Robotics stocks are publicly traded companies focused on the robotics sector. Robots have captivated our imaginations since the invention of modern robotics in the 1950s. The idea of lifelike machines performing human tasks is intriguing for some and an uneasy thought for others.

But like most technology, robotics isn't about replacing humans. Rather, robots can automate redundant tasks to free up our time for more meaningful activities. Breakthroughs in recent years, like the advent of generative artificial intelligence (AI) services such as ChatGPT, have spurred the adoption of automation processes within organizations.

Some estimates point to an acceleration in the global adoption of robotics. GlobalData forecasts that the industry will grow at a 14% compound annual rate, rising from $76 billion in 2023 to $218 billion by 2030. Investing in robotics company stocks could be a lucrative move in the years ahead.

Investing in the best robotics stocks in 2025

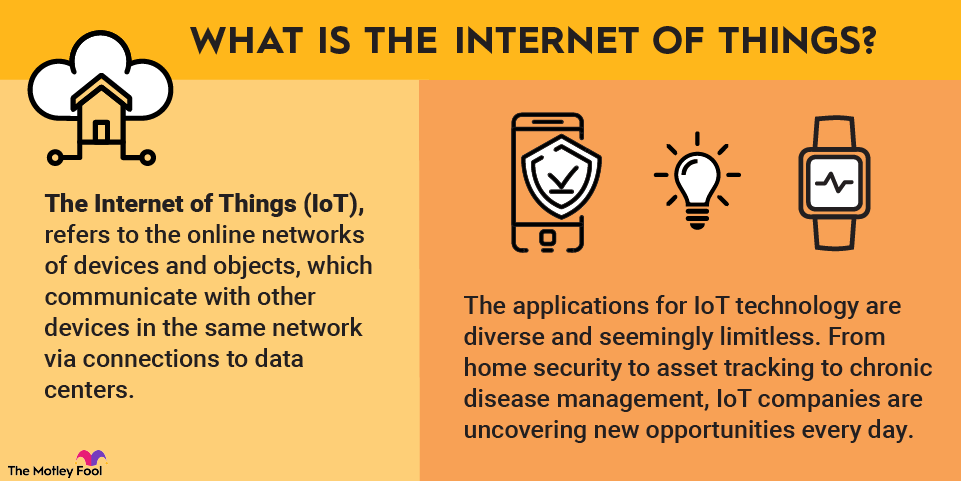

We already benefit from robotic processes every day. E-commerce companies, such as Amazon (AMZN +0.34%) and Shopify (SHOP -0.03%), automate tasks in fulfillment warehouses using intelligent machines. Smart speakers and other Internet of Things (IoT) devices in our homes play music and inform us of our daily schedules. Chatbots help us find the information we need on websites.

Other robot applications are a little less visible, though. Here are eight robotics stocks to consider investing in.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Nvidia (NASDAQ:NVDA) | $4.9 trillion | 0.02% | Semiconductors and Semiconductor Equipment |

| Intuitive Surgical (NASDAQ:ISRG) | $193.3 billion | 0.00% | Healthcare Equipment and Supplies |

| Abb (OTC:ABBN.Y) | $0.0 million | 0.00% | Electrical Equipment |

| Rockwell Automation (NYSE:ROK) | $40.7 billion | 1.45% | Electrical Equipment |

| Zebra Technologies (NASDAQ:ZBRA) | $13.9 billion | 0.00% | Electronic Equipment, Instruments and Components |

| Teradyne (NASDAQ:TER) | $23.0 billion | 0.33% | Semiconductors and Semiconductor Equipment |

| Deere & Company (NYSE:DE) | $126.6 billion | 1.38% | Machinery |

| UiPath (NYSE:PATH) | $8.6 billion | 0.00% | Software |

1. Nvidia

NASDAQ: NVDA

Key Data Points

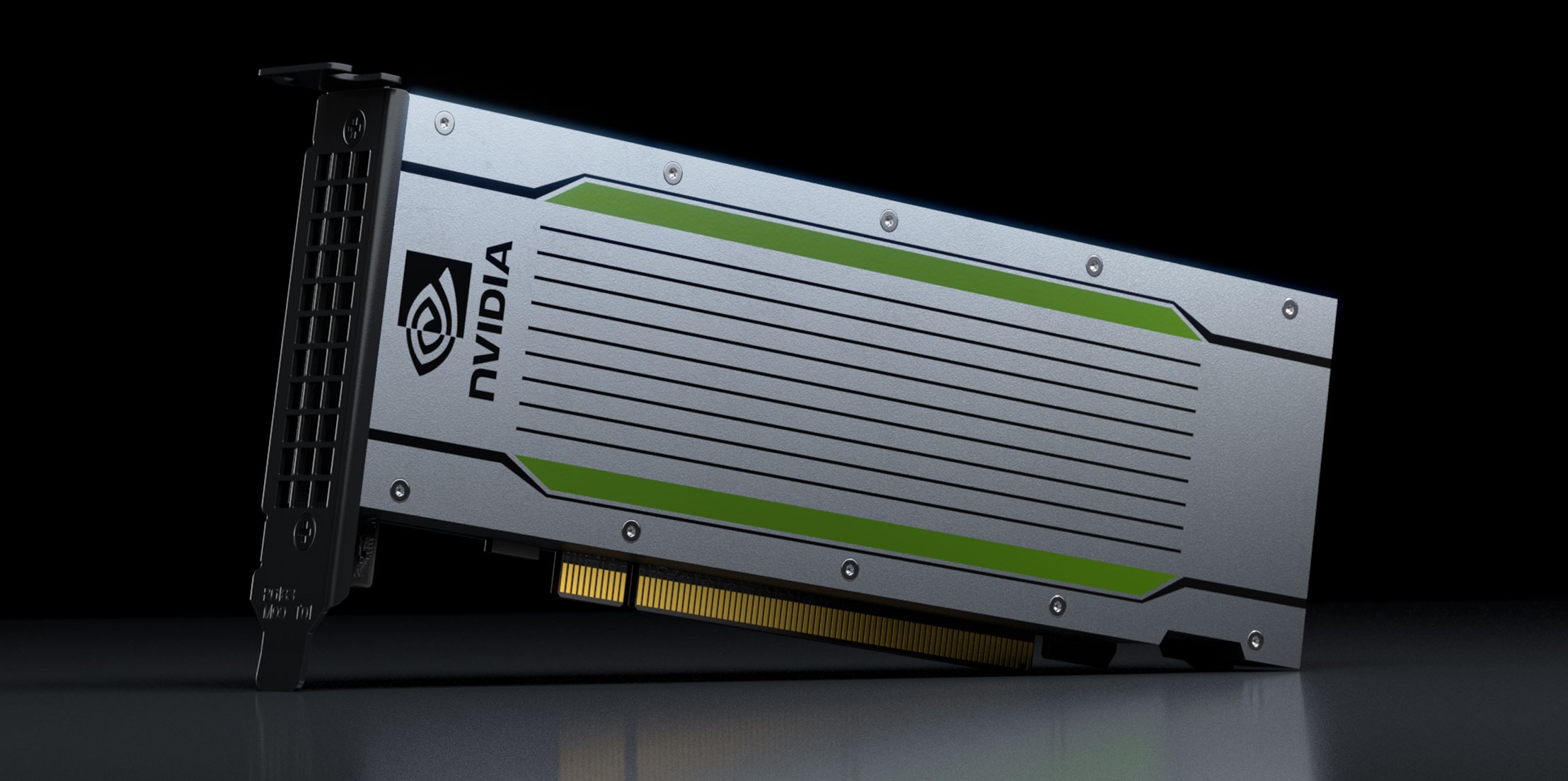

Semiconductors are the basic building blocks of all technology. Nvidia (NVDA +2.92%) has risen to become a leader in this area, and its advanced circuitry designs are enabling all sorts of high-end computing processes -- robots included.

Nvidia's GPUs (graphics processing units) are accelerating how quickly computing units can crunch data, especially in data centers. However, Nvidia chips also power everything from personal computers to small IoT devices to robotics in factories. For a complex system such as a robot, fast computing time is a necessity.

One example of Nvidia's work is embodied in its aptly named "Jetson" lineup of modules. Complete with artificial intelligence (AI) and machine learning software, Jetson devices are being used in applications spanning industrial and manufacturing machinery, healthcare devices, and self-driving vehicles. The company's three-computer solution to robotics enables robots to see, learn, and perceive their surroundings to make real-time decisions.

With its advanced capabilities on the hardware and software fronts, Nvidia is a top play on robotics for the long term since it helps its customers unlock AI's power.

Semiconductor

2. Intuitive Surgical

NASDAQ: ISRG

Key Data Points

3. ABB

OTC: ABBN.Y

Key Data Points

4. Rockwell Automation

NYSE: ROK

Key Data Points

5. Zebra Technologies

NASDAQ: ZBRA

Key Data Points

Machine Learning

6. Teradyne

NASDAQ: TER

Key Data Points

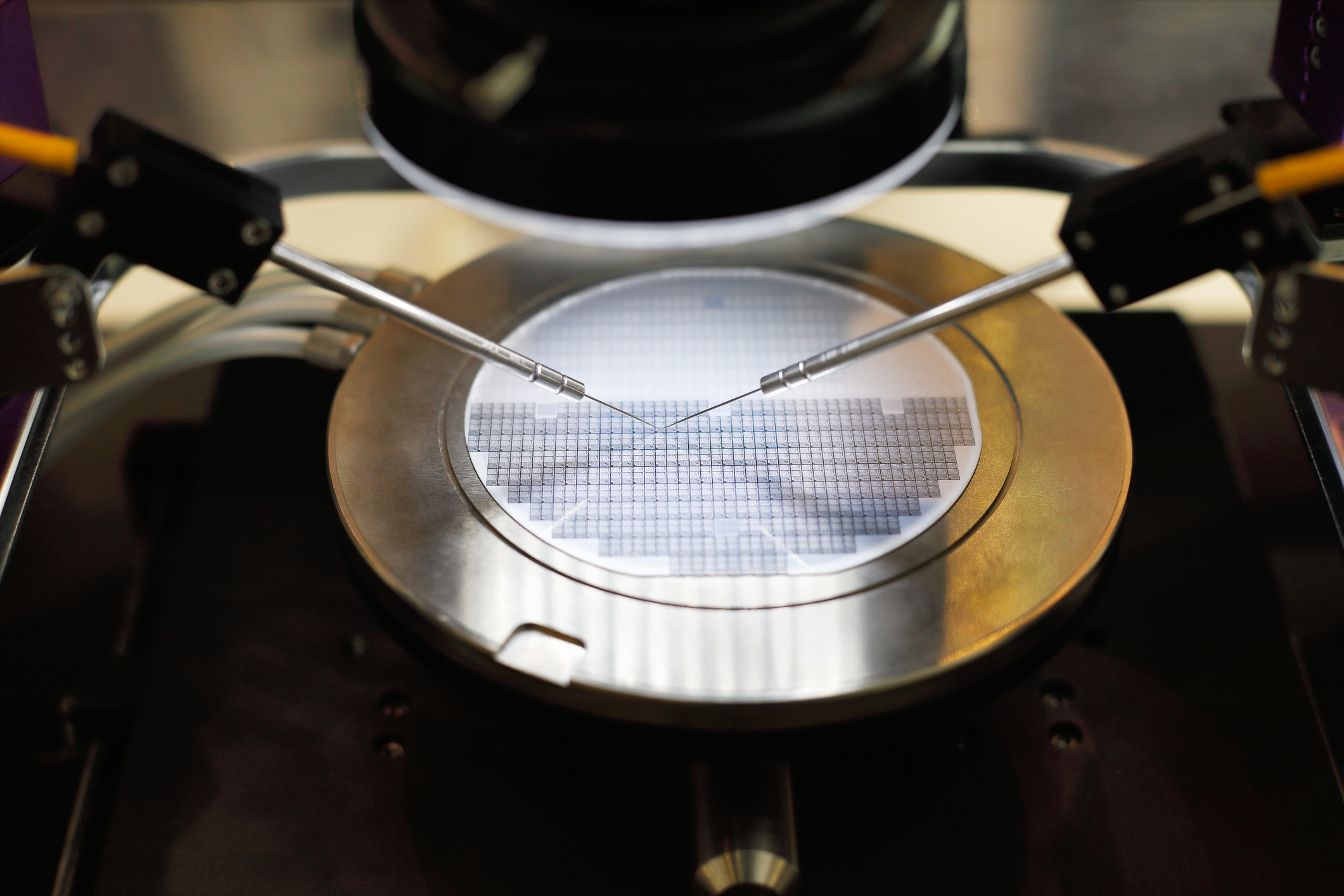

Teradyne (TER +20.54%) is a developer of industrial equipment that helps automate repetitive tasks, specifically for the semiconductor industry. In manufacturing electronic devices, testing the products to ensure they work correctly is one of the most repetitive and time-intensive tasks.

Teradyne's robotics help free people from this activity, speed up testing and verification times, and increase the accuracy of device testing before a product is delivered.

This robotics company is also a top partner of automotive, aerospace, and defense companies. It owns Universal Robots (UR) and Mobile Industrial Robots (MiR), two businesses it acquired in recent years. Universal Robots is known for devices like robotic arms used in manufacturing, and MiR for its self-driving bots used in warehouses. The company's robotics division reported $75 million of revenue in the second quarter of 2025, a 9% increase from the first quarter.

Although it's a behind-the-scenes play on automation, all sorts of everyday devices, mission-critical machinery, and tech services (such as 5G mobile networks) benefit from Teradyne's work. The company is constantly improving its robotic equipment. In 2025, Teradyne Robotics unveiled several advanced AI-driven robotics solutions, including Physical AI, equipping robots with the ability to perceive and respond to the real world.

7. John Deere

NYSE: DE

Key Data Points

8. UiPath

NYSE: PATH

Key Data Points

Related investing topics

Invest in robotics for the long term

Thanks to semiconductor and software innovation in recent years, robots are being applied throughout the global economy at a record pace. As the technology improves, it will transform the way organizations operate and make the world a more efficient place.

Bear in mind that robotics is a long-term trend, and investing in stocks in this space will require patience. However, potential investment gains could be sizable for those companies making the best use of robotics technology.

What is the future outlook for the robotics industry?

The future outlook for the robotics industry is very promising. Robotics has the potential to revolutionize several industries, including manufacturing, healthcare, logistics, and agriculture. It can help companies in these industries save time, reduce costs, and increase productivity.

According to an estimate by McKinsey, the general-purpose robotics market could reach a staggering $370 billion by 2040, with 50% of that value coming from China.

AI could play a key role in accelerating the adoption of robotics. The technology can make robots more autonomous, enabling them to perform more tasks without human intervention. For example, AI-powered robots are giving rise to "dark factories" or "lights-out manufacturing" as companies build fully automated manufacturing facilities that can operate in complete darkness without any human presence.

The expected growth of the robotics industry should benefit the top robotics stocks.