The "Magnificent Seven" describes the seven biggest technology-focused companies that have led the market's returns in recent years. Bank of America (BAC +0.79%) analyst Michael Hartnett coined the phrase based on the Western film with the same name (originally made in 1960 and remade in 2016).

This update on the term FAANG stocks encompasses more of the top companies capitalizing on technology megatrends. Here's a look at the Magnificent Seven stocks and whether they are good investments right now.

What are the Magnificent Seven stocks?

The Magnificent Seven stocks are seven of the largest technology-focused companies by market cap.

All seven companies are focused on capitalizing on large technology-driven growth trends. But technically speaking, five are tech stocks, and two are tech-focused consumer discretionary stocks.

They're leaders in the fields of artificial intelligence (AI), cloud computing, video games, social media, digital advertising, software, hardware, e-commerce, and electric vehicles (EVs). These technology trends are driving outsized growth for companies focused on them.

Should I invest in the Magnificent Seven?

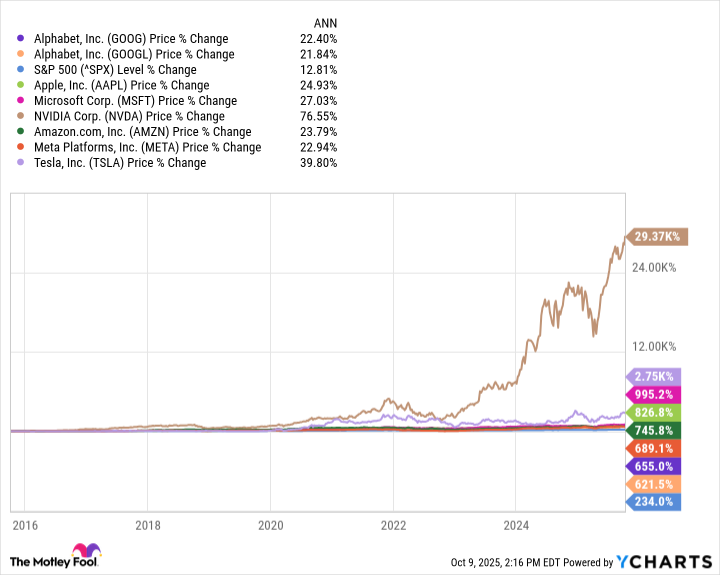

The Magnificent Seven stocks have delivered magnificent returns. As a group, these seven stocks delivered a 40% return over the last 12 months (as of early October 2025). That compares to the nearly 17% return delivered by the S&P 500.

Magnificent Seven stocks have delivered market-crushing returns over the past decade:

Asset

Risks of investing in the Magnificent Seven

Although the Magnificent Seven are among the world's largest and financially strongest companies, they're not without risk. Here are some risk factors to consider before investing in the Magnificent Seven:

- High valuations: After their market-smashing returns in recent years, the group traded at a premium price. In late 2025, the Magnificent Seven traded at price-to-earnings (P/E) ratios of over 25 times (Alphabet) to more than 250 times (Tesla), with most trading at more than 35 times earnings. That was higher than the S&P 500's P/E ratio (25.5 times) and a bit more than the tech-heavy Nasdaq-100 (around 33 times). If their growth slows, shares of the Manificent Seven could tumble.

- Cyclical nature of tech spending: If there's a recession and economic growth slows, it could significantly affect the growth of the Magnificent Seven.

The bottom line on the Magnificent Seven

The Magnificent Seven stocks have delivered magnificent returns over the years. These tech-focused companies have capitalized on many of the biggest technological growth trends, enabling them to grow rapidly and produce strong returns for their investors.

While they're in excellent positions to continue growing rapidly in the future, they're not without risk. Investors must understand the risks before loading their portfolios with these seven stocks.