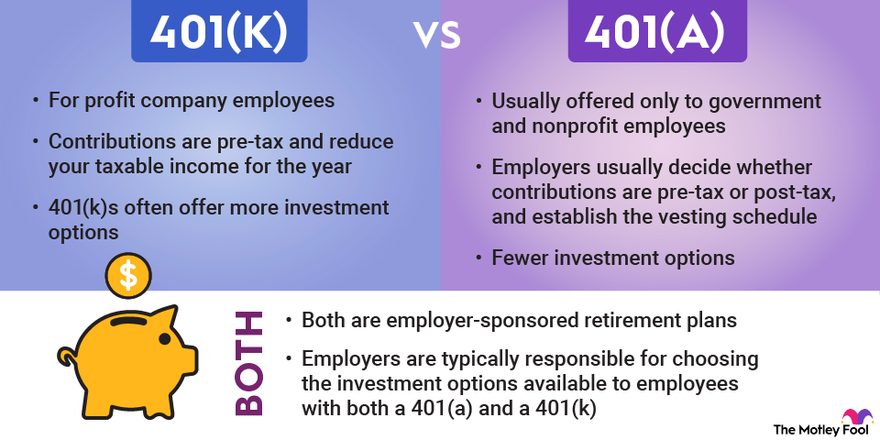

A 401(a) and a 401(k) are both employer-sponsored retirement plans, each named after a part of the tax code. The key differences between the two come down to who's eligible to participate and who dictates how much employees contribute to each account. We'll explore how the two accounts compare in terms of contribution limits, investment options, and more.

How a 401(a) works

How a 401(a) works

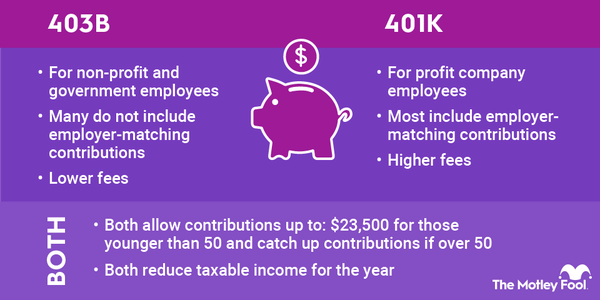

Most people are familiar with the more common 401(k), but few understand the 401(a). That's not surprising considering 401(a)s are usually offered only to government and nonprofit employees.

Both employees and employers can contribute to a 401(a). While 401(k)s allow employees to decide how much to contribute, 401(a)s can have mandatory or voluntary employee contributions. These contributions come out of each paycheck, just like 401(k) contributions.

Employers usually decide whether 401(a) contributions are pre-tax or post-tax, and they establish the vesting schedule for employer-matched funds just as they do with 401(k)s. This determines whether you get to keep your company match if you quit. If you leave before you're fully vested, you could forfeit some or all of your company match.

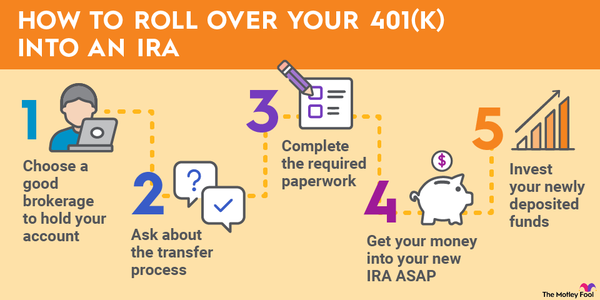

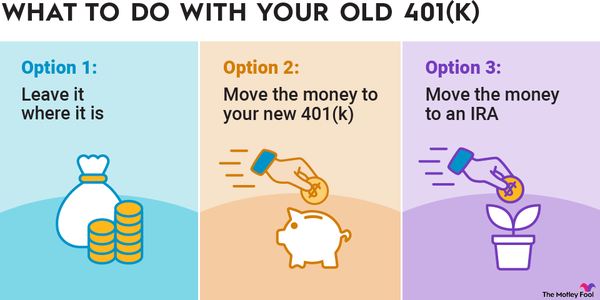

401(a) plans are usually offered to a select group of key employees because they're easy to customize. Companies can craft 401(a)s in a way that suits the participants as an added employee benefit. If an employee later leaves the company, they can roll over their 401(a) into another qualified retirement plan, such as a 401(k) or an annuity.

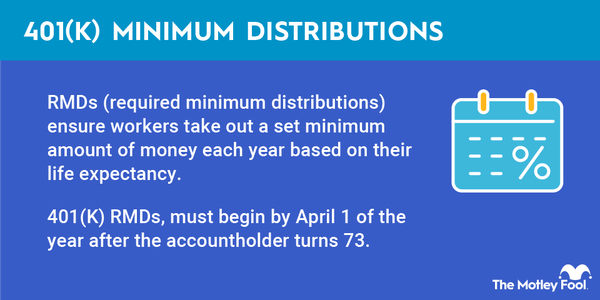

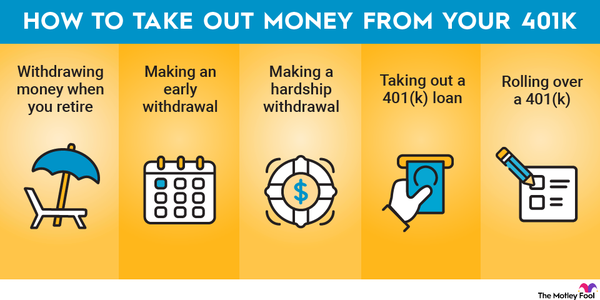

Because 401(k)s and 401(a)s are both retirement plans, you're not meant to withdraw money before turning 59 1/2. If you do, you'll pay a 10% early withdrawal penalty on top of income tax, if your contributions were pre-tax.

If you funded your 401(a) with after-tax contributions, you won't pay taxes when you withdraw your contributions, although you could still owe taxes and penalties on your earnings. There are exceptions to the early withdrawal penalty for things such as major medical expenses and educational expenses, but you still owe taxes on these withdrawals.

Contribution limits

Contribution limits

In 2025, your total contribution to a 401(a) or 401(k), including employee contributions and your company match, is limited to the lesser of $70,000 or 100% of your compensation. Employees who are 50 and older can make an extra $7,500 catch-up contribution.

Only $23,500 (or $31,000 if you're 50 or older) can come from employee contributions in 2025. Those between the ages of 60 and 63 may contribute up to $34,750 in 2025. If you decide to save more than this, your extra contributions will be after-tax contributions. This means you pay taxes on your contributions, but you don't owe taxes until you withdraw them.

Investment options

Investment options

Employers are typically responsible for choosing the investment options available to employees with both a 401(a) and a 401(k). Typical 401(a) investment options include low-risk government bonds and mutual funds that focus on value-based stocks.

Employees who use a 401(a) often have even fewer investment options to choose from than 401(k) participants. However, since 401(a)s are often designed specifically for a select group of employees, a few choices may be all they need.

401(k)s often offer more investment options but are still known for offering far fewer options than IRAs do. 401(k) options usually include mutual funds, although some companies may offer a handful of exchange-traded funds (ETFs) and annuities as well. Employees who work for publicly traded companies may also be able to purchase company stock if they're interested.

Keep in mind

Keep in mind

While it helps to understand the difference between 401(a)s and 401(k)s, you probably won't ever have to decide between the two accounts. Only government and nonprofit employees qualify for 401(a) plans, while employees of for-profit companies will typically have access to a 401(k).

Whichever type of retirement plan you end up with, make sure you review your investment options carefully and understand your plan's rules, particularly those regarding company matches and withdrawals, so you can make the most of your retirement account.