This massive technology rollout will take years to complete. It will encompass wide swaths of the global economy since 5G network development will have substantial overlap with items ranging from automotive technology and industrial Internet of Things (IoT) to video games and virtual reality (part of the metaverse). Consumers and businesses will need to upgrade smartphones and other devices that can connect to 5G networks, making the upgrade cycle a top investment theme for 2025 and beyond.

Best 5G chip companies

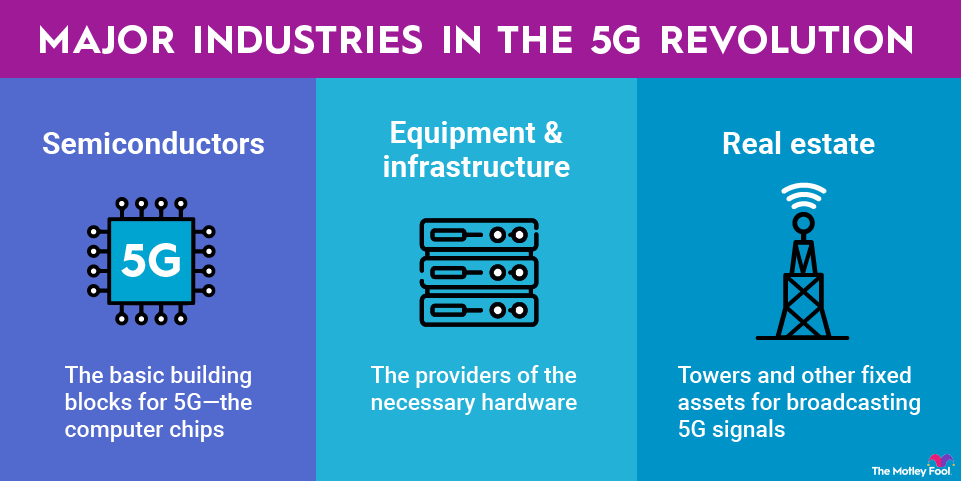

The basic building blocks for 5G are semiconductors -- the electronics that process data and execute commands in a computing system. These companies provide the chips that make 5G work. Top chip companies include:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Broadcom (NASDAQ:AVGO) | $1.6 trillion | 0.69% | Semiconductors and Semiconductor Equipment |

| Qualcomm (NASDAQ:QCOM) | $182.2 billion | 2.06% | Semiconductors and Semiconductor Equipment |

| Marvell Technology (NASDAQ:MRVL) | $72.6 billion | 0.28% | Semiconductors and Semiconductor Equipment |

| Advanced Micro Devices (NASDAQ:AMD) | $386.3 billion | 0.00% | Semiconductors and Semiconductor Equipment |

| Nvidia (NASDAQ:NVDA) | $4.4 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

1. Broadcom

NASDAQ: AVGO

Key Data Points

2. Qualcomm

NASDAQ: QCOM

Key Data Points

3. Marvell Technology Group

NASDAQ: MRVL

Key Data Points

4. Advanced Micro Devices

NASDAQ: AMD

Key Data Points

AMD (AMD -1.05%) makes this list because of its acquisition of Xilinx in early 2022 -- the industry leader in field-programmable gate array (FPGA) chips. FPGA chips can be reprogrammed and reconfigured at the hardware level even after they’ve been built. As new hardware is developed for 5G, the adaptability of FPGA chips makes them ideal for building the basic equipment to deploy 5G technology.

The merger gives AMD access to a best-in-class research and development (R&D) department. Xilinx will also improve AMD’s profitability since Xilinx’s profit margins are far higher than those of some of the traditional AMD chips used in personal computers and data centers.

AMD remains at the forefront of 5G technology with its ZynUltraScale+ RFSoC (Radio Frequency System-on-Chip), which the company lauds for its ability to enable "a flexible solution that is high performance, power-efficient, and cost-effectiveness."

5. Nvidia

NASDAQ: NVDA

Key Data Points

Best 5G equipment and infrastructure stocks

Beyond the basic chips needed to power 5G telecommunications, general equipment makers provide hardware that makes mobile networks possible. To reach businesses and consumers, wireless 5G signals need extensive equipment. These companies have had supply chain issues in recent years that have pressured growth rates and profit margins. However, they remain solid investments since they enable the construction of wireless networks and supporting infrastructure around the world.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Corning (NYSE:GLW) | $73.7 billion | 1.30% | Electronic Equipment, Instruments and Components |

| Ciena (NYSE:CIEN) | $23.9 billion | 0.00% | Communications Equipment |

| Arista Networks (NYSE:ANET) | $183.4 billion | 0.00% | Communications Equipment |

1. Corning

NYSE: GLW

Key Data Points

Before it gets turned into a high-speed Wi-Fi signal, 5G data needs to travel along the wired portion of the internet, just like other electronic data. That’s where fiber-optic cable comes in, and Corning (GLW +0.90%) -- the legacy glass and ceramics manufacturer -- is a major supplier. Even as they deploy new radio towers, many telecoms providing 5G service also need to add more high-speed cable to their networks.

Corning also builds small cell antennas and accompanying software -- core components of 5G systems used in office buildings and venues such as sports arenas to deploy wireless signals. Corning has been around for a long time, but it has a long history of paying a rising dividend to its shareholders.

2. Ciena

NYSE: CIEN

Key Data Points

NYSE: ANET

Key Data Points

Best 5G real estate investments

5G also requires real estate. Towers and other fixed assets are needed to broadcast 5G signals, and real estate investment trusts (REITs), such as American Tower, Crown Castle, and Digital Realty Trust, are some of the largest players in the sector. Besides slower but steady growth, the REITs are also top income-generating investments in the 5G space.

1. American Tower

Related investing topics

Invest in 5G for the long term

While previous telecom network upgrades enabled the smartphone and mobility booms, 5G technology entrenches digital technology even more into daily life. It overlaps with cloud computing, given that so many people now work from home. 5G is also unlocking new forms of entertainment, such as ultra-high-definition video, video game streaming, and virtual reality. Investors who are patient throughout the lengthy course of 5G’s deployment (a decade or more) could enjoy attractive long-term returns.