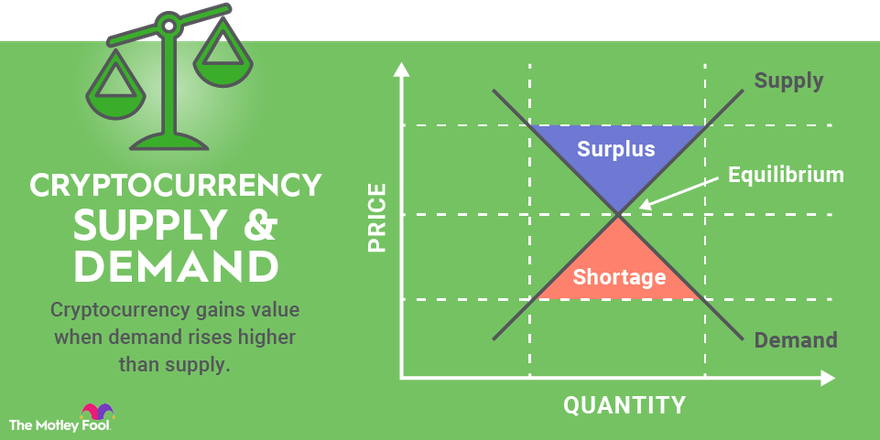

The most exciting thing about cryptocurrency investments is how they can skyrocket in value. Case in point: In 2025, privacy coin Zcash (ZEC -10.12%) surged by 1,870%. Because of the massive potential returns, many investors want to find the next cryptocurrency to explode.

The volatility of cryptocurrency can work for you or against you. Prices can fall just as quickly, as investors have seen recently. It's also impossible to know which cryptocurrency will go on a hot streak next. However, we can pick out some possible candidates, especially with so many coins trading well below their all-time highs.

Decentralized Application (dApp)

Five cryptocurrencies to explode in 2026

Here are the cryptocurrencies that could be due for a significant bull run:

1. Solana

CRYPTO: SOL

Key Data Points

Solana (SOL -7.06%) is a blockchain platform with smart contract capabilities. It's one of Ethereum's (ETH -5.41%) biggest competitors and is famous for its blazing-fast speeds and transaction fees that cost a fraction of a cent.

Since Solana can run smart contracts, it has a wide range of uses, including decentralized finance (DeFi) services and, more recently, the tokenization of real-world assets (RWAs). It's also a popular place to launch meme coins -- for example, Official Trump (TRUMP -2.40%) is a Solana-based token.

Ethereum is a fierce competitor, but Solana's speed advantage makes it an excellent alternative. It processes thousands of transactions per second (tps) and went live with its Firedancer upgrade in late 2025, which reportedly hit 1 million tps in testing environments. With the recent upgrade and Solana's low fees, it's the next big crypto that could deliver rapid growth.

2. XRP

CRYPTO: XRP

Key Data Points

Ripple, a blockchain payments company, launched XRP (XRP -7.07%) in 2012, making it one of the oldest cryptocurrencies. It's designed to work with Ripple's payments network, which provides fast and affordable cross-border payments for financial institutions.

This cryptocurrency took off after the 2024 presidential election. Investors viewed the incoming crypto-friendly administration as a good sign for Ripple, which had been locked in a lawsuit with the Securities and Exchange Commission (SEC) since 2020 over allegations that XRP tokens were unregistered securities. In August 2025, the SEC ended the lawsuit.

With no more regulatory issues looming, Ripple can focus on expanding its list of banking partners and growing XRP. It serves as a bridge currency for international payments, eliminating the need for banks to have accounts funded with various currencies.

3. Chainlink

CRYPTO: LINK

Key Data Points

On their own, blockchains are disconnected from the real world and lack access to real-world data. Chainlink (LINK -3.98%) bridges the gap, serving as an oracle platform that provides the infrastructure to let blockchains securely access external data.

Tokenized real-world assets, or RWAs, are an example of why this matters. Several blockchains now have tokenized versions of stocks and other assets. For tokenized RWAs to work, the blockchain needs data from the outside world on the current values of those assets.

Chainlink scored a big win in August 2025 when it began working with the U.S. Department of Commerce to bring government economic data to public blockchains. It's a clear sign that Chainlink is the oracle platform of choice and will serve a crucial role in the future of the crypto market. The SEC also recently approved the first spot Chainlink ETF.

4. TRON

CRYPTO: TRX

Key Data Points

Smart Contracts

TRON (TRX -1.83%) is another smart contract blockchain. It was founded by businessman Justin Sun, who previously worked at Ripple.

One of the big selling points with TRON right now is its massive stablecoin supply. Stablecoins, which are crypto tokens pegged to the value of another asset, have been growing rapidly in popularity. TRON's stablecoin supply is second only to Ethereum, and in some regions, it has more stablecoin activity than Ethereum.

TRON is also a top blockchain in terms of activity. It has about 3 million daily active addresses, ranking second in that category, and it has processed more than 12 billion transactions. TRON's activity levels and role in the stablecoin market make it a dark horse candidate to take off.

5. Monero

Privacy coins have been gaining popularity. This type of cryptocurrency has privacy-enhancing features to make transaction tracing more difficult. Zcash isn't the only option here -- Monero (XMR -2.59%) is one of the first privacy coins, and according to the Monero website, transactions are confidential and untraceable.

As governments pass more crypto regulations, a subset of users will likely prefer to keep their activity private. Monero could be a long-term winner due to its privacy features. There have been no public reports of anyone cracking it.

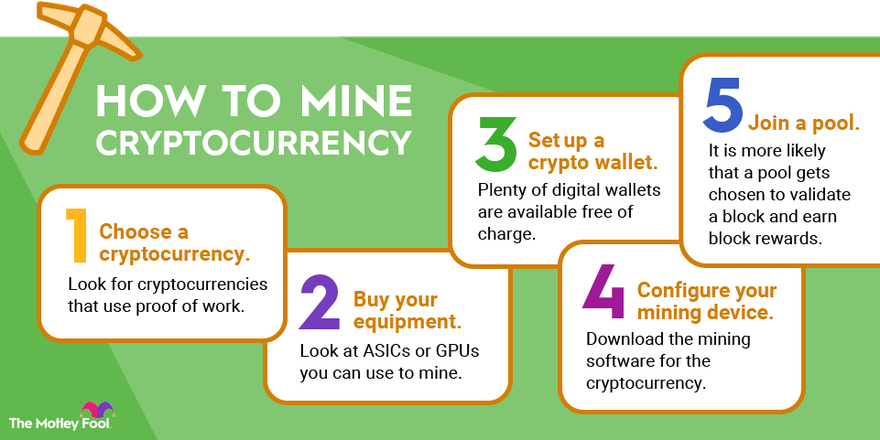

Another unique feature of Monero is that it's ASIC-resistant, meaning people can mine it using normal computing hardware instead of application-specific integrated circuits, custom processors designed to perform specific tasks. This has encouraged more people to mine Monero, strengthening its network.

Should you consider investing in the next crypto that explodes?

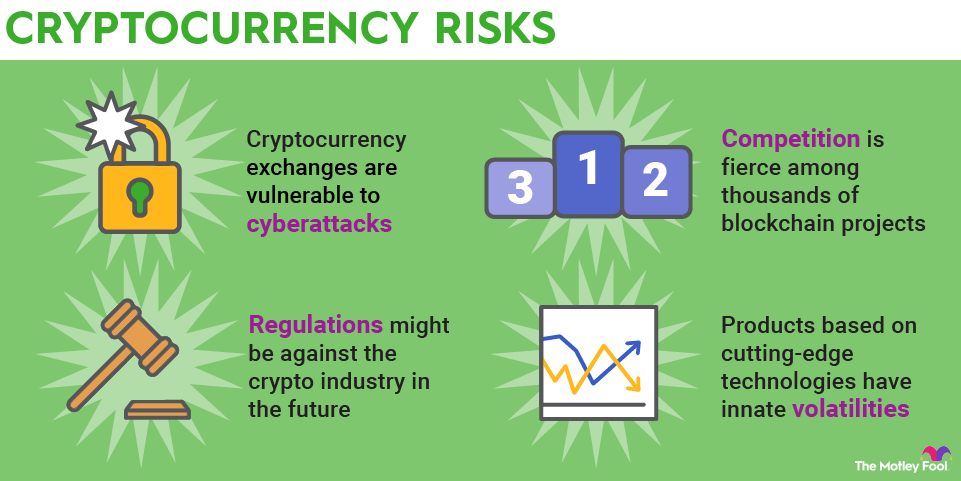

It's tempting to try to find that next big cryptocurrency. Even though you could see incredible returns this way, there are a few serious downsides:

- It's extremely risky. Most cryptocurrencies don't succeed. CoinGecko research found that more than 50% of cryptocurrencies have stopped trading, and even the ones that stick around often go through steep declines. Small cryptocurrencies have more growth potential, but they're also more likely to fail.

- It's time-consuming. You need to spend quite a bit of time reviewing cryptocurrencies to make educated investments. Otherwise, you're throwing darts at the wall.

- The crypto market is highly unpredictable. Your carefully researched investment could go nowhere, while a practically useless cryptocurrency goes to the moon just because it has some variation of Shiba Inu (SHIB -2.30%) or Dogecoin (DOGE -3.73%) in its name.

Following cryptocurrency trends or trying to predict them isn't a good investment strategy. There's nothing wrong with giving it a shot, but keep your expectations -- and the amount you invest -- very low. You might also want to put some of your money into cryptocurrency stocks or large-cap coins, such as market leader Bitcoin (BTC -5.51%), to balance out the risk.

Related investing topics

What to look for in a booming crypto

When you're evaluating a booming crypto, start with its real-world utility. Consider the uses for it and the problems it aims to solve. A good place to find this information is in the cryptocurrency's whitepaper, typically found on its website. Here are a few more important items you can use to evaluate a cryptocurrency:

- Leadership: A strong management team can help separate cryptocurrencies that last from those that are a flash in the pan. See who's behind the project, their qualifications, and their experience.

- Unique attributes: This could be anything that makes a cryptocurrency stand out from the competition, such as Solana's speed or TRON's success with stablecoins.

- Total value locked (TVL): For blockchains with smart contract capabilities, TVL shows you how much value is on a blockchain. It's a good measure of which blockchains people are using.

- Number of users: This metric provides an indication of a blockchain's popularity.

There's no guarantee that a booming cryptocurrency will maintain its momentum. But those factors can help you determine whether a cryptocurrency has genuine value or is just designed to enrich the developers behind it.