Robotics stocks are publicly traded companies focused on the robotics sector. Robots have captivated our imaginations since the invention of modern robotics in the 1950s. The idea of lifelike machines performing human tasks is intriguing for some and an uneasy thought for others.

But like most technology, robotics isn't about replacing humans. Rather, robots can automate redundant tasks to free up our time for more meaningful activities. Breakthroughs in recent years, like the advent of generative artificial intelligence (AI) services such as ChatGPT, have spurred the adoption of automation processes within organizations.

Some estimates point to an acceleration in the global adoption of robotics. GlobalData forecasts that the industry will grow at a 14% compound annual rate, rising from $76 billion in 2023 to $218 billion by 2030. Investing in robotics company stocks could be a lucrative move in the years ahead.

Investing in the best robotics stocks in 2026

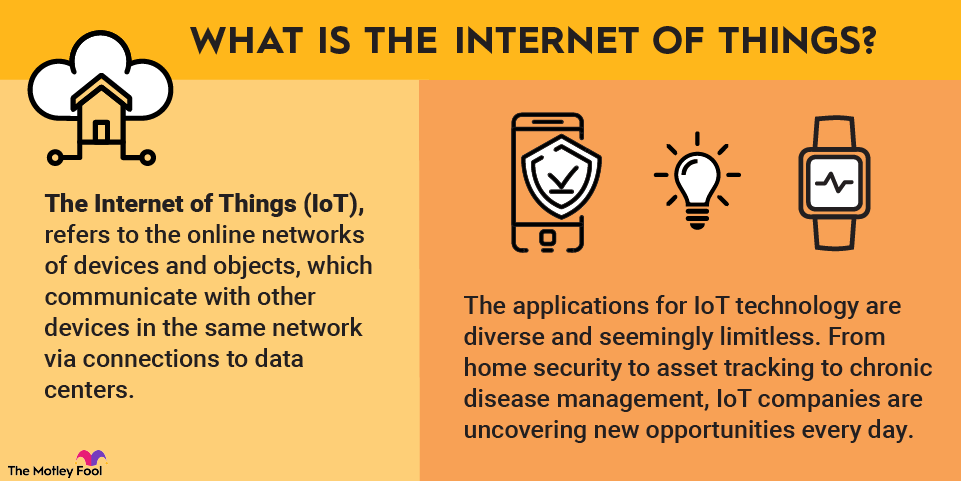

We already benefit from robotic processes every day. E-commerce companies, such as Amazon (AMZN -1.39%) and Shopify (SHOP -6.82%), automate tasks in fulfillment warehouses using intelligent machines. Smart speakers and other Internet of Things (IoT) devices in our homes play music and inform us of our daily schedules. Chatbots help us find the information we need on websites.

Other robot applications are a little less visible, though. Here are eight robotics stocks to consider investing in.

1. Nvidia

NASDAQ: NVDA

Key Data Points

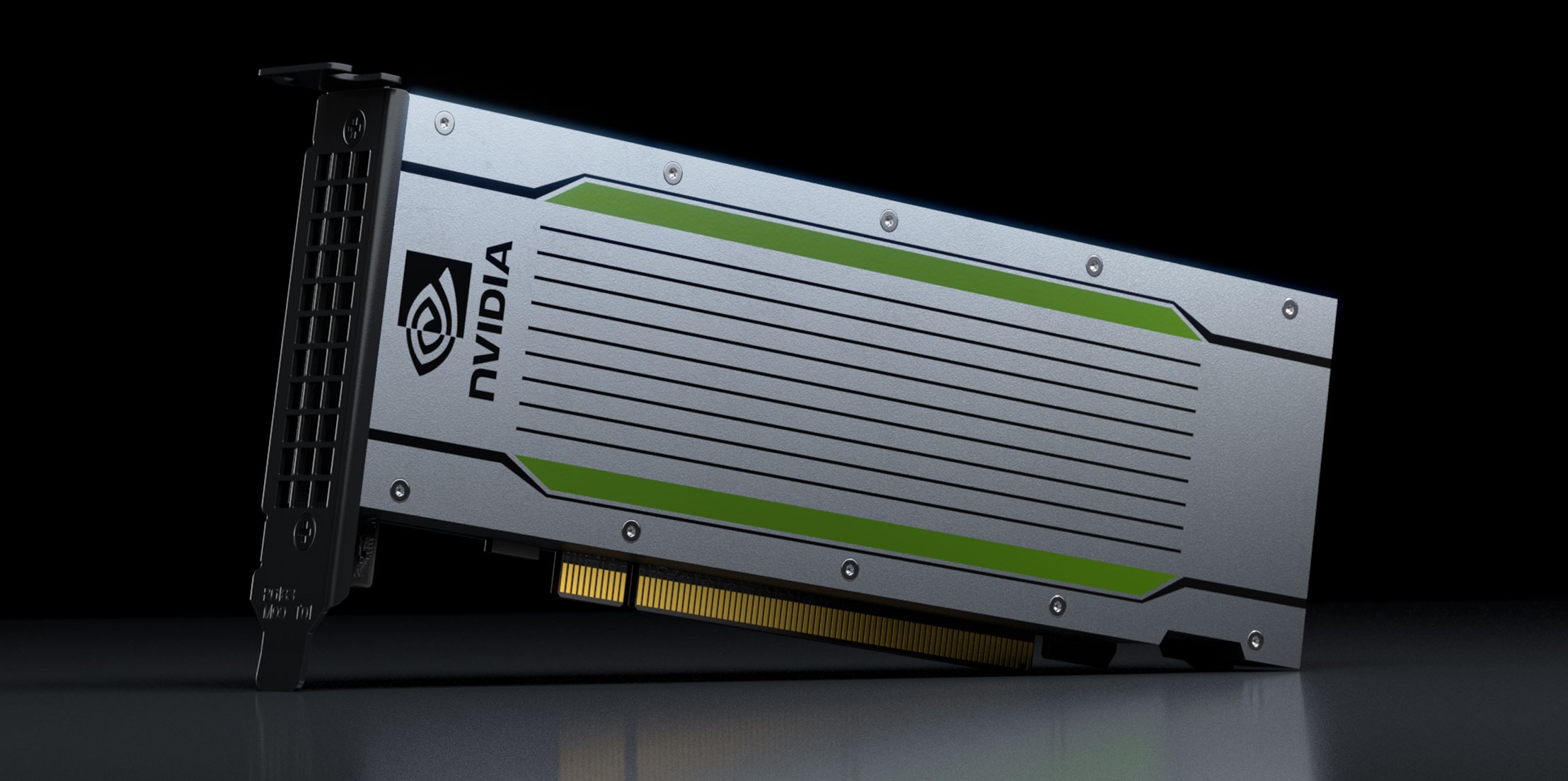

Semiconductors are the basic building blocks of all technology. Nvidia (NVDA -1.88%) has risen to become a leader in this area, and its advanced circuitry designs are enabling all sorts of high-end computing processes -- robots included.

Nvidia's GPUs (graphics processing units) are accelerating how quickly computing units can crunch data, especially in data centers. However, Nvidia chips also power everything from personal computers to small IoT devices to robotics in factories. For a complex system such as a robot, fast computing time is a necessity.

One example of Nvidia's work is embodied in its aptly named "Jetson" lineup of modules. Complete with artificial intelligence (AI) and machine learning software, Jetson devices are being used in applications spanning industrial and manufacturing machinery, healthcare devices, and self-driving vehicles. The company's three-computer solution to robotics enables robots to see, learn, and perceive their surroundings to make real-time decisions.

With its advanced capabilities on the hardware and software fronts, Nvidia is a top play on robotics for the long term since it helps its customers unlock AI's power. In January 2026, Nvidia released new physical AI models for next-generation robots. Its new technologies speed workflows across the entire robot development lifecycle to drive increased adoption of robots.

Semiconductor

2. Intuitive Surgical

NASDAQ: ISRG

Key Data Points

Intuitive Surgical (ISRG -2.26%) is a pioneer of robotic-assisted surgery. Its da Vinci system made its commercial debut in 2000 and has since expanded across the globe. Intuitive Surgical's robots help surgeons and their teams execute more precise procedures, greatly improving patient outcomes and recovery times.

More than two decades later, Intuitive Surgical is still in growth mode. The vast majority of surgeries performed every day are done without robotic assistance, so there's no shortage of opportunities to develop new da Vinci capabilities (as well as new robotic surgery devices, like the AI-powered Ion) to address more procedures. Once one of Intuitive's systems is installed, the business model generates ongoing revenue from disposable instrument sales, services, and support.

This applied use of robotics technology and an ongoing revenue stream once a da Vinci robot is installed make Intuitive Surgical one of the best long-term bets in healthcare technology.

3. ABB

OTC: ABBNY

Key Data Points

ABB (OTC:ABBN.Y) is one of Europe's largest industrial conglomerates and a top global provider of industrial equipment. From next-gen energy infrastructure -- like electric vehicle (EV) charging stations -- to manufacturing measurement tools to metallurgical equipment, ABB is there. Included in its portfolio are robots. ABB has the second-largest industrial robotics business in the world after Japan's FANUC (FANUY +6.61%), putting it ahead of fellow "Big Four" robotics rivals Yaskawa (YASKY +2.05%) and Kuka, a subsidiary of China-based Midea Group.

Chief among ABB's products in this department are robotic arms and controllers. These are used to automate various tasks in manufacturing all sorts of products, from cars to pharmaceuticals. ABB also provides software that helps its customers manage these robots, continuously improve their automated operations, and even view their robotic army in action with augmented reality (AR) visualization tools.

ABB unveiled plans in 2025 to spin off its robotics division. However, it subsequently opted to sell that unit to Softbank for $5.4 billion in a deal that should close by the end of 2026. The deal will enable Softbank to leverage its AI, robotics, and next-gen computing capabilities to create an even stronger robotics company.

4. Rockwell Automation

Rockwell Automation (ROK +0.80%) is a leader in industrial-grade technology. Its systems, components, and software help manufacturers develop smarter and more efficient machines. Rockwell's services and equipment address a wide swath of the economy, such as energy and chemical producers, food and beverage companies, and automakers.

The industries Rockwell helps have been around for a long time and aren't secular growth stories anymore. However, Rockwell is a leader in highly profitable robotics and related IT services.

The company is using software developed by Nvidia to bring AI to its Otto autonomous mobile robots used in manufacturing facilities. In October 2025, Rockwell's first Otto autonomous mobile robot rolled off the production line, marking a milestone in the company's robotics strategy.

In November 2025, Rockwell unveiled plans to build a new manufacturing facility. It will feature advanced automation, robotics, and digital systems to showcase the company's leadership in industrial automation.

5. Zebra Technologies

NASDAQ: ZBRA

Key Data Points

Zebra Technologies (ZBRA +3.02%) is a longtime player in the automation space. The firm develops mobile computing devices to help employees work more efficiently. Retail and warehousing, healthcare, and banking are just a few of the places where Zebra's robotic-enhanced computers help workers organize and automate their workflows.

While the company announced plans to wind down its autonomous mobile robot division in late 2025, Zebra remains focused on digitalizing and automating frontline workflows.

Machine Learning

6. Teradyne

NASDAQ: TER

Key Data Points

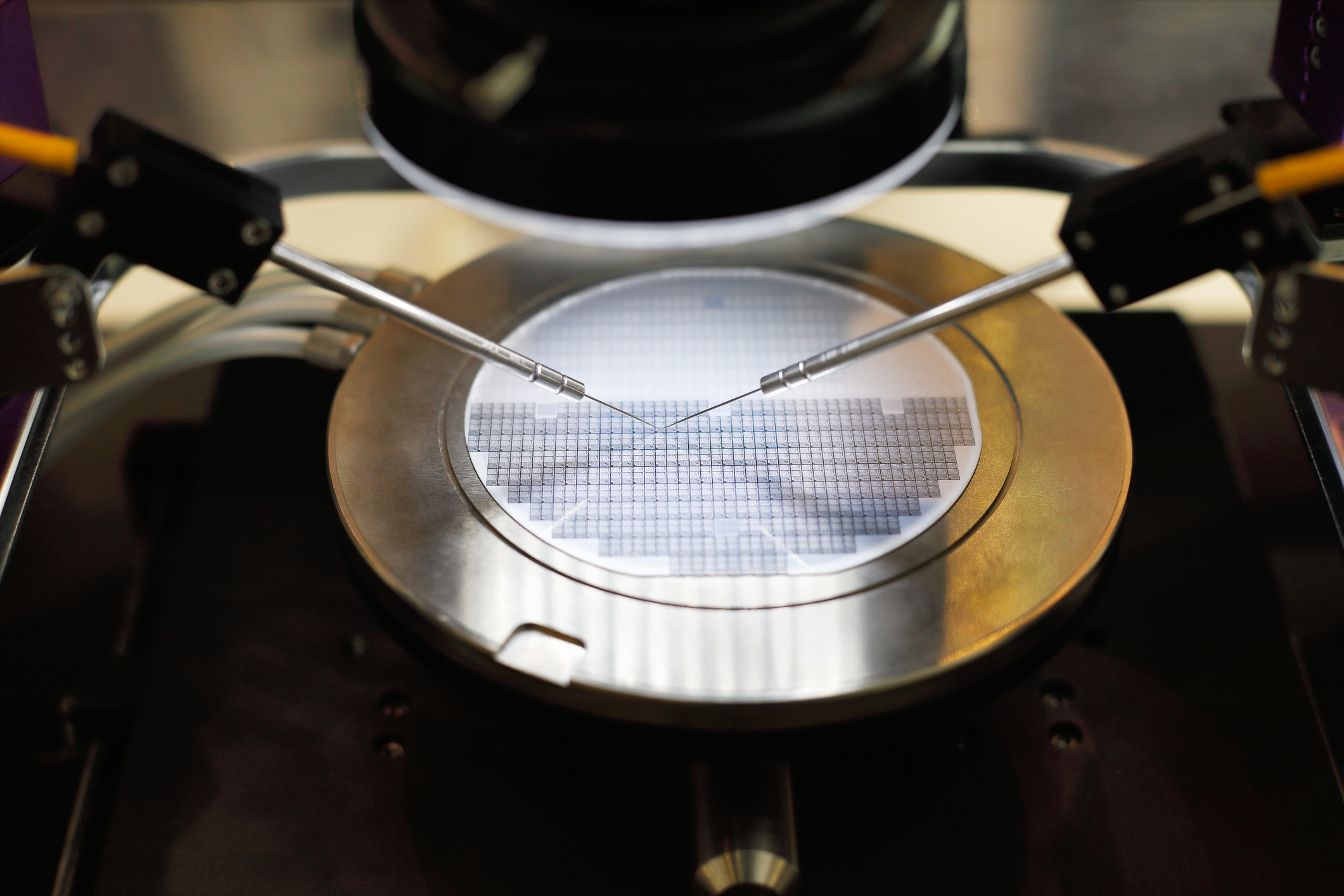

Teradyne (TER +0.57%) is a developer of industrial equipment that helps automate repetitive tasks, specifically for the semiconductor industry. In manufacturing electronic devices, testing the products to ensure they work correctly is one of the most repetitive and time-intensive tasks.

Teradyne's robotics help free people from this activity, speed up testing and verification times, and increase the accuracy of device testing before a product is delivered.

This robotics company is also a top partner of automotive, aerospace, and defense companies. It owns Universal Robots (UR) and Mobile Industrial Robots (MiR), two businesses it acquired in recent years. Universal Robots is known for devices like robotic arms used in manufacturing, and MiR for its self-driving bots used in warehouses. The company's robotics division reported $75 million of revenue in the second quarter of 2025, a 9% increase from the first quarter.

Although it's a behind-the-scenes play on automation, all sorts of everyday devices, mission-critical machinery, and tech services (such as 5G mobile networks) benefit from Teradyne's work. The company is constantly improving its robotic equipment. In December 2025, Teradyne announced plans to expand its global robotics presence by opening a new U.S. operations hub in 2026.

7. John Deere

NYSE: DE

Key Data Points

Iconic farm machinery company John Deere (DE +2.86%) is investing heavily in automation technology. It aims to build smarter, more precise, and more productive farm machines and construction equipment.

In 2021, it acquired Bear Flag Robotics for $250 million to accelerate the development of autonomous technology on farms. It also bought SparkAI in 2023, which helps robots resolve problems in real time, and Guss Automation in 2025, a leader in crop automation. These deals and other investments have enabled John Deere to build a leading automation platform. It sells fully automated tractors, sprayers, dump trucks, and self-driving mowers for commercial landscapers.

The company has emerged as an early leader in helping the agriculture and mining industries automate. That's opening the door to a more than $150 billion incremental addressable market opportunity for the machinery company.

8. UiPath

NYSE: PATH

Key Data Points

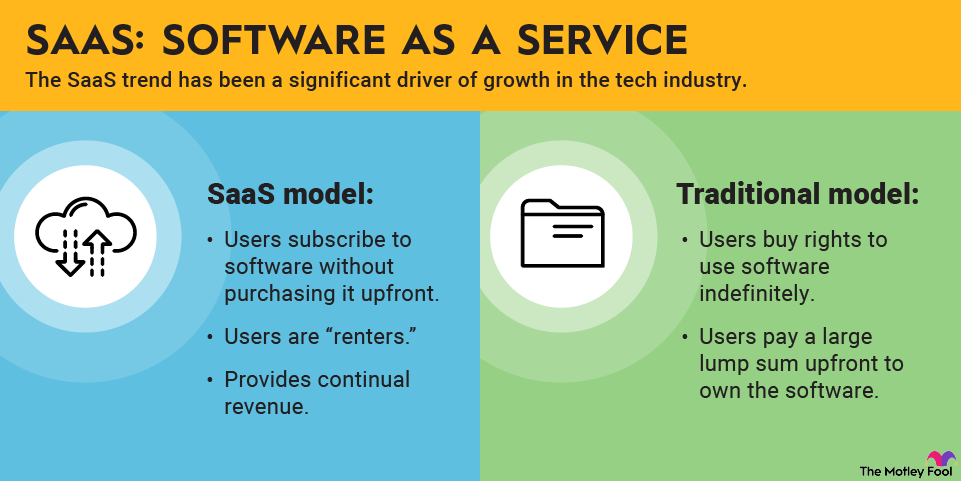

Not all robots are real-life machines. Many dwell in the virtual world, where they execute tasks on computers and within cloud computing systems. A leader in robotic process automation (RPA), UiPath (PATH -2.80%) builds and supports software bots that can be trained to handle virtual tasks and act as virtual assistants to the human workforce.

Although they may not be physical machines, UiPath's robots are incredibly efficient when set loose on typical office tasks, such as data collection and form entry, compliance, and customer relationship management.

UiPath is at the forefront of automation with its virtual bots. Its latest innovation, agentic automation, combines AI agents, robots, people, and models to work together to complete tasks. It will free up people to do higher-value work while robots and agents handle more repetitive tasks. Growing momentum for its agentic capabilities helped drive an 11% increase in the company's annual recurring revenue (ARR) in the third quarter of 2025 to almost $1.8 billion. UiPath has added several new capabilities to its platform for agentic automation over the past quarter, positioning it for continued growth.

Benefits and risks of investing in robotics stocks

Investing in the robotics sector has its share of benefits and drawbacks. Some of the positives include:

- Growth potential: Demand for robotics is growing briskly. For example, global robot demand in factories could double over the next 10 years, according to a report by the International Federation of Robotics.

- AI play: AI will play an important role in the future of robotics, making the sector another way to invest in the AI megatrend.

- Diverse options: The robotics industry is broad, providing investors with many different options. For example, there are companies focused on using robotics in healthcare, agriculture, and industrial automation.

On the other hand, there are some risks to investing in robotics stocks, including:

- Limited pure plays: Many of the largest robotics players are foreign or private companies. Meanwhile, others involved in the sector have more diversified operations. This limits pure play investment options.

- Competition: There's a lot of competition in the sector, which might put the brakes on the robotics industry's profitability and growth.

- High costs: It's expensive to develop robots, which could slow their future adoption.

Related investing topics

What is the outlook for the robotics industry?

The future for the robotics industry is very promising. Robotics has the potential to revolutionize several industries, including manufacturing, healthcare, logistics, and agriculture. It can help companies in these industries save time, reduce costs, and increase productivity.

According to an estimate by McKinsey, the general-purpose robotics market could reach a staggering $370 billion by 2040, with 50% of that value coming from China.

AI could play a key role in accelerating the adoption of robotics. The technology can make robots more autonomous, enabling them to perform more tasks without human intervention. For example, AI-powered robots are giving rise to "dark factories" or "lights-out manufacturing" as companies build fully automated manufacturing facilities that can operate in complete darkness without any human presence.

The expected growth of the robotics industry should benefit the top robotics stocks.