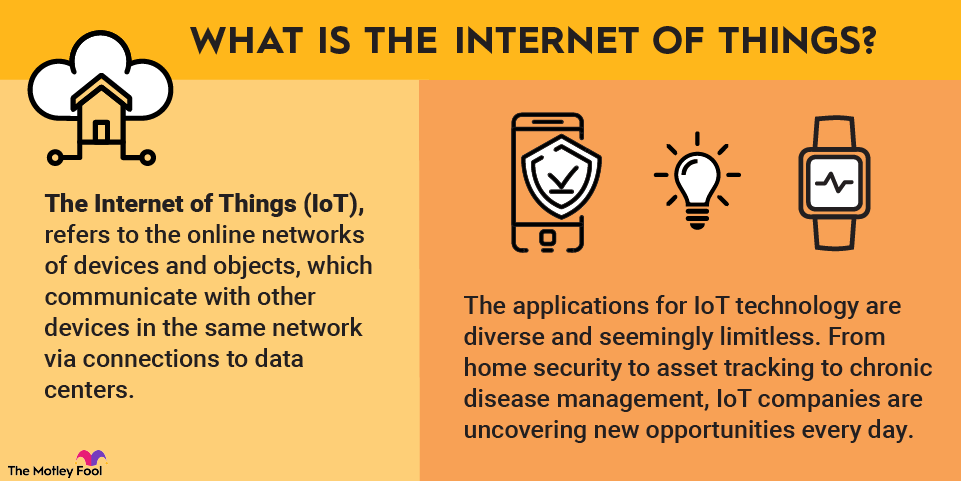

Computers and smartphones aren't the only devices connecting to the internet. Everyday objects such as lights, televisions, major appliances, cars, and even doorbells are being brought online. The Internet of Things (IoT) refers to the networks of devices and objects that communicate with other devices in the same network via connections to data centers.

What is the Internet of Things?

Although there is plenty of overlap among general technology, cloud computing, and the IoT, pure-play IoT companies are relatively rare. Any company that makes consumer electronics devices, sensors, or chips for industrial or commercial purposes has at least some exposure to IoT technology. Software platforms that manage IoT devices and cloud computing companies are also engaged with the IoT sector.

Best IoT stocks in 2025

These six top IoT stocks range from a diversified tech giant to a pure-play IoT company:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Cisco Systems (NASDAQ:CSCO) | $288.2 billion | 2.24% | Communications Equipment |

| Alarm.com (NASDAQ:ALRM) | $2.4 billion | 0.00% | Software |

| DexCom (NASDAQ:DXCM) | $26.7 billion | 0.00% | Healthcare Equipment and Supplies |

| Impinj (NASDAQ:PI) | $6.0 billion | 0.00% | Semiconductors and Semiconductor Equipment |

| Intel (NASDAQ:INTC) | $187.6 billion | 0.00% | Semiconductors and Semiconductor Equipment |

| Samsara (NYSE:IOT) | $22.1 billion | 0.00% | Software |

1. Cisco Systems

NASDAQ: CSCO

Key Data Points

2. Alarm.com

NASDAQ: ALRM

Key Data Points

Revenue

Management recognizes ample growth opportunities, identifying more than 500 million serviceable properties. Since only a small fraction of homes are currently using Alarm.com’s platform, the IoT company has a long growth runway.

With the smart home trend here to stay, Alarm.com -- and its millions of subscribers -- is an early leader.

3. DexCom

NASDAQ: DXCM

Key Data Points

NASDAQ: PI

Key Data Points

Total spending on consumer and industrial IoT technology is expected to pass $1 trillion in 2025.

5. Intel

NASDAQ: INTC

Key Data Points

Semiconductor

6. Samsara

NYSE: IOT

Key Data Points

As developer of the Connected Operations Platform, (IOT +4.15%) Samsara has created a platform that integrates data from IoT devices and other connected assets to provide customers with actionable insights from the ample data that the IoT devices collect. Samsara estimates that in fiscal 2025, its Data Platform processed more than 14 trillion data points -- everything from video footage to people and motion detection to GPS location and a wide variety of other pieces of data.

The company has achieved considerable growth in the 10 years since its founding. In fiscal 2018, for example, Samsara had more than $10 million in annual recurring revenue (ARR), yet in the first quarter of fiscal 2026, the company reported ARR in excess of $1.5 billion.

Unsurprisingly, Samsara has also achieved impressive growth with respect to the income statement. From the $119.9 million that it reported on the top line in fiscal 2020 to the sales of $1.25 billion it reported for fiscal 2025, Samsara has grown revenue at a near 60% CAGR. For fiscal 2026, Samsara projects further growth, forecasting sales of $1.547 billion to $1.555 billion.

Despite the company's success in emerging as an IoT leader, it's still early in the company's development, and with management estimating it has a total addressable market approaching $200 billion, it's clear that Samsara has the potential for further growth in the years ahead.

Related investing topics

How to invest in IoT stocks

If you think you're ready to start investing in IoT stocks, there are a few basic steps you must take.

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.