Shorting a stock means opening a position by borrowing shares that you don't own and then selling them to another investor. Shorting, or selling short, is a bearish stock position -- in other words, you might short a stock if you feel strongly that its share price was going to decline.

How does short selling work?

Short-selling allows investors to profit from stocks or other securities when they go down in value.

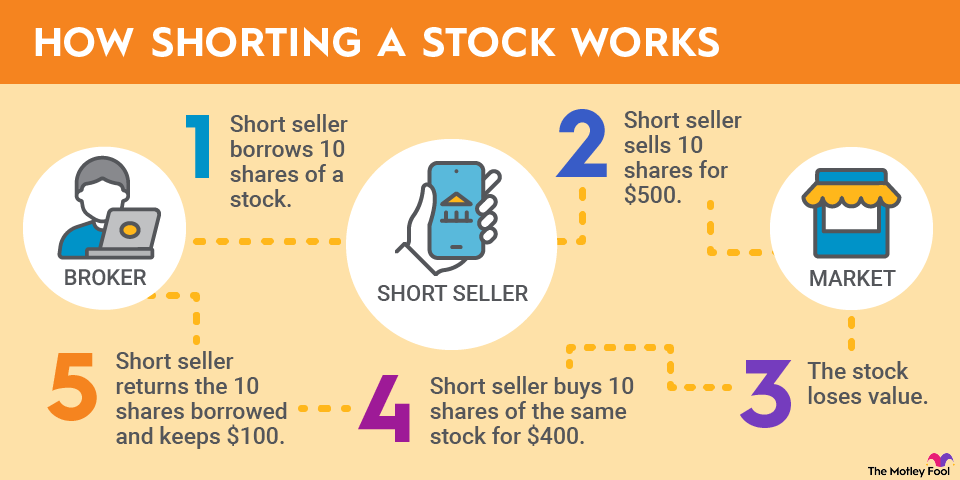

To sell short, an investor has to borrow the stock or security through their brokerage company from someone who owns it. The investor then sells the stock, retaining the cash proceeds.

The short-seller hopes that the price will fall over time, providing an opportunity to buy back the stock at a lower price than the original sale price. Any money left over after buying back the stock is profit to the short-seller.

As an example, let's say that you decide that Company XYZ, which trades for $100 per share, is overpriced. So, you decide to short the stock by borrowing 10 shares from your brokerage and selling them for a total of $1,000. If the stock proceeds to go down to $90, you can buy those shares back for $900, return them to your broker, and keep the $100 profit.

When short-selling makes sense

At first glance, you might think that short-selling would be just as common as owning stock. However, relatively few investors use the short-selling strategy.

One reason for that is general market behavior. Most investors own stocks, funds, and other investments that they want to see rise in value. The stock market can fluctuate dramatically over short time periods, but over the long term it has a clear upward bias. For long-term investors, owning stocks has been a much better bet than short-selling the entire stock market. Shorting, if used at all, is best suited as a short-term profit strategy.

Sometimes, you'll find an investment that you're convinced will drop in the short term. In those cases, short-selling can be a way to profit from the misfortunes that a company is experiencing.

Even though short-selling is more complicated than simply going out and buying a stock, it can allow you to make money during a bear market when others are seeing their investment portfolios shrink.

The risks of shorting

Short-selling can be profitable when you make the right call, but it carries greater risks than what ordinary stock investors experience.

Specifically, when you short a stock, you have unlimited downside risk but limited profit potential. This is the exact opposite of when you buy a stock, which comes with limited risk of loss but unlimited profit potential. When you buy a stock, the most you can lose is what you pay for it. If the stock goes to zero, you'll suffer a complete loss, but you'll never lose more than that.

By contrast, if the stock soars, there's no limit to the profits you can enjoy. It's quite common for long-term stock investors to earn profits that are several times the size of their initial investment.

Short Squeeze

With short-selling, however, that dynamic is reversed. There's a ceiling on your potential profit, but there's no theoretical limit to the losses you can suffer. For instance, say you sell 100 shares of stock short at a price of $10 per share. Your proceeds from the sale will be $1,000.

If the stock goes to zero, you'll get to keep the full $1,000. However, if the stock soars to $100 per share, you'll have to spend $10,000 to buy the 100 shares back. That will give you a net loss of $9,000 -- nine times as much as the initial proceeds from the short sale. And if you think losses like this aren't possible, think again.

Still, even though short-selling is risky, it can be a useful way to take calculated positions against a particular company for investors who know what they're doing.

Managing your risk is important. But when used in moderation, short selling can diversify your investment exposure and give you an opportunity to capture better returns than someone who only owns stocks and other investments.

Short Covering

Related investing topics

Alternative to shorting

As a final thought, an alternative to shorting that limits your downside exposure is to buy a put option on a stock.

Essentially, a put option gives you the right -- but not the obligation -- to sell a stock at a predetermined price (known as the strike price) at any time before the option contract expires.

For example, if you buy a put option in a stock with a strike price of $100 and the stock drops to $60, you can then buy shares for $60 and exercise your option to sell them for $100, profiting from the decline in the stock.

So, the idea behind buying a put option is similar to shorting, although the most you can possibly lose is what you pay for the put option. Now, there's more to trading options than I can explain here, so do your homework if this is a strategy that sounds appealing to you. But it can be a smart alternative to the unlimited loss exposure that comes with shorting a stock.