5G stocks provide exposure to companies that develop, manufacture, or provide the infrastructure, equipment, software, and services necessary for fifth-generation (5G) wireless technology networks. Rapid 5G mobile network construction will continue in 2026.

According to mobile infrastructure provider Ericsson (ERIC +1.28%), global 5G subscriptions are expected to total about 2.9 billion at the end of 2025 and climb to a projected 6.3 billion (about 67% of all mobile subscriptions) in 2030.

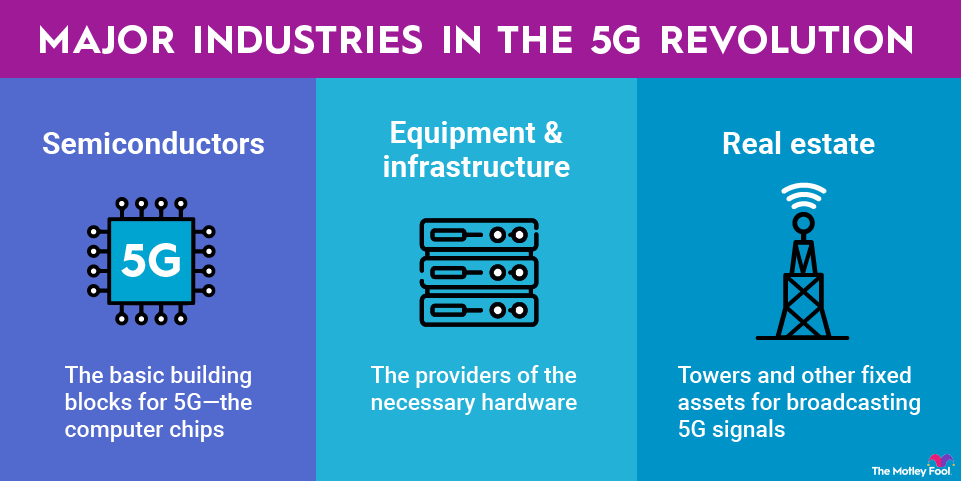

Best 5G chip stocks

The basic building blocks for 5G are semiconductors -- the electronics that process data and execute commands in a computing system. These companies provide the chips that make 5G work. Top chip companies include:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Broadcom (NASDAQ:AVGO) | $1.6 trillion | 0.71% | Semiconductors and Semiconductor Equipment |

| Qualcomm (NASDAQ:QCOM) | $172.8 billion | 2.18% | Semiconductors and Semiconductor Equipment |

| Marvell Technology (NASDAQ:MRVL) | $68.2 billion | 0.30% | Semiconductors and Semiconductor Equipment |

| Advanced Micro Devices (NASDAQ:AMD) | $371.1 billion | 0.00% | Semiconductors and Semiconductor Equipment |

| Nvidia (NASDAQ:NVDA) | $4.5 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

NASDAQ: AVGO

Key Data Points

In recent years, Broadcom has made several acquisitions to add infrastructure management software to its operations. The segment assists customers with monitoring and securing their networks and cloud computing assets.

This has boosted the company's profit margins, as the software is often packaged with network hardware. Broadcom's free-cash-flow generation is incredible. Through the first three quarters of fiscal 2025, Broadcom reported $19.4 billion in free cash flow, a 40% increase over the same period in fiscal 2024.

A serial acquirer, Broadcom acquired cloud and networking hardware giant VMware in 2023 for $69 billion -- one of the largest acquisitions so far this decade. This resulted in the creation of a powerhouse in networking component design, ranging from cloud computing to 5G to infrastructure management software.

NASDAQ: QCOM

Key Data Points

NASDAQ: MRVL

Key Data Points

NASDAQ: AMD

Key Data Points

NASDAQ: NVDA

Key Data Points

5G networks enable faster download speeds and can handle higher traffic and intelligently route network signals where they're most needed. So, high-end GPUs are ideal for this task. Nvidia's GPUs are being used by telecom companies and equipment makers, and 5G deployment is likely to increase the need for GPUs to operate cloud-based video games streamed over networks.

In late 2024, for example, Nvidia and Verizon announced that they had collaborated to develop a solution that makes it possible for various AI applications to run over Verizon's 5G private network with private Mobile Edge Compute. Already a huge enterprise, Nvidia is finding a potentially gigantic new market in 5G.

Best 5G equipment and infrastructure stocks

Beyond the basic chips needed to power 5G telecommunications, general equipment makers provide hardware that makes mobile networks possible. To reach businesses and consumers, wireless 5G signals need extensive equipment.

These companies have had supply chain issues in recent years that have pressured growth rates and profit margins. However, they remain solid investments since they enable the construction of wireless networks and supporting infrastructure around the world.

Even as they deploy new radio towers, many telecoms providing 5G service also need to add more high-speed cable to their networks. Corning also builds small cell antennas and accompanying software -- core components of 5G systems used in office buildings and venues such as sports arenas to deploy wireless signals. Corning has been around for a long time, but it has a long history of paying a rising dividend to its shareholders.

Arista is a top equipment provider for data centers and internet infrastructure, with open-source hardware and network management and cybersecurity tools. Arista is well positioned to benefit from the accompanying boom in cloud computing services as 5G further increases the capabilities of mobile devices.

Best 5G real estate investments

5G also requires real estate. Towers and other fixed assets are needed to broadcast 5G signals, and real estate investment trusts (REITs), such as American Tower, Crown Castle, and Digital Realty Trust, are some of the largest players in the sector. Besides slower but steady growth, the REITs are also top income-generating investments in the 5G space.

Invest in 5G for the long term

While previous telecom network upgrades enabled the smartphone and mobility booms, 5G technology entrenches digital technology even more into daily life. It overlaps with cloud computing, given that so many people now work from home.

5G is also unlocking new forms of entertainment, such as ultra-high-definition video, video game streaming, and virtual reality. Investors who are patient throughout the lengthy course of 5 G's deployment may enjoy attractive long-term returns.