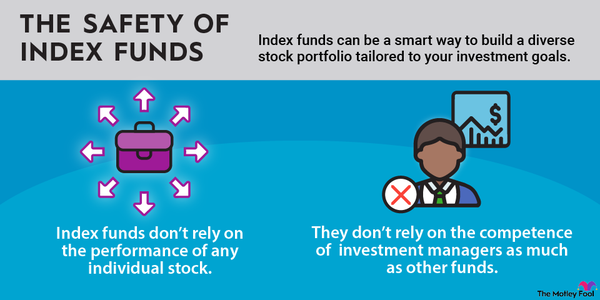

The best index funds can help you build wealth by diversifying your portfolio while minimizing your fees. Investing in an index fund is less risky than investing in individual stocks or bonds because index funds often hold hundreds of financial securities. Index funds spread your investment risk across the stocks or bonds of many different individual companies.

How to choose

How to choose an index fund

Index funds hold baskets of investments that track a market index, such as the S&P 500 (SNPINDEX:^GSPC). They are passively managed, meaning the fund's holdings are entirely determined by the index the fund tracks.

The goal of an index fund is to match the performance of the underlying index. They're a good choice for long-term investors because you can lock in the returns of the overall stock market or a specific segment of it.

The returns generated by an index fund generally never exceed the performance of the index itself, if only because of index fund expense ratios, which are the annual management fees collected by index fund managers. Since index funds are passively managed, they are actually more likely to outperform funds with active managers over the long term.

An index fund can be either a mutual fund or an exchange-traded fund (ETF), both of which are managed by investment advisers who have to register with the U.S. Securities and Exchange Commission (SEC). Investors buy shares of mutual funds directly from asset management companies, while shares in ETFs are purchased and sold through stock exchanges.

Exchange-Traded Fund (ETF)

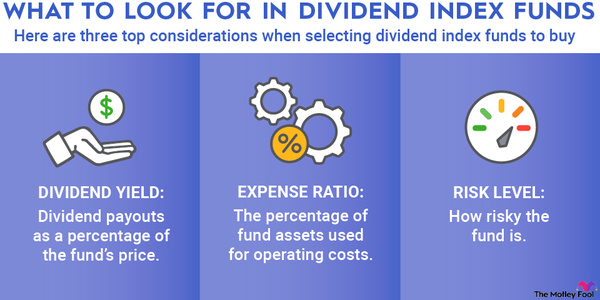

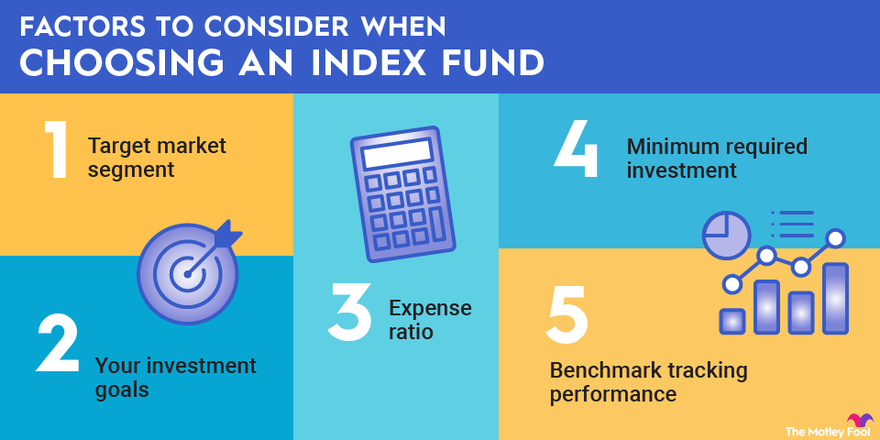

Consider these key factors when picking an index fund to invest in:

- Target market segment: Some index funds confer portfolio exposure to the entire U.S. stock market by tracking indexes such as the S&P 500. Others track narrower indexes focused on specific stock market sectors, industries, countries, or company sizes.

- Your investment goals: Some stock market indexes and, by extension, some index funds track companies with specific characteristics, such as high growth potential, a history of reliable dividend payments, or adherence to environmental, social, and governance (ESG) standards.

- Expense ratio: An index fund's expense ratio -- the percentage of your investment paid annually as a management fee to the fund's manager -- can vary significantly. A good expense ratio for a total stock market index fund is about 0.1% or less; a small number of index funds have 0% expense ratios. More specialized index funds tend to have higher expense ratios.

Expense Ratio

- Minimum required investment: Some mutual funds have minimum investments of $1,000 or more. ETF index funds are accessible for the cost of a single share. Many brokers also offer ETFs as fractional shares, allowing you to invest for as little as $1.

- Benchmark tracking performance: The degree to which an index fund tracks its underlying index can vary. The performances of the best index funds are very closely correlated with their benchmark indexes.

Best index funds

Best index funds to invest in for 2025

Our picks for the eight best index funds for this year can help you accomplish a variety of investment goals. Plus, they have low expense ratios and low minimum investments.

After a rocky 2022, many of the funds listed below rebounded significantly in 2023 and 2024. As the stock markets have reacted to economic uncertainty, particularly fears of a growing trade war due to President Trump's tariffs, many of the funds on this list have dipped again in early 2025. But remember: Index investing is about building wealth for the long haul, so try not to focus on short-term ups and downs.

1. Fidelity ZERO Large Cap Index Fund

Investing in S&P 500 index funds is, perhaps, the closest thing to a guaranteed way to build wealth over time. The Fidelity ZERO Large Cap Index Fund (NASDAQMUTFUND:FNIL.X) tracks an index of more than 500 U.S. large-cap stocks and performs very similarly to an S&P 500 index fund.

However, because this fund is not an official S&P 500 index fund, it avoids paying expensive licensing fees to S&P Global (SPGI -0.7%), the index's parent company. The fund tracks the Fidelity U.S. Large Cap Index as its benchmark.

The "ZERO" in the fund's name denotes that its expense ratio is 0%. There's also no minimum investment, making the fund a good choice for beginning investors.

The fund's performance closely mirrors that of the S&P 500. The fund was down almost 4% as of mid-March 2025, almost identical to the S&P 500 index's year-to-date drop.

2. Schwab S&P 500 Index Fund

If you want to invest in an official S&P 500 index fund, the Schwab S&P 500 Index Fund (NASDAQMUTFUND:SWPP.X) is about the cheapest you'll find. Its expense ratio is 0.02%, meaning you'll pay just $0.20 annually for every $1,000 you invest.

Because the investment fee is so low, your returns are virtually identical to the performance of the S&P 500. There's no minimum investment amount, so you can start investing with as little as $1.

In 2022, the fund fell more than 18%, almost identical to the S&P 500's losses for the year. Like its benchmark index, the fund had gains of about 25% in 2024 but had fallen by almost 4% in early 2025.

3. Vanguard Growth ETF

If you want to assume more investment risk in the pursuit of higher rewards, the Vanguard Growth ETF (VUG 0.76%) is a solid choice. The fund tracks the CRSP US Large Cap Growth Index, which performs similarly to the S&P 500 Growth Index. The ETF invests in 180 U.S. large-cap growth stocks. The fund is most heavily concentrated in the following sectors:

- Tech stocks (57%)

- Consumer discretionary stocks (19%)

- Industrial stocks (9%)

Consumer staples and utility stocks each make up less than 1% of the fund's value. The ETF has a minuscule 0.04% expense ratio. As early spring 2025, the fund's average annual return over five years (before taxes) was almost 19% compared to about 17% for the S&P 500. As tech stocks slumped in early 2025, the Vanguard Growth ETF dropped by almost 8%, about double the losses posted by the S&P 500.

4. SPDR S&P Dividend ETF

The SPDR S&P Dividend ETF (SDY 0.33%) is a top-performing index fund for income-oriented investors. The dividend-weighted fund's benchmark is the S&P High Yield Dividend Aristocrats® Index, which tracks 135 stocks with the highest dividend yields in the S&P Composite 1500 Index. (Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services LLC.)

Dividend Yield

All the companies owned by the ETF have increased their dividend payments annually for at least 25 consecutive years.

Dividend-paying stocks tend to be less volatile compared to the overall stock market. So it's unsurprising that the SPDR S&P 500 Dividend ETF underperformed compared to the S&P 500 in 2023 and 2024 or that it outperformed the S&P 500 in the early months of 2025, with modest gains of about 2.5% as of mid-March.

The fund's 30-day SEC yield as of mid-March 2025 was 2.57% -- significantly higher than the S&P 500's 1.23%. The expense ratio is also somewhat higher at 0.35%. The fund's top five holdings are:

- Verizon Communications Inc. (VZ -0.21%)

- Realty Income (O -0.07%)

- Abbvie Inc. (ABBV 0.4%)

- Chevron Corp. (CVX 1.63%)

- Consolidated Edison Inc. (ED -0.92%)

Several real estate investment trusts (REITs) are represented in the fund. REITs typically pay high dividends because they're required to disburse at least 90% of their taxable income. The ETF is underweighted in tech stocks, which don't tend to pay generous dividends.

5. Vanguard Real Estate ETF

If you want to invest across the real estate market, the Vanguard Real Estate ETF (VNQ 0.22%) is a solid, low-cost option. With an expense ratio of 0.13%, it's also the largest real estate index fund by far, with total net assets of more than $67 billion.

Its benchmark index is the MSCI US Investable Market Real Estate 25/50 Index, which broadly tracks equity REITs in the U.S. Although the index includes a few real estate management and development companies, it consists mostly of equity REITs, which own and operate income-producing real estate.

Because it invests primarily in REITs, the ETF is also attractive to dividend investors. The fund's 12-month dividend yield as of mid-March 2025, was 3.81%. The Vanguard ETF may also appeal to investors concerned about inflation since real estate is traditionally seen as a hedge against rising prices elsewhere.

6. Vanguard Russell 2000 ETF

The Vanguard Russell 2000 ETF (VTWO 1.37%), which tracks the Russell 2000, is a good place to start for investors who want to take advantage of the potential upside of investing in small-cap companies. The fund invests in about 1,970 small- and mid-cap companies with a median market capitalization of $3.2 billion.

As of early March 2025, the index fund's largest concentrations were in industrials (19%), financials (18.9%), and healthcare (16.6%). At 0.1%, its expense ratio is relatively low, especially for a fund offering exposure to the companies with the most growth potential. Like its benchmark index, the Vanguard Russell 2000 ETF dropped by more than 3% during the early part of 2025.

7. ROBO Global Robotics and Automation Index ETF

Thematic investors wanting to capitalize on a long-term secular trend should check out the ROBO Global Robotics and Automation Index ETF (ROBO 1.11%). The index fund's benchmark is the Robo Global Robotics and Automation Index, which tracks 77 robotics, automation, and artificial intelligence (AI) companies. It has more than $985 million in total net assets and a 0.95% expense ratio, higher than any fund on this list.

Artificial Intelligence

The ETF offers investors a way to capture the growth of several booming trends. Robotics offers huge cost savings to companies; the industry is forecast to have a compound annual growth rate of 15.2% through 2032. Interest in AI stocks had also surged since late 2022, when ChatGPT launched. The ETF finished 2023 with a gain of almost 24% but sank about 2% in 2024. It had posted losses of just under 2% through early 2025, slightly less than the S&P 500's losses.

8. Schwab Emerging Markets Equity ETF

If you want to diversify your portfolio through exposure to high-growth emerging markets but don't want your risk concentrated in a single economy or region, the Schwab Emerging Markets Equity ETF (SCHE 0.33%) may be a good fit. It tracks the FTSE Emerging Index, a collection of large- and mid-cap stocks in more than 20 developing countries.

The fund has 2,057 holdings, with the largest concentrations in China, India, Taiwan, Brazil, and Saudi Arabia. Its expense ratio is only 0.11%.

The stocks of companies in emerging markets have historically underperformed compared to U.S. stocks. In the past five years as of March 2025, the Schwab emerging market fund had annualized returns just shy of 5%. Meanwhile, the S&P 500 racked up annualized returns of about 17% during the same five-year period.

The Schwab emerging market fund has been up slightly through mid-March, though, with year-to-date returns of about 2%, as international stocks have largely outperformed U.S. stocks in early 2025.

But considering about 85% of the world's population lives in developing countries, investors who have a long-term focus and are comfortable with volatility seriously may want to consider investing in this fund.

Related investing topics

The bottom line on index funds for long-term investors

There are two ways to make money from index funds: sell the investment for a gain or earn dividends. A growth-focused index fund, like the Vanguard Growth ETF, has the potential for big gains.

However, higher rewards come with greater risk, and dividend payments will likely be minimal. If you want investment income, a dividend fund like the SPDR S&P Dividend ETF is a good choice. There's less potential for big gains, but you can earn reliable dividend income.

Although there's no single best index fund to invest in, a couple of good options are an S&P 500 index fund, which tracks about 80% of the U.S. stock market, or a total stock market fund, which tracks the entire U.S. stock market. These tend to be good choices because they're well diversified and allow you to lock in the historical growth of the domestic stock market.

All investments carry some risk, but S&P 500 index funds have been historically safe investments for the long term since the S&P 500 has always delivered positive returns over long periods. The S&P 500's average annual returns are about 10%.