If you have $100,000 to put to work, then you are well positioned to achieve financial independence over time.

But how should you go about investing that money? Your investment portfolio should be able to withstand unexpected crises, such as the COVID-19 pandemic and the 2022 bear market, just to name recent examples. At the same time, your investments should be in a position to benefit from booming sectors of the economy. Plus, with a six-figure sum or greater, it's also important to invest in a way that minimizes fees and taxes.

With that in mind, here are some tips for investing $100,000.

Before you start investing

Although you may be eager to begin investing money in the stock market or another asset, two financial objectives should be satisfied first:

- Pay off high-interest debt. You should start by repaying high-interest debt, such as credit cards. The interest on credit cards is compound interest, which is the most expensive interest for borrowers. Low-interest debts, such as home mortgages and auto loans, do not need to be repaid before you start to invest.

- Start an emergency fund. Establish an emergency fund before investing in the stock market. Experts generally suggest you aim to keep six months' worth of expenses in a readily accessible savings account. If you aren't close to that, it would be a smart idea to set aside a sizable amount of your $100,000 for emergency use.

Determining what kind of investor you are

Before you invest any money, it's also important to think about your goals. Ask yourself these questions:

- What is my investing objective? You may be saving for a large expense, such as a down payment on a house or for retirement. Do you simply want to grow your money for a rainy day? Do you have children you'd like to be able to send to college?

- When do I need the money? It's generally not a good idea to put any money you'll need in the next few years into the stock market.

- What is my appetite or tolerance for risk? Investing involves risk, so you should consider whether enduring ups and downs in account value is something you are willing to accept. For example, someone with a low risk tolerance probably shouldn't put their money into the fastest-growing artificial intelligence (AI) companies or cryptocurrencies.

- Do I want to be actively involved with my investments? If you don't want to choose your own investment options (more on that below), there are some great alternatives, which we'll get into shortly.

When it comes to investing, understanding your preferences and needs is important. For most investors, buy-and-hold investing is the easiest way to cope with the inevitable price volatility of the stock market.

However, if you plan on needing the money at a predetermined time or aren't comfortable with the variables of being an investor, this can drastically alter the types of investment choices you make.

How to invest $100K: Seven best ways

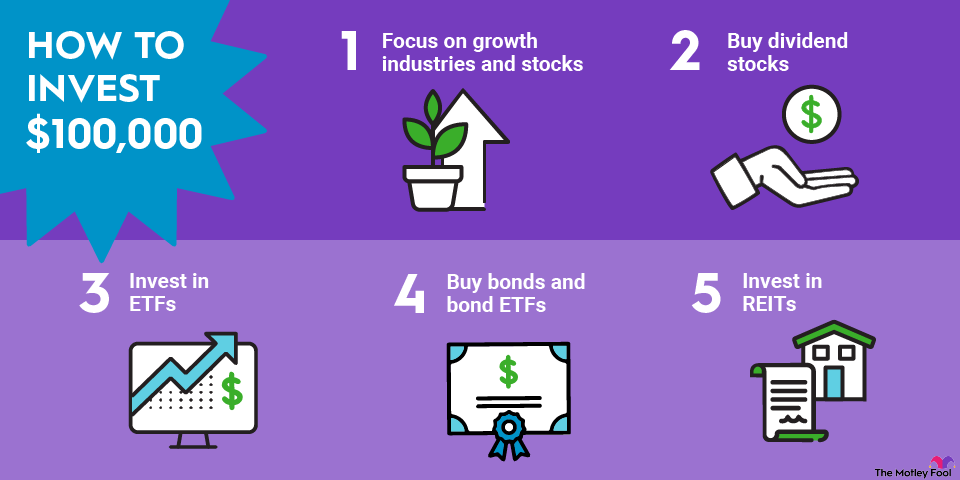

Here are some of the best ways to invest $100,000:

1. Invest in growth

The world economy is changing at a rapid pace, with some industries expanding and others contracting. Some of the fastest-growing sectors include cloud computing, e-commerce, financial technology, and healthcare.

The technology sector, in particular, is attractive as a growth industry. Technology innovations drive progress in essentially every other industry, and tech trends like artificial intelligence (AI), autonomous driving, and Internet of Things are particularly exciting right now.

Some tech giants -- Facebook (NASDAQ:FB), Apple (AAPL -0.13%), Amazon (AMZN +2.06%), Nvidia (NVDA +1.60%), and Google's parent Alphabet (GOOGL -0.73%)(GOOG -0.68%) -- are solid options in the technology realm that are established, profitable businesses.

This is by no means an exhaustive list of stocks that could make great long-term investments. But each of these companies is steadily increasing in both revenue and profitability and plays a core role in the modern economy.

2. Buy dividend stocks

Investing in dividend-paying stocks is a great way to generate a stable source of passive income, which you can either reinvest or use for day-to-day expenses. A dividend is a portion of profits that a company chooses to distribute, usually in cash, to its shareholders.

The best dividend-paying companies are those that steadily increase their payouts. A company that consistently raises its dividend usually has excellent cash flow and stable growth.

A company with an increasing stock price and dividend can generate significant investment returns over long time horizons. The combination of these is known as a stock's total return.

3. Invest in index funds

Buying shares in index funds is a great option for investors who don't want to choose individual stocks. These passively managed funds track the performance of certain indexes, have low expense ratios, and can provide exposure to entire asset classes. Index funds come in the form of both exchange-traded funds (ETFs) and mutual funds, with the former generally easier for most people to invest in.

An index fund might track a broad index like the S&P 500 (^GSPC +0.03%). Others might track sectors of the market, or track indexes that follow a specific type of stock (like growth stocks or large-cap stocks).

Some index funds are focused on specific industries, such as the Vanguard Information Technology ETF (VGT +0.10%), which invests in technology and software stocks.

There are several hundred great index funds to choose from, and they can allow you to track any benchmark index, invest in any sector, or put your money to work in some of the most exciting trends -- all without the risks involved with choosing individual stocks.

4. Buy bonds and bond ETFs

You can also add bonds to your investment portfolio.

A bond is a loan to a business or organization. Bondholders are entitled to collect interest payments during the bond's term and receive the bond's face value in a lump-sum payment at the end of the period.

Although bonds are generally less risky than stocks, they also generate lower returns over the long term. The bonds with the highest yields are known as junk bonds and are issued by companies that are less financially stable than their peers.

Another consideration when investing in bonds is that the interest payments from bonds can be taxed as income if you are using a taxable brokerage account. Exceptions include most municipal bonds, which are bonds issued by local governments.

It can be complicated to buy bonds directly. So, many investors instead opt to put their money in bond ETFs since they take the hard work out of the process.

5. Invest in real estate

While buying real estate is another great way to diversify your investment portfolio, owning property is not cheap. Even owning a few properties would not result in a diversified portfolio. Plus, even if you hire a property manager, owning investment properties can be a rather time-consuming way to invest in real estate. It can be a great way to build wealth, but it's not right for everyone.

Another way to invest in real estate is to buy shares in real estate investment trusts, or REITs (pronounced "reets").

REITs are professionally managed portfolios of properties. Most REITs are organized around a real estate theme, such as apartment buildings or data centers. Because REITs are required to disburse to shareholders at least 90% of their taxable income, which is generated by rent and interest payments, REITs often pay higher dividends than most stocks. Their share prices can also appreciate in value as the price of real estate rises.

Shares of REITs trade on stock exchanges just like shares of any public company.

6. Mutual funds

A mutual fund is an investment vehicle that involves many investors pooling their money together to invest toward a common goal. Mutual funds can be passive index funds, but there are also many mutual funds that are actively managed, meaning that investment managers pick stocks with the goal of beating the market over time.

Actively managed mutual funds definitely have market-beating potential. But they also tend to have higher fees, and the reality is that most actively managed ETFs don't beat their benchmark index. So, it's important to do research, especially on the fund's record of performance, before you invest.

7. High-yield savings accounts (HYSA)

It may sound odd to think of a savings account as an investment, but the combination of an elevated interest rate environment and the increased competition among online banks has created some highly investable accounts. As of late 2025, there were savings accounts readily available from reputable institutions that paid a risk-free return in the 4% ballpark.

Common mistakes to avoid when investing $100,000

There's not just one right way to invest $100,000, and the best investment or combination of investments depends on your goals, risk tolerance, and other factors. But there are some common mistakes to steer clear of:

- Don't put too much in any single investment, especially one that is a high-growth or speculative type of investment.

- Don't try to time the market. The best way to invest, especially in the stock market, is to make investments consistently over time.

- Don't ignore fees, especially when it comes to mutual funds and ETFs. These can make a big difference in your long-term returns.

- Don't chase trendy investments, especially if you're a newer or inexperienced investor.

Remember to diversify your portfolio

Regardless of how you choose to invest your $100,000, establishing a diversified portfolio is key to achieving your financial goals. No single company or investment should have an outsized place in your portfolio, especially when you're new to investing.

Diversifying eliminates the risk of your portfolio's value changing dramatically if one company or sector of the stock market encounters misfortune. A diversified portfolio is also more likely to generate relatively consistent returns from year to year.

A good range for how many stocks to own can be anywhere from 25 to 75, depending on your particular goals and investment style. Any less, and your portfolio can be too concentrated; any more, and you might as well buy mutual funds or ETFs. You can keep adding to your holdings and also invest in other types of assets such as bonds, real estate, and index funds. The key is to conduct the necessary research on each investment to make sure you know what you are buying and why.

Invest to minimize taxes and fees

When putting your $100,000 to work, take care to minimize taxes and fees. Over long periods of time, expenses on your investments can significantly reduce your returns since every dollar subtracted from your portfolio is a dollar that is no longer earning compound interest.

The most obvious way to lower taxes is to use a tax-advantaged retirement account. Individual retirement accounts (IRAs), including traditional IRAs and Roth IRAs, confer valuable tax savings.

Other tax-advantaged options include 401(k) plans, if your employer offers one, and health savings accounts (HSAs). Every tax-advantaged retirement account has its own restrictions, but you are not limited to investing in just one type of account.

In a taxable investment account, you are not obligated to pay taxes on gains until you sell the security (except for dividends, which are usually taxed as ordinary income). Your tax burden is significantly reduced if you own the stock for more than a year because you pay the long-term capital gains tax rate.

Monitoring and adjusting your portfolio

As a final point, it's important to do your homework after you invest. Monitor how your investments are performing over time and be willing to make adjustments to your strategy if needed.

For example, it's a smart idea to rebalance your portfolio regularly, especially if you have some investments that perform far better than others.

To be clear, it's important to regularly monitor your portfolio, even if you invest in hands-off assets like ETFs and mutual funds.

Related investing topics

A recap on how to invest $100,000

- Pay off high-interest debt.

- Establish an emergency fund.

- Begin your investing journey.

Your specific investment goals and risk appetite predominantly determine how you should invest your money. Risk-averse investors or those nearing retirement may choose to invest more conservatively, while risk-seekers or younger investors may opt to buy mostly stocks.

Once you establish your portfolio, remember to stay focused on your investment goals and the reasons why you invested in each security. Market volatility is inevitable, but that matters little if your original investment thesis remains unchanged. Plan to continue adding to your best investments over time, sell chronically underperforming holdings, and look forward to enjoying the substantial wealth that you generate by investing $100,000. And above all, keep learning and becoming a better investor!