A 401(k) is an employer-provided retirement account you can contribute to with pre-tax dollars.

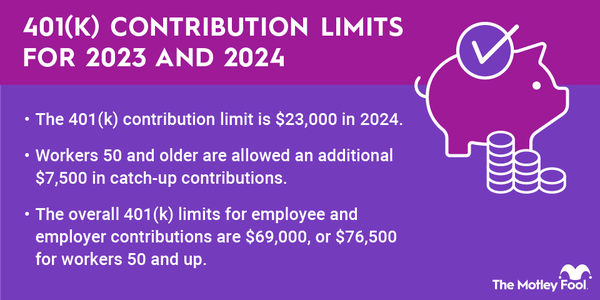

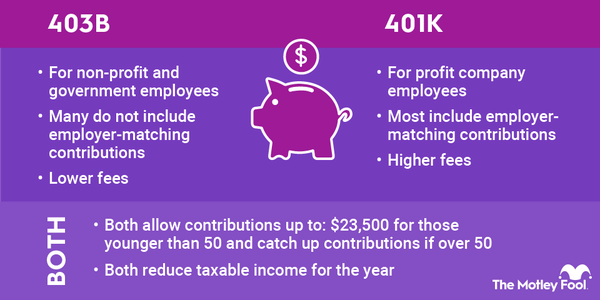

In 2023, you can contribute a maximum of $22,500 (up from $20,500 in 2022) to your 401(k) if you are younger than 50. If you're 50 or older, you become eligible to make additional catch-up contributions valued at $7,500 (up from $6,500 in 2022). That means you can contribute a total of $30,000 (up from $27,000 in 2022). These limits can change annually, and they do not include any matching funds your employer provides.

If you have enough money to do so, you will need to decide if you should max out your 401(k) or if it would be smarter to do other things with your money. There are pros and cons to both options.

When you should max out your 401(k)

When you should max out your 401(k)

Maxing out your 401(k) can be a smart financial move under certain circumstances. You should consider contributing the maximum to this account if the following apply to you:

- You are financially stable: It makes little sense to put thousands of dollars into a 401(k) if you're struggling to accomplish basic financial tasks such as paying your bills on time or keeping a roof over your head and food on the table.

- You don't have high-interest debt: Your 401(k) returns will rarely, if ever, exceed the interest rate you'd pay on credit cards or payday loans. If you have debt with an interest rate of around 10% or higher, you should generally contribute only enough money to your 401(k) to earn your maximum employer match. Then focus on paying down your debt with your extra money.

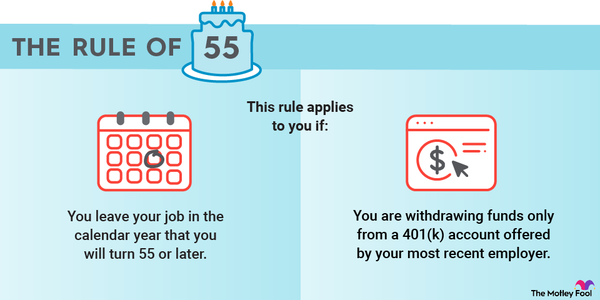

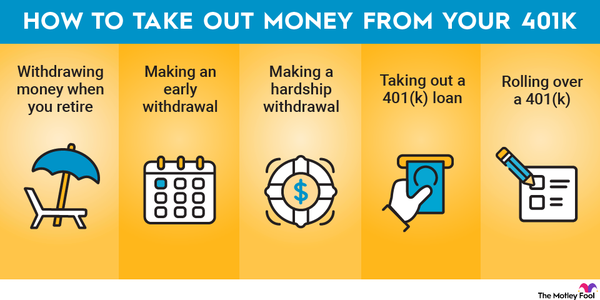

- You have an emergency fund: You need liquid cash accessible for emergencies to avoid ending up in debt when you face unexpected expenses. You do not want to be forced to withdraw funds from a 401(k) to cover emergencies, especially since you could face penalties for withdrawing funds before age 59 1/2 or you could be forced to sell 401(k) investments at an inopportune time. Save up at least a small emergency fund before contributing anything to your 401(k) and then contribute enough to earn the maximum employer match. After that, divide your spare cash between 401(k) contributions and building an emergency fund with enough money to cover three to six months’ worth of living expenses.

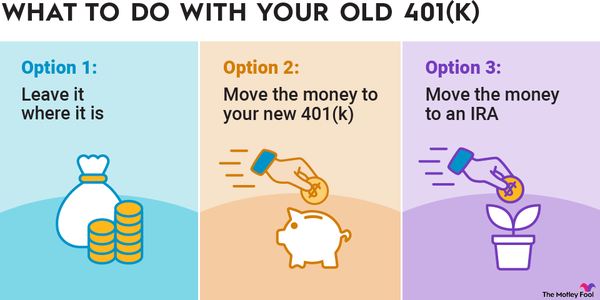

- You have considered other types of tax-advantaged accounts: Rather than devoting all your retirement money to maxing out your 401(k), you should consider whether some of your funds should go into a traditional or Roth IRA or a health savings account. These accounts can provide different tax benefits, and, in some cases, more flexibility in what assets you invest in.

If you have the money to max out your 401(k) and have considered the opportunity costs of using your funds for this instead of other financial goals, then spending the money to maximize this tax-advantaged retirement account can make sense.

You'll benefit from the ease of contributing directly via your paycheck and from the tax breaks a 401(k) provides. And, having most or all of your retirement money in one place can make it easier to monitor your portfolio and make sure you maintain the proper asset allocation.

When you shouldn't max out your 401(k)

When you shouldn't max out your 401(k)

There are also circumstances where you should not max out your 401(k). You likely shouldn't contribute the maximum to this account in the following situations:

- You're struggling to make ends meet: If you're living paycheck to paycheck or can't cover your bills, you need to address other pressing financial priorities first.

- You could benefit from allocating some of your money to other retirement investment accounts: If you are eligible for a health savings account, for example, you may wish to put some money into this type of account since it provides even better tax advantages than the 401(k). Or, if you would prefer to take some money out tax-free in retirement, putting money into a Roth IRA could be a better choice.

- You aren't prepared for financial emergencies: Prioritizing an emergency fund is likely more important than maxing out your 401(k). Otherwise, surprise costs could leave you in debt.

- Your employer's 401(k) plan isn't very good: If your plan charges high administrative fees or has a limited pool of investments that come with high fees, you may wish to invest only enough in your 401(k) to earn the maximum employer match and then put the rest of your retirement money elsewhere.

Even when you do not want to contribute the maximum to your 401(k), you should not pass up an employer match. This is guaranteed free money that you cannot obtain in most other circumstances.

Where to invest after maxing out your 401(k)

Where to invest after maxing out your 401(k)

If you have maxed out your 401(k), there are other types of tax-advantaged accounts you may be interested in investing in. These include the following:

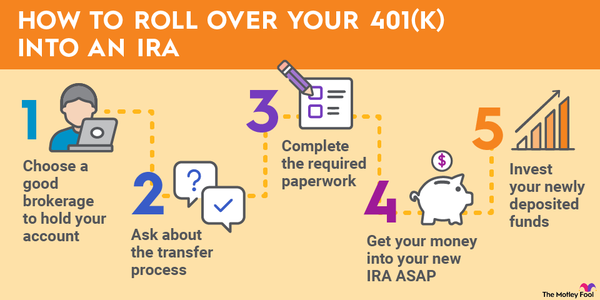

- Traditional or Roth IRAs: These accounts have a lower contribution limit than a 401(k). There are income limits for making deductible IRA contributions or for investing in a Roth IRA, but they provide more flexibility in what you invest in. Also, Roth IRAs allow you to invest with after-tax dollars and take tax-free withdrawals, which could provide more tax savings than a 401(k) if you expect your tax rate to be higher in retirement.

- Health savings accounts: These are open only to individuals with qualifying high-deductible health insurance plans. You contribute with pre-tax funds, money grows tax-free, and withdrawals for qualifying health expenditures are also tax-free. These are the only accounts offering a triple tax benefit. Seniors can also make penalty-free withdrawals for any reason after reaching age 65, but they would be taxed on those withdrawals at their ordinary tax rate.

You can invest in these accounts after maxing out your 401(k) if you are eligible for them. You can also choose to split your contributions between your 401(k) and these other types of accounts after putting enough into your 401(k) to get the maximum employer match -- even if you don't put the full $22,500 or $30,000 into your 401(k) account in 2023.

Related retirement topics

The Motley Fool has a disclosure policy.