As the world of blockchain technology expands, investor interest has gone beyond just cryptocurrencies. Enter DAOs, a new type of organization built using blockchain technology. Perhaps you’ve heard of DAOs in relation to other buzzwords, such as Web3 or NFTs, or the DAO that unsuccessfully tried to acquire an original copy of the U.S. Constitution.

It’s true that some top DAOs have been formed to bid on some interesting niche purchases, but there’s a lot more to these new organizational structures. Here’s what you need to know.

Blockchain

What are DAOs?

What are DAOs?

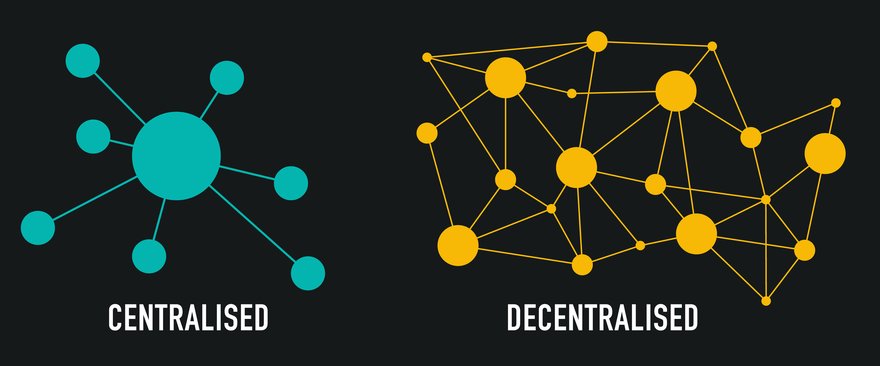

DAO (pronounced “dow”) stands for “decentralized autonomous organization.” They’re sometimes also called a decentralized autonomous corporation. DAOs are organizations that operate on the internet, often by members who have never met each other in person. Given that trust among founders is essential to a new company’s success, how does that work?

A DAO is started with a specific goal or objective in mind, but, unlike a traditional business model, DAOs are completely decentralized. There’s no central authority (such as a CEO, CFO, board of directors, etc.) needed for the organization to operate. Instead, “smart contracts” -- or software code written on a blockchain, Ethereum (CRYPTO:ETH) being the most common here -- are used to enforce the rules governing the DAO. Included in these rules are explicit directions on how money will be spent and which projects will be tackled. Any changes to DAO rules require members of the organization to vote on the proposal’s passage.

The impartiality and transparency of these smart contract-enforced rules allow DAOs to run in such a decentralized fashion.

A brief history

A brief history of DAOs

If this organizational structure sounds a lot like a co-op, you’re on the right track. Businesses formed as a collective of independent people and small businesses with a like-minded goal have been around for a long time (for example, maybe you have a local farmers’ co-op where you buy groceries). The twist here is that DAOs are created and managed on a blockchain, the same distributed ledger system that cryptocurrencies use.

Not long after the Ethereum blockchain network was launched in 2015, the very first DAO -- simply called The DAO -- was started. It was envisioned as a decentralized venture capital fund geared toward investing in Ethereum developer projects. By May 2016, The DAO had raised $150 million in investor funds, but security issues were exploited by hackers over the summer of 2016. Some one-third of The DAO’s funds were diverted to the hackers’ account, and The DAO’s ownership tokens were delisted from crypto exchanges by the end of the year.

Since then, many security issues have been addressed and numerous DAOs have popped up in the crypto and digital asset community. A diverse mix of uses are emerging for DAOs. One mentioned earlier, ConstitutionDAO, raised almost $50 million in funds to bid (unsuccessfully) on an original copy of the U.S. Constitution. The metaverse real estate platform Decentraland (MANA 3.93%) that sells virtual parcels of land is a DAO. Crypto trading site Uniswap and its Uniswap Protocol Token (UNI -3.26%), built on Ethereum, are also part of a DAO. In fact, most decentralized finance (DeFi) platforms are managed with a DAO.

How they work

How DAOs work

DAOs operate online, recording initial rules, decisions, and any organizational changes on the blockchain using smart contracts. After a development team writes the smart contract for the DAO, a token offering is typically sold to investors to raise funds. The tokens represent ownership of the DAO, although there are other models, such as share-based membership (a request for membership is submitted in exchange for something of value) or reputation-based membership (tokens representing ownership are earned via participation in the DAO).

Once funding is raised, the DAO is deployed to the blockchain. From this point on, the DAO’s stakeholders make decisions via voting. The original creators and smart contract developers of the DAO no longer have sole power to make any changes to the organization.

Pros and cons

Pros of using DAOs

- Transparency and democratization: Because a DAO’s rules are written into a smart contract, owners know what to expect as far as governance of the organization. Any changes (new projects or how money will be spent) are voted on by owners of the DAO.

- Goal- or task-specific: Because they are created to accomplish a specific goal or task, and because of the automatic execution of many of their processes, DAOs can move quickly once they are deployed as compared to a more traditional organizational structure. Any forays into projects beyond the original scope of work need member approval.

- Alignment of interests: Issues sometimes arise in a traditional organization. For example, the goals of the executive leadership of a company may not always align with the interests of stakeholders (investors, employees, customers, etc.). An executive team might make decisions that benefit it financially and may not have the long-term interests of stakeholders in mind (for example, awards based on short-term stock price performance might lead to financially risky behavior).

- Global reach: Because DAOs are internet-native, DAO creators can raise global interest from other potential members/owners. And, since governance is written and enforced in the DAO’s code, trust between individual members of the organization is not necessary.

Cons of using DAOs

- Blockchain technology is new: Although the co-op business model is nothing new, the technology twist here certainly is. Writing smart contracts for a DAO requires the efforts of a software engineering team skilled in blockchain development. Attention to detail is a must because once the smart contract is written and executed, changes can only be made via membership voting. Hackers will also be interested in exploiting any security holes in the DAO.

- Maybe not so democratic: Because voting power is vested in token holders, nothing necessarily prevents an interested party from amassing ownership of a DAO to concentrate voting power in themselves.

- Centralized leadership isn’t always bad: The world is a complex and fast-changing place. Even with a single goal on its plate, a DAO might not be able to solve problems quickly enough via its decentralized voting structure.

- Lack of legal precedence: As an online-only entity, there are also legal risks with DAOs. Because its operations might span multiple jurisdictions (different states or even different countries), legal issues can arise that complicate governance of the organization, or that could even lead to trouble with the law.

- DAOs might get pricey: Every business is going to run up expenses, and DAOs are no exception. In this case, interacting with a blockchain network to write a smart contract and record changes that have been voted on will incur fees paid to the blockchain’s miners, much like NFT creators and buyers pay “gas fees” on their creations.

Related investing topics

The future of DAOs

The future of DAOs

Just like the blockchain and crypto industry overall, DAOs are breaking fresh ground in the digital world. They are generating a lot of excitement, but there’s risk as well. Given their limited history, DAOs generally aren’t going to be suitable for most small retail investors looking for portfolio growth. Like the crypto space, DAO tokens can be highly volatile in price, so involvement with a DAO should be viewed as a way to participate in a specific project or community that you’re interested in. If blockchain and its related development is unfamiliar territory, consider investing in stocks that have some involvement with blockchain and crypto instead.

For the tech world, however, DAOs represent a new organizational structure that could have merits for certain projects. Right now, many of these projects deal with the blockchain and crypto world itself, and a lot of work is going into expanding the use of DAOs for creation of common, everyday services. With less than a decade of history, DAOs will be a fast-changing area within the blockchain universe in the years ahead.