401(k)s are incentivized plans to help Americans save for retirement. The government provides tax breaks to encourage you to contribute, but also enforces certain rules to discourage you from taking distributions before retirement. In some cases, taking distributions early can cost you a 10% penalty in addition to the ordinary income taxes you'll owe on withdrawn funds.

Let's look at all the approved ways you can take money out of a 401(k) and the penalties you'll incur if your early distributions don't fall within one of those exceptions.

How to withdraw money

How to take money out of your 401(k)

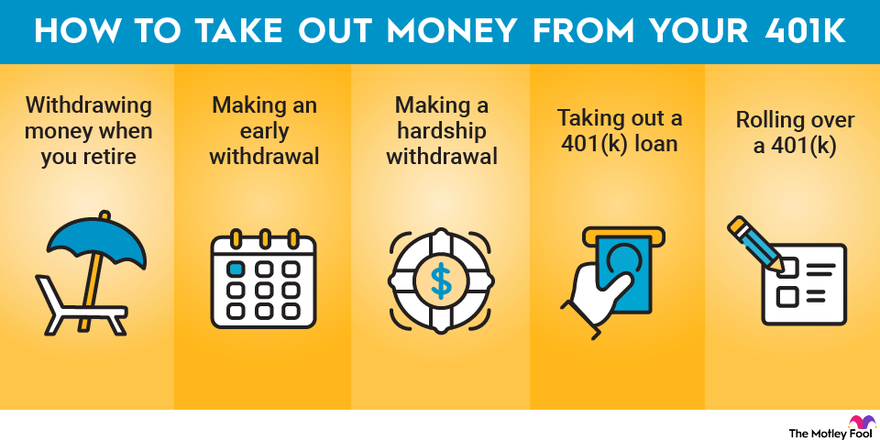

There are many different ways to take money out of a 401(k), including:

- Withdrawing money when you retire: Withdrawals you make after age 59 1/2 are penalty-free.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies for an exception.

- Making a hardship withdrawal: These are early withdrawals you make because of an immediate financial need. However, hardship withdrawals are still penalized in some circumstances.

- Taking out a 401(k) loan: You can borrow against your 401(k) without incurring penalties as long as you repay the loan on schedule.

- Rolling over a 401(k): If you leave your job, you can move your 401(k) into another 401(k) or individual retirement account (IRA) without penalty as long as you put the funds in another retirement account within 60 days of your distribution.

When you retire

Withdrawing when you retire

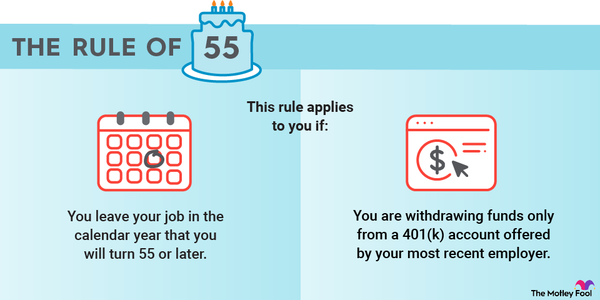

After you reach age 59 1/2, you may begin taking withdrawals from your 401(k). If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401(k) you had with that company. If you are a public safety worker, this rule takes effect at age 50.

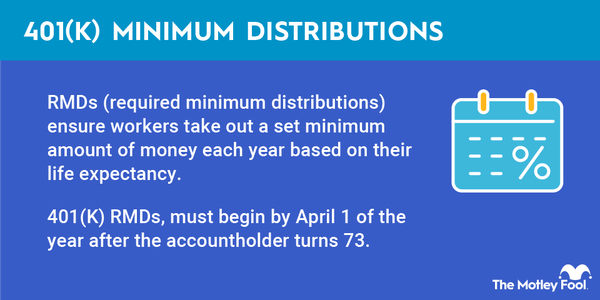

Once you reach 73 (previously age 72), you're actually obligated to begin taking required minimum distributions (RMDs) from non-Roth accounts.

Early withdrawals

Early withdrawals

Any withdrawal you make prior to age 59 1/2 is considered an early withdrawal. In most cases, in addition to the ordinary income taxes you always owe when taking money out of a pre-tax 401(k), you are subject to a 10% penalty for any early withdrawal.

However, there are a few exceptions when you can avoid the 10% penalty (but not any applicable income taxes):

- Rule of 55: This applies if you leave your current employer in the calendar year you turn 55 or later and take money only from that company's 401(k).

- Substantially equal periodic payments: These require you to withdraw a certain amount from your account for at least five years or until you reach 59 1/2 (whichever is longer).

- Permanent disability: This applies if you meet your employer plan's definition of disabled.

- Qualifying medical expenses: If your medical expenses exceed a certain percentage of your adjusted gross income, you can withdraw funds penalty-free to cover them.

- Qualified domestic relations order: If a court orders you to give 401(k) funds to a spouse or dependent, you can withdraw the money penalty-free.

Adjusted Gross Income (AGI)

Hardship

Hardship withdrawals

Some 401(k) plans allow you to take early withdrawals when you experience an "immediate and heavy financial need." Some examples include:

- Medical expenses

- Costs associated with purchasing a primary home

- Tuition payments or other qualifying educational expenses for the 401(k) owner, his or her spouse, or dependents

- Payments necessary to prevent eviction or foreclosure

- Burial or funeral expenses for a parent, spouse, child, or other dependent

Even if your employer's plan permits hardship withdrawals, you may still be subject to the 10% early withdrawal penalty unless you fall within one of the above exemptions.

401(k) loans

401(k) loans

Some plans allow you to borrow up to 50% of your vested account balance, up to a maximum of $50,000, within a 12-month period. A 401(k) loan operates much like a standard loan: You must pay back the borrowed funds with interest. If you default on repayment, it will be considered a distribution, and you could be subject to the 10% penalty for early withdrawals.

Rollovers

Rolling over a 401(k)

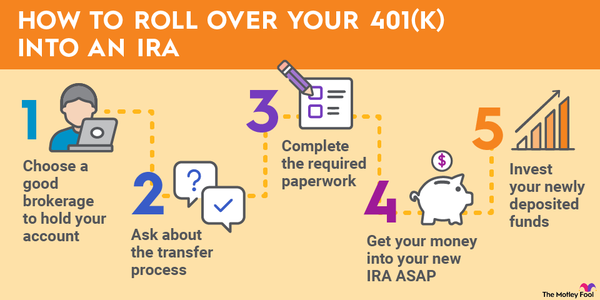

If you leave your job or your plan terminates, you can roll over the 401(k) funds to another tax-advantaged retirement account. A direct rollover means the money moves from your 401(k) into your new tax-advantaged account and is usually recommended.

You can also do an indirect rollover, wherein you receive the funds directly and deposit them into your new account within 60 days to avoid treatment as a distribution. Your plan administrator will be required to withhold 20% of the amount you're rolling over for income taxes if you opt for an indirect rollover.

When you leave a job

When you leave a job, you generally have the option to:

- Leave your 401(k) with your current employer.

- Roll over the funds to an IRA.

- Roll over the funds to your new employer's 401(k).

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but doing so will trigger early withdrawal penalties if you are younger than 59 1/2 (unless the Rule of 55 applies).

Roll over to an IRA

Rolling a 401(k) over into an individual retirement account (IRA) is often a good option when you leave your job or your plan terminates. You can open an IRA with any brokerage and generally have a wider choice of investment options. You may have the option of a direct or indirect rollover.

You must roll over a traditional 401(k) into a traditional IRA to avoid owing taxes. If you wish to do a Roth conversion instead, you'll need to pay taxes on the amount you convert.

Related retirement topics

Early withdrawal penalties

401(k) early withdrawal penalties

If you withdraw money from a 401(k) before age 59 1/2 and don't roll the funds into another tax-advantaged plan or qualify for an exemption, such as the Rule of 55, you will face early withdrawal penalties. These penalties equal 10% of the amount withdrawn.

So, if you take $5,000 out of your 401(k) before retirement age, you would be faced with a $500 penalty. In addition, you will also pay ordinary income tax on your withdrawn funds. With a $5,000 withdrawal, you would owe an extra $1,100 in taxes if your marginal tax rate is 22%.

These penalties add up. If you withdrew $5,000 and paid the 10% penalty and ordinary income taxes, you would be left with $3,400. Consider this major downside before you take money out of your 401(k) early.

FAQ

Taking money out of your 401(k): FAQ

How do I cash out my 401(k) balance?

You can contact your 401(k) administrator to obtain a form requesting the distribution of your 401(k) funds. However, be sure you understand the implications.

When you withdraw your money, you must roll it over into another tax-advantaged retirement account, such as an IRA, or you will be taxed on the distribution as ordinary income. If you are not yet 59 1/2 and don't fall within an exemption, such as the rule of 55, you will also owe a 10% penalty.

How do I avoid the 20% tax on my 401(k) withdrawal?

Your 401(k) withdrawal is taxed as ordinary income when the funds are distributed from the account. Your tax bracket will determine how much you are taxed.

If you withdraw funds early (typically before age 59 1/2) and don't qualify for an exception, you'll also be hit with a 10% penalty. The only way to avoid taxes on distributed funds is to do a direct rollover to another tax-advantaged retirement account.

Does my employer have to approve a 401(k) withdrawal?

Whether your employer must approve a 401(k) withdrawal depends on many factors, including the plan documents and the purpose of the withdrawal. For example, your plan may give your employer authority to determine under what circumstances you can take a hardship withdrawal. You should check with your 401(k) administrator to determine the rules applicable to your plan.

What are valid reasons to withdraw funds from a 401(k)?

The best reason to withdraw funds from a 401(k) is that you are retired and taking money out as part of your long-term financial plan. You can withdraw funds earlier in certain situations, such as when you have an immediate and heavy financial need.

However, you should try to avoid doing so, as there is a penalty for most early withdrawals. You could also jeopardize your retirement security by accessing retirement funds early, as you lose the chance to earn returns on those funds.