More and more employers are adding Roth options to their 401(k) plans. If you recently gained the option to save in a Roth account, you may need to examine the advantages and disadvantages of a Roth 401(k) versus a traditional 401(k).

The biggest difference between a Roth account and a traditional 401(k) account is in how you're taxed. With a traditional 401(k), you'll save on income tax now and pay income tax on your withdrawals in retirement. With a Roth 401(k), you'll pay income tax on your contributions but no tax when you withdraw funds from the account. However, there are several caveats to consider.

Traditional 401(k) vs. Roth 401(k)

Both a traditional 401(k) and a Roth 401(k) are tax-advantaged accounts. That means there are tax savings to be had from using a 401(k) account instead of a taxable brokerage account.

Contributions to a traditional 401(k) aren't included in your taxable wages. As a result, you won't pay any income tax on those contributions in the year you make them. Roth 401(k) contributions, however, are still included in your taxable wages even though they come out of your paycheck.

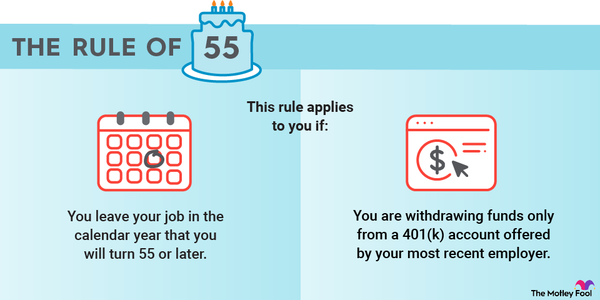

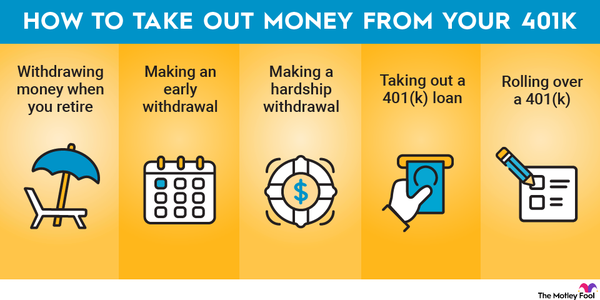

Both accounts produce their biggest advantages if you don't withdraw funds before you reach age 59 1/2. Withdrawing from your 401(k), whether traditional or Roth, before that age may require you to pay a penalty and additional income tax. There are certain exceptions, such as first-time home purchases and medical or educational expenses. You can also withdraw funds starting the year you separate from service if you turn 55 or older that year, but that lets you avoid only penalties and not the taxes on early withdrawals.

With a traditional 401(k), early withdrawals that don't fall under an exception carry a 10% penalty, and you'll usually owe income taxes on the full amount of the withdrawal. With a Roth 401(k), your withdrawal will be prorated based on the proportion of contributions to earnings in the account. You'll pay only tax and the 10% penalty on the portion of the withdrawal attributable to earnings.

If you make it all the way to retirement age without touching your funds, you can save a lot of money. Withdrawals from a Roth 401(k) come out entirely tax-free for both your contributions and your earnings. You'll still owe income taxes on the full withdrawal from a traditional 401(k), but you won't be subject to that nasty 10% penalty.

There are a few other differences between traditional and Roth accounts.

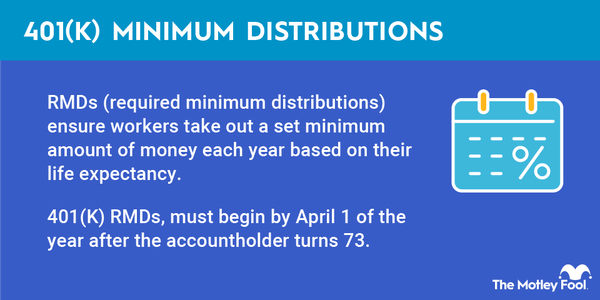

Traditional 401(k) accounts have required minimum distributions starting the year after you turn 73 (previously 72). If you don't take the minimum distribution, which is based on the account value and average life expectancy, you'll be penalized. The penalty is 25%, though it may be reduced to 10% if you take swift corrective action.

The Secure Act 2.0 eliminated RMDs from Roth-designated accounts beginning in the 2024 tax year.

Another rule to keep in mind is that you cannot take withdrawals from a Roth 401(k) within the first five years of establishing the account without paying a penalty. Even if you're over 59 1/2 or withdrawing earlier with the separation of service qualification at age 55 or older, you'll still pay both the penalty and the taxes on part of the withdrawal attributable to the earnings. So if you're starting to save late and you think you might tap the account in just a few years, you may want to stick with a traditional 401(k).

| Aspect | Traditional | Roth |

|---|---|---|

| When you're typically taxed | Upon withdrawal | Upon contribution |

| Tax on early withdrawals | Full amount | Amount attributable to earnings |

| Minimum investment horizon to avoid penalty | 0 years | 5 years |

| Required minimum distributions | Starting at age 73 | Eliminated for 2024 and subsequent tax years |

Related Retirement Topics

Which is best for you?

Since the biggest difference between a traditional 401(k) and a Roth 401(k) is in how they're taxed, which is best for you is a matter of your current tax situation and what you expect your taxes to look like in the future.

The important comparison is what your marginal tax rate is today versus what you expect your effective tax rate to be when you start taking withdrawals.

If your marginal tax rate today is higher than your expected effective tax rate in the future, you should choose a traditional 401(k). If you're in a low tax bracket now and expect your effective tax rate to be higher in retirement, choose a Roth.

This decision can be challenging because it's impossible to know what tax rates will be in the future, so it's an inexact equation.