Artificial intelligence is already reshaping industries and driving real revenue growth for the companies building and powering it. From chips and cloud infrastructure to software and automation, AI is becoming a core competitive advantage.

Below are some of the top AI stocks to consider buying now, followed by tips on how to invest in the space.

Seven AI stocks to buy in 2026

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Nvidia (NASDAQ:NVDA) | $4.4 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

| Alphabet (NASDAQ:GOOG) | $4.1 trillion | 0.24% | Interactive Media and Services |

| Alphabet (NASDAQ:GOOGL) | $4.1 trillion | 0.24% | Interactive Media and Services |

| Microsoft (NASDAQ:MSFT) | $3.1 trillion | 0.83% | Software |

| CoreWeave (NASDAQ:CRWV) | $44.9 billion | 0.00% | IT Services |

| Meta Platforms (NASDAQ:META) | $1.8 trillion | 0.30% | Interactive Media and Services |

| Adobe (NASDAQ:ADBE) | $111.6 billion | 0.00% | Software |

| Alibaba Group (NYSE:BABA) | $367.7 billion | 0.64% | Multiline Retail |

1. Nvidia

NASDAQ: NVDA

Key Data Points

Nvidia (NVDA -2.82%) has become the backbone of the AI revolution. Its graphics processing units (GPUs) are the industry standard for training and running large language models, making the company one of the earliest and biggest beneficiaries of generative AI.

Once known primarily for gaming chips, Nvidia now supplies the core hardware for data centers worldwide. Its data center segment generates the vast majority of revenue, fueled by surging demand from cloud providers and AI developers.

Revenue has exploded since 2023, with full-year sales reaching $130.5 billion in 2024, up 114% year over year, and growth continuing into 2025. Nvidia has also expanded beyond chips, offering full-stack AI infrastructure that includes networking, software, and systems designed to run AI workloads at scale.

The company is currently rolling out its Blackwell platform, with the next-generation Rubin platform expected in the second half of 2026. Demand continues to outstrip supply, underscoring Nvidia’s dominant position.

Beyond data centers, Nvidia is investing in autonomous vehicles, robotics, and “physical AI.” These initiatives remain a small part of revenue today, but they could become meaningful growth drivers for Nvidia over time.

2. Alphabet

NASDAQ: GOOGL

Key Data Points

Alphabet (GOOGL -1.16%) (GOOG -1.22%) has been investing in artificial intelligence for more than a decade, highlighted by its acquisition of DeepMind in 2014. Today, AI touches nearly every part of its business.

The company’s Gemini models power products across Google Search, YouTube, Google Cloud, and Workspace. While some investors worried that generative AI could threaten Google Search, advertising revenue continues to grow steadily.

Alphabet is also a leader in autonomous driving through Waymo, which operates fully driverless ride-hailing services in multiple U.S. cities. On the infrastructure side, Alphabet designs its own AI chips, known as TPUs, putting it in direct competition with Nvidia in certain workloads.

In 2025, Alphabet planned roughly $75 billion in capital spending, much of it aimed at AI infrastructure. With information and data at the heart of its business, Alphabet remains one of the most deeply integrated AI companies in the world.

3. Microsoft

NASDAQ: MSFT

Key Data Points

Microsoft's (MSFT -2.86%) partnership with OpenAI has made it one of the most visible players in AI. The company began investing in OpenAI in 2019 and now owns a significant minority stake following the startup’s restructuring.

AI is embedded across Microsoft’s ecosystem, from Azure cloud services to Microsoft 365 Copilot, Edge, and GitHub. Azure OpenAI has seen rapid adoption, with more than 65% of Fortune 500 companies using the service.

Microsoft has also diversified its AI strategy by supporting multiple internal and third-party models across its platforms, reducing reliance on any single partner. Azure AI Foundry, launched in late 2024, allows customers to build and manage AI applications and agents, and adoption has grown quickly.

CEO Satya Nadella has called AI the next major computing platform, and Microsoft’s heavy investment reflects its determination to lead that transition.

4. CoreWeave

NASDAQ: CRWV

Key Data Points

CoreWeave (CRWV +1.26%) may be the closest thing to a pure-play AI infrastructure stock. The company’s cloud platform was designed specifically for AI workloads and counts customers like Nvidia, OpenAI, Microsoft, and Meta among its core clients.

Revenue growth has been explosive. CoreWeave went from minimal sales in 2022 to $1.9 billion in 2024 and is expected to generate more than $10 billion in revenue in 2026.

That growth comes with risk. Microsoft accounted for 62% of revenue in 2024, and the company carries heavy debt and large capital expenditures. However, management has reported improving customer diversification, and nearly all of CoreWeave’s revenue is directly tied to AI demand.

For investors seeking direct exposure to AI infrastructure, CoreWeave offers high upside, along with elevated risk.

5. Meta Platforms

NASDAQ: META

Key Data Points

Meta Platforms (META -2.08%) doesn’t operate a cloud platform, but it’s investing heavily in AI across advertising, consumer apps, and hardware. Meta AI is embedded across Facebook, Instagram, and WhatsApp and reached 1 billion monthly active users in 2025.

AI plays a growing role in ad targeting and creative tools, and Meta aims to automate much of the advertising process using AI. The company also continues to develop its open-source Llama models, now in their fourth generation.

Beyond software, Meta is incorporating AI into devices like Ray-Ban smart glasses and Meta Quest headsets. The company sees AI as central to its long-term strategy across experiences, advertising, and hardware.

6. Adobe

NASDAQ: ADBE

Key Data Points

Adobe (ADBE -7.31%) has successfully integrated AI into its creative software ecosystem. Its Firefly generative AI tools are designed to enhance, not replace, creative work, and Adobe has taken a cautious approach to training models using licensed and public data.

More than 18 billion images have been generated using Firefly since launch. Adobe has also expanded into agentic AI, offering tools that improve productivity for marketing, analytics, and operations teams.

While Adobe’s growth has slowed compared to earlier years, it remains a dominant player in creative and marketing software and is well positioned to benefit from AI adoption across enterprise teams.

7. Alibaba

NYSE: BABA

Key Data Points

Alibaba (BABA -2.87%) has broad exposure to AI through cloud computing, e-commerce, and logistics. Its Qwen family of large language models underpins a rebuilt AI-focused cloud platform, and the company plans to invest more than $50 billion in AI infrastructure.

AI is also used to improve Alibaba’s e-commerce operations, including product recommendations, search, and automation. The company has partnered with Nvidia on physical AI projects and continues to expand its data center footprint.

While consumer demand in China remains uneven, Alibaba trades at a discount to many U.S. peers and maintains a strong competitive position in its home market.

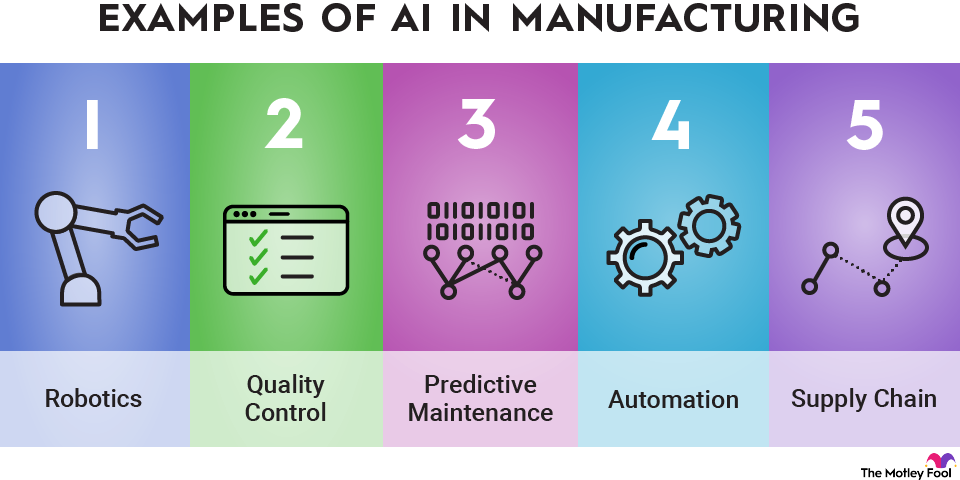

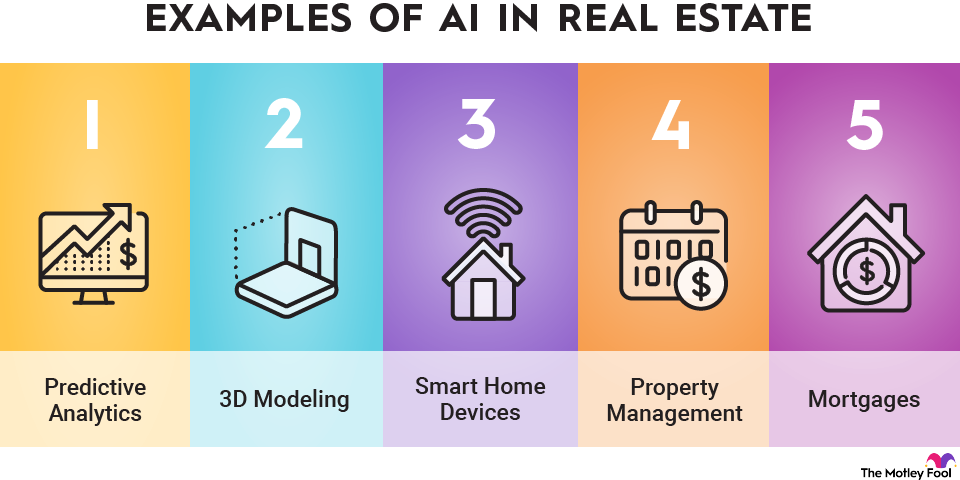

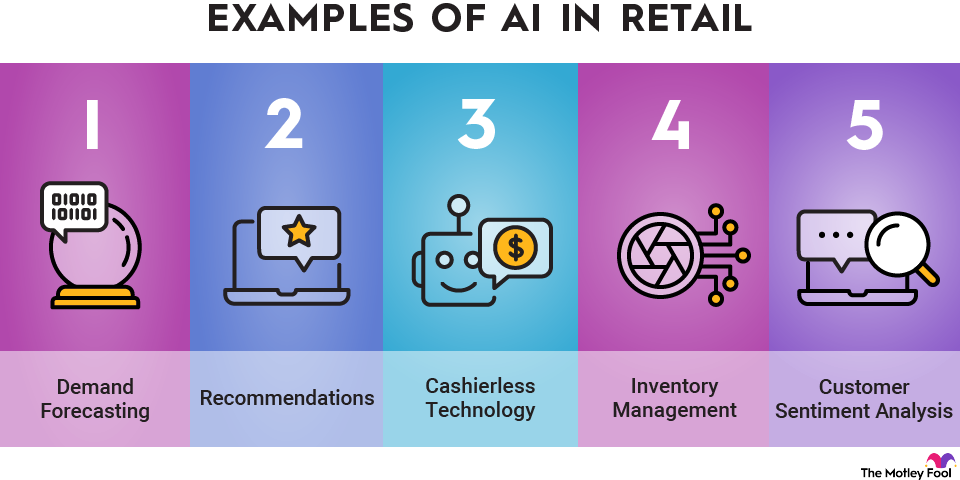

AI technologies powering these companies

Most AI innovation across these stocks falls into a few core categories:

- Machine learning: Models trained on large datasets to identify patterns and make predictions.

- Deep learning: Advanced neural networks used in language models, image recognition, and autonomous systems.

- Generative AI: Tools that create text, images, video, or code in response to prompts.

Pros and cons of investing in AI stocks

Pros

- Significant long-term growth potential

- Broad adoption across industries

- Potentially transformative technology

Cons

- Valuations can be volatile

- Heavy capital spending may not pay off

- Competition and disruption remain intense

What to consider when investing in AI stocks

Investing in AI stocks requires a lot of the same analysis and considerations as investing in any stock. Here are some things to consider if you're investing in AI stocks.

Look for durable advantages

Most AI stocks are well-established tech companies, but some have stronger competitive advantages than others in AI. Nvidia, for example, dominates the market for data center GPUs, giving it a strong competitive advantage.

Understand the business model

There are lots of different ways to make money in AI. There are chip companies like Nvidia, infrastructure companies like CoreWeave, software companies like Adobe, and companies like Microsoft that are diversified across verticals. Each one of these subsectors offers a different set of risks and opportunities, and it's important to understand how they differ from each other.

Assess AI exposure

Most tech stocks are doing something with AI, but some companies have more exposure than others. Nvidia and CoreWeave, for example, are virtually pure-play AI stocks, making most of their revenue directly by powering AI. Meta, on the other hand, makes almost all of its revenue from advertising, though it says that AI has enhanced its advertising product.

The bottom line

AI is already translating into real revenue and sustained investment, and the strongest opportunities in 2026 are coming from the companies building and deploying AI at scale.

If you’re investing in AI stocks, a long-term mindset and diversification across several leaders can help balance growth potential with risk.