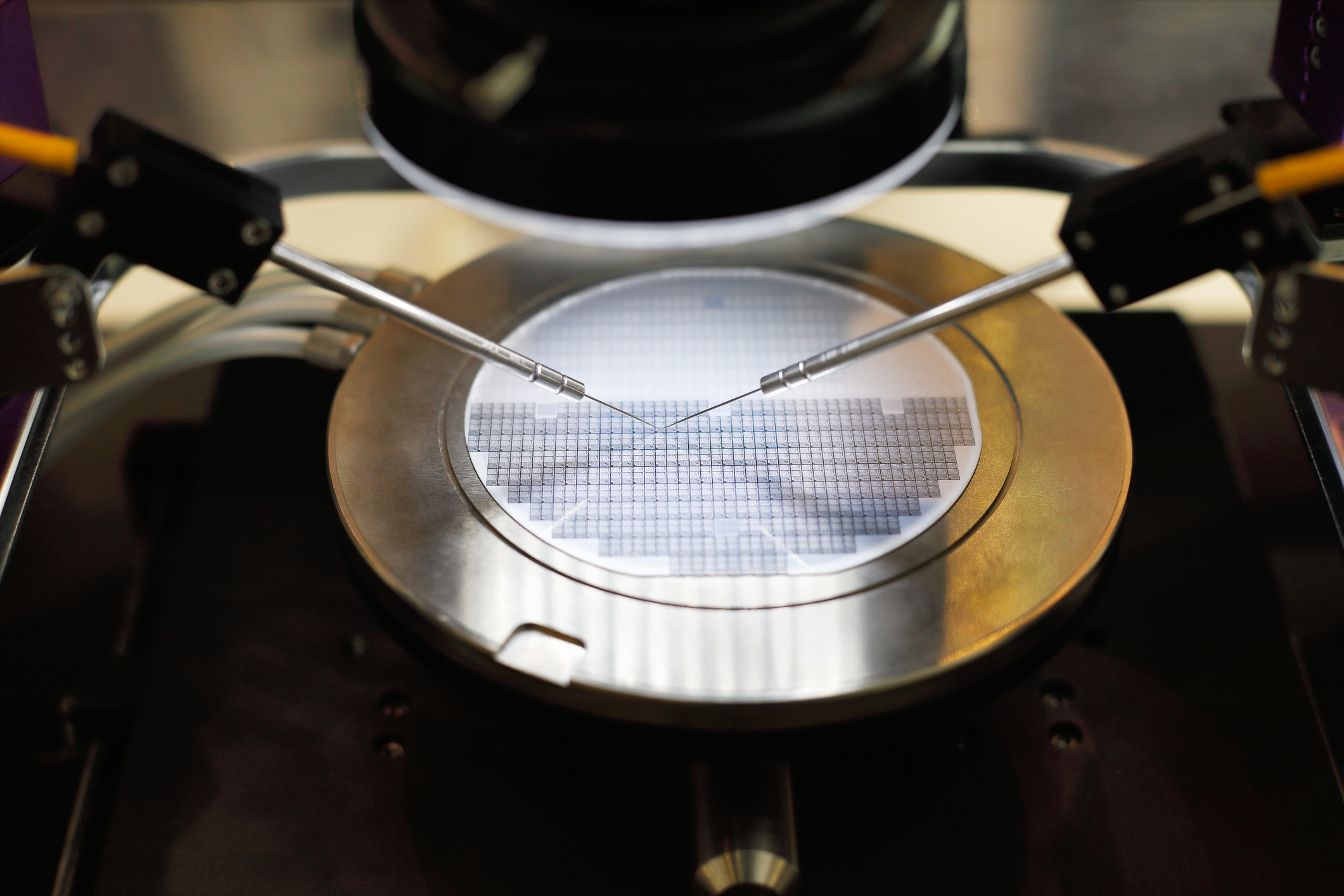

IoT isn't Intel's (INTC -0.79%) core market, but the semiconductor giant's data center chips power the cloud data centers that link IoT devices. Despite rising competition, Intel still dominates the data center CPU market.

Beyond powerful chips crunching data in the cloud, Intel sells chips meant for the edge. Its Xeon D family of processors, for example, has built-in AI for IoT applications and can operate in harsh, rugged conditions.

In 2015, Intel acquired Altera to expand its exposure to the IoT. Recently, Intel said it is exploring the spinning off of Altera and potentially holding an initial public offering (IPO) for it in the near future.

Intel also owns a majority stake in Mobileye (MBLY -4.79%), a leading developer of autonomous driving and advanced driver assistance systems. There are more than 1 billion cars on the road globally, and the fleet will become smarter and more connected.

In addition to selling its own chips that serve various parts of the IoT market, Intel is pouring tens of billions of dollars into building out its manufacturing capacity and starting up its own foundry business. Intel can further tap into the growing demand for IoT devices by manufacturing the necessary chips for other companies.

Intel isn't a pure-play IoT stock, but the company has multiple ways to benefit from a growing IoT industry.

Semiconductor

6. Samsara

NYSE: IOT

Key Data Points

Related investing topics

How to invest in IoT stocks

If you think you're ready to start investing in IoT stocks, there are a few basic steps you must take.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.