Cloud computing exchange-traded funds (ETFs) give investors diversified exposure to companies powering one of the most important layers of modern tech. While artificial intelligence grabs headlines, cloud infrastructure and software remain the backbone that makes AI, cybersecurity, and digital services work at scale, and the market is still growing fast. The global cloud computing market was valued at $752 billion in 2024 and is projected to reach $2.4 trillion by 2030, according to Grand View Research.

Cloud computing enables businesses to store data, run applications, and manage operations over the internet. That ecosystem spans infrastructure leaders like Amazon Web Services, software platforms such as Salesforce, and many firms in between. Rather than betting on a single stock, cloud computing ETFs bundle dozens of these companies into one investment.

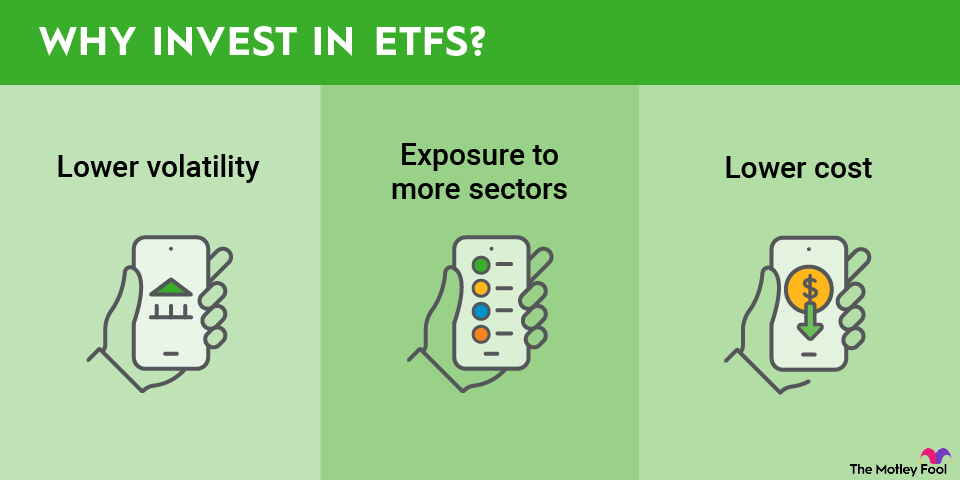

For investors, that means instant diversification, access to leading tech innovators, and exposure to long-term growth trends, without the added risk of picking individual winners. Cloud ETFs can be an efficient way to participate in ongoing digital transformation while spreading risk across the broader cloud landscape.

7 best cloud computing ETF investments in 2026

Offering low fees and instant diversification for your portfolio, here are the seven best cloud computing ETF investments in 2026, along with their holdings, company goals, and expense ratios.

1. First Trust Cloud Computing ETF

With about $3.2 billion in net assets, the First Trust Cloud Computing ETF (SKYY -2.06%) aims to match the performance of the ISE CTA Cloud Computing index. The index comprises 64 stocks engaged in the cloud computing industry.

NASDAQ: SKYY

Key Data Points

In addition to leading platform-as-a-service stocks, like Alphabet (GOOG -0.04%) (GOOGL -0.07%) and IBM (IBM -0.82%), this ETF holds computer networking equipment manufacturer stocks like Arista Networks (ANET -4.21%) and infrastructure-as-a-service (IAAS) and SaaS stocks such as Microsoft (MSFT -0.83%).

For the 10-year period ending Dec. 11, 2025, the First Trust Cloud Computing ETF had provided a total return of 361%. The ETF has a 0.60% expense ratio, and it's rebalanced quarterly.

2. Global X Cloud Computing ETF

Investors looking for a greater growth opportunity will likely be drawn to the Global X Cloud Computing ETF (CLOU -1.62%). Striving to match the performance of the Indxx Global Cloud Computing index, the Global X Cloud Computing ETF had 37 holdings and $274 million in net assets in December 2025.

NASDAQ: CLOU

Key Data Points

The fund leans toward more speculative investments, such as two of its five largest positions: Shopify (SHOP -8.94%), which offers e-commerce platforms for online businesses, and Salesforce. With a 0.68% expense ratio, this ETF provided a 98.2% total return from its inception on April 12, 2019, through Dec. 11, 2025.

3. WisdomTree Cloud Computing Fund

The WisdomTree Cloud Computing Fund (WCLD -1.41%) represents another stellar opportunity for those seeking high growth potential. The fund strives to match the performance of the BVP Nasdaq Emerging Cloud index, which WisdomTree characterizes as an index of "emerging public companies focused on delivering cloud-based software to customers."

NASDAQ: WCLD

Key Data Points

While the WisdomTree Cloud Computing Fund represents industrials, financials, and healthcare stocks, its information technology stocks represent the lion's share -- about 95.5%. Providing cloud-based databases, MongoDB (MDB -0.72%) is the ETF's largest position, while Bill Holdings (BILL -0.51%) and Internet of Things specialist Samsara (IOT -3.58%) represent other prominent holdings.

From its inception in September 2019 to Dec. 11, 2025, this WisdomTree ETF, which has a moderately low 0.45% expense ratio, had climbed 42.9%.

4. iShares Expanded Tech-Software Sector ETF

Since its launch in July 2001, the iShares Expanded Tech-Software Sector ETF (IGV -2.12%) has enabled investors to gain exposure to the software industry, as well as interactive home entertainment and interactive media stocks. For those seeking broad exposure to cloud stocks, not merely cloud computing, this ETF is worth further investigation.

NYSEMKT: IGV

Key Data Points

NYSEMKT: FCLD

Key Data Points

Microsoft, Salesforce, and ServiceNow (NOW -0.01%) represent the three largest positions in this ETF, which has 53 holdings. In addition to cloud computing specialists, the fund includes data center real estate investment trusts (REITs), such as Equinix (EQIX -0.62%) and Digital Realty Trust (DLR -1.11%) -- companies that provide the physical infrastructure for cloud computing -- and other cloud-related stocks.

The ETF doesn't have a long history, so it's important to take its performance with a grain of salt. Since the fund's inception in October 2021, its value had risen about 21% through Dec. 11, 2025.

NASDAQ: SKYU

Key Data Points

NASDAQ: CLOD

Key Data Points

This index includes the largest 50 companies by market capitalization for various cloud computing businesses. These include digital security, e-commerce infrastructure, data infrastructure, data architecture, internet infrastructure, and data support.

The ETF has a 0.35% expense ratio. Alphabet is its largest holding, while mobile technology specialist AppLovin (APP -16.89%) and Salesforce round out the top three of 51 holdings.

How to invest in cloud computing using ETFs

Before clicking the buy button on one of the best cloud ETFs, investors must perform their due diligence, researching the various options to determine whether the fund's holdings, goals, and expense ratios align with their own interests. Here are the steps to take to invest in a cloud technology ETF:

- Open your brokerage app: Log in to your brokerage account where you manage your investments.

- Search for the stock: Enter the stock ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select the order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in cloud computing ETFs?

Numerous companies are relying on the cloud to fortify their business, making cloud computing stocks a logical consideration for investors. Here are some of the potential benefits of an investment in cloud computing ETFs:

- Potential for strong growth since the cloud computing market is expected to increase substantially over the coming years

- Portfolio diversification

- Exposure to a diverse assortment of industries that are adopting cloud computing solutions

Of course, there are also risks that investors must acknowledge before buying cloud computing ETFs:

- In a market downturn, companies may curb spending and forego the adoption of cloud computing solutions.

- A more compelling technology may emerge that makes cloud computing less desirable.

- Cloud computing companies may invest heavily in research and development (R&D), risking the growth of profits in the near-term for long-term success.

Future outlook for cloud computing ETFs

With the rapidly escalating adoption of AI computing occurring among various industries, cloud computing infrastructure will certainly remain in high demand. Investors should look for signs that the AI industry is continuing to grow as well as machine learning and big data analytics to confirm that the cloud computing industry is proceeding to flourish.