ChatGPT is owned by OpenAI, a private company. There is no ChatGPT stock, no OpenAI ticker symbol, and no way for everyday investors to buy shares directly.

That said, ChatGPT has become one of the most important products driving the artificial intelligence boom, and several publicly traded companies are deeply tied to its success. Investors looking to benefit from ChatGPT’s growth can do so indirectly by owning those businesses.

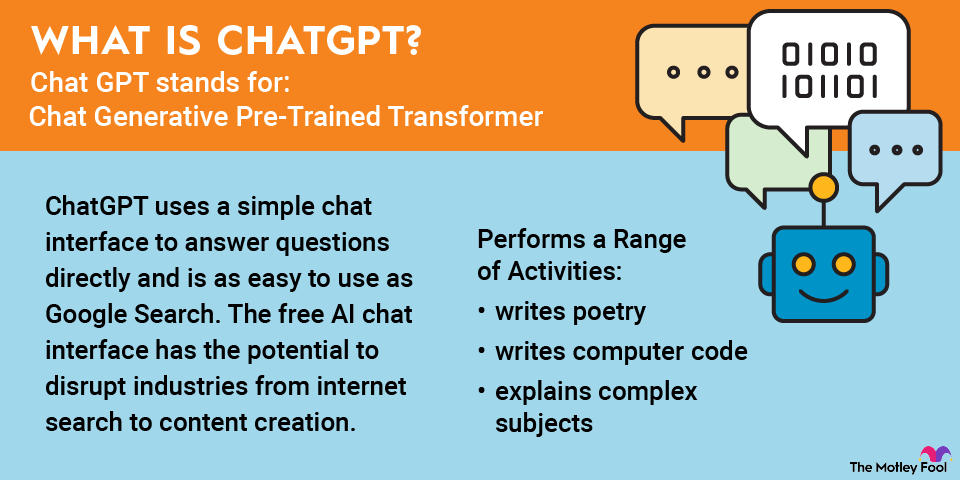

What is ChatGPT?

ChatGPT is an artificial intelligence chatbot. It uses a type of AI model called a large language model (LLM) to understand prompts and generate human-like responses.

What makes ChatGPT different from earlier AI tools is its simplicity and usefulness. Instead of searching for links, users can ask questions directly and get clear, conversational answers. That ease of use helped ChatGPT reach 100 million users within two months of its November 2022 launch.

As of 2025, ChatGPT reportedly serves hundreds of millions of weekly users, and it’s being used for everything from writing and coding to research, customer support, and data analysis.

How to invest in ChatGPT indirectly

While you can’t buy ChatGPT stock, you can invest in companies that:

- Fund OpenAI

- Provide the computing power ChatGPT runs on

- Supply the hardware and architecture required to scale AI

Here are three of the most closely connected options.

| Name | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Microsoft (NASDAQ:MSFT) | $3.5 trillion | 0.73% | Software |

| Nvidia (NASDAQ:NVDA) | $4.6 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

| Arm Holdings (NASDAQ:ARM) | $123.2 billion | 0.00% | Semiconductors and Semiconductor Equipment |

1. Microsoft: The platform and distribution partner

Microsoft (MSFT +3.28%) is the most direct way for public-market investors to gain exposure to ChatGPT.

Microsoft has partnered with OpenAI since 2019 and invested billions into the company, including a widely reported $10 billion investment following ChatGPT’s breakout success. More importantly, Microsoft has embedded OpenAI’s technology across its own ecosystem.

Today, ChatGPT powers or supports:

- Azure OpenAI services

- Microsoft Copilot across Office and Windows

- AI tools within GitHub, Dynamics, and other platforms

Microsoft CEO Satya Nadella has repeatedly called AI the next major computing platform. As of late 2025, Microsoft reported hundreds of millions of users interacting with AI features across its products.

Microsoft’s size means ChatGPT represents only a portion of its business, but that also makes it one of the lowest-risk ways to gain AI exposure.

NASDAQ: MSFT

Key Data Points

2. Nvidia: The infrastructure behind ChatGPT

If Microsoft helps distribute AI, Nvidia (NVDA +1.60%) helps make it possible.

Nvidia designs the graphics processing units (GPUs) that train and run large language models like ChatGPT. These chips are the backbone of modern AI data centers, and demand has surged as companies race to build and deploy AI systems.

Analysts estimate that tens of thousands, and likely far more, Nvidia GPUs are used to train and operate ChatGPT. Nvidia has also partnered closely with Microsoft and OpenAI on massive AI infrastructure projects, including the multi-year Stargate initiative.

While Nvidia’s growth has slowed from its peak, it remains the primary supplier of AI computing power, placing it at the center of the generative AI economy.

NASDAQ: NVDA

Key Data Points

3. Arm Holdings: Power efficiency at scale

Arm Holdings (ARM -2.63%) plays a quieter but important role in the AI ecosystem.

Arm licenses energy-efficient CPU designs used in smartphones, servers, and increasingly, AI data centers. As AI models like ChatGPT scale, power consumption has become a major constraint, and Arm’s architecture helps reduce energy usage.

Microsoft is one of Arm’s customers, using its designs in cloud-focused processors. Arm earns revenue through licensing and royalties, meaning its growth is tied to how widely its designs are adopted.

For investors, Arm offers exposure to AI growth without relying solely on demand for GPUs.

NASDAQ: ARM

Key Data Points

AI ETFs with exposure to ChatGPT-related companies

Investors who don’t want to pick individual stocks can use ETFs to gain diversified exposure to AI and generative technology.

While no ETF owns ChatGPT directly, several hold companies closely tied to its growth.

1. Invesco AI and Next Gen Software ETF

The Invesco AI and Next Gen Software (IGPT -0.25%) focuses on AI stocks that are closely related to generative AI and ChatGPT. Its top three holdings, for example, are Micron, Nvidia, AMD, and Meta Platforms (META +1.77%), three companies that are all investing heavily in generative AI.

NYSEMKT: IGPT

Key Data Points

2. Roundhill Generative AI & Technology ETF

Roundhill Generative AI & Technology ETF (CHAT -0.45%) was the first ETF designed to track generative AI stocks. Roundhill believes that generative AI will be one of the most important technological innovations of the future as it delivers significant productivity growth.

NYSEMKT: CHAT

Key Data Points

3. iShares Future AI & Tech ETF

If you're looking for a broader approach to a generative AI ETF, the iShares Future AI & Tech ETF (NYSEMKT:ARTY) could be a good option. This ETF holds 48 stocks and is one of the largest ETFs focusing on AI.