If you're lucky enough to have access to a 401(k) plan through work, you're probably aware that you have a real opportunity to sock away some serious cash for retirement.

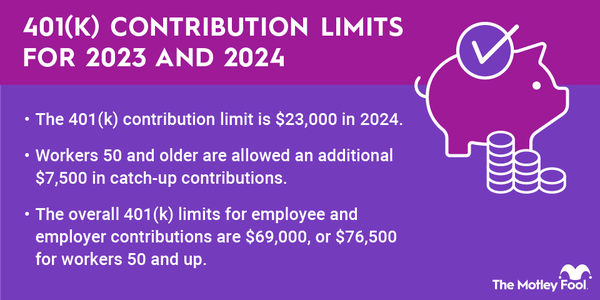

The annual contribution limits in 2024 are:

- $23,000 for workers younger than 50

- $30,500 for those 50 and older

In 2025, the contribution limits rise to:

- $23,500 for workers younger than 50

- $31,000 for workers 50-59 and 64 and older

- $34,250 for those ages 60-63

And, while it pays to focus on growing your 401(k) during your working years, it also helps to familiarize yourself with how 401(k) distributions work. Here are a few things you need to know.

Take qualified distributions

401(k) plans are designed to help you save for retirement. As such, the IRS makes certain rules to encourage you to save longer. The most important is that you must meet the criteria for a "qualified distribution" in order to realize the tax benefits of saving in the retirement plan.

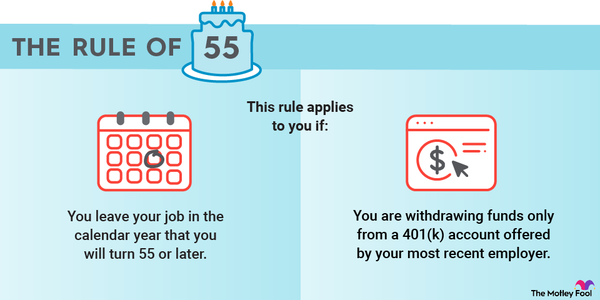

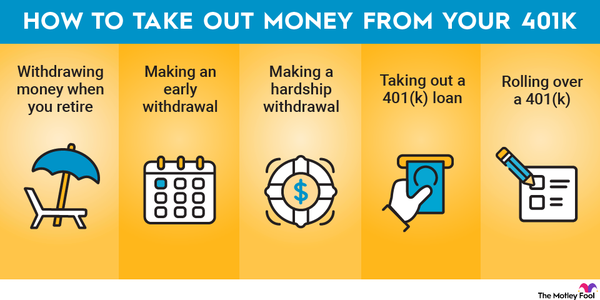

The simplest criterion is reaching age 59 1/2 before taking a distribution. You can also begin taking distributions from your 401(k) if you separate from service with your employer in the year you turn 55 or later. Importantly, you can only use this "rule of 55" to withdraw funds from your last employer's 401(k) and not any other 401(k) or retirement accounts.

If you contributed funds to your 401(k) pre-tax (in a traditional account), you'll owe income tax on your qualified distributions. If you contributed to an after-tax Roth 401(k) account, your distributions will come out tax-free.

In the past, employer contributions were always pre-tax. However, the Secure Act 2.0 allows employers to make post-tax Roth contributions, though many plans haven't yet implemented the feature. You'll still need to pay taxes on any distributions your employer made on a pre-tax basis.

Be mindful of early distributions

If your distribution doesn't meet the criteria for a qualified distribution, it'll be subject to a 10% early distribution penalty. It's rarely a good idea to take an early withdrawal from your 401(k). Not only will you pay the 10% penalty and any income taxes owed on the distribution, you'll forego future tax-advantaged growth.

There are some cases where it's your best option, though, and the IRS has certain rules that allow you to access your funds early. You may qualify for a hardship distribution, which allows you to withdraw funds from your 401(k) up to the amount necessary to cover a financial hardship. Eligible funds for a hardship withdrawal include employee elective salary deferrals (but not the earnings on those deferrals) and employer contributions. You'll owe income tax on your hardship distribution, but you may be exempt from the additional 10% penalty. For example, if the distribution covers unreimbursed medical expenses in excess of 7.5% of your adjusted gross income, you can avoid the penalty.

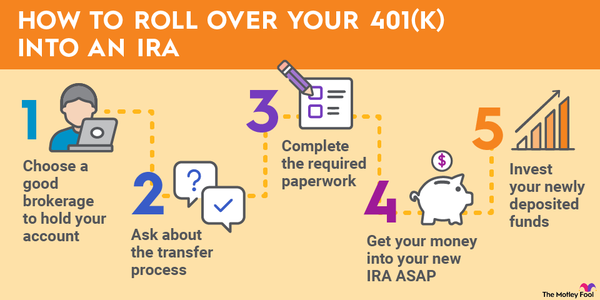

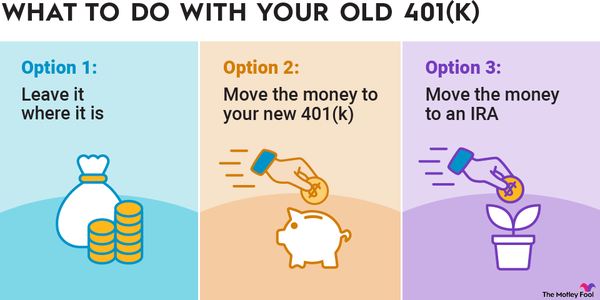

Be sure to avoid accidentally taking an early distribution when you roll over your 401(k) plan. If you ask to roll over your 401(k) after separating from your old employer, the plan administrator may liquidate your holdings and mail you a check. You'll have 60 days from that distribution to deposit those funds into an IRA or your new employer's retirement plan.

If you fail to deposit the funds in that time period, the IRS considers it a distribution. It could be subject to the 10% penalty if you separated from your old job before the year you turn 55, and you'll owe income taxes on the entire amount distributed from non-Roth accounts. You'll no longer be able to contribute those funds to a tax-advantaged retirement account. You can avoid this problem with a direct rollover, where the funds never touch your personal bank account.

Related Retirement Topics

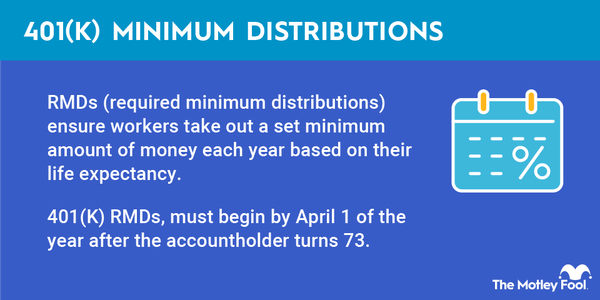

Required minimum distributions

We've talked a lot about early 401(k) distributions and how to avoid them. Believe it or not, there will come a time when you'll be forced to start withdrawing from your 401(k). Once you turn 73, you'll need to begin worrying about required minimum distributions, or RMDs.

Your RMDs are calculated based on your account balance and life expectancy. The penalty for not taking them is 25% of the amount you neglect to withdraw, though the penalty can decrease to 10% if you act quickly to take care of your mistake. This means that if your RMD for a given year is $5,000 and you don't take it, you could lose up to $1,250. You'll still have to take that required distribution, too. That's much worse than the 10% penalty you'll face for removing funds early.

Your first RMD is due by April 1 of the year after you turn 73. So if you turned 73 in August 2024, your first RMD will be due by April 1, 2025. All subsequent RMDs are then due by the last day of each respective calendar year. If you opt to delay your first RMD until the year after you turn 73, you'll need to take a second RMD on Dec. 31 of the same year.

However, there is an exception to the RMD rule. If, at the time you turn 73, you're still working for the company sponsoring your 401(k), and you don't own 5% or more of that company, you can avoid RMDs for as long as you remain employed. Once you leave that job, though, you'll be liable for those distributions.

Saving in a 401(k) is a smart way to establish a strong retirement nest egg. Just be sure to read up on 401(k) distributions and how they work. That way, you'll be better positioned to make smart decisions about when and how to access your savings.