A dividend payment is the distribution of a company's profits to its shareholders. Dividends are usually paid in cash but sometimes in company stock, and companies often use them to return excess profits to investors.

Beyond that basic definition, there are a number of important things about dividend payments that investors should know:

- How do companies decide on dividend payments?

- How do stocks pay dividends?

- When do stocks pay dividends?

- How do you get dividend payments?

- What is the average dividend payment?

How do companies decide on dividend payments?

A company's board of directors is responsible for its dividend policy and determining the size of a dividend payment. Depending on a company's growth goals, earnings and cash flows, its industry, and other factors, the board will determine an appropriate (if any) dividend payment.

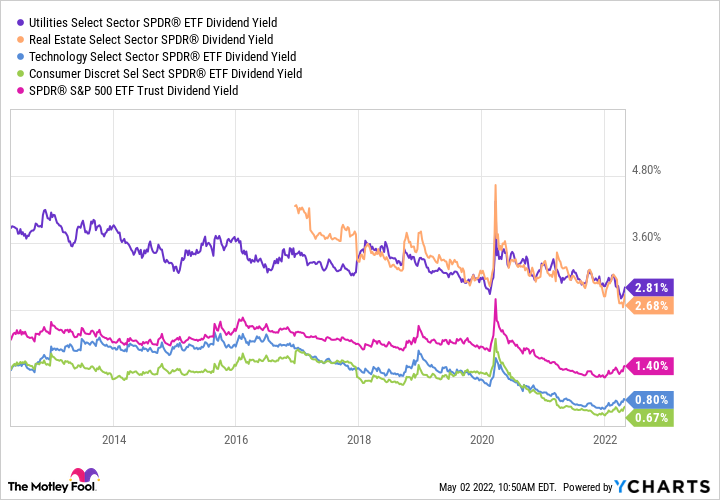

This can vary from one industry to the next and among companies in different growth phases. Industries that are lower growth but generate stable earnings and cash flows, such as utility companies, often prioritize higher dividend payments to attract investors. Companies in sectors that are more cyclical, such as consumer discretionary goods, may pay a lower portion of their earnings -- the payout ratio -- as dividends, prioritizing their ability to maintain the dividend payment when business is weaker.

How do stocks pay dividends?

Whether you want dividend stocks as a source of income or for more cash to reinvest in your stock portfolio, it's important to know how a company pays a dividend. The short answer is that a company pays a dividend from its earnings. When a company earns a profit, it essentially has three things it can do:

- Invest it back into the business (build a factory, expand into a new market, make an acquisition, pay off debt, etc.).

- Retain it for a future need.

- Return it to shareholders by repurchasing stock or paying a dividend.

In a broad sense, if a company doesn't have a clear internal use for excess profits, returning them to investors by paying a dividend is ideal.

A company that doesn't generate regular or consistent earnings, or is not yet profitable -- like many start-ups or high-growth companies that are aggressively spending to expand their operations -- may not be able to pay a dividend. These companies have better use for their earnings, or they simply don't generate enough earnings to afford a dividend.

In a few instances, a company may pay dividends in stock, not cash. While it's rare, it's important to make sure you know whether this is the case, especially if you're counting on those dividend payments for income today.

You may also earn something called substitute payments in lieu of dividends. This happens when you own a dividend stock but allow your broker to lend it out to a short-seller. In this case, the dividend doesn't technically come to you, so the short-seller reimburses the dividend to you. The upside is you earn extra money by lending your shares and continue to earn the dividend equivalent. The downside is additional tax complications, depending on what kind of brokerage account you're using.

When do stocks make dividend payments?

The vast majority of dividend stocks pay dividends quarterly, although there are some companies that make dividend payments monthly and a very small number that make annual and semiannual dividend payments. This recurring, expected dividend is generally called a regular dividend.

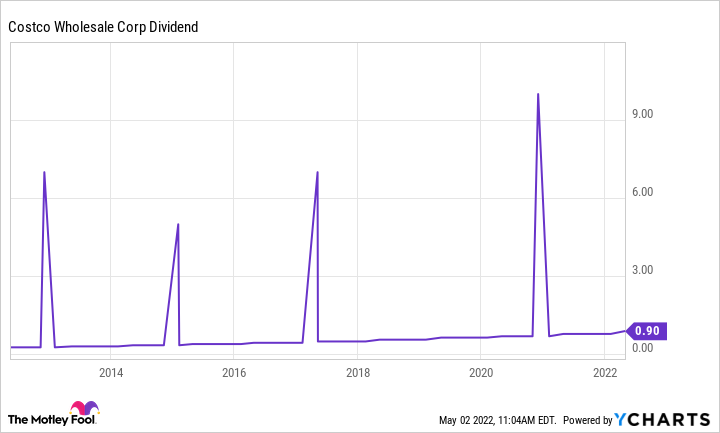

Some companies may occasionally pay a special dividend. This is a nonrecurring, one-time payout, and it is usually the result of an extraordinary circumstance or event that generates excess earnings or cash for a company. This can include an asset sale, divestiture of a subsidiary or part of the company, or a particularly profitable quarter or year.

Special dividends are generally rare, but there are a few companies with a track record of paying special dividends every few years, with the most notable being Costco (COST +1.16%). As you can see in the chart below (the four big spikes in the dividend) it is not out of the ordinary for Costco to issue a large special dividend every few years.

But those special dividends are less secure than the regular dividend, even from companies with a history of paying them. Investors looking for dependable income should exclude them from dividends per share when calculating the dividend yield.

Determining when each stock you own will pay dividends is relatively easy. When a company's board of directors determines the next dividend, it will declare the dividend, typically in a press release or in a filing with the Securities and Exchange Commission (SEC). This release will disclose the amount of the dividend, the dividend payment date, and the date you must own shares to receive the dividend payment.

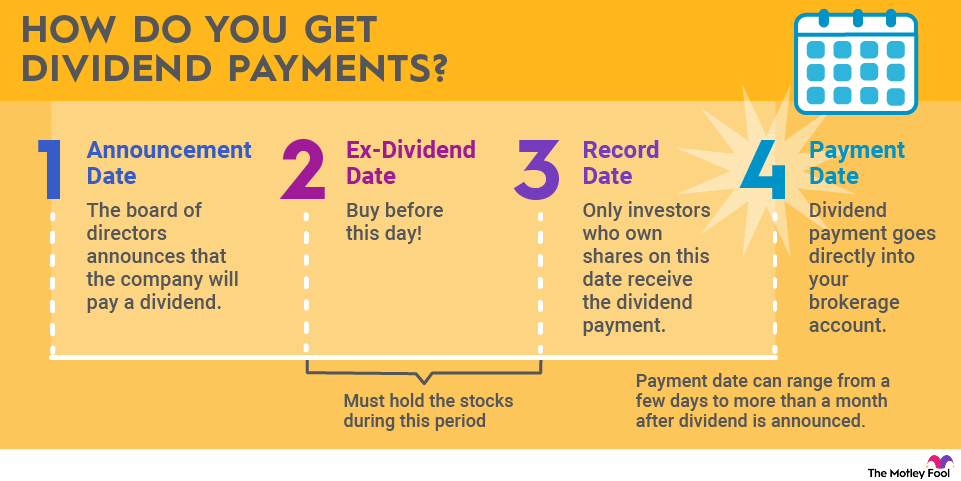

How do you get dividend payments?

Although some investors own stocks in company-sponsored direct stock purchase plans and receive the dividend directly from the company, the vast majority own stocks through a broker. In this case, the dividend payments come to your brokerage and are deposited in your brokerage account.

For this reason, your dividend payment may not appear in your account on the payment date in the company's release declaring it. It could be a day or two before the money shows up. This is particularly important if you are counting on those dividend payments for income since you may need to allow for a few more days to transfer the cash from your brokerage account into your checking or savings account.

In those rare instances when a company makes a dividend payment in company stock, it will take even longer to get cash if you own the dividend as a source of income today. You'll need to sell the shares and then wait a couple of business days for the trade to settle before you can initiate the cash transfer. Make sure to plan accordingly.

Related investing topic

What is the average stock dividend payment?

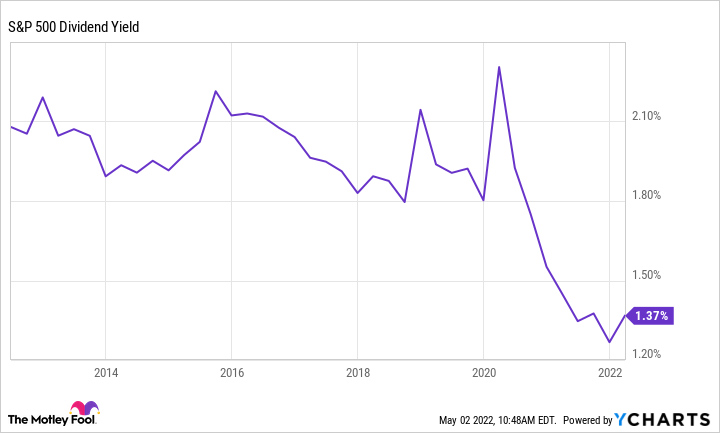

This can vary greatly from one industry to the next -- and even from one stock to the next in similar industries. But, as a starting point, we can use the S&P 500 Index (NYSEMKT:GSP). This index, which tracks the largest U.S. publicly traded companies, makes up about 80% of the market cap -- the dollar value of a company's stocks -- of the entire U.S. stock market.

Here is the average dividend yield -- the annualized dividend payment as a percentage of the recent stock price -- of the S&P 500 over the past decade or so through May 2, 2022:

As you can see, it can fluctuate significantly from one period to the next, with the dividend yield falling sharply because of the rebound in stock prices from the lows of 2020.

Individual industries, such as utilities and real estate, often pay higher dividends due to the stability of their revenues and their slower rate of growth. More volatile industries, such as consumer discretionary goods and technology companies, generally pay much smaller dividend payments, as seen below.