When trying to determine how to make a product line profitable or how many units you must sell to break even, it's important to look at the problem from a number of angles. One way to do that is by using a cost-volume-profit analysis.

What is cost-volume-profit analysis?

Simply put, the cost-volume-profit analysis is a tool to help you understand how many units of a product need to be created to meet a financial target. This is often a calculation used to find the break-even point, which is why it's sometimes referred to as a break-even analysis.

In a cost-volume-profit analysis, business owners can easily see how changes in the cost of manufacturing goods and the sales of those goods will affect their profits. However, like all accounting models, cost-volume-profit analysis requires many assumptions that don't always occur in real life, making it a specific tool for a specific job.

How is cost-volume-profit analysis used?

Cost-volume-profit analysis can be used in a few different ways to help businesses make decisions and for investors to understand why those decisions were made.

For example, when using a cost-volume-profit analysis with a target profit margin, you can work backward to see if there's even enough theoretical demand for the product to justify making it. If the cost-volume-profit analysis results in units that match the projected sales, it may justify moving forward with the product.

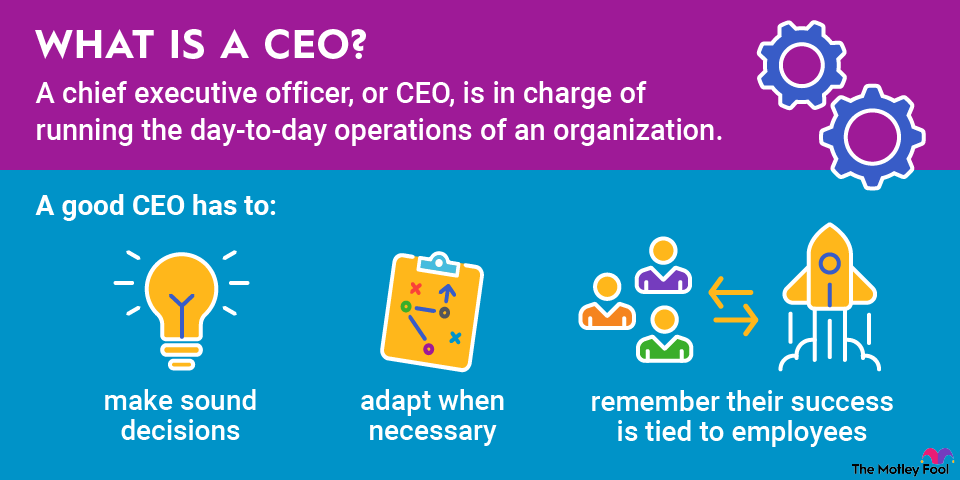

Net Profit Margin

You could also use cost-volume-profit analysis to help determine the sales price of a new product. If you know your needed profit and the cost involved in making the product, using cost-volume-profit analysis will tell you how much you have to charge per item. It may turn out that the product will simply be too expensive compared to the competition, which is good to know long before you start making it.

Limitations of cost-volume-profit analysis

Although cost-volume-profit analysis can be helpful when you're trying to theorize and plan for a new product line or figure out how to make an existing one more profitable, it has a lot of limitations because of the assumptions that must be made to do the calculations.

For example, in cost-volume-profit analysis, you must assume that the costs of creating the product are consistent, meaning that materials, labor, and so forth will be the same price indefinitely, which is certainly not true in the real world. You can peg this a little high to compensate for rising costs, but it's difficult to really know the long-term costs.

Another assumption that makes the cost-volume-profit analysis much better in theory than practice is that all units are sold in the model. In this scenario, you must sell everything, always. And you must do so at the same fixed sales price across the run.

So, while cost-volume-profit analysis is useful for understanding how to price a product based on current market conditions, there are quite a few things to keep in mind when turning the cost-volume-profit analysis results into actionable steps.

Related investing topics

Components of cost-volume-profit analysis

There are several different elements that are involved in a cost-volume-profit analysis, but these are the most important:

- Fixed costs: Fixed costs are costs that don't change, even if production does. This might include things like rent or insurance. Just add them all together to get a total.

- Variable costs: These costs change as production changes, so they might include materials, labor, or even utilities since producing more items will typically use more power, water, and gas.

- Sales revenue: The sales revenue is the money you generate from selling your goods. It's all the money before you subtract any costs.

- Contribution margin: The difference between your product's sales revenue and variable costs is the contribution margin -- it represents the money you have available to cover your fixed costs and can be expressed as a ratio or on a per-unit basis. A useful formula is Sales Revenue - Variable Costs = Contribution Margin.

- Break-even point: This is a big part of your analysis: At what point does your revenue equal your total costs? The next penny is when you start to profit, and that's your goal. You can figure out the break-even point by dividing your fixed costs by your contribution margin.

- Target profit: This is the amount of profit you hope to make, within reason. You can then use this number to figure out how much sales volume or revenue you need, figuring in costs and margins. Do this with the following formula: (Fixed Costs + Target Profit) / Contribution Margin = Required Sales Volume (expressed in either in units or dollars, depending on the unit of your contribution margin)