A 401(k) is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA's tax-free distributions more appealing.

Contributing funds to a Roth IRA is always an option, but you could also do a 401(k) to Roth IRA conversion with your existing savings. This lets you reclassify your 401(k) funds as Roth savings by paying taxes on the amount you'd like to convert.

Here's a closer look at how 401(k) to Roth IRA conversions work and how to decide whether they're right for you.

How it works

How a 401(k) to Roth IRA conversion works

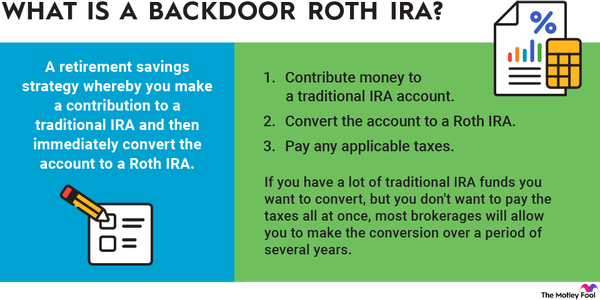

Converting a 401(k) to a Roth IRA is essentially the same process as rolling your 401(k) funds over to a traditional IRA. However, there's the extra step of paying taxes on your converted funds since most 401(k)s are taxed differently from Roth IRAs.

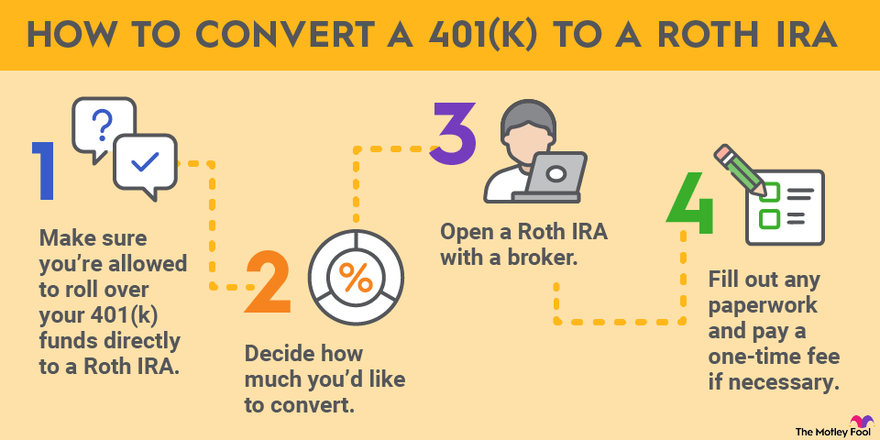

First, make sure you're allowed to roll over your 401(k) funds directly to a Roth IRA. Many companies will allow only former employees to do rollovers or conversions, but a few may permit current employees to roll some of their savings over to an IRA as well. Some plans permit you to roll your 401(k) savings only into a traditional IRA. Then, you can open a Roth IRA and do your conversion.

Second, you must decide how much you'd like to convert. You can convert the full value of your plan, or you may be able to convert just a portion if your plan allows it. If you can't do a partial conversion but don't want to convert everything to Roth savings, you can always roll part of your savings into a Roth IRA and the other part into a traditional IRA.

There are no limits on how much you can convert to a Roth IRA in a single year. However, most people try to keep the impact on their tax rates in mind, which we will discuss below.

If you don't already have one, you must open a Roth IRA with a broker. Then, you'll provide your 401(k) plan administrator with the details regarding where you'd like your funds transferred and how much you'd like to transfer if you're doing a partial conversion. You may have to fill out some paperwork and pay a one-time rollover fee.

Brokerage Account

Taxes on conversions

Paying taxes on your 401(k) to Roth IRA conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401(k)s are funded with pre-tax dollars. So, you must pay taxes on your 401(k) to Roth IRA conversions. In most cases, the funds you're converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year's tax bill.

The effect on your tax bill depends on how much you convert and how much other taxable income you've earned during the year. If you're not careful, your 401(k) to Roth IRA conversion could significantly increase your tax rate, meaning you'll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket and taxable income throughout the year.

You may not owe taxes on the full amount of your 401(k) to Roth IRA conversion if you've made nondeductible 401(k) contributions in the past. But that's where things get a little hairy. Nondeductible 401(k) contributions are funds you contribute to a traditional 401(k) but don't get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax-deferred until you withdraw them.

Not all plans allow nondeductible 401(k) contributions, but if yours does, you must understand how the government handles these withdrawals. If you're converting only some of your savings, the government looks at the proportion of nondeductible versus deductible contributions and taxes you accordingly.

For instance, let's say you have $100,000 in your 401(k), $10,000 of which is nondeductible contributions. If you wanted to convert $10,000 to a Roth IRA, only 10% of the converted amount, or $1,000, would be considered nondeductible contributions since only 10% of your total 401(k) contributions were nondeductible.

If you decide to roll over your entire 401(k) balance, you can roll all your pre-tax dollars into a traditional IRA and all your nondeductible contributions into a Roth IRA. You wouldn't pay taxes on this type of conversion because you already paid taxes on your nondeductible contributions the year you made them.

Roth 401(k) to Roth IRA conversions

Roth 401(k) to Roth IRA conversion

Roth 401(k)s are essentially the same as traditional 401(k)s except that, like Roth IRAs, they're funded with after-tax dollars instead of pre-tax dollars. This isn't always the case for employer-matched funds, though.

In the past, these were considered pre-tax dollars, even in a Roth 401(k). However, under the Secure Act 2.0, employer contributions made in 2023 and later can be made on a Roth basis, though many plans haven't yet adopted this feature.

Because the government taxes Roth 401(k) and Roth IRA contributions the same way, you can roll over Roth 401(k) savings to a Roth IRA without paying taxes on your Roth 401(k) contributions. But if the amount you're rolling over includes employer-matched funds made pre-tax, these will affect your tax bill for the year.

Related retirement topics

Roth IRA conversion ladder

Roth IRA conversion ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It's a way to tap your retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they've been in your account for five years. Roth IRA conversion ladders leverage this to get around the government's 10% early withdrawal penalty on tax-deferred savings for those younger than 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401(k) or other tax-deferred accounts to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you're ready to retire, you convert another sum you can use in your second year of retirement.

You continue doing this until you have enough to last until you're 59 1/2, at which point you can use all your savings penalty-free. It requires a lot of retirement savings to pull off and could result in a larger tax bill, but it's a strategy worth considering if you plan to retire before you're 59 1/2.

There are quite a few rules to keep in mind when doing a 401(k) to Roth IRA conversion. However, as long as you check your plan's restrictions and prepare yourself for the accompanying tax bill, you shouldn't run into any problems.

FAQ

401(k) to Roth IRA conversion: FAQ

Can I roll my 401(k) into a Roth IRA without penalty?

Yes, it's possible to roll 401(k) funds into a Roth IRA without a penalty, but you have to pay taxes on the converted amount in the year you do the conversion.

Why convert a 401(k) to an IRA?

Converting 401(k) funds to a Roth IRA enables you to access that money tax-free in retirement. However, doing this will increase your tax liability this year.

When should I convert my 401(k) to a Roth IRA?

It's best to convert your 401(k) funds to a Roth IRA at least five years before you use them. Withdrawing them from your Roth IRA sooner could lead to government penalties.

Many people also prefer to do these conversions later in the year when they have a better idea of where they'll fall in their tax bracket. Just make sure you do yours by Dec. 31 if you want it to count toward the current tax year.