Divorce takes an emotional and financial toll. You and your soon-to-be ex-spouse have to decide how to divide all your assets, including retirement accounts such as your 401(k)s. Finding a solution that both parties can agree on is part of the challenge, but you also have to figure out how to minimize taxes, or you'll lose even more of your savings to the government.

Below, we'll take a look at what typically happens to 401(k) assets during a divorce and what steps you can take to hold on to as much of your savings as possible.

How are 401(k)s split in a divorce?

How are 401(k)s split during a divorce?

The way divorcing couples split 401(k)s depends on several factors, including where they live, the balance of each 401(k), how the government taxes the 401(k), and the value of other marital assets.

Most states follow marital property law, which requires marital property to be divided equitably, although not necessarily equally. Community property states require that all marital assets be divided 50/50 in a divorce. Note that the key here is marital assets. In both types of states, any money you put into your 401(k) before you got married isn't considered marital or community property and isn't subject to division in a divorce.

If one spouse has significantly more savings than the other, a court may order the one with more savings to give some to the other. But that doesn't necessarily mean you have to liquidate your 401(k) and hand part of it over to your ex.

Dividing your assets

Dividing your assets

Before you can figure out how to fairly divide your marital assets, you need to know how much you have. You should both get summary plan descriptions (SPDs) of your 401(k)s and other retirement accounts. Then reach out to your plan administrator to learn about any rules your 401(k) plan has for dividing your assets. Share this information with both parties' divorce lawyers. They'll need it to draft an agreement that the plan administrator will accept. If the administrator rejects your plan, you'll have to go back to the drawing board.

When both spouses have a roughly equal amount of savings in their 401(k)s, each may elect to keep their own savings and leave the other's untouched. But when one spouse has substantially more than the other, things get more complicated.

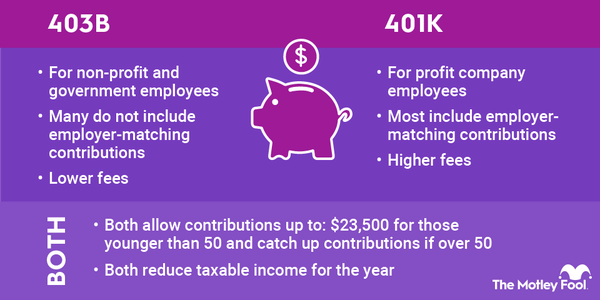

You can't just take the sum of your collected retirement savings and divide it in half. You also have to weigh how the government taxes the money. Traditional 401(k)s are tax-deferred, which means you owe taxes on your distributions. Roth 401(k)s are funded with after-tax dollars, so you don't owe taxes on your withdrawals. So Roth savings are more valuable than tax-deferred savings since you'll eventually have to give some of your tax-deferred savings back to the government.

Your financial advisor and divorce lawyers can help you work with your spouse to come up with a solution that works for both of you. The longer your divorce proceedings drag out, the more expensive they become for both of you.

Avoiding losses

Avoiding losses

When dividing up your 401(k) funds and other assets, your top priority should be to minimize the taxes and fees you pay since these can set your retirement savings back even further. It's important that you file all proper paperwork and carefully spell out how you plan to divide your assets. Your divorce lawyers can help with this.

You may not have to do anything with your 401(k) funds if you can offer your spouse other marital assets of comparable value, such as a home or car. If they accept this, your retirement savings will be untouched.

If you and your spouse agree that you should give up a portion of your 401(k), you'll need a qualified domestic relations order (QDRO). This is a court order that gives your spouse the right to a portion of the funds in your 401(k). Usually you split your 401(k) into two new accounts. You can continue to manage and contribute to yours, and your spouse can manage their funds and investment options, but they cannot contribute more money to that account directly.

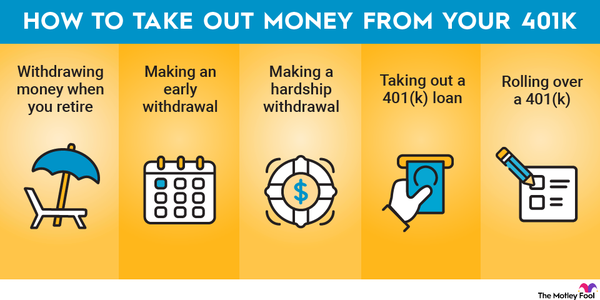

A QDRO is probably your best option for dividing 401(k) funds, but you could choose to withdraw from your 401(k) to pay your ex-spouse. This can result in taxes coming due if the money is from a traditional 401(k), and there will be a penalty if you're younger than age 59 1/2. But you may be able to stipulate in your divorce agreement that your spouse is responsible for these taxes and fees.

Related retirement topics

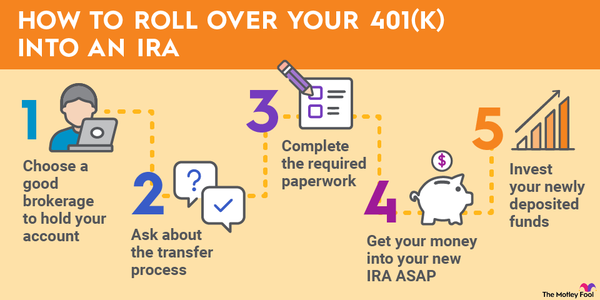

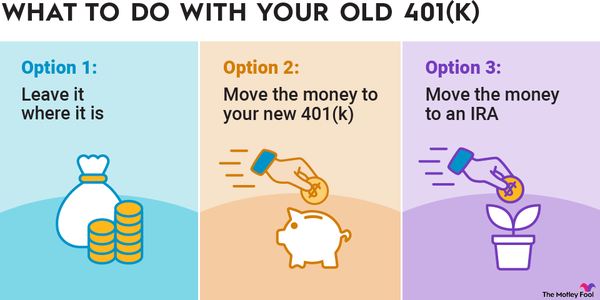

You may also be able to roll your 401(k) funds over into an IRA if you've left your employer or your plan allows you to. You can then move your portion of the funds into an IRA in your name and give your spouse their portion in a separate IRA. You may have to pay a small one-time rollover fee to do this, but you won't have to worry about taxes until you withdraw the funds in retirement.

There isn't always a simple way to divide your 401(k) assets in a divorce, but you can make the process a little less painful by understanding what your 401(k) plan allows and what your state requires. While it's not always easy, try your best to work with your spouse to come up with a fair solution. It will make things faster and more affordable for everyone involved.

FAQs

How to Protect Your 401(k) During Divorce: FAQs

Is my spouse entitled to my 401(k) if we divorce?

Your spouse may be entitled to some of your 401(k) funds in a divorce. It depends on several factors, including the value of your 401(k), how the IRS taxes the account, the value of your other marital assets, and where you live. In cases where both spouses have similar 401(k) balances, they may each elect to keep their own savings.

When one spouse has a significantly larger 401(k) than the other, it's more likely that the one with the larger 401(k) will have to give some of their retirement savings to their soon-to-be ex. But it depends on the terms of the divorce agreement. If you can offer your spouse other marital assets of comparable value, like a home, you may get to keep your 401(k) funds.

Can I withdraw from my 401(k) without penalty for divorce?

If you are required to give some of your 401(k) funds to your spouse in a divorce, you'll usually get a Qualified Domestic Relations Order (QDRO) from a court. This enables you to transfer the funds to your spouse with no tax penalty to you.

However, if you want to withdraw money from your 401(k) for other reasons, like paying your divorce lawyer's fees, you could still owe taxes on this money if it comes from a traditional 401(k). You may also owe a 10% early withdrawal penalty if you're under age 59 1/2 at the time.

How do you protect your financial assets in a divorce?

You can protect your financial assets in a divorce by working with a divorce lawyer who can advocate for your best interests. If you have to give some of your 401(k) funds to your spouse, your lawyer can also help you petition a court for a Qualified Domestic Relations Order (QDRO), so you can transfer the funds tax- and penalty-free.

It's also important to try to work with your spouse during the divorce proceedings. The longer they drag on, the more expensive your lawyer fees will become, leaving you with less money for future expenses.

Who pays taxes on a 401(k) that is split in a divorce?

It's possible that no one has to pay taxes immediately when a 401(k) is split in a divorce. If you have a Qualified Domestic Relations Order (QDRO), this enables you to transfer the funds to your spouse without paying taxes or a 10% early withdrawal penalty. If your spouse chooses to roll the QDRO distribution into an IRA in their own name, they won't owe taxes on the funds either until they withdraw them later.