Rapid 5G mobile network construction will continue in 2025. According to mobile infrastructure provider Ericsson (ERIC 0.0%), global 5G subscriptions totaled about 2.3 billion at the end of 2024, while global 5G subscriptions are projected to reach 6.3 billion (about 67% of all mobile subscriptions) in 2030.

This massive technology rollout will take years to complete. It will encompass wide swaths of the global economy since 5G network development will have substantial overlap with items ranging from automotive technology and industrial Internet of Things (IoT) to video games and virtual reality (part of the metaverse). Consumers and businesses will need to upgrade smartphones and other devices that can connect to 5G networks, making the upgrade cycle a top investment theme for 2025 and beyond.

Top 5G stocks

The top 5G stocks to buy in 2025

5G is the fifth generation of wireless networking technology. It offers lower latency (the time between an input or request for data and the network’s response). 5G also boasts download speeds as much as 100 times faster than 4G. Mobile providers such as T-Mobile (TMUS 1.4%) and rivals Verizon (VZ -0.09%) and AT&T (T 0.12%) are all great options for investing in 5G. However, investors wanting higher-growth exposure to 5G should focus on companies providing infrastructure, equipment, and technology.

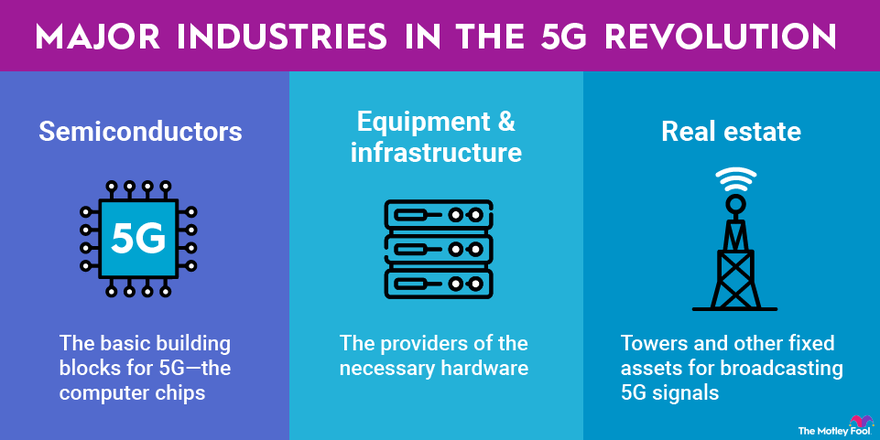

Semiconductor companies, manufacturers of mobile tech equipment and infrastructure, and real estate asset holders are some of the best-positioned stocks to benefit from the proliferation of 5G. Several 5G exchange-traded funds (ETFs) also focus on companies building the next generation of mobile technology.

| Semiconductor Companies | Market Capitalization | Description |

|---|---|---|

| Broadcom (NASDAQ:AVGO) | $1.09 trillion | A diversified developer of chips and electronic components for phones and networking hardware. |

| Qualcomm (NASDAQ:QCOM) | $175.35 billion | The leader in mobile computing chips; practically every smartphone on the planet contains Qualcomm hardware. |

| Marvell Technology Group (NASDAQ:MRVL) | $102.26 billion | Designer of data processing and networking chips that enable high-speed transfer of information. |

| AMD (NASDAQ:AMD) | $203.45 billion | Top chip company that is making a key acquisition to break into new markets, including 5G. |

| Nvidia (NASDAQ:NVDA) | $3.54 trillion | The pioneer of the graphics processing unit (GPU), which is finding new uses outside of its traditional video game roots. |

Best 5G chip companies

Best 5G chip companies

The basic building blocks for 5G are semiconductors -- the electronics that process data and execute commands in a computing system. These companies provide the chips that make 5G work. Top chip companies include:

1. Broadcom

Chip design giant Broadcom is a top name in 5G. Its circuitry designs can be found across the mobile network ecosystem. Included in this list of equipment are base stations that create wireless signals and network infrastructure that serves as the backbone of the internet. Broadcom also designs parts that connect smartphones and other devices to a wireless signal.

In recent years, Broadcom has made several acquisitions to add infrastructure management software to its operation. The segment assists customers with monitoring and securing their networks and cloud computing assets. This has boosted the company’s profit margins since the software is often packaged with network hardware. Broadcom’s free cash flow profit margin was an incredible 38% for fiscal 2024.

A serial acquirer, Broadcom acquired cloud and networking hardware giant VMware in 2023 for $69 billion -- one of the largest acquisitions so far this decade. This resulted in the creation of a powerhouse in networking component design ranging from cloud computing to 5G to infrastructure management software.

2. Qualcomm

Qualcomm's product portfolio includes chips that enable 5G technology. Qualcomm has profited from the smartphone boom since the early 2000s by focusing on the tech behind 3G and 4G mobile networks. However, 5G is broadening the mobile chip designer's horizons and is opening up opportunities in IoT devices and industrial equipment, new smartphones, cars, and even modems that make up the 5G network.

The smartphone industry has matured, and unit sales no longer reliably post double-digit percentage growth. However, the 5G device upgrade boom is lifting Qualcomm's sales higher again. In addition, the automotive market is providing another source of growth. The company's fiscal 2024 10-K states that "67% of new vehicles produced in 2030 are projected to have embedded cellular connectivity, with 48% of new vehicles featuring 5G connectivity compared to 11% of new vehicles featuring 5G connectivity in 2024." The company has ample cash on its balance sheet to drive innovation in hardware, and it has consistently paid a dividend for almost two decades.

3. Marvell Technology Group

Marvell Technology Group has long been a leader in developing data processing units (DPUs). Its chips are instrumental in moving large amounts of digital information in networking equipment and data centers. Since mobile networks are increasingly being used in enterprise applications, 5G has been a natural fit for Marvell’s portfolio of silicon.

To broaden its exposure to 5G, the cloud, and other business solutions, Marvell acquired Inphi and Innovium in 2021 and Tanzanite in 2022. The designers of fiber optics and network switching build on Marvell’s existing DPU technology. As 5G technology advances and network deployment increases in markets around the globe, Marvell has a clear path to fast growth for years to come.

4. Advanced Micro Devices

AMD makes this list because of its acquisition of Xilinx in early 2022 -- the industry leader in field-programmable gate array (FPGA) chips. FPGA chips can be reprogrammed and reconfigured at the hardware level even after they’ve been built. As new hardware is developed for 5G, the adaptability of FPGA chips makes them ideal for building the basic equipment to deploy 5G technology.

The merger gives AMD access to a best-in-class research and development (R&D) department. Xilinx will also improve AMD’s profitability since Xilinx’s profit margins are far higher than some of the traditional AMD chips used in personal computers and data centers.

5. Nvidia

Nvidia pioneered the graphics processing unit (GPU), which is most commonly used in high-end video games. However, GPUs are also being used for other applications such as artificial intelligence (AI), self-driving car development, and 5G.

5G networks enable faster download speeds and can also handle higher traffic and intelligently route network signals where they're most needed, so high-end GPUs are ideal for this task. Nvidia's GPUs are being used by telecom companies and equipment makers, and 5G deployment is likely to increase the need for GPUs to operate cloud-based video games streamed over networks. Already a huge enterprise, Nvidia is finding a potentially gigantic new market in 5G.

| Equipment and Infrastructure Companies | Market Capitalization | Description |

|---|---|---|

| Corning (NYSE:GLW) | $40.67 billion | The legacy glass and ceramics firm is refocused on technology that includes 5G equipment and radio transmitters. |

| Ciena (NYSE:CIEN) | $11.88 billion | A fiber-optic equipment and network software provider for the telecom industry. |

| Arista Networks (NYSE:ANET) | $145.12 billion | A top provider of data center equipment and management software. |

Best 5G equipment and infrastructure stocks

Best 5G equipment and infrastructure stocks

Beyond the basic chips needed to power 5G telecommunications, general equipment makers provide hardware that makes mobile networks possible. To reach businesses and consumers, wireless 5G signals need extensive equipment. These companies have had supply chain issues in recent years that have pressured growth rates and profit margins. However, they remain solid investments since they enable the construction of wireless networks and supporting infrastructure around the world.

1. Corning

Before it gets turned into a high-speed Wi-Fi signal, 5G data needs to travel along the wired portion of the internet, just like other electronic data. That’s where fiber-optic cable comes in, and Corning -- the legacy glass and ceramics manufacturer -- is a major supplier. Even as they deploy new radio towers, many telecoms providing 5G service also need to add more high-speed cable to their networks.

Corning also builds small cell antennas and accompanying software -- core components of 5G systems used in office buildings and venues such as sports arenas to deploy wireless signals. Corning has been around for a long time, but it has a long history of paying a rising dividend to its shareholders.

2. Ciena

Ciena is another company that sells fiber-optic equipment and network design services to communications companies. Ciena's profits from the expansion of 5G technology have enabled the company to increase cash reserves and repurchase stock. Along the way, it has developed new capabilities, including a software segment that helps telecoms manage their networks.

As organizations update their systems to handle 5G, the company is capable of providing the engineering design and materials needed to deploy next-generation mobility. After a sales slump early in the COVID-19 pandemic, Ciena is back in growth mode again. It predicts its addressable market will expand by about $12 billion from 2023 to 2028, representing a compound annual growth rate of 20%.

3. Arista Networks

Data center and internet infrastructure company Arista Networks is an often-overlooked 5G stock. Because 5G carries massive amounts of data -- enabling ultra-high-definition video streaming or communications for network-connected vehicles -- data centers will play an increasingly important role in mobile network management.

Arista is a top equipment provider for data centers and internet infrastructure, with open-source hardware and network management and cybersecurity tools. Arista is well positioned to benefit from the accompanying boom in cloud computing services as 5G further increases the capabilities of mobile devices.

| Real Estate Companies | Market Capitalization | Description |

|---|---|---|

| American Tower (NYSE:AMT) | $85.31 billion | One of the largest REITs and focused on mobile network infrastructure. |

| Crown Castle (NYSE:CCI) | $39.11 billion | A leading mobile network REIT in the U.S., with a growing number of 5G small cell tower deployments. |

| Digital Realty Trust (NYSE:DLR) | $60.29 billion | A top data center developer, with a group of mobile network clients using its services to manage 5G. |

Best 5G real estate investments

Best 5G real estate investments

5G also requires real estate. Towers and other fixed assets are needed to broadcast 5G signals, and real estate investment trusts (REITs) American Tower, Crown Castle, and Digital Realty Trust are some of the largest players in the sector. Besides slower but steady growth, the REITs are also top income-generating investments in the 5G space.

1. American Tower

With more than 221,000 properties worldwide, American Tower is one of the largest REITs and is a top real estate company in tech. It concerns itself primarily with the land, buildings, and cell tower sites crucial to the function of both mobile networks and internet infrastructure. It also establishes fiber-optic networks that connect 5G small cell sites to the rest of the internet, which is a critical service for mobile network operators as more consumers and businesses rely on a mobile service for their internet use.

2. Crown Castle

Crown Castle is much smaller than American Tower, but it is a leading North American communications infrastructure property manager. It operates more than 40,000 cell towers and has tens of thousands of miles of fiber, including a fast-growing portfolio of small cell nodes for 5G deployment. Although there are industries growing faster than real estate, Crown Castle offers its shareholders the potential for income and growth as the 5G industry develops.

3. Digital Realty Trust

Digital Realty Trust is a top developer and acquirer of data centers, the basic computing units of the cloud computing industry. However, since there is an overlap between cloud services and 5G, it’s noteworthy that Digital Realty’s clients include telecommunications companies that are building the physical assets to make 5G possible.

Although their investments are primarily designed to generate income, all three REITs have seen share prices significantly increase over the past decade. As mobility becomes increasingly important around the globe and data volume continues to swell, the demand for American Tower, Crown Castle, and Digital Realty Trust real estate assets will increase.

Related investing topics

Invest in 5G for the long term

Invest in 5G for the long term

While previous telecom network upgrades enabled the smartphone and mobility booms, 5G technology entrenches digital technology even more into daily life. It overlaps with cloud computing, given that so many people now work from home. 5G is also unlocking new forms of entertainment, such as ultra-high-definition video, video game streaming, and virtual reality. Investors who are patient throughout the lengthy course of 5G’s deployment (a decade or more) could enjoy attractive long-term returns.